Annual wages, salaries and commissions of T1 tax filers, 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-03-17

Labour markets were massively disrupted in 2020 as a result of pandemic-induced economic shut-downs. Losses in jobs and hours impacted lower-earning workers disproportionately, while workers in some higher earning industries and occupations experienced increases in employment and wages. Taken altogether, median annual wages, salaries and commissions in Canada were $39,880 in 2020, up 0.8% from 2019. At the same time, the number of earners among tax filers was virtually unchanged (down 18,510 earners, or 0.1%) and the earnings of lower-earning workers fell 10.6%.

Today, Statistics Canada is releasing new data on the wages, salaries and commissions of Canadian tax filers from the 2020 T1 Family File. The release provides information on the annual earnings of tax filers, using administrative tax data. Over the coming months, Statistics Canada will make available additional data on the incomes of Canadians, including from the Canadian Income Survey, additional information from the T1 Family File and the 2021 Census of Population.

Median earnings increase, but there are fewer earners in most provinces and territories

The 0.8% growth in the median annual wages, salaries and commissions of Canadian tax filers in 2020 was greater than that recorded in 2019 (+0.5%). The increase occurred in the context of restrictions introduced to help slow the spread of COVID-19, and of income support programs designed to mitigate the negative economic impacts of the pandemic, including the Canada Emergency Response Benefit (CERB).

Growth in median earnings is often interpreted as indicating increased well-being. However, such gains can also reflect the disproportionate impacts of the pandemic among lower-wage earners. From 2019 to 2020, the number of wage earners decreased 0.1%, with larger declines observed in lower-paid sectors such as accommodation and food services, and arts, entertainment and recreation, which were more impacted by public health restrictions. These sectors also recorded the largest decreases in median earnings.

Median wages, salaries and commissions rose in 9 of the 13 provinces and territories in 2020. The fastest growth in median earnings occurred in the territories and in British Columbia; these regions were also where the number of wage earners decreased the most.

Earnings in British Columbia reached $40,450 in 2020, up 6.8% compared with 2019. Alberta (-3.6%), Newfoundland and Labrador (-2.6%), and Saskatchewan (-1.6%) were the only three provinces where a decrease in median earnings was observed. In addition to facing the negative economic impacts of the pandemic, resources-based provinces were affected by lower oil prices. In April 2020, oil prices, as measured by Western Canadian Select, fell to a trough of US$3.50 per barrel, the lowest monthly level on record.

The number of earners decreased in most provinces and territories in 2020. This decline was particularly pronounced in Nunavut (-4.1%), in the Northwest Territories (-3.8%) and in British Columbia (-2.9%). Five provinces recorded increases in the number of earners: Prince Edward Island (+1.1%), Ontario (+1.0%), Nova Scotia (+0.9%), Manitoba (+0.7%) and Quebec (+0.2%).

In 2020, median annual earnings remained highest in the Northwest Territories ($58,900), Yukon ($53,610) and Alberta ($44,660).

The earnings of lower earning workers falls more than that of middle- or higher-earnings workers, especially for women

To see the impact of the pandemic on lower-earning workers, one needs to look beyond the median. Looking at earnings for earners at the 25th percentile is one way to assess the effects of the pandemic. The 25th percentile is the point on the earnings distribution where a quarter of workers earned less and three quarters earned more.

Across Canada, the earnings of workers at the 25th percentile fell by 10.6% between 2019 and 2020, and by even more in Ontario (-14.7%) Saskatchewan (-12.1%) and Alberta (-17.5%). Earnings for low-earning workers also fell more for women (-12.8%) than for men (-8.4%), and decreased most for women in Alberta (-19.9%).

Median earnings increase the most in Victoria, and decrease the most in Windsor and St. Catharines–Niagara

Median wages, salaries and commissions rose in 22 of the 35 census metropolitan areas (CMAs) in 2020. Meanwhile, the number of tax filers with employment income decreased in 13 of the 35 CMAs. The four CMAs in British Columbia, Victoria (+11.3%), Kelowna (+7.1%), Abbotsford–Mission (+6.0%) and Vancouver (+4.5%), recorded the highest increases in median earnings.

In contrast, Windsor (-6.9%) and St. Catharines–Niagara (-6.6%) posted the greatest decreases in median earnings in 2020. In Windsor, reduced production in motor vehicle plants in 2020 contributed to the decline. Of all the CMAs, St. Catharines–Niagara had the highest proportion of earners in accommodation and food services. About 1 in 10 earners in the CMA worked in this sector, which was among those most impacted by the pandemic.

In Alberta, the CMAs of Edmonton (-3.5%), Calgary (-2.5%) and Lethbridge (-1.6%) recorded decreases in median earnings in 2020, but remained among the CMAs with the highest median earnings. In 2020, median earnings were highest in Ottawa–Gatineau, at $50,000.

Earnings of younger and older workers decline in 2020

From 2019 to 2020, the wages, salaries and commissions of younger and older workers declined, while those of core-aged workers increased slightly.

Median annual earnings among youth aged 15 to 24 decreased 7.2% from 2019 to 2020. Youth unemployment rose to a historic peak of 28.8% in May 2020. There was also a decline in the number of youth aged 15 to 24 with earnings (-5.7%). These results largely reflect the concentration of younger workers in sectors such as accommodation and food services, wholesale trade, and retail trade, which were among the most impacted by measures put in place to slow the spread of COVID-19.

Both the number of older workers with earnings and these workers' median earnings experienced declines in 2020. Among those aged 65 to 74, the number with earnings decreased 1.0%, while median annual earnings were down 3.4%.

The number of adults aged 35 to 44 with earnings increased 2.7% from 2019 to 2020, and their median earnings went up 1.0% to $54,420. Median earnings of tax-filing women in younger age groups (15 to 24 and 25 to 34 years old) decreased faster than for their male counterparts while the earnings of women aged 35 to 54 and 55 to 64 years old increased faster than for their male counterparts. In each of these age groups the number of female earners increased more or decreased less than that of male earners.

Earnings decline the most in accommodation and food services and in arts, entertainment and recreation

Measures introduced to slow the spread of COVID-19 in 2020 limited economic activity in many sectors, while other sectors saw growing demand for workers. Public health restrictions had a greater impact on lower-paying service sectors such as accommodation and food services; arts, entertainment and recreation; and retail trade. Other sectors (for example, higher-paying sectors that transitioned more easily to remote work) recorded increased activity. As a result, half of the sectors considered in this release posted higher earnings in 2020 than in 2019, while the other half saw decreases.

Median earnings were down by approximately 25% from 2019 to 2020 both in accommodation and food services, and in arts, entertainment and recreation. These were the greatest declines recorded among all sectors; large decreases were observed in all provinces and territories. Median annual earnings in these two sectors were also the lowest among all sectors in 2020, at $12,280 for accommodation and food services and $13,500 for arts, entertainment and recreation. Pronounced decreases in the number of earners were also observed in both sectors (-11.9% and -13.6%, respectively).

Median earnings in retail trade fell by 8.3% to $21,480 in 2020, the third-largest decline among the sectors. From 2018 to 2019, this sector had posted one of the largest increases in median annual earnings.

Strong growth from 2019 to 2020 in median earnings was recorded in higher-paid sectors, such as finance and insurance (+6.2% to $62,400), public administration (+5.2% to $64,930), and information and cultural industries (+5.1% to $64,200).

In these higher-paid sectors, the proportion of individuals working full time, based on results from the Labour Force Survey, was either already higher in 2019 or increased at a much faster rate than in other sectors in 2020. The information and cultural industries sector includes telecommunications; data processing, hosting, and related services; and other information services, such as Internet publishing and broadcasting, and web search portals.

Median annual earnings in health care and social assistance rose 1.4% in 2020 to reach $42,330. This sector is composed of four subsectors, and the sector-wide increase in earnings was driven by higher annual wages among workers in hospitals, as well as nursing and residential care facilities.

The number of tax filing earners in health care and social assistance increased in all provinces. The highest growth was in Quebec (+8.2%) as the government put in place several measures (financial and non-financial) to attract new or retired health care workers. Median annual earnings in that sector in Quebec reached $42,920 in 2020, an increase of 3.7% compared with 2019.

Work-related benefits more present among lower-paid earners than among other earners

In 2020, major income support programs were introduced by governments to help mitigate the economic impacts of the pandemic on Canadians. In the T1 Family File tax data used in this release, it is possible to identify those who received work-related benefits such as the Canada Emergency Response Benefit (CERB), Employment Insurance (EI) benefits, or the Canada Recovery Benefit (CRB).

About 8,400,000 tax filers with or without wages, salaries and commissions received EI, CERB or CRB payments in 2020. Individuals with lower annual earnings were more likely to receive these benefits. The median annual earnings in 2020 of people who received EI, CERB or CRB payments were $22,070, about 60% lower than those of people who did not receive such payments ($55,020). For a detailed analysis of the characteristics of CERB recipients, see "Workers receiving payments from the Canada Emergency Response Benefit program in 2020."

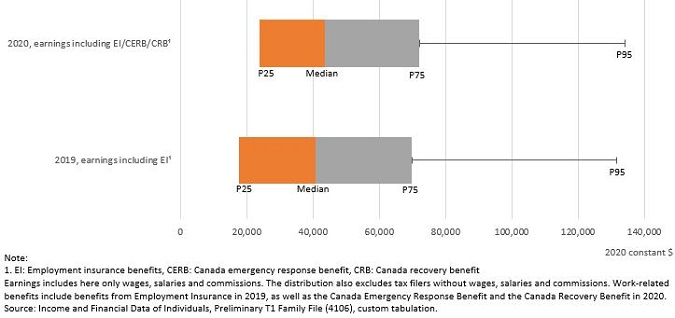

Earners with the lowest work-related income were the most compensated by the EI, CERB and CRB programs. In 2019, the 25th percentile of earners earned $17,680 in work-related income (earnings plus EI). In 2020, after employment related benefits are included, the 25th percentile of earners earned $23,940 in work-related income (earnings plus EI, CERB and CRB), reflecting increased income in the bottom income quintiles in 2020 as a result of increased government transfers. The 25% of earners with the highest wages did not see such a strong impact on their earnings. The proportion of workers in high-earning industries and workers with higher earnings were less likely to have received EI benefits, CERB or CRB.

Looking ahead

Following a period of growth and a strong labour market in Canada, the pandemic brought multiple challenges to Canadians in 2020. The unemployment rate in 2020 was above 9.0% for the first time since 1997 at 9.5%. Shutdowns continued to affect several sectors in 2021, and governments continued to provide support to individuals facing employment losses. While 2021 started and ended with pandemic-induced business closures, results from the Labour Force Survey showed a recovery in employment and wages during 2021 and the Income and Expenditure Accounts showed strong wage gains in 2021. More information on 2020 household and family incomes, other income sources and poverty rates will be released by the Canadian Income Survey on March 23, 2022.

Note to readers

The term "earnings" in the release includes the wages, salaries and commissions declared by tax filers.

This release provides data on wages, salaries and commissions from all sources received throughout the year for paid employment as reported on T1 Income Tax and Benefit returns. Data for this release are produced using the preliminary version of the T1 Family File, which is based on an early version of the T1 file received by Statistics Canada from the Canada Revenue Agency.

The extension by the Canada Revenue Agency of the deadlines for filing 2019 tax returns and for the payment of taxes without penalty impacted the completeness of the 2019 data used in this release. The number of tax filers appearing in the preliminary income tax data, generally speaking individuals who filed taxes before September, edged down by 0.8% in 2019 and increased by 2.5% in 2020 while the number of tax filers in the preliminary tax file increased on average by 1.3% yearly since 2009. The larger increase in 2020 was likely due to a number of later filings in 2019. Therefore, caution should be used with this data when interpreting moderate changes in counts of earners between 2019 and 2020. The decline in the number of earners could be understated by approximately 1.2 percentage point.

These estimates cover all tax filers 15 and older (as of December 31 of the tax year) who reported wages, salaries or commissions. This group includes workers employed full and part time, as well as full and part year. It excludes tax filers who only reported income from self-employment during the year.

Wages, salaries and commissions reported by tax filers on their T1s are based on the employment income recorded on their T4 Statement of Remuneration Paid. In addition to wages, salaries and commissions, this income includes training allowances, tips, gratuities and royalties received from employers during the tax year. Tax-exempt employment income earned by registered Indians is also included. Self-employment income is excluded.

Main industry refers to the two-digit sector assigned to a tax filer using the North American Industry Classification System. An industry is assigned to each tax filer based on the industry that accounted for the highest share of their total employment income during the tax year over all of their T4 slips. The category "not available" in the main industry table represents tax filers for whom an industry code could not be assigned.

Data source on employment and hours worked is the Labour Force Survey.

The Canada Emergency Response Benefit (CERB) and the Canada Recovery Benefit were introduced in 2020 to compensate workers for some loss in earnings related to the various measures put in place by governments to limit the spread of COVID-19. The research paper "Workers receiving payments from the Canada Emergency Response Benefit program in 2020" presents some characteristics of workers who received CERB payments.

The median is the value in the middle of a group of values (i.e., half of people have wages, salaries and commissions above this value and half of people have wages, salaries and commissions below this value).

The 25th percentile is the value in a distribution where a quarter of values are below and three quarters of values are above.

All figures for previous years are in constant dollars and have been adjusted for inflation using the Consumer Price Index, table 18-10-0005-01.

All data in this release have been tabulated according to the 2016 Standard Geographical Classification used for the 2016 Census.

A census metropolitan area (CMA) is formed by one or more adjacent municipalities centred on a population centre (also known as the core). A CMA must have a total population of at least 100,000, of which 50,000 or more must live in the core.

Products

The document Technical Reference Guide for the Preliminary Estimates from the T1 Family File (11260001) presents information about the methodology, concepts and data quality for the data available in this release.

Data on wages, salaries and commissions (11230001, various prices) and Canadian tax filers (17C0010, various prices) are now available for Canada, provinces and territories, economic regions, census divisions, census metropolitan areas, census agglomerations, census tracts, and postal-based geographies. These custom services are available upon request. Tables 11-10-0047-01, 11-10-0072-01 and 11-10-0073-01 for this release are available for free on the Statistics Canada website for Canada, provinces and territories, census metropolitan areas, and census agglomerations.

The Income, pensions, spending and wealth statistics portal, which is accessible from the Subjects module of the Statistics Canada website, provides users with a single point of access to a wide variety of information related to income, pensions, spending and wealth.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: