Labour Force Survey, March 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-04-09

Measuring the labour market is not business as usual for the week of March 15 to 21

Data from the Labour Force Survey (LFS) are based on interviews with 56,000 households and more than 100,000 individuals every month. When used in coordination with other Statistics Canada employment data—including the Survey of Employment, Payroll and Hours and the Job Vacancy and Wage Survey—the LFS paints an accurate and current portrait of the Canadian labour market and Canada's economic performance.

The March Labour Force Survey (LFS) results reflect labour market conditions during the week of March 15 to 21. By then, a sequence of unprecedented government interventions related to COVID-19—including the closure of non-essential businesses, travel restrictions, and public health measures directing Canadians to limit public interactions—had been put in place. These interventions resulted in a dramatic slowdown in economic activity and a sudden shock to the Canadian labour market. The slowdown continued beyond the LFS reference week and is likely to be more fully reflected in April LFS data.

Changes in employment, defined as those who work at a paid job or business, and unemployment, defined as those who are available to work, are internationally standardized concepts that capture some of this shock. To fully measure the size and extent of the impact of COVID-19 on Canadian workers and businesses, however, additional measures are required. This includes measures of Canadians who kept their job but worked reduced hours, and the number of people who did not look for work because of ongoing business closures.

COVID-19 and the Labour Force Survey

Statistics Canada is closely monitoring the impacts of COVID-19 (also known as the novel coronavirus) on the Canadian labour market.

The March release of the Labour Force Survey (LFS) is the first at Statistics Canada in which the impact of the COVID-19 outbreak is clearly visible. The data in this release correspond to the reference period of March 15 to 21.

During the reference period, a number of provinces and territories, as well as municipalities across the country, declared a state of emergency. This had a clear and immediate impact on the Canadian labour market. Businesses and institutions of all sizes and in a variety of industrial sectors announced layoffs, and many individuals still employed experienced changes in the way they work, including to their hours worked. In response, an unprecedented number of Canadians took advantage of existing and newly-announced support measures.

The LFS will measure the impact of COVID-19 on the Canadian labour force as it continues to evolve over the coming months. Statistics Canada is committed to the application of existing survey concepts, based on internationally-accepted best practices, as well as the development and reporting of innovative indicators and analysis appropriate to this unprecedented situation.

In March, to ensure the safety of both interviewers and respondents, all interviews were conducted over the phone or with an electronic questionnaire. Statistics Canada is deeply grateful for the cooperation of tens of thousands of Canadians who responded to the survey and to our dedicated interviewers who ensured that the data collected was of the highest possible quality.

Statistics Canada will continue to report the impacts of COVID-19 on the Canadian labour force as information becomes available.

From April 3 to 16, Statistics Canada is collecting data on the impacts of COVID-19 on Canadians. All Canadians living in the 10 provinces and 3 territories can participate by completing a short online questionnaire through our secure platform. To find out more and to participate, visit the online platform.

Headlines

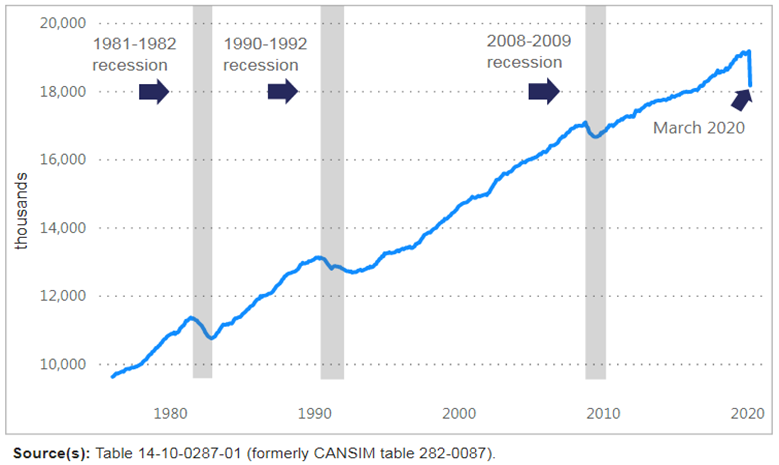

Employment fell by more than one million in March (-1,011,000 or -5.3%). The employment rate—or the proportion of people aged 15 and older who were employed—fell 3.3 percentage points to 58.5%, the lowest rate since April 1997.

Of those who were employed in March, the number who did not work any hours during the reference week (March 15 to 21) increased by 1.3 million, while the number who worked less than half of their usual hours increased by 800,000. These increases in absences from work can be attributed to COVID-19 and bring the total number of Canadians who were affected by either job loss or reduced hours to 3.1 million.

The unemployment rate increased by 2.2 percentage points to 7.8%, the largest one-month increase since comparable data became available in 1976. Unemployment increased by 413,000 (+36.4%), largely due to temporary layoffs. In addition, the number of Canadians who had worked recently and wanted to work, but did not meet the official definition of unemployed, increased by 193,000.

Sharp decrease in employment

In March, the number of employed people fell by more than one million (-1,011,000 or -5.3%). The employment rate, or the proportion of people aged 15 and older who were employed, fell 3.3 percentage points to 58.5%. This was the lowest employment rate since April 1997.

It is expected that the sudden employment decline observed in March will have a significant effect on the performance of the Canadian economy over the coming months (Release schedule). The employment decline in March was larger than in any of the three significant recessions experienced since 1980 (see infographic 2).

Provincially, employment fell in all provinces, with Ontario (-403,000 or -5.3%), Quebec (-264,000 or -6.0%), British Columbia (-132,000 or -5.2%) and Alberta (-117,000 or -5.0%) reporting the largest declines.

Large movements out of employment

In any month, the net change in employment is the result of the difference between the number of people leaving employment and the number becoming newly-employed. In March, most of the employment change was the result of people leaving employment (see infographic 3). Both the number of people moving from employment to unemployment (+506,000) and those moving from employed to not in the labour force (+515,000) increased. For more information on the use of gross flows to interpret changes in labour market conditions, see Labour market dynamics since the 2008/2009 recession.

Sharp increase in unemployment and more Canadians out of the labour force

The number of people who were unemployed increased by 413,000 (+36.4%) from February to March, the largest monthly change since comparable data became available in 1976. Almost all of the increase in unemployment was due to temporary layoffs, meaning that workers expected to return to their job within six months.

The unemployment rate increased 2.2 percentage points to 7.8% in March. This was the largest one-month increase on record, and brought the rate to a level last observed in October 2010.

The unemployment rate increased in all provinces except Newfoundland and Labrador and Prince Edward Island. The largest increases were in Quebec (+3.6 percentage points to 8.1%), British Columbia (+2.2 percentage points to 7.2%) and Ontario (+2.1 percentage points to 7.6%).

In March, the number of people who were out of the labour force—that is, those who were neither employed nor unemployed—increased by 644,000.

Of those not in the labour force, 219,000 had worked recently and wanted a job but did not search for one, an increase of 193,000 (+743%). Because they had not looked for work and they were not temporarily laid off, these people are not counted as unemployed. Since historically the number of people in this group has been generally very small and stable, the full monthly increase can be reasonably attributed to COVID-19.

Increased absences show impacts of COVID-19

There were 1.3 million Canadians who were away from work for the full week of March 15 to 21, for reasons that can likely be attributed to COVID-19, including 'business conditions' and 'other reasons' but excluding reasons such as 'vacation'; 'labour dispute'; 'maternity leave'; 'holiday'; and 'weather.'

The number of Canadians who were employed but who worked less than half their usual hours due to 'business conditions' or 'other reasons' increased 800,000 in March. When these absences are included, the total number of people who missed all or part of their week increased to 2.1 million and the total number of Canadians who were affected by either job loss or reduced hours was 3.1 million.

For employees who were absent from a job for the full week, about 55.8% were not paid (not adjusted for seasonality). The number of people who were absent all week without pay may be an indication of future job losses. The Labour Force Survey does not collect information on whether people who are absent for part of the week were paid for the hours they did not work.

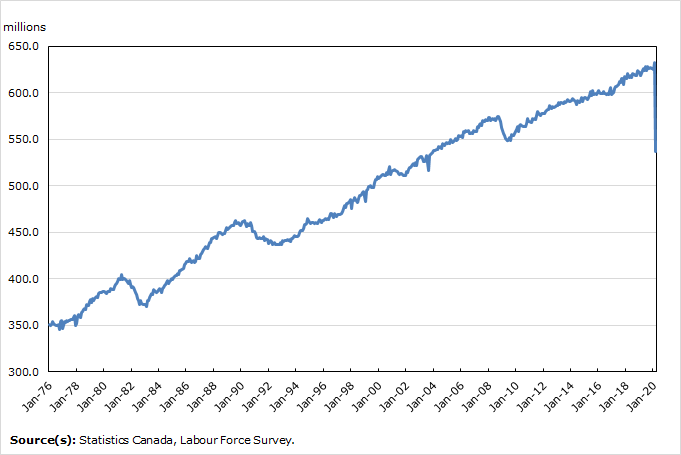

More hours lost than during 1998 Ice Storm

The Labour Force Survey began measuring hours lost in 1997. Since then, the closest comparison to the sudden decline in economic activity and employment observed in March 2020 has been the 1998 Ice Storm, which caused business closures in parts of Quebec and Ontario, and resulted in an estimated 166,000 people across Canada losing all or the majority of their hours worked (see infographic 4). The increase in absences the week of March 15 to 21 was more than eight times greater than that observed in 1998.

COVID-19 creates a complex picture: not working, but not unemployed

The unemployment rate is the number of people unemployed as a proportion of the total labour force (employed plus unemployed). In March, the unemployment rate increased by 2.2 percentage points to 7.8%, the largest one-month increase since comparable data became available in 1976.

In March, 219,000 people were not in the labour force but had worked earlier in March and still wanted a job. They were not counted as unemployed because they did not look for a job, presumably because of ongoing business shutdowns and the requirement to socially isolate. If this group were counted as unemployed, the adjusted unemployment rate would be 8.9%.

In March, the "recent labour underutilization rate" was 23.0%, meaning about one-quarter of the potential labour force was fully or partially underutilized. In comparison, this rate was 12.8% at the peak of the 2008/2009 recession, highlighting the depth of the impact of COVID-19 on the Canadian labour market.

The "recent labour underutilization rate" is calculated by combining all those who were unemployed with those who recently worked and wanted a job but did not meet the definition of unemployed; and those who remained employed but lost all or the majority of their usual work hours.

Most employment losses in the private sector; small declines among self-employed

Employment decreased more sharply in March among employees in the private sector (-830,200 or -6.7%) than in the public sector (-144,600 or -3.7%).

The number of self-employed workers decreased relatively little in March (-1.2% or -35,900), and was virtually unchanged compared with 12 months earlier. The number of own-account self-employed workers with no employees increased by 1.2% in March (not adjusted for seasonality). Most of this increase was due to an increase in the healthcare and social assistance industry (+16.7%), which offset declines in several other industries. At the onset of a sudden labour market shock, self-employed workers are likely to continue to report an attachment to their business, even as business conditions deteriorate.

Greatest employment declines among youth

Among youth aged 15 to 24, employment decreased by 392,500 (-15.4%) in March, the fastest rate of decline across the three main age groups. The decrease was almost entirely in part-time work, and brought the employment rate for youth to 49.1%, the lowest on record using comparable data beginning in 1976.

About two-thirds of youth are students, and employment fell more sharply among those enrolled in school (-31.6%) than among non-students (-1.8%), unadjusted for seasonality. Students are also more likely to work in the accommodation and food services industry, which had the largest declines overall.

Approximately 20% of employed youth lost all or the majority of their usual hours.

Unemployment for youth increased by 145,300 (+49.7%) in March, bringing their unemployment rate up 6.5 percentage points to 16.8%, the highest rate for this group since June 1997. An additional 88,400 (+1892.4%) youth wanted work in March but did not search due to reasons related to COVID-19 (not adjusted for seasonality). Including that group would result in a supplemental youth unemployment rate of 20.7% (not adjusted for seasonality).

In core-age population, more losses among women than men

Among people in the core working ages of 25 to 54, the monthly decline in employment for women (-298,500 or -5.0%) was more than twice that of men (-127,600 or -2.0%). Nearly half of the decrease among women was from part-time employment (-144,100 or -14.0%).

The number of core-aged women (25 to 54 years) who lost all or the majority of their usual hours increased by 885,000 (+433.3%) from February to March (not adjusted for seasonality). This represents 19.2% of employed women in this age group. For employed men in this age group, there was an increase of 637,000 who lost all or the majority of their usual hours (+280.0%), which resulted in 13.9% of this group being affected.

There were 162,000 (+55.8%) more core-aged women unemployed in March than in February, raising their unemployment rate 2.8 percentage points to 7.4%. For men in this age group, unemployment increased by 71,300 (+21.8%) bringing the rate up 1.1 percentage points to 5.9%.

Of all workers in this age group who recently worked and wanted a job but did not search in March, approximately two-thirds (67.0% or 99,400) were women (not adjusted for seasonality). Including this group of marginally attached workers with the unemployed would result in a supplemental unemployment rate for women of 8.7%, and 7.6% for men (not adjusted for seasonality).

Largest employment losses among vulnerable workers

In general, workers in less secure, lower-quality jobs, were more likely to see employment losses in March. The number of employees in temporary jobs decreased by 14.5% (-274,900) compared with a decline of 5.3% (-749,500) among employees with permanent jobs (unadjusted for seasonality). Decreases were observed across all types of temporary work, led by those in casual employment (-23.5% or -136,000). There were 5.0% fewer temporary workers with a term or contract position.

Temporary employees were more likely to lose all or the majority of their usual work hours (21.7%) compared with permanent employees (11.6%) in March, unadjusted for seasonality.

Not adjusted for seasonality, employment fell slightly more among employees not covered by a union or collective agreement (-7.0% or -777,600), and they were more likely to lose all or a majority of their usual work hours (19%). In contrast, the number of employees covered by a union or collective agreement fell by 5% (-246,900), and 13% lost all or a majority of their usual hours.

Half (49.9%) of the decline in employment among employees (not adjusted for seasonality) was accounted for by those earning less than two-thirds of the 2019 median hourly wage. Employment for this group declined by 15.8% (-510,800) in March, compared with a decrease of 4.0% (-513,600) among higher-paid employees. The number of low-wage employees who lost all or the majority of their hours increased by 545.5% (+496,000) in March, compared with an increase of 444.2% (+1,072,000) for higher-wage workers.

Multiple jobholding declines

The number of workers holding more than one job at the same time decreased by 25.6% (-283,200) in March (unadjusted for seasonality). As seen for total employment, youth (-33.6% or -44,900) and core-aged women (-30.5% or -127,200) saw the most notable declines in holding multiple jobs. The share of workers holding more than one job declined from 5.8% to 4.5%, a rate last seen consistently in the late 1980s. If workers are holding multiple jobs for financial reasons, this decline could compound the financial impact of the COVID-19 related business closures for some workers.

COVID-19 affects both family earning ability and living arrangements

The ability of Canadians to withstand the economic hardship associated with COVID-19 depends on a number of factors, including their family and living arrangements.

Employment losses in March affected a range of family types, including couple families where one or both partners may have lost their job. Between March 2019 and March 2020, the number of spouses/partners in dual-earner couples decreased, while that in single and non-earner couples increased by 918,000 (+11.7%), unadjusted for seasonality.

In addition to employment impacts, directives to socially isolate at home may have affected living arrangements. A number of Canadians living alone or with non-relatives were faced with a choice to self-isolate by themselves or to move in with family members. On a year-over-year basis, unadjusted for seasonality, the total number of unattached individuals decreased by 128,000 (-2.2%), while the number of lone parents decreased by 38,000 (-3.5%). As a point of reference, the total Canadian population aged 15 and older increased by 1.6% over the same period.

Working from home

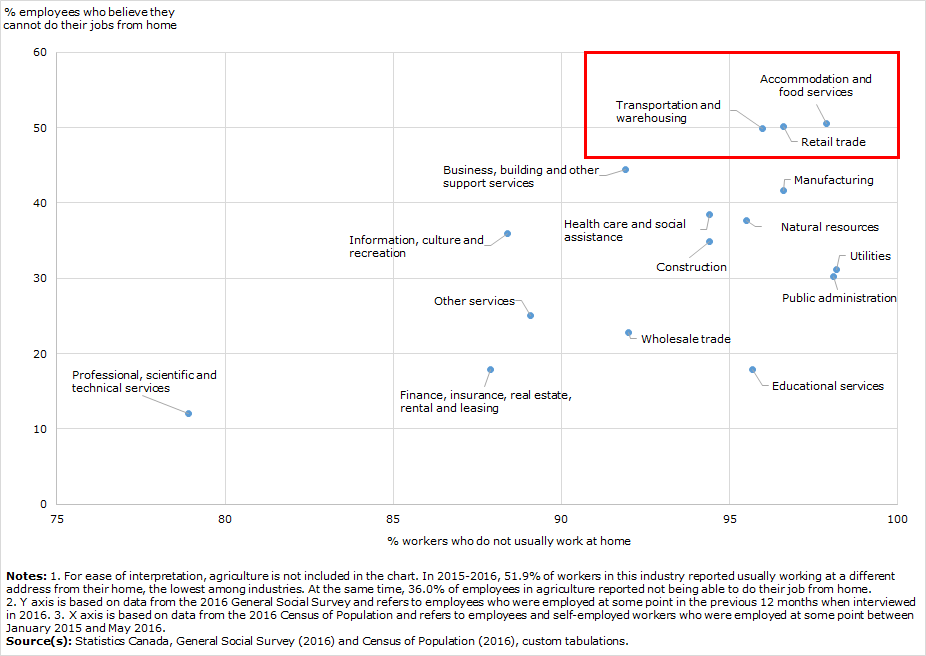

Data from a range of existing Statistics Canada sources provide some insight into the ability of Canadian businesses and organizations to conduct their activities through telework. In 2015/2016, according to the 2016 Census of Population, only 7.5% of workers usually worked at the same address as their home, with significant variation by occupation and industry. Working at home was significantly more common among self-employed workers (34.3%) than employees (3.8%).

Results from the 2016 General Social Survey (GSS) indicate that 13.8% of employees in Canada reported working all or some of their hours from home as part of their regular schedule in 2015/2016. More recent evidence from the Canadian Internet Use Survey suggests that in 2018, among the vast majority of workers who used the Internet, 22.9% had teleworked at least once during the previous 12 months.

Data from the census and the GSS indicate that, in 2015/2016, three industries were associated with particularly limited opportunities to work from home: accommodation and food services, retail trade, and transportation and warehousing.

Data from the 2016 GSS also indicates that, in 2015/2016, a relatively large proportion (more than 45%) of employees in the broad occupational categories of manufacturing and utilities; trades, transport and equipment operators; sales and services; as well as health occupations reported not being able to do their job from home.

Further information on this topic, for the reference period of March 22 to 28, will be released in the coming weeks, in the web panel series Canadian Perspective Survey Series, no.1: Impacts of COVID-19. A special set of questions will be asked to a subset of LFS respondents for the April reference week (April 12 to 18).

Largest job losses in accommodation and food services industry

The federal and provincial governments issued social distancing orders or recommendations before and during the LFS reference week restricting the activities of many workplaces. Government measures instated early in the LFS reference period included states of emergency, restrictions on certain business activities, and limits on the travel of non-residents into the country.

Businesses and organizations may have responded to these unprecedented instructions in a number of ways. They could have reduced activities, resulting in a combination of reduced work hours, temporary layoffs, and permanent reductions in employment. Alternatively, they could have continued to operate as usual or continued operations with an increased reliance on telework, depending on the nature of their operations.

In March, the largest employment declines were recorded in industries which involve public-facing activities or limited ability to work from home. This includes accommodation and food services (-23.9%); information, culture and recreation (-13.3%); educational services (-9.1%); and wholesale and retail trade (-7.2%).

Smaller employment declines were observed in most other sectors, including those related to essential services, such as health care and social assistance (-4.0%). Employment was little changed in public administration; construction; and professional, scientific and technical services. An employment increase was observed in natural resources.

Even within industries which recorded the largest employment declines, not all occupations were equally affected. On average in 2019, employment in sales and service occupations represented about one-quarter of total Canadian employment, but in March 2020, these occupations accounted for 61.8% of the overall employment decline in the month, dropping by an estimated 625,000.

Jobs in this occupational group are relatively low-paid, indicating that the first workers to experience job losses as a result of COVID-19 are among those least able to withstand economic hardship. In 2019, the average hourly wage rate of employees in sales and service occupations was $18.36, compared with the total employment average of $27.83.

Large drop in total hours worked, led by declines in public-facing industries

The total of all hours worked across all industries was down 15.1% in March, the largest decline since the beginning of the series in 1976. Total hours worked declined in all provinces, led by Quebec (-18.9%).

As with employment declines, industries which involve public-facing activities or a limited ability to work from home saw the largest declines in hours worked. This includes accommodation and food services (-41.1%); information, culture and recreation (-30.6%); and educational services (-28.8%). Overall, total hours worked decreased more in the services-producing sector (-17.3%) than in the goods-producing sector (-8.3%).

Accommodation and food services

In March, employment in accommodation and food services declined by 294,000 (23.9%) on a month-over-month basis. Employment declined at a similar rate in the two sub-sectors: food services and drinking places; and accommodation services.

The March decrease is by far the largest employment variation in the sector since comparable data became available in 1976. During the 2008/2009 recession, for example, employment in this industry declined by 5.4% in the 12 months to September 2009.

In March, the number of people employed in accommodation and food services declined in all provinces, ranging from 13.5% in Newfoundland and Labrador to 27.9% in Alberta.

In March 2020, half of those that were still employed in the accommodation and food services sector worked 15 hours or less per week, compared with an average of approximately 25% over recent years (unadjusted for seasonality). One in four reported having worked zero hours, compared with an average of 7% over recent years. This increase in lost hours suggests that further employment losses may be observed in this sector in April. On the other hand, since the March LFS reference week, a number of restaurants have begun offering delivery and take-out services, an example of business adaptations which might partially mitigate further losses.

Information, culture and recreation

Employment in the information, culture and recreation sector decreased by 104,000 or 13.3% in March, with declines observed in all provinces.

On a year-over-year basis, employment declined in performing arts, spectator sports and related industries, consistent with the cancellation or postponement of large sports and entertainment events across the country.

Educational services

Employment in educational services declined by 9.1% (or 125,000) in March, the largest monthly decline in the sector since comparable data became available in 1976.

Most of the decline was observed in Quebec (-73,000) and Ontario (-25,000), while there were smaller declines in British Columbia, New Brunswick, Saskatchewan, Nova Scotia and Manitoba. Employment in educational services was little changed in the other three provinces. The Quebec provincial government announced the closure of all schools, universities and daycares on March 13. The government of Ontario made a similar announcement around the same time, as March break was about to begin in their province.

Compared with March 2019, declines were observed in non-professional occupations in education, such as educational support workers, while employment in professional occupations in educational services was little changed (not adjusted for seasonality). Employment declined by about 10% for those who were not covered by a collective agreement compared with about 4% for those who were (not adjusted for seasonality). Similarly, declines were proportionally greater in small institutions and businesses (less than 500 employees) (not adjusted for seasonality).

Wholesale and retail trade

The number of people employed in wholesale and retail trade declined by 208,000 or 7.2% in March.

Employment changes in subsectors reflect the need for some retail businesses to remain open despite widespread shutdowns and instructions to socially distance. For example, employment in subsectors related to food and beverages was relatively stable, while employment for clothing stores and other retail stores decreased.

Within wholesale and retail trade, the vast majority of the decline in employment was attributable to sales and services occupations, which represented over half of all the workers in the sector.

Declines in social assistance and gains in some health professions

In March, employment in health care and social assistance declined by 100,000 (-4.0%), led by a decline in the social assistance subsector. This subsector represents about 20% of employment in the sector and includes day-care services.

Compared with March 2019, employment in professional and technical occupations in health care (except nursing) increased (not seasonally adjusted).

Natural resources

An important impact of the COVID-19 crisis is an ongoing decline in global economic activity, accompanied by decreases in the price of oil. At the beginning of the LFS reference week, the market price of a barrel of West Texas Intermediate oil was about 54% lower (in US dollars) than at the beginning of 2020.

Despite the sharp fall in the price of oil, the number of people working in natural resources increased by 1.8% month-over-month to 316,000 in March. In addition to oil and gas extraction, this sector includes forestry, fishing, mining and quarrying.

Over the coming months, Statistics Canada will monitor the impact of falling oil prices on economic output and employment. Analysis will appear in a range of reports (Release schedule).

Other occupational groups

Of all broad occupational groups, the second biggest employment decline in March was in occupations in education, law and social, community and government services, which includes home child care providers. Employment losses in this broad occupational group totalled 138,000.

Employment in other broad occupational categories associated with limited opportunities to work from home declined less rapidly in March 2020, including some associated with essential services. This included trades, transport and equipment operators as well as occupations in manufacturing and utilities.

Occupations where employment was little changed in March included occupations in natural and applied sciences; occupations in business, finance and administration; and management occupations. This may reflect the relative ease with which workers in these occupations are able to work from home.

Quarterly update for the territories

The Labour Force Survey collects labour market data in the territories, produced in the form of three-month moving averages.

In the first quarter of 2020, the number of people employed in Yukon edged down by an estimated 100 people, compared with the final quarter of 2019. Employment as a percentage of the population aged 15 and older fell slightly by 0.6 percentage points to 70.0%. Over the same period, the unemployment rate fell from 4.5% in the final quarter of 2019 to 3.2% in the first quarter of 2020.

In the Northwest Territories, the unemployment rate rose slightly by 0.7 percentage points to 9.1% in the first quarter of 2020, compared with the final quarter of 2019. Over the same period, employment increased by an estimated 400 people.

In the first quarter of 2020, employment in Nunavut was unchanged, compared with the final quarter of 2019. At the same time, a slight increase was reported in the number of people looking for work, and the unemployment rate rose by 3.9 percentage points to 15.5%.

Canada-United States comparison

For comparison purposes, all indicators described below are adjusted to US concepts.

The unemployment rate in Canada increased by 2.3 percentage points to 6.9% in March, compared with 4.4% (+0.9 percentage points) in the United States. At the same time, the employment rate (also referred to as employment-to-population ratio, which is the number of employed as a percentage of the population) fell by 3.3 percentage points to 59.1% in Canada, while the US rate declined by 1.1 percentage points to 60.0% .

The labour-force participation rate in Canada fell to 63.5% (down 1.9 percentage points), compared with 62.7% in the United States (down 0.7 percentage points).

For more information on Canada-US comparisons, see "Measuring Employment and Unemployment in Canada and the United States – A comparison."

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The Labour Force Survey is an example of how Statistics Canada supports the reporting on the global sustainable development goals. This release will be used to help measure the following goals:

Note to readers

The Labour Force Survey (LFS) estimates for March are for the week of March 15 to 21.

The LFS estimates are based on a sample and are therefore subject to sampling variability. As a result, monthly estimates will show more variability than trends observed over longer time periods. For more information, see "Interpreting Monthly Changes in Employment from the Labour Force Survey."

This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level.

The LFS estimates are the first in a series of labour market indicators released by Statistics Canada, which includes indicators from programs such as the Survey of Employment, Payrolls and Hours (SEPH); Employment Insurance Statistics; and the Job Vacancy and Wage Survey. For more information on the conceptual differences between employment measures from the LFS and those from the SEPH, refer to section 8 of the Guide to the Labour Force Survey (71-543-G).

LFS estimates at the Canada level do not include the territories.

In March 2020, all face-to-face interviews were replaced by telephone interviews to protect the health of both interviewers and respondents. In addition, all telephone interviews were conducted by interviewers working from their home and none were done from Statistics Canada's call centres. In March, approximately 44,000 interviews were completed, compared to 48,300 in February.

The distribution of LFS interviews in March 2020 compared to February 2020, was as follows:

Personal face-to-face interviews

- February 2020 19.5%

- March 2020 0.0%

Telephone interviews – from call centres

- February 2020 46.1%

- March 2020 0.0%

Telephone interviews – from interviewer homes

- February 2020 5.7%

- March 2020 71.0%

Online interviews

- February 2020 28.7%

- March 2020 29.0%

The employment rate is the number of employed people as a percentage of the population aged 15 and older. The rate for a particular group (for example, youths aged 15 to 24) is the number employed in that group as a percentage of the population for that group.

The unemployment rate is the number of unemployed people as a percentage of the labour force (employed and unemployed).

The participation rate is the number of employed and unemployed people as a percentage of the population.

Full-time employment consists of persons who usually work 30 hours or more per week at their main or only job.

Part-time employment consists of persons who usually work less than 30 hours per week at their main or only job.

Total hours worked refers to the number of hours actually worked at the main job by the respondent during the reference week, including paid and unpaid hours. These hours reflect temporary decreases or increases in work hours (for example, hours lost due to illness, vacation, holidays or weather; or more hours worked due to overtime).

In general, month-to-month or year-to-year changes in the number of people employed in an age group reflect the net effect of two factors: (1) the number of people who changed employment status between reference periods, and (2) the number of employed people who entered or left the age group (including through aging, death or migration) between reference periods.

To update concepts related to duration of unemployment, seasonally adjusted data and standard errors have been added to table 14-10-0342-01, detailing duration of unemployment categories by sex and age group. Three new duration of unemployment categories (14 to 26 weeks, less than 27 weeks, 52 weeks or more) have been added to the table, replacing previous categories in archived table 14-10-0056-01. These new categories align with those used in the Employment Insurance program and provide better insight on duration of unemployment characteristics. Two new indicators (percentage unemployed less than 27 weeks, percentage unemployed 27 weeks or more) have also been added, as the latter can be used as an indicator of long-term unemployment.

Supplementary Indicators used in March 2020 analysis

Employed, worked zero hours includes employees and self-employed who have been away for a total of two or fewer weeks, but excludes employees who have been away for reasons such as 'vacation,' 'maternity,' 'labour dispute.'

Employed, worked less than 50% of usual hours includes both employees and self-employed, where only employees were asked to provide a reason for the absence. This exludes reasons for absence such as 'vacation,' 'labour dispute,' 'maternity,' 'holiday,' and 'weather.' Also excludes those who were away all week.

Not in labour force but wanted work, last worked within the current month includes those who worked within the current month and wanted work, but did not search for reasons such as 'waiting for recall (to former job),' 'waiting for replies from employers,' 'believes no work available (in area, or suited to skills),' 'long-term future start,' and 'other.'

Seasonal adjustment

Unless otherwise stated, this release presents seasonally adjusted estimates, which facilitate comparisons by removing the effects of seasonal variations. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Next release

The next release of the LFS will be on May 8.

Products

The infographic "The impact of COVID-19 on the Canadian labour market" is now available.

More information about the concepts and use of the Labour Force Survey is available online in the Guide to the Labour Force Survey (71-543-G).

The product "Labour Force Survey in brief: Interactive app" (14200001) is also available. This interactive visualization application provides seasonally adjusted estimates available by province, sex, age group and industry. Historical estimates going back five years are also included for monthly employment changes and unemployment rates. The interactive application allows users to quickly and easily explore and personalize the information presented. Combine multiple provinces, sexes and age groups to create your own labour market domains of interest.

The product "Labour Market Indicators, by province and census metropolitan area, seasonally adjusted" (71-607-X) is also available. This interactive dashboard provides easy, customizable access to key labour market indicators. Users can now configure an interactive map and chart showing labour force characteristics at the national, provincial or census metropolitan area level.

The product "Labour Market Indicators, by province, territory and economic region, unadjusted for seasonality" (71-607-X) is also available. This dynamic web application provides access to Statistics Canada's labour market indicators for Canada, by province, territory and economic region and allows users to view a snapshot of key labour market indicators, observe geographical rankings for each indicator using an interactive map and table, and easily copy data into other programs.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

- Date modified: