Canadian Housing Statistics Program, 2021

Released: 2023-06-13

Today, the Canadian Housing Statistics Program (CHSP) is publishing data on residential properties for the reference year 2021, providing details on all land and structures intended for private dwelling purposes in the provinces and territories covered by the program.

Highlights

From 2019 to 2021, housing stock growth (+3.5%) outpaced population growth (+1.3%) in the Toronto census metropolitan area (CMA). Similarly in Vancouver, the housing stock grew at a faster pace (+3.6%) than the total population (+2.1%).

Ontario saw the largest decline in the number of residential vacant land properties (-6,680) among the provinces and territories covered.

New condominium apartments were a key contributor to housing stock growth in Vancouver and they have become increasingly smaller.

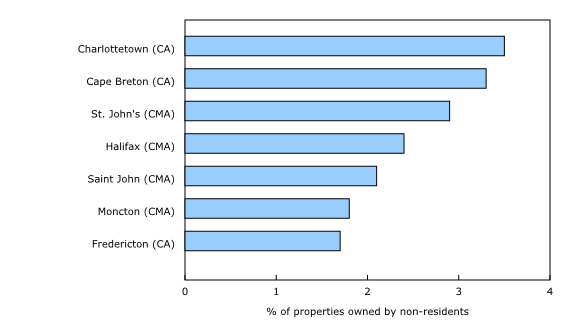

Charlottetown had the second-highest rate of non-resident ownership in urban Canada at 3.5%, after Vancouver (4.3%).

This release marks the inclusion of three new provinces in the CHSP—Prince Edward Island, Saskatchewan, and Alberta—and brings program coverage to all provinces and territories in Canada, except Quebec.

Housing stock growth outpaced population growth in Toronto and Vancouver

Housing prices and affordability are prime concerns for Canadians. Today's release provides new insights on key components of housing supply by providing detailed information on the type and number of properties that were added to the housing stock (i.e., all residential properties, excluding vacant land) across the country.

From 2019 to 2021, the populations of the Toronto (+1.3%) and Vancouver (+2.1%) census metropolitan areas both grew. During this period, the housing stock grew by 3.5% (+61,320 properties) in Toronto and 3.6% (+28,085) in Vancouver. More than half of this growth was attributed to condominium apartments. In Toronto, 38,070 such properties were added during that period, and the number of net new row houses (+12,825) surpassed the number of net new single detached houses (+8,425) in the CMA. A similar trend was observed in Vancouver, with 6,245 net new row houses and a net reduction in single detached homes of 3,680. However, while population and housing stock growth are indicators of supply and demand, they are not the sole determinants of housing prices in these CMAs. Other factors such as income, macroeconomic conditions, and pre-existing shortages in housing supply also play an important role.

While Toronto and Vancouver experienced similar rates of housing stock growth, there were notable differences, particularly for properties with multiple residential units, which is a prime source of rental supply. While Toronto saw a net increase of 55 of these properties from 2019 to 2021, Vancouver saw a net increase of 6,020. A previous release from the CHSP indicated that in some urban markets, such as Toronto, densification has produced a high number of large housing structures (such as rental apartment buildings and towers). In others, like Vancouver, more concentrated forms of density have emerged, such as single-detached houses with secondary suites or laneway units, duplexes, or triplexes. Therefore, the modest number of such new properties in Toronto is not proportional to the number of dwellings added to the stock.

In Vancouver, single-detached houses are getting bigger and condominium apartments are getting smaller

A trend toward residential densification in the Vancouver CMA can be observed not only in the decline of single-detached houses and the increased presence of denser property types, but also in the living area of these properties. The data released today show that newer condominium apartments—those built in 2016 or later—were 13.8% smaller than those built in the 1990s. While condominium apartments have been getting steadily smaller, newer single-detached houses have been getting larger, with a median living area of about 3,600 square feet, which was the highest of all CMAs covered by the program.

Decline in vacant land properties greatest in Ontario

Vacant land is a key input to residential building construction and therefore a major determinant of housing supply and affordability. From 2019 to 2021, a reduction in the number of available vacant land properties was observed in some provinces, especially in Ontario (-6,680). This trend can be explained by several factors, including new greenfield residential construction and land assembly (adjacent vacant land properties being bundled into a single parcel).

At the CMA level, Toronto saw a larger decline in vacant land properties than any other CMA covered, with an overall decrease of 11.8% (-4,305) from 2019 to 2021. Some of the largest decreases occurred in East Gwillimbury (-1,190; -34.8%), Brampton (-680; -16.5%), Markham (-490; -26.5%) and Toronto City (-480; -9.5%).

Charlottetown has the highest rate of non-resident ownership among Atlantic Canada's largest cities

Demand for housing involves different types of owners, from individuals seeking their first home to live in, to investors buying for financial gain or for recreational purposes. Today's release provides information on properties owned by non-residents of Canada, as well as out-of-province owners.

Among the four Atlantic provinces, Charlottetown had the highest proportion of properties owned by non-residents of Canada in 2021, at 3.5%. This was the second-highest rate of non-resident ownership among all the CMAs and census agglomerations (CAs) currently covered by the CHSP. In 2021, rates of non-resident ownership remained steady in Vancouver (4.3%) and Toronto (2.6%).

In addition to the new information on non-residents of Canada who own properties in the Atlantic provinces, CHSP data show that 3.8% of properties in Charlottetown were owned by owners who lived outside the province but within Canada. The rate was 2.2% in Saint John, 1.9% in Halifax, and 1.6% in St. John's. By comparison, the rate of out-of-province ownership was 0.2% in Toronto and 0.8% in Vancouver.

Note to readers

The Canadian Housing Statistics Program (CHSP) currently covers all provinces and territories in Canada, except Quebec.

The unit of analysis for this release represents residential properties, rather than dwellings.

Data for Newfoundland and Labrador and the Northwest Territories are not available at the provincial or territorial levels.

Data on property use, residency ownership and participation are not available in Saskatchewan and Alberta.

Data by property type are not available for Newfoundland and Labrador or the Northwest Territories. Property use is also not available outside of census metropolitan areas and census agglomerations or for recently built properties in all geographies.

Living area is not available for all property types in Prince Edward Island and is not available for mobile homes in Nova Scotia and British Columbia.

For the 2021 reference year, a revision to the classification of property types in Nova Scotia and Manitoba took place. Consequently, users are advised to limit comparisons of property types between 2020 and 2021.

In Ontario, assessment values for properties built since the last assessment year (2016) are not available.

Geographical boundaries

The CHSP disseminates data based on the geographical boundaries from the Standard Geographical Classification 2016.

The CHSP database does not contain information about residential properties on reserves.

Definitions

Housing stock refers to all residential properties in a given geographic region, excluding vacant land.

Property type refers to property characteristics and dwelling configuration. There can be one or more residential structures on a property. Property type includes single-detached houses, semi-detached houses, row houses, condominium apartments, mobile homes, other property types, properties with multiple residential units, and vacant land.

Vacant land includes vacant land properties intended for residential use.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: