Rural and Small Town Canada Analysis Bulletin

The outlook of rural businesses, first quarter of 2022

by Andrew Balcom and Anne Munro

Skip to text

Text begins

In January 2022, inflation in Canada rose to over 5% for the first time in over 30 years.Note Total hours worked fell 2.2% after being sustained at pre-COVID levels through the previous two monthsNote as businesses dealt with the implementation of new restrictions related to the rise of the Omicron variant. Real gross domestic product (GDP) continued to grow, increasing by 1.6% in the fourth quarter following an increase of 1.3% in the previous quarter.Note

The extent to which these changing conditions impacted businesses varied, depending on their region and industry. The Canadian Survey on Business Conditions (CSBC) provides detailed information on the environment in which businesses are currently operating as well as their expectations moving forward. This analysis focuses on businesses in rural areasNote using results from the CSBC, first quarter 2022, conducted from January 4th to February 7th, 2022.Note

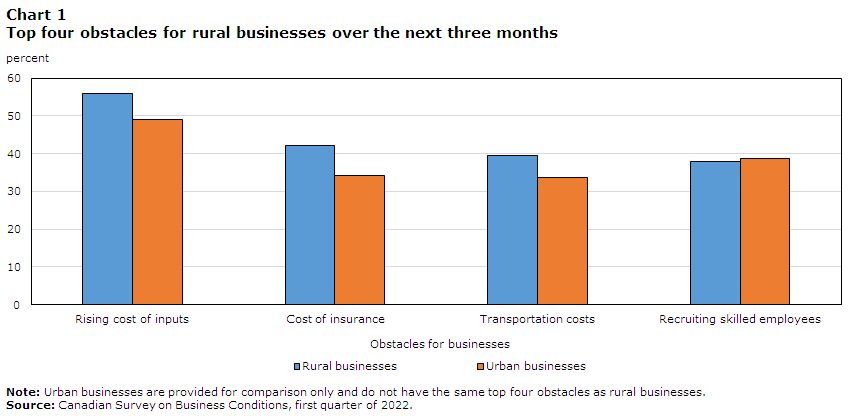

The most frequently expected short-term obstacles among rural businesses were the rising cost of inputs (56.0%), cost of insurance (42.2%), transportation costs (39.4%), and recruiting skilled employees (38.0%).

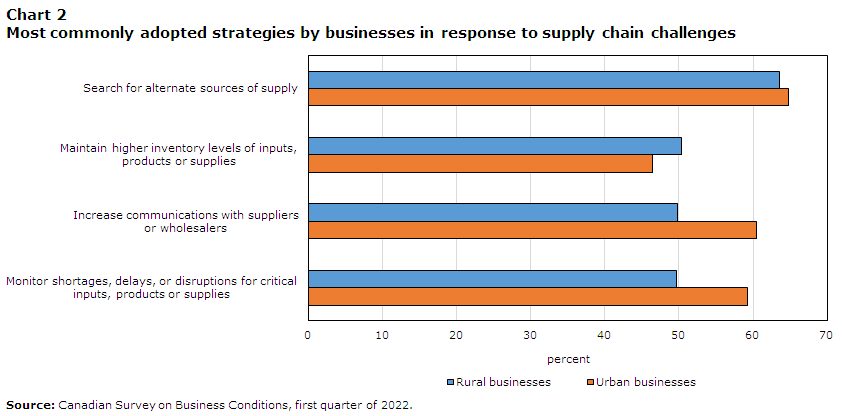

Among rural businesses that expected supply chain challenges, almost three-quarters (71.9%) reported that these difficulties had become more severe over the last three months, and nearly three-fifths (58.4%) expected supply chain challenges to continue for six months or longer. The most commonly adopted strategies by rural businesses to deal with supply chain challenges were searching for alternative supply sources (63.6%), maintaining higher inventory levels (50.4%), increasing communications with suppliers or wholesalers (49.8%), and monitoring issues for critical inputs, products or supplies (49.7%).

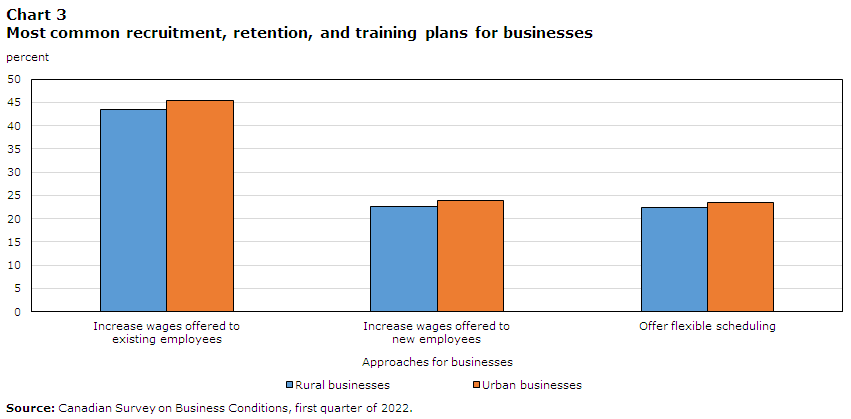

The most commonly reported recruitment, retention, and training plans among rural businesses over the next twelve months were increasing wages offered to existing employees (43.4%), increasing wages offered to new employees (22.6%), and offering flexible scheduling (22.3%).

More than half of rural businesses expect rising cost of inputs to be an obstacle in the near future

While consumers may notice rising costs at the gas pump or in the grocery store, businesses may also experience rising costs of business expenses. The rising cost of inputsNote was the most commonly expected short-term obstacleNote among rural businesses for the fifth successive quarter, increasing from 49.4% of businesses in the fourth quarter of 2021 to 56.0% in the first quarter of 2022. Rising cost of inputs was also the most frequently cited short-term obstacle for urban businesses in the first quarter of 2022 at 49.0%, up 8.0 percentage points from the previous quarter.

For the first time, the cost of insurance was the second most common short-term obstacle for rural businesses at 42.2%, with transportation costs next at 39.4%. In fourth place, rural businesses were slightly more likely to expect recruiting skilled employees to be an obstacle in this quarter, with the value increasing to 38.0% from 35.5% in the previous quarter.

Difficulty acquiring inputs, products or supplies domestically decreased across quarters from the second most common rural obstacle to the fifth, despite an increase in share of businesses reporting this challenge. This indicates that while domestic supply chain issues remain, other challenges have become more common across rural businesses.

Data table for Chart 1

| Rising cost of inputs | Cost of insurance | Transportation costs | Recruiting skilled employees | |

|---|---|---|---|---|

| percent | ||||

| Rural businesses | 56.0 | 42.2 | 39.4 | 38.0 |

| Urban businesses | 49.0 | 34.2 | 33.6 | 38.6 |

|

Note: Urban businesses are provided for comparison only and do not have the same top four obstacles as rural businesses. Source: Canadian Survey on Business Conditions, first quarter of 2022. |

||||

Rural supply chain difficulties have increased and are expected to continue and intensify

Almost three-quarters (71.9%) of rural businesses expecting supply chain difficulties in the short-term reported that these problems had worsened over the last three months. Over one-quarter (26.3%) reported that the challenges remained about the same, while 1.9% reported that they were improving. Similarly to rural businesses, 71.9% of urban businesses expecting supply chain difficulties reported that these issues had increased in severity over the preceding three months.

Among the rural businesses that expected difficulty acquiring inputs, products or supplies from within Canada in the short term, 12.3% expected these difficulties to subside within the next six months. Almost three-fifths (58.4%) expected them to continue for six months or longer, while 29.3% were unsure how long the difficulties would remain.

Rural businesses that expected difficulty acquiring foreign inputs, products or supplies were also pessimistic, with 9.3% expecting the difficulties to be resolved within six months, 62.0% expecting them to remain for six months or longer, and 28.7% being unsure when they would subside.

Over half (51.6%) of rural businesses that anticipated supply chain challenges expected those difficulties to worsen over the next three months, and 43.6% expected them to remain about the same. Less than five percent (4.8%) expected supply chain issues to improve in the short-term.

Almost two-thirds of affected rural businesses looking for alternative supply sources to solve supply chain difficulties

The most common strategy that rural businesses anticipating supply chain difficulties adopted in response was searching for alternative supply sources, with close to two-thirds (63.6%) of rural businesses reporting that they were using this approach. Other common strategies among rural businesses included maintaining higher inventory levels of inputs, products or supplies (50.4%), increasing communications with suppliers or wholesalers (49.8%), and monitoring shortages, delays, or disruptions for critical inputs, products or supplies (49.7%). Meanwhile, 7.2% of rural businesses reported that they were taking no action in response to supply chain difficulties.

Data table for Chart 2

| Rural businesses | Urban businesses | |

|---|---|---|

| percent | ||

| Search for alternate sources of supply | 63.6 | 64.8 |

| Maintain higher inventory levels of inputs, products or supplies | 50.4 | 46.4 |

| Increase communications with suppliers or wholesalers | 49.8 | 60.4 |

| Monitor shortages, delays, or disruptions for critical inputs, products or supplies | 49.7 | 59.2 |

| Source: Canadian Survey on Business Conditions, first quarter of 2022. | ||

Looking over the next 12 months, there was less consensus among rural businesses that were looking to adapt to anticipated supply chain issues. The most common approaches were to partner with new suppliers (33.7%), substitute inputs, products or supplies with alternate inputs, products or supplies (29.6%), and shift to local suppliers (18.5%). Over one-quarter (27.5%) reported they did not plan to implement any strategies over the next year.

Rural businesses less likely to plan to increase current employee wages

As unemployment increased for the first time in nine months in January 2022Note , there was a decrease in the share of rural businesses that were planning to increase wages for their existing employees over the next 12 months, falling from 49.1% to 43.4% between the two quarters. Urban businesses saw the same trend, falling from 48.2% to 45.3%.

The next most common approaches for rural businesses to plan for recruitment and retention were increasing the wages offered to new employees (22.6%), and offering flexible scheduling (22.3%). Encouraging employees to participate in on-the-job training fell from the previous quarter, with 18.2% of rural businesses planning to pursue that over the next 12 months, compared to the 28.3% previously.

Rural and urban businesses largely followed a similar pattern in their recruitment and retention strategies (Chart 3). The largest difference between the two was seen for remote work, where urban businesses were almost twice as likely as rural ones to report they would start offering the option to work remotely within 12 months, at 13.0% and 7.3% respectively.

Rural businesses were less likely than in previous quarters to anticipate that their workforce would work exclusively on-site for the next three months; the share decreased from over four-fifths of rural businesses (80.9%) in the previous quarter, to 62.0%. Less than half (47.6%) of urban businesses expected all their staff to work exclusively on site.

Data table for Chart 3

| Increase wages offered to existing employees | Increase wages offered to new employees | Offer flexible scheduling | |

|---|---|---|---|

| percent | |||

| Rural businesses | 43.4 | 22.6 | 22.3 |

| Urban businesses | 45.3 | 23.9 | 23.5 |

| Source: Canadian Survey on Business Conditions, first quarter of 2022. | |||

Methodology

From January 4 to February 7, 2022, representatives from businesses across Canada were invited to take part in an online questionnaire about business conditions and business expectations moving forward. The Canadian Survey on Business Conditions uses a stratified random sample of business establishments with employees classified by geography, industry sector, and size. An estimation of proportions is done using calibrated weights to calculate the population totals in the domains of interest. The total sample size for this iteration of the survey is 35,026 and results are based on responses from a total of 17,695 businesses or organizations. Businesses were classified as rural or urban based on their geographic location. The 2016 Census Subdivision Boundary File was used to identify all businesses’ census subdivisions (CSD) based on location. Businesses located in CSDs classified as either Census Metropolitan Areas or Census Agglomerations were classified as urban. All businesses in other locations were classified as rural.

References

Statistics Canada. (2022). Canadian Survey on Business Conditions, first quarter of 2022.

Statistics Canada. (2022). Canadian Survey on Business Conditions, fourth quarter of 2021.

Statistics Canada. (2021). Canadian Survey on Business Conditions, third quarter of 2021.

Statistics Canada. (2021). Canadian Survey on Business Conditions, second quarter of 2021.

Statistics Canada. (2021). Canadian Survey on Business Conditions, first quarter of 2021.

Previous issues of the “The outlook of rural businesses” papers were published in the StatCan COVID 19: Data to Insights for a Better Canada series:

The outlook of rural businesses, fourth quarter of 2021

Outlook of rural businesses and impacts related to COVID-19, third quarter of 2021

Outlook of rural businesses and impacts related to COVID-19, second quarter of 2021

Outlook of rural businesses and impacts related to COVID-19, first quarter of 2021

- Date modified: