Gross domestic product, income and expenditure, fourth quarter 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-03-01

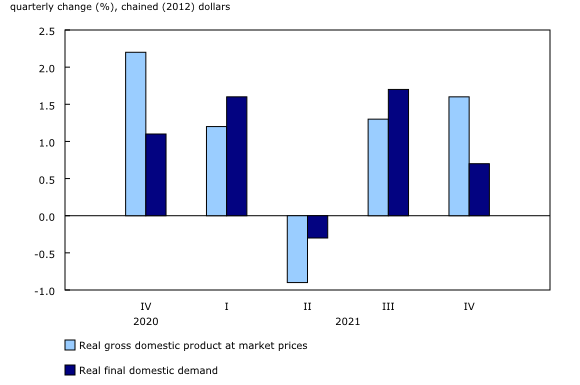

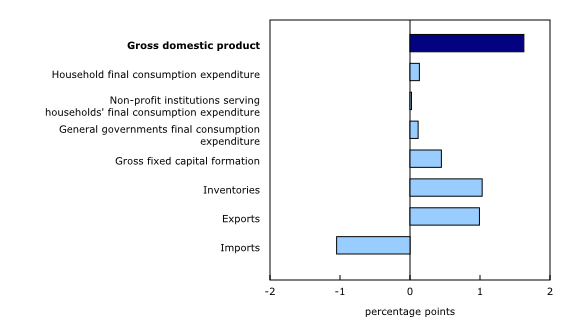

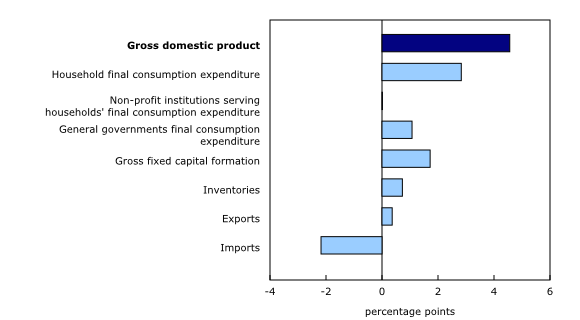

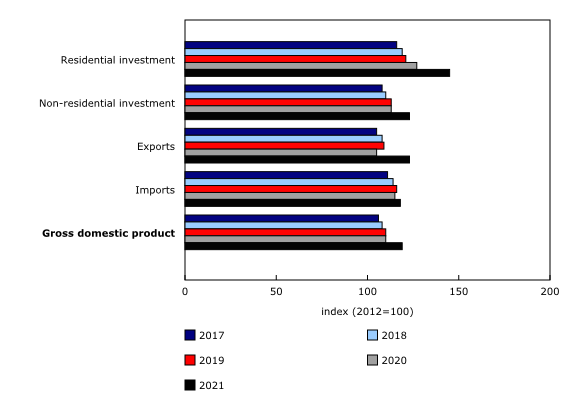

Real gross domestic product (GDP) grew 1.6% in the fourth quarter of 2021, following a 1.3% rise in the third quarter. Real GDP posted a strong 4.6% growth in 2021, after the COVID-19 pandemic-induced decline (-5.2%) in 2020. Final domestic demand rose 0.7% in the fourth quarter of 2021, after rising 1.7% in the previous quarter.

Growth in real GDP was driven by business investment in engineering structures (+3.5%) and home ownership transfer costs (+14.3%), which include commissions and land transfer taxes associated with home resale, and by an accumulation of inventories. Increases in international exports were overshadowed by larger increases in imports. Rising prices moderated growth in household final consumption.

Accumulation of business non-farm inventories (+$11.0 billion) was a major contributor to growth during the fourth quarter, driven by manufacturers and wholesalers. Manufacturers of non-durable goods accounted for the bulk of the inventory increase of the sector, with a smaller accumulation of durable goods inventories.

Wholesale inventory accumulation of durable goods was quite strong in the fourth quarter, and non-durable wholesalers added to the build-up as well. Inventory held by retailers decreased again, but at roughly half the level of the third quarter. In addition, several categories of both durable and non-durable goods were drawn down in the fourth quarter.

Overall, non-farm inventory accumulation kept the real economy-wide stock-to-sales ratio stable at 0.829, the same as in the third quarter. This was still below the 0.842 average for 2018 and 2019 and was most evident in the record-low stock-to-sales ratio of retail motor vehicle dealers.

Growth in international trade for both exports (+3.2%) and imports (+3.4%) was primarily driven by motor vehicles and parts, and in travel services. Increased motor vehicle production after the slowdown caused by motor vehicle parts shortages, combined with high demand domestically and externally, led to 14.0% growth in exports and 12.7% growth in imports. As countries loosened restrictions, there was a marked increase in travel for the second consecutive quarter.

Household spending and residential construction the largest GDP contributors to 2021

Large gains in household spending on food and beverage services and clothing in 2021 reflected re-opening of the economy, as activities outside the home increased. Moreover, working from home, savings from less travel and low mortgage rates fostered spending on housing. Across the country, new home construction, resales and renovations increased at near-record levels in 2021. Household mortgage debt was up 10.3% in 2021, an unprecedented increase of $182.4 billion.

Terms-of-trade improves and gross domestic product implicit prices rise

The terms-of-trade (ratio of price of exports to price of imports) rose 1.0%, primarily because of a 12.5% increase in prices of exported crude oil and crude bitumen in the fourth quarter. In 2021, terms-of-trade rose by 14.0%, again reflecting an 81.7% increase in prices of exported crude oil and crude bitumen.

The GDP implicit price index, which reflects the overall price of domestically produced goods and services, increased 1.6% in the fourth quarter. Record growth in residential and non-residential construction prices and in the price for exported goods in 2021 pushed the GDP implicit price index up 8.2%, the highest since 1982. The price increase was exacerbated by higher production costs due to supply chain disruptions and increased housing demand.

Compensation of employees rises

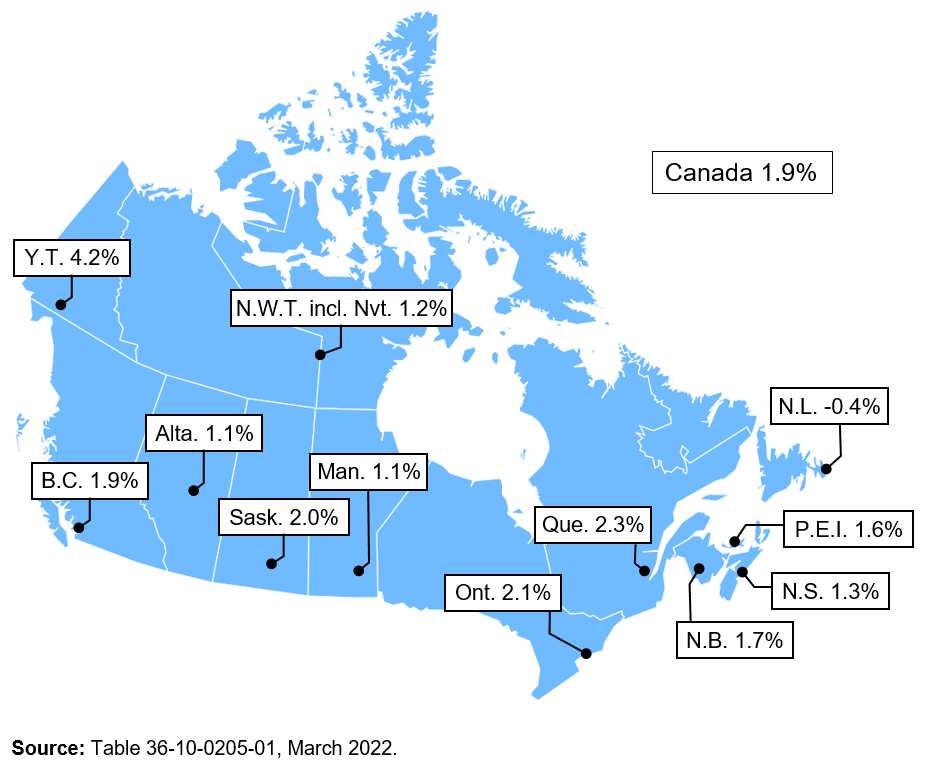

Compensation of employees rose 1.9% in the fourth quarter, following the 2.9% rise in the third quarter. In 2021, compensation was 9.1% higher than in 2020.

The major contributors to wage growth in the fourth quarter were professional and personal services, finance, real estate and company management, and construction. Contributors varied by region, reflecting the diverse nature of employment across the country. After a solid third quarter, Yukon posted strong growth in the fourth quarter. Newfoundland and Labrador was the only region with a decrease in the fourth quarter.

After a decrease in 2020, the $77.0 billion gain in wages in 2021 compared with 2019 was felt in all regions except Alberta. Wages in Alberta for 2021 remain lower than in 2019, primarily due to the professional and personal services industry and the mining, oil and gas industry remaining below pre-pandemic levels. The strongest wage gains for 2021 compared with 2019 were in British Columbia, led by the health care industry; Prince Edward Island, mostly due to the educational services industry; and Yukon, due to the mining, oil and gas extraction industry.

Household disposable income and savings rate drop

Household disposable income was down 1.3% in the fourth quarter, the second consecutive quarterly decline, primarily due to an 11.9% decrease in government transfers to households. Government transfers to households as a proportion of disposable income fell to 19.1% in the fourth quarter, marking a return to pre-pandemic shares of less than 20%.

Continued easing of pandemic-related restrictions, despite the arrival of the Omicron variant late in the quarter, helped boost nominal household consumption by 1.3%. With less disposable income and higher expenditures, households were left with smaller net savings—$23.0 billion at quarterly rates—a level that, despite the notable decrease, was more than double that of the last quarter of 2019. Consequently, the savings rate dropped to 6.4% in the fourth quarter from 9.0% in the third quarter, falling to single-digit territory in the latter half of 2021 after five consecutive quarters of savings rates in excess of 10%. The household savings rate is aggregated across all income brackets. In general, savings rates are higher for higher income brackets.

Support and recovery programs remain sizeable contributors to government expenditures, but their footprint has diminished

Overall, government revenues rebounded 11.4% in 2021, after a 2.2% decline in 2020. At the same time, expenditures decreased 1.9% in 2021, as support measures such as the Canada Emergency Wage Subsidy and Canada Recovery Benefit wound down in the fourth quarter of 2021. This was a reversal of the story from the previous year when support programs initially rolled out and government expenditures rose 23.8%. Still-elevated expenditures, representing roughly 45% of nominal GDP in 2021, balanced against growing revenues, meant that total government remained in a sizeable net borrowing position in 2021. However, by the fourth quarter of 2021, net borrowing had fallen considerably to $11.8 billion at quarterly rates from a record-high $114.8 billion in the second quarter of 2020 and $44.9 billion in the second quarter of 2021.

Non-financial corporations remain in net lending position

Non-financial corporations were in a net lending position throughout 2021 as the economy rebounded. Net operating surplus rose 35.5% after a decline in 2020. Some industries, such as those engaged in energy-related activities, also benefited from rising prices.

Continued growth among financial corporations

Financial corporations recorded a strong year of growth, with net operating surplus up 15.9% in 2021 after weaker growth in 2020 as chartered banks and financial investment related firms, such as portfolio management companies, recorded notable gains. Increased investment activity and strong mortgage lending bolstered revenues despite lower interest rates. Household demand for financial services mirrored this trend, with investment-related expenditures and explicit fees recording double-digit increases in 2021 compared with 2020. Net operating surplus rose 5.0% in the fourth quarter, extending a string of consecutive growth since the second quarter of 2020, when the initial effects of the pandemic constrained activity.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the following 15 years. The plan is based on 17 specific sustainable development goals.

Data on gross domestic product, income and expenditure are an example of how Statistics Canada supports the reporting on global sustainable development goals. This release will be used to measure the following goals:

Note to readers

Updates to data estimates

GDP data for the fourth quarter of 2021 have been released along with updated data from the first quarter of 2021. Updates to the first quarter to the third quarter of 2021 were due to incorporation of updated source data and of preliminary estimates from the Capital and Repair Expenditures survey.

Support measures by governments

To alleviate the economic impact of the pandemic, governments implemented programs, such as the Canada Emergency Wage Subsidy, and the recently ended Canada Emergency Rent Subsidy and the Canada Recovery Benefit. A comprehensive explanation of how government support measures were treated in the compilation of the estimates is available in "Recording COVID-19 measures in the national accounts" and "Recording new COVID measures in the national accounts."

Details of some of the more significant government measures can be found on the page Federal government expenditures on COVID-19 response measures.

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

For more information on GDP, see the video "What is Gross Domestic Product (GDP)?"

General

Percentage changes for expenditure-based statistics (such as household spending, investment, and exports) are calculated from volume measures that are adjusted for price variations. Percentage changes for income-based statistics (such as compensation of employees and operating surplus) are calculated from nominal values; that is, they are not adjusted for price variations.

Unless otherwise stated, growth rates represent the percentage change in the series from one quarter to the next; for instance, from the third quarter of 2021 to the fourth quarter of 2021.

Real-time tables

Real-time tables 36-10-0430-01 and 36-10-0431-01 will be updated on March 7, 2022.

Next release

Data on GDP by income and expenditure for the first quarter of 2022 will be released on May 31, 2022.

Products

The data visualization product "Gross Domestic Product by Income and Expenditure: Interactive tool," which is part of Statistics Canada – Data Visualization Products (71-607-X), is now available.

The document, "The 2018 to 2020 revisions of the Income and Expenditure Accounts," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is available.

The document, "Recording new COVID measures in the national accounts," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is available.

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structure.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@statcan.gc.ca) or Media Relations (STATCAN.mediahotline-ligneinfomedias.STATCAN@statcan.gc.ca).

- Date modified: