Labour Force Survey, November 2023

Released: 2023-12-01

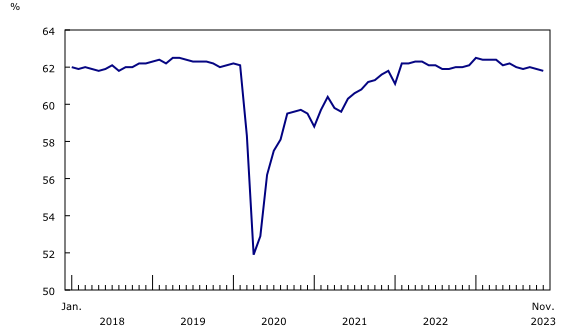

Employment was little changed in November (+25,000; +0.1%) and the employment rate fell 0.1 percentage points to 61.8%, as growth in the population continued to outpace employment growth.

The unemployment rate rose 0.1 percentage points to 5.8%, continuing an upward trend observed since April.

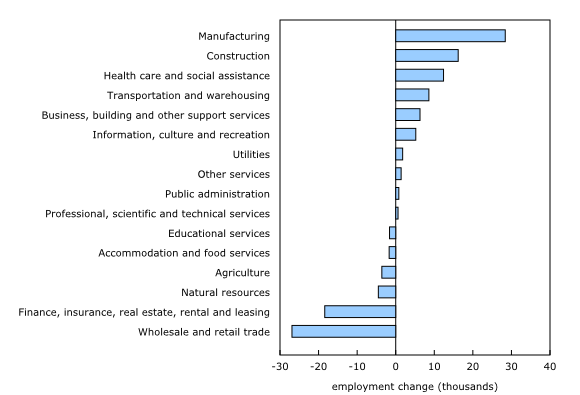

Employment increased in manufacturing (+28,000; +1.6%) and construction (+16,000, +1.0%). There were declines in wholesale and retail trade (-27,000; -0.9%) and finance, insurance, real estate, rental and leasing (-18,000; -1.3%).

Employment increased in New Brunswick (+2,400; +0.6%) and declined in Prince Edward Island (-1,300; -1.4%). Employment was little changed in all other provinces.

Among Canada's 20 largest census metropolitan areas (CMAs), St. Catharines–Niagara and Oshawa recorded the largest unemployment rate increases from April to November (three-month moving averages).

Total hours worked fell 0.7% in November and were up 1.3% on a year-over-year basis.

On a year-over-year basis, average hourly wages rose 4.8% (+$1.57 to $34.28) in November, similar to the increase recorded in October (not seasonally adjusted).

Most immigrants who had arrived in the previous five years faced challenges finding work related to their post-secondary credentials or work experience acquired abroad (population in the labour force aged 15 to 69, not seasonally adjusted).

Employment little changed in November for second consecutive month

Employment was little changed in November (+25,000; +0.1%), the second consecutive month of little change. The employment rate—the proportion of the working-age population that is employed—fell 0.1 percentage points to 61.8% in the month, while the population aged 15 and older in the Labour Force Survey (LFS) grew by 78,000 (+0.2%).

The employment rate has decreased in four of the past five months, and has generally trended down since January 2023, when it reached a recent high of 62.5%.

The number of private sector employees rose by 38,000 (+0.3%) in November, the first increase since June. Meanwhile, the number of self-employed workers decreased by 25,000 (-0.9%), partly offsetting cumulative increases of 76,000 (+2.9%) in August and September. The number of public sector employees was little changed in November, but was up by 98,000 (+2.3%) from June.

Employment rate falls among core-age men, continuing downward trend since June

Employment held steady for core-aged (25 to 54 years old) men and women in November. Among women in this age group, an increase in full-time work (+34,000; +0.6%) was partially offset by a decrease in part-time work (-21,000; -2.1%). Overall employment was little changed for youth and older workers in November.

In November, the employment rate among core-age men declined by 0.2 percentage points to 87.3%. The employment rate for core-aged men has trended down in recent months, declining 0.9 percentage points from a recent peak of 88.2% observed in June. The employment rate of core-aged women was little changed at 81.6% in November, but has trended downward throughout most of the year from its record high of 82.2% in January.

The employment rate of young women (aged 15 to 24) fell 0.6 percentage points to 56.4% in November, bringing the cumulative decline since August to 2.7 percentage points. The employment rate of young men (aged 15 to 24) was 56.5% in November, down 0.5 percentage points from October and down 1.7 percentage points from July.

Among women aged 55 and older, the employment rate rose 0.2 percentage points to 30.4% in November, while for men it held steady at 40.6%.

Unemployment rate increases for a second consecutive month, continuing upward trend since April

The unemployment rate rose 0.1 percentage points to 5.8% in November, bringing the cumulative increase since April 2023 to 0.8 percentage points.

Although the unemployment rate has trended up for all major age groups, increases have been more pronounced among youth. From April to November, the unemployment rate increased by 2.0 percentage points (to 11.6%) among youth aged 15 to 24. Over the same period, it increased by 0.6 percentage points among people aged 25 to 54 (to 4.9%) and by 0.7 percentage points among people aged 55 and older (to 4.6%).

More unemployed due to layoff compared with a year earlier

Compared with a year earlier, unemployed people in November were more likely to have been laid off from their previous job, reflecting more difficult economic and labour market conditions in 2023 compared with 2022.

Of those who were unemployed in November and had worked in the previous year, more than two-thirds (68.7%) had been laid off from their previous job, compared with 62.6% in November 2022. In comparison, less than one-third (31.3%) of the unemployed in November 2023 who had worked in the previous year had voluntarily left their job, down from 37.4% in November 2022 (not seasonally adjusted).

Employment gains in manufacturing and construction

Employment increased by 28,000 (+1.6%) in manufacturing in November, offsetting a decline of 19,000 (-1.0%) in October. Employment in this sector was up by 2.4% (+43,000) on a year-over-year basis, in line with overall annual employment growth across all sectors (+2.5%; +499,000).

In construction, employment increased by 16,000 (+1.0%) in November, building on an increase of 23,000 (+1.5%) in October. While employment declined in construction through the spring and summer of 2023, gains in October and November brought employment levels in this sector to within 15,000 of the peak reached in January 2023. According to the most recent data on building construction, investment in building construction, in particular residential building construction, trended down for most of 2023, before partially rebounding in August and September.

Employment declined by 27,000 (-0.9%) in wholesale and retail trade in November, adding to a drop of 22,000 (-0.7%) in October. As of November, employment in the industry was at its lowest since December 2022.

In finance, insurance, real estate, rental and leasing, employment fell by 18,000 (-1.3%) in November. Since July, employment in this industry has declined by 63,000 (-4.4%), the steepest decrease of any industry over the period.

Employment up in New Brunswick in November, while Prince Edward Island records a decline

In November, employment rose in New Brunswick and declined in Prince Edward Island. All other provinces posted little change. For further information on key province and industry level labour market indicators, see "Labour Force Survey in brief: Interactive app."

Employment in New Brunswick increased (+2,400; +0.6%) in November, following an identical increase in October (+2,400; +0.6%). In the 12 months to November 2023, employment in the province increased by 15,000 (+4.0%). The unemployment rate stood at 6.4% in November, down 0.8 percentage points from November 2022.

Following successive monthly increases from June to September 2023 and little change in October, employment in Prince Edward Island declined (-1,300; -1.4%) in November. The unemployment rate rose by 1.9 percentage points to 8.1%.

Employment in Quebec was little changed in November, following a decrease in October (-22,000; -0.5%). The unemployment rate rose 0.3 percentage points to 5.2% in November, 1.3 percentage points above the record low of 3.9% reached in November 2022 and in January 2023.

Employment was little changed for the fifth consecutive month in Ontario in November. The employment rate in the province (61.3%) was down a full percentage point (-1.0%) from the recent high of 62.3% in April 2023. The unemployment rate stood at 6.1% in November, little changed in the month but up 1.2 percentage points from April.

St. Catharines–Niagara and Oshawa record largest April-to-November unemployment rate increases

Among Canada's 20 largest CMAs, the unemployment rate in November was highest in Windsor (7.6%), St. Catharines–Niagara (7.3%) and Oshawa (7.3%) and lowest in the CMAs of Québec (2.7%), Kelowna (3.9%) and Victoria (4.1%).

Mirroring the trend at the national level, the unemployment rate increased in 10 of these 20 CMAs from April to November, while in the other 10 CMAs the unemployment rate was little changed over the period. The largest increase was in St. Catharines–Niagara, where the unemployment rate in November (7.3%) was up 2.9 percentage points from April, followed by Oshawa, where the unemployment rate in November (also 7.3%) was up 2.7 percentage points from April.

In the Spotlight: Nearly 6 in 10 recent immigrants who are in the labour force faced challenges finding work in their field over the last two years

In recent years, record numbers of immigrants have arrived in Canada to seek job opportunities, to reunite with their families or to claim asylum as refugees. In 2021, the proportion of the population who were immigrants reached a historic high of 23.0%. From July 1, 2022, to July 1, 2023, immigrants and non-permanent residents have accounted for close to 98% of population growth.

Although immigrants play an increasingly large role in Canada's labour market, many continue to face barriers integrating into the labour market, including those with post-secondary credentials or work experience acquired abroad. In November, supplementary questions were added to the LFS to better understand the labour market challenges experienced by newcomers.

Among recent immigrants (those who had arrived in Canada in the previous five years) who had work experience or post-secondary credentials from abroad, nearly 6 in 10 (58.2%) had faced difficulties finding work related to their foreign work experience or credentials in the past two years. In comparison, fewer than half (47.6%) of those who had arrived from 5 to 10 years earlier had faced such difficulties (population in the labour force aged 15 to 69, not seasonally adjusted).

The most common difficulties encountered by recent immigrants with credentials or experience were not having enough Canadian job experience (22.7%), having no connections in the job market (20.3%) and lacking enough references from Canada (18.5%).

In the Spotlight: Parents of young children more likely to have hybrid work arrangement or to work exclusively from home

After increasing markedly in the context of the COVID-19 pandemic, the share of workers who work exclusively from home has gradually declined since the winter of 2022, falling from 24.3% in January 2022 to 12.6% in November 2023 (population in the labour force aged 15 to 69, not seasonally adjusted).

In comparison, the share of workers that indicated that they usually worked exclusively at locations other than their home in November 2023 was just over three-quarters (75.7%), similar to August 2023 (76.1%), but up from January 2022 (72.1%).

Part of the return to in-person work has taken the form of hybrid arrangements, where workers usually work some hours at home, and some hours outside the home. The share of workers with hybrid arrangements has more than tripled since January 2022, rising from 3.6% to reach 11.7% in November 2023.

The prevalence of specific work arrangements can reflect a range of factors, including industry and occupational composition, and the specific circumstances of employers and workers. However, working from home and hybrid work can be appealing to parents, due to the time saved from commuting and the greater prevalence of flexible schedules. In November 2023, 3 in 10 (30.1%) parents with at least one child five years or younger worked exclusively from home or had a hybrid arrangement, including 33.2% of mothers and 27.4% of fathers with a child aged five or younger. In comparison, 23.5% of workers without a child five years or younger worked exclusively from home or had a hybrid work arrangement.

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The Labour Force Survey is an example of how Statistics Canada supports the reporting on the Global Goals for Sustainable Development. This release will be used in helping to measure the following goals:

Note to readers

The Labour Force Survey (LFS) estimates for November are for the week of November 5 to 11, 2023.

The LFS estimates are based on a sample and are therefore subject to sampling variability. As a result, monthly estimates will show more variability than trends observed over longer time periods. For more information, see "Interpreting Monthly Changes in Employment from the Labour Force Survey."

This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level.

LFS estimates at the Canada level do not include the territories.

The LFS estimates are the first in a series of labour market indicators released by Statistics Canada, which includes indicators from programs such as the Survey of Employment, Payrolls and Hours (SEPH); Employment Insurance Statistics; and the Job Vacancy and Wage Survey. For more information on the conceptual differences between employment measures from the LFS and those from the SEPH, refer to section 8 of the Guide to the Labour Force Survey (71-543-G).

Face-to-face personal interviewing resumed in November 2022. Telephone interviews continued to be conducted by interviewers working from their homes rather than Statistics Canada's call centres, as they have since March 2020. About 48,100 interviews were completed in November and in-depth data quality evaluations conducted each month confirm that the LFS continues to produce an accurate portrait of Canada's labour market.

The employment rate is the number of employed people as a percentage of the population aged 15 and older. The rate for a particular group (for example, youths aged 15 to 24) is the number employed in that group as a percentage of the population for that group.

The unemployment rate is the number of unemployed people as a percentage of the labour force (employed and unemployed).

The participation rate is the number of employed and unemployed people as a percentage of the population aged 15 and older.

Full-time employment consists of persons who usually work 30 hours or more per week at their main or only job.

Part-time employment consists of persons who usually work less than 30 hours per week at their main or only job.

Total hours worked refers to the number of hours actually worked at the main job by the respondent during the reference week, including paid and unpaid hours. These hours reflect temporary decreases or increases in work hours (for example, hours lost due to illness, vacation, holidays or weather; or more hours worked due to overtime).

In general, month-to-month or year-to-year changes in the number of people employed in an age group reflect the net effect of two factors: (1) the number of people who changed employment status between reference periods, and (2) the number of employed people who entered or left the age group (including through aging, death or migration) between reference periods.

Seasonal adjustment

Unless otherwise stated, this release presents seasonally adjusted estimates, which facilitate comparisons by removing the effects of seasonal variations. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Population growth in the Labour Force Survey

The LFS target population includes all persons aged 15 years and older whose usual place of residence is in Canada, with the exception of those living on reserves, full-time members of the regular Armed Forces and persons living in institutions (including inmates of penal institutions and patients in hospitals and nursing homes).

The LFS target population includes temporary residents—that is, those with a valid work or study permit, their families, and refugee claimants—as well as permanent residents (landed immigrants) and the Canadian-born.

Information gathered from LFS respondents is weighted to represent the survey target population using population calibration totals. These totals are updated each month, using the most recently available information on population changes, including changes in the number of non-permanent residents. LFS population calibration totals are derived from Canada's official population estimates using similar sources and methods, with minor adjustments being made to reflect exclusions from the LFS target population.

Concepts for Labour Force Survey supplement on immigrants

The LFS supplement includes a question on the time since an immigrant or non-permanent resident first came to live in Canada (arrival date). This variable was used in the analysis instead of the core LFS variable on the time since an immigrant became a permanent resident (landing date).

Next release

The next release of the LFS will be on January 5, 2024. December 2023 data will reflect labour market conditions during the week of December 3 to 9, 2023.

Products

More information about the concepts and use of the Labour Force Survey is available online in the Guide to the Labour Force Survey (71-543-G).

The product "Labour Force Survey in brief: Interactive app" (14200001) is also available. This interactive visualization application provides seasonally adjusted estimates by province, sex, age group and industry.

The product "Labour Market Indicators, by province and census metropolitan area, seasonally adjusted" (71-607-X) is also available. This interactive dashboard provides customizable access to key labour market indicators.

The product "Labour Market Indicators, by province, territory and economic region, unadjusted for seasonality" (71-607-X) is also available. This dynamic web application provides access to labour market indicators for Canada, provinces, territories and economic regions.

The product Labour Force Survey: Public Use Microdata File (71M0001X) is also available. This public use microdata file contains non-aggregated data for a wide variety of variables collected from the Labour Force Survey. The data have been modified to ensure that no individual or business is directly or indirectly identified. This product is for users who prefer to do their own analysis by focusing on specific subgroups in the population or by cross-classifying variables that are not in our catalogued products.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: