StatCan COVID-19: Data to Insights for a Better CanadaOutlook of rural businesses and impacts related to COVID-19, first quarter of 2021

StatCan COVID-19: Data to Insights for a Better CanadaOutlook of rural businesses and impacts related to COVID-19, first quarter of 2021

by Marina Smailes, Anne Munro, Andrew Balcom, Stephen Fudge, and Haaris Jafri

Throughout 2020, businesses and organizations in Canada have had to adjust to the realities of carrying on daily operations during a global pandemic. Despite growth over each of the eight previous months, total economic activity in January 2021 was still around 3% less than in February’s pre-pandemic heights.Note

The impacts of the pandemic on businesses have varied across industry sectors and regions. Using the results of the Canadian Survey on Business Conditions (CSBC),Note first quarter of 2021, this study focuses on businesses in rural areas.Note This survey was conducted by Statistics Canada from mid-January to mid-February 2021 with the aim of developing a detailed understanding of current business practices and business expectations moving forward, as well as the effects on businesses of the ongoing pandemic.

In 2020, there were approximately 220,000 businesses with employees located in rural areas across Canada, representing 16.9% of all employers.Note According to Statistics Canada’s Labour Force Survey, about 1.9 million persons residing in Canada’s rural areas were working as employees of businesses in 2020.Note Factors relevant to the business environment typically differ between rural and urban areas. These include the regional industrial make-up, employment profiles, and remoteness from important services and amenities.

Results of the CSBC, first quarter of 2021, show that the most common challenges rural businesses expect to face over the three-monthNote horizon are the rising cost of inputs, supply chain concerns, fluctuations in consumer demand, and being able to recruit and retain skilled employees. Over the longer 12-month term, about one-fifth of both rural and urban businesses expect to face layoffs. While 7.4% of rural businesses and 6.1% of urban businesses have plans to sell, close or transfer ownership over this horizon, close to one-quarter of businesses in both urban and rural areas expressed uncertainty in this regard.

The unprecedented challenges created by the pandemic have resulted in a precipitous and widespread shift to remote workingNote and an increase in online shopping.Note These changes are less prevalent among rural businesses, pointing to a persistent rural-urban “digital divide”.Note Teleworking is a possibility for 17.5% of rural businesses, only about half the figure of that for urban businesses (35.1%). In a similar vein, as few as 6.3% of rural businesses made 30% or more of their sales online in 2020 as compared to 13.2% of those in urban areas.

Despite challenges, rural businesses fared better than those in urban areas both in terms of remaining operational during the pandemic and year-to-year revenue declines. While nearly half of rural businesses remained fully operational during the pandemic, this proportion was lower for those in urban areas, at about two-fifths. Likewise, 45.8% of rural businesses saw their annual revenues decrease between 2019 and 2020 by 10% or more compared to 57.4% among their urban counterparts.

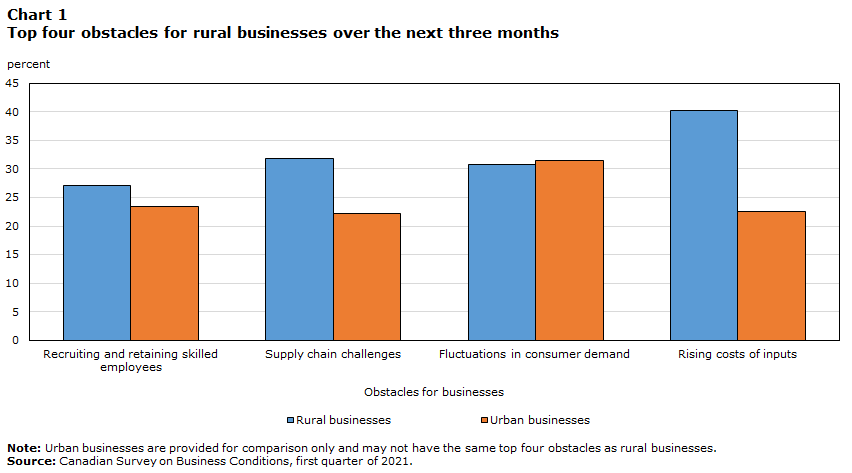

Rising cost of inputs is the short-term obstacle most frequently cited by rural businesses

In the short-term, as captured by expectations for the coming three months, about 40% of rural businesses across Canada foresee rising cost of inputs as a problem, nearly twice as high as in urban areas (22.5%) (Chart 1). Other short-term obstacles that are perceived as particularly challenging by rural businesses include supply chain challenges (31.9%), fluctuation in consumer demand (30.8%), and recruiting and retaining skilled employees (27.1%). In contrast, these shares were 22.2%, 31.5%, and 23.4%, respectively, among urban businesses. Supply chain disruptions in goods-producing sectors have been pervasive during the pandemic, while labour market changes accelerated by COVID-19 may prove particularly challenging for rural businesses.Note

Over the next 12 months, rural and urban businesses hold similar expectations in terms of layoffs. About one-fifth of both rural and urban businesses expect to face layoffs in the next 12 months, while close to one-half in both rural and urban areas are uncertain as to when they could face layoffs.

Data table for Chart 1

| Obstacles for businesses | ||||

|---|---|---|---|---|

| Recruiting and retaining skilled employees | Supply chain challenges | Fluctuations in consumer demand | Rising costs of inputs | |

| percent | ||||

| Rural businesses | 27.1 | 31.9 | 30.8 | 40.2 |

| Urban businesses | 23.4 | 22.2 | 31.5 | 22.5 |

|

Note: Urban businesses are provided for comparison only and may not have the same top four obstacles as rural businesses. Source: Canadian Survey on Business Conditions, first quarter of 2021. |

||||

Urban businesses outpace rural counterparts in shifts to telework and online sales

The need to maintain physical distance during the COVID-19 pandemic has led to many businesses taking measures that would permit employees to work remotely. Rural businesses were less likely than urban businesses to have such arrangements in place. During the first quarter of 2021, 17.5% of rural businesses indicated that teleworking or working remotely was a possibility for their employees, while among urban businesses, this percentage was almost double at 35.1% (Chart 2). Moreover, for businesses where teleworking was a possibility, 9.7% planned to have all employees working remotely for the next three months among rural businesses, compared with 22.1% among urban employers.

This may be partly explained by a different industry mix in rural areas, as some operations are more dependent on employee presence on site. The greater availability of broadband internet in urban areas may also be another driver.Note

The only industry in which rural businesses were better positioned to present teleworking opportunities was retail trade, in which 16.2% of rural businesses were able to offer a remote work option, compared to 12.8% of urban businesses.

Data table for Chart 2

| Industry | Rural businesses | Urban businesses |

|---|---|---|

| percent | ||

| All industries | 17.5 | 35.1 |

| Agriculture, forestry, fishing and hunting | 4.5 | 8.1 |

| Mining, quarrying, and oil and gas extraction | 18.4 | 54.3 |

| Construction | 16.7 | 21.3 |

| Manufacturing | 32.8 | 36.7 |

| Wholesale trade | 38.0 | 43.6 |

| Retail trade | 16.2 | 12.8 |

| Transportation and warehousing | 9.1 | 16.1 |

| Information and cultural industries | 50.6 | 72.5 |

| Finance and insurance | 70.0 | 70.2 |

| Real estate and rental and leasing | 26.6 | 39.8 |

| Professional, scientific and technical services | 45.1 | 74.9 |

| Administrative and support, waste management and remediation services | 18.3 | 32.9 |

| Health care and social assistance | 14.2 | 38.4 |

| Arts, entertainment and recreation | 17.4 | 41.8 |

| Accommodation and food services | 4.5 | 6.6 |

| Other services (except public administration) | 15.4 | 23.4 |

|

Note: For the rural industries of real estate and rental and leasing and professional, scientific and technical services, the values had a data quality label of E. For data with a quality indicator of E, SE is greater than 16.5% and should be used with caution. Source: Canadian Survey on Business Conditions, first quarter of 2021. |

||

Online sales were another area in which rural businesses differed from their urban counterparts. In 2020, 6.3% of rural businesses made 30% or more of their sales online compared to 13.2% for urban businesses, an increase from 2019 when the figures were 4.2% and 8.9%, respectively.

The share of online sales varied significantly between industries. The rural businesses that were most likely to have achieved a 30% or greater share of sales through an online channel in 2020 were other services (except public administration) at 16.6%, arts, entertainment and recreation at 15.9%, and finance and insurance at 15.0%. The industry sectors showing the lowest online sales were construction at 1.9%, administrative and support, waste management and remediation services at 2.7%, and professional, scientific and technical services at 3.5%.

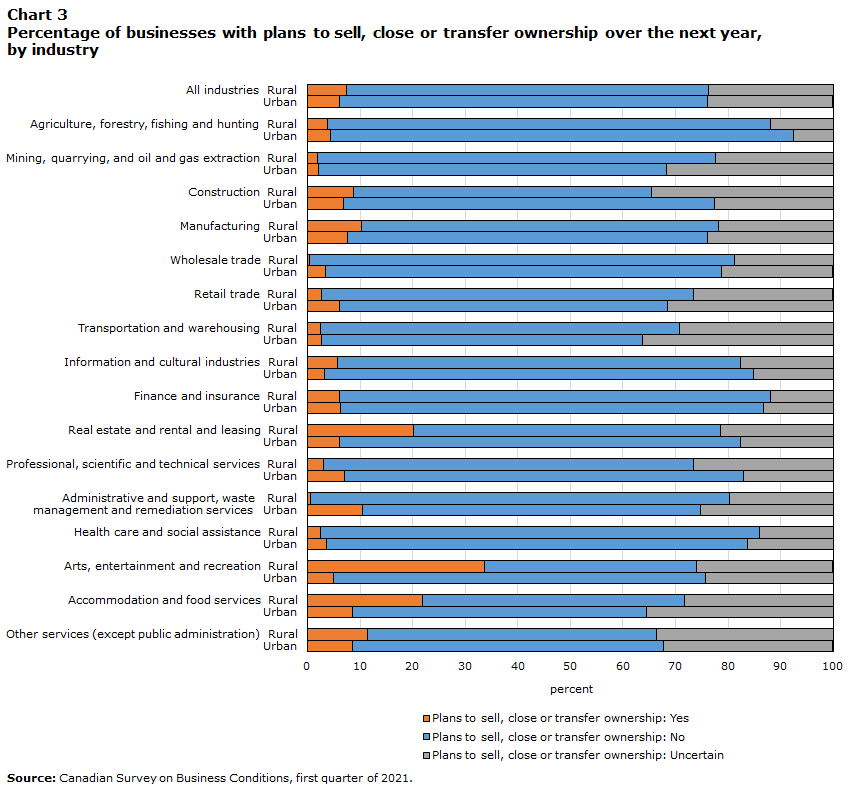

Rural businesses in arts, entertainment and recreation most likely to contemplate ownership changes

Despite the significant impacts of the pandemic, nearly 70% of both rural and urban businesses have no plans to sell, close or transfer ownership within the next 12 months (Chart 3) and under one quarter reported being uncertain.

While the patterns for rural and urban businesses were similar at the national level, there were significant differences within individual industry sectors. There were three industries where more than 20% of rural businesses have plans to sell, close or transfer, but less than 10% of their urban counterparts had similar intentions: arts, entertainment and recreation (33.6% rural, 4.9% urban), accommodation and food services (21.8% rural, 8.6% urban), and real estate and rental and leasing (20.2% rural, 6.0% urban).

Furthermore, the industries in which rural businesses were least likely to expect ownership changes are wholesale trade (0.3%), administrative and support, waste management and remediation services (0.6%), mining, quarrying, and oil and gas extraction (1.9%), health care and social assistance (2.4%), and transportation and warehousing (2.5%). Additionally, rural businesses in these industries were also less likely to expect ownership changes than their urban counterparts.

Data table for Chart 3

| Industry | Rural | Urban | ||||

|---|---|---|---|---|---|---|

| Plans to sell, close or transfer ownership: Yes | Plans to sell, close or transfer ownership: No | Plans to sell, close or transfer ownership: Uncertain | Plans to sell, close or transfer ownership: Yes | Plans to sell, close or transfer ownership: No | Plans to sell, close or transfer ownership: Uncertain | |

| percent | ||||||

| All industries | 7.4 | 68.9 | 23.8 | 6.1 | 69.9 | 23.9 |

| Agriculture, forestry, fishing and hunting | 3.8 | 84.3 | 11.9 | 4.4 | 88.1 | 7.6 |

| Mining, quarrying, and oil and gas extraction | 1.9 | 75.7 | 22.4 | 2.1 | 66.2 | 31.7 |

| Construction | 8.8 | 56.7 | 34.5 | 6.9 | 70.6 | 22.5 |

| Manufacturing | 10.3 | 67.9 | 21.9 | 7.7 | 68.4 | 23.9 |

| Wholesale trade | 0.3 | 80.9 | 18.8 | 3.4 | 75.4 | 21.1 |

| Retail trade | 2.7 | 70.7 | 26.5 | 6.1 | 62.3 | 31.6 |

| Transportation and warehousing | 2.5 | 68.2 | 29.3 | 2.6 | 61.1 | 36.4 |

| Information and cultural industries | 5.8 | 76.6 | 17.7 | 3.3 | 81.6 | 15.1 |

| Finance and insurance | 6.1 | 81.9 | 12.0 | 6.2 | 80.6 | 13.2 |

| Real estate and rental and leasing | 20.2 | 58.4 | 21.4 | 6.0 | 76.3 | 17.7 |

| Professional, scientific and technical services | 3.0 | 70.5 | 26.5 | 7.1 | 75.8 | 17.2 |

| Administrative and support, waste management and remediation services | 0.6 | 79.6 | 19.8 | 10.4 | 64.3 | 25.3 |

| Health care and social assistance | 2.4 | 83.5 | 14.2 | 3.7 | 80.0 | 16.3 |

| Arts, entertainment and recreation | 33.6 | 40.3 | 26.0 | 4.9 | 70.9 | 24.2 |

| Accommodation and food services | 21.8 | 49.9 | 28.4 | 8.6 | 55.9 | 35.5 |

| Other services (except public administration) | 11.5 | 54.8 | 33.7 | 8.5 | 59.3 | 32.1 |

| Source: Canadian Survey on Business Conditions, first quarter of 2021. | ||||||

Rural businesses more likely to remain operational than urban businesses

Since the onset of the COVID-19 pandemic, public health restrictions and the need for physical distancing have impacted businesses. The majority of businesses in both rural (52.3%) and urban (61.4%) areas indicated that they have either remained partially operational or have had to shut down temporarily due to COVID-19 impacts. However, rural businesses have been able to remain fully operational during the pandemic in a larger proportion (47.7%) than their urban counterparts (38.6%) (Chart 4).

Data table for Chart 4

| Remained fully operational | Remained partially operational | Shut down temporarily and remained shut down |

Shut down temporarily but has since reopened |

|

|---|---|---|---|---|

| percent | ||||

| Rural businesses | 47.7 | 33.4 | 3.2 | 15.7 |

| Urban businesses | 38.6 | 37.8 | 4.6 | 19.1 |

| Source: Canadian Survey on Business Conditions, first quarter of 2021. | ||||

Due to a need for reduced person-to-person contact during the pandemic, businesses in industries that are more dependent on in-person activities have been particularly vulnerable to closure of one type or another (Chart 5). Rural businesses were least likely to remain fully operational in the accommodation and food services and arts, entertainment and recreation industries, which was also the case among urban businesses.

Compared with businesses in urban areas, a larger percentage of those in rural areas remained fully operational in the majority of industries. However, in some industries, urban businesses were on par or did better, with the differences being most marked in professional, scientific and technical services and information and cultural industries.

Data table for Chart 5

| Industry | Rural businesses | Urban businesses |

|---|---|---|

| percent | ||

| All industries | 47.7 | 38.6 |

| Agriculture, forestry, fishing and hunting | 77.4 | 76.5 |

| Mining, quarrying, and oil and gas extraction | 53.7 | 49.3 |

| Construction | 51.6 | 35.3 |

| Manufacturing | 49.6 | 44.2 |

| Wholesale trade | 64.1 | 44.2 |

| Retail trade | 38.9 | 29.1 |

| Transportation and warehousing | 43.3 | 33.7 |

| Information and cultural industries | 26.0 | 50.3 |

| Finance and insurance | 53.1 | 60.5 |

| Real estate and rental and leasing | 48.0 | 56.9 |

| Professional, scientific and technical services | 34.4 | 51.8 |

| Administrative and support, waste management and remediation services | 55.5 | 37.2 |

| Health care and social assistance | 33.9 | 38.7 |

| Arts, entertainment and recreation | 9.5 | 10.6 |

| Accommodation and food services | 11.5 | 9.4 |

| Other services (except public administration) | 37.4 | 30.0 |

|

Note: For the rural industries of real estate and rental and leasing and administrative and support, waste management and remediation services, “remained fully operational” had a data quality label of E. For data with a quality indicator of E, SE is greater than 16.5% and should be used with caution. Source: Canadian Survey on Business Conditions, first quarter of 2021. |

||

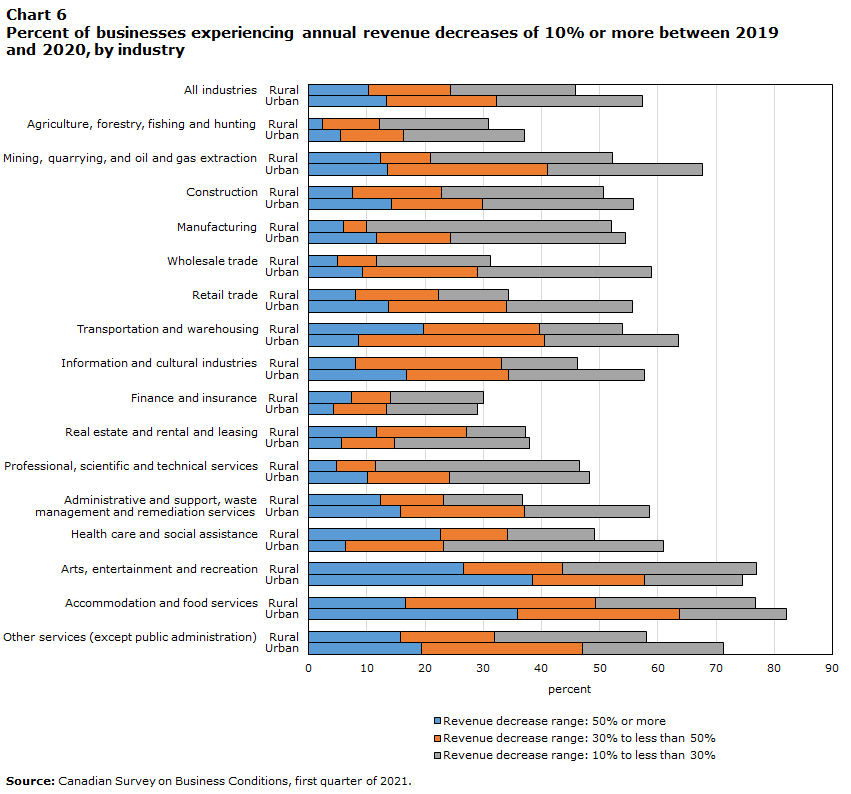

Rural businesses were less likely to experience a decline in revenue than urban businesses

The COVID-19 pandemic had a significant impact on the revenues and sales of business across Canada. For example, Canada-wide sales in wholesale trade shrank by 1.0% in 2020, which was the first decrease since 2009.Note Retail trade sales declined by 1.4% from 2019. This was the largest annual decline since the 2009 recession.Note

Overall, 45.8% of rural businesses had a 10% or more decline in revenues in 2020 compared with 2019 (Chart 6). This percentage was higher for urban businesses at 57.4%. Moreover, the portion of businesses that experienced year-to-year revenue increases of 10% or more was higher in rural areas (16.4%) than in urban areas (11.9%).

The proportion of businesses reporting revenue decreases of 10% or more was generally higher in urban regions across all industries, except for arts, entertainment and recreation and finance and insurance. While the rural-to-urban difference in revenue decreases of 10% or more varied by industry, this difference was greatest in wholesale trade (31.3% rural, 58.9% urban), followed by administrative and support, waste management and remediation services (36.7% rural, 58.5% urban) and retail trade (34.3% rural, 55.7% urban).

Spending on tourism in Canada rose 56.4% during the third quarter of 2020. However, this increase only partially offset the large declines in the first (-14.0%) and second (-65.0%) quarters.Note While having indirect impacts in many industries, tourism impacts some areas of the economy more directly.Note More than 70% of rural businesses in the arts, entertainment and recreation and accommodation and food services sectors suffered year-to-year revenue declines of 10% or more between 2019 and 2020, the highest figures among rural businesses.

In comparison, rural businesses in finance and insurance (30.1%), agriculture, forestry, fishing and hunting (30.9%), and wholesale trade (31.3%) were the least likely among rural industries to suffer year-to-year revenue decreases of 10% or more.

Data table for Chart 6

| Industry | Rural | Urban | ||||

|---|---|---|---|---|---|---|

| Revenue decrease range: 50% or more | Revenue decrease range: 30% to less than 50% | Revenue decrease range: 10% to less than 30% | Revenue decrease range: 50% or more | Revenue decrease range: 30% to less than 50% | Revenue decrease range: 10% to less than 30% | |

| percent | ||||||

| All industries | 10.3 | 14.1 | 21.4 | 13.4 | 18.9 | 25.1 |

| Agriculture, forestry, fishing and hunting | 2.3 | 9.9 | 18.7 | 5.4 | 10.9 | 20.8 |

| Mining, quarrying, and oil and gas extraction | 12.3 | 8.7 | 31.2 | 13.6 | 27.4 | 26.6 |

| Construction | 7.5 | 15.4 | 27.8 | 14.3 | 15.5 | 26.0 |

| Manufacturing | 5.9 | 4.0 | 42.1 | 11.7 | 12.6 | 30.1 |

| Wholesale trade | 5.0 | 6.6 | 19.7 | 9.3 | 19.7 | 29.9 |

| Retail trade | 8.1 | 14.2 | 12.0 | 13.7 | 20.3 | 21.7 |

| Transportation and warehousing | 19.7 | 19.9 | 14.3 | 8.5 | 32.0 | 23.1 |

| Information and cultural industries | 8.1 | 25.0 | 13.1 | 16.8 | 17.5 | 23.4 |

| Finance and insurance | 7.4 | 6.7 | 16.0 | 4.3 | 9.0 | 15.7 |

| Real estate and rental and leasing | 11.7 | 15.4 | 10.1 | 5.7 | 9.0 | 23.2 |

| Professional, scientific and technical services | 4.7 | 6.7 | 35.2 | 10.1 | 14.1 | 24.1 |

| Administrative and support, waste management and remediation services | 12.4 | 10.7 | 13.6 | 15.7 | 21.3 | 21.5 |

| Health care and social assistance | 22.7 | 11.5 | 14.9 | 6.3 | 16.8 | 37.9 |

| Arts, entertainment and recreation | 26.6 | 17.0 | 33.4 | 38.5 | 19.2 | 16.8 |

| Accommodation and food services | 16.7 | 32.5 | 27.6 | 35.8 | 28.0 | 18.3 |

| Other services (except public administration) | 15.8 | 16.1 | 26.1 | 19.3 | 27.8 | 24.2 |

| Source: Canadian Survey on Business Conditions, first quarter of 2021. | ||||||

Methodology

From January 11 to February 11, representatives from businesses across Canada were invited to take part in an online questionnaire about how COVID-19 is affecting their business. This iteration of the Canadian Survey on Business ConditionsNote used a stratified random sample of business establishments with employees classified by geography, industry sector, and size. Estimation of proportions is done using calibrated weights to calculate the population totals in the domains of interest.

Business were classified as rural or urban based on their geographic location. The 2016 Census Subdivision Boundary File was used to identify all businesses’ Census Subdivisions (CSD) based on location. Businesses located in CSDs classified as either Census Metropolitan Areas or Census Agglomerations were classified as urban. All businesses in other locations were classified as rural.

References

Statistics Canada. (2021). Canadian Survey on Business Conditions, first quarter of 2021.

- Date modified: