Consumer Price Index, December 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-01-20

December 2020

0.7%

(12-month change)

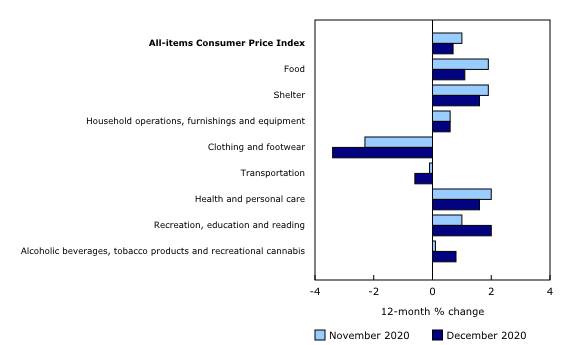

Year over year, the Consumer Price Index (CPI) rose at a slower pace in December (+0.7%) than in November (+1.0%). Consumer price growth slowed on lower air transportation prices (-14.5%) and reduced food price growth (+1.1%). Excluding gasoline, the CPI rose 1.0% in December—down from the 1.3% increase observed in November.

On a seasonally adjusted monthly basis, the CPI rose 0.1% in December.

Check out the 2020 annual review infographic

Today, Statistics Canada released the infographic Consumer Price Index: 2020 in Review, highlighting the annual average consumer inflation in Canada and the regions in 2020 while also examining the noteworthy average commodity movements of the year amid the COVID-19 pandemic.

Explore the Consumer Price Index

Check out the Personal Inflation Calculator. This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation that represents the average Canadian household—the Consumer Price Index (CPI).

Visit the Consumer Price Index portal to find all CPI data, publications, interactive tools, and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Check out the Consumer Price Index Data Visualization Tool to access current and historical CPI data in a customizable visual format.

Highlights

Prices rose in six of the eight major components on a year-over-year basis in December.

Price movements in December occurred in an environment of uncertainty. Consumer confidence rose to its highest point since the onset of the pandemic, as Canadians received good news with the approval of the first two vaccinations against COVID-19.

At the same time, more regions locked down or imposed further restrictions to limit the spread of COVID-19, resulting in job losses for some Canadians and employment uncertainty for others.

Travel tours and COVID-19

In the wake of international travel advisories, travel tours remained unavailable to consumers in December. A general imputation strategy for services not available to consumers resulted in prices for travel tours being replaced with an imputed movement from the all-items CPI.

As a result of this treatment, the travel tours index, which is highly seasonal in nature, increased 21.3% compared with December 2019, when prices fell 2.7%, resulting in upward pressure on the index.

As such, the 12-month price change indicator for travel tours should be interpreted with caution.

Shelter prices are higher year over year, led by rising homeowners' replacement cost

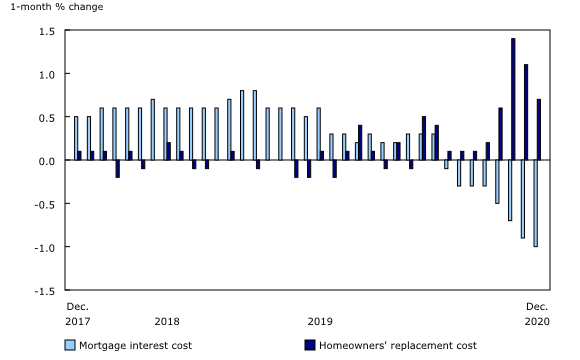

The homeowners' replacement cost index, which is linked to the price of new homes, rose 5.5% on a year-over-year basis in December, contributing to higher shelter prices (+1.6%). Historically low interest rates coupled with a shift in buyer preferences toward larger homes continued to fuel demand for single-family homes. The increase in demand combined with higher building material costs and low inventory of homes for sale in some markets contributed to higher prices for new housing.

The mortgage interest cost index fell 3.1% year over year. Lower interest rates following reductions to the Bank of Canada's policy interest rate in March continued to contribute to the decline in borrowing costs as more Canadians renewed or initiated mortgages at lower rates.

On a monthly basis, the homeowners' replacement cost and mortgage interest cost indexes moved in opposite directions for the eighth consecutive month in December.

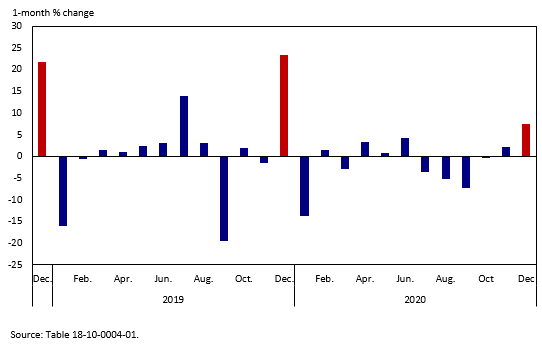

Gasoline prices higher month over month

Gasoline prices increased 3.3%, the first monthly price increase since July 2020. Higher crude oil prices—driven primarily by production cuts in major oil-producing countries in response to consistently low global demand for oil amid limited travel and lower levels of economic activity—contributed to the gain. Despite the monthly increase in December, gasoline prices were 8.5% lower compared with December 2019.

Air transportation

Year over year, lower demand for air travel pushed air transportation prices (-14.5%) down in December. The typical seasonal demand for air travel during the holiday season was significantly reduced in December. However, on a monthly basis, air transportation prices rose 7.4% in December compared with a 23.4% gain in December 2019.

Price growth for food slows year over year

Year over year, food prices rose at a slower pace in December (+1.1%) compared with November (+1.9%).

On a year-over-year basis, fresh vegetables rose at a slower pace in December (+1.1%) than in November (+4.6%), while prices for fresh fruit fell 6.0% year over year. Favourable weather conditions in growing regions in the United States and Mexico contributed to the increased supply of fresh fruit and vegetables. Redirected supply from the food service industry also increased supply at retail outlets.

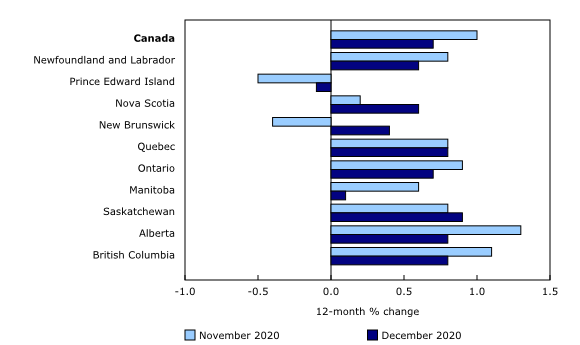

Regional highlights

Prices increased in nine provinces on a year-over-year basis in December.

Fresh or frozen beef prices rise in Eastern Canada and fall in the west

Fresh or frozen beef prices moved in opposite directions in Eastern and Western Canada. East of Ontario, Canadians paid more for beef. While consumers in Quebec (+4.4%) paid more for beef, consumers in Ontario (-2.7%) paid less compared with the same month a year earlier. Price declines in Ontario and Western Canada contributed to the drop in beef prices (-1.5%) nationally year over year.

Additional research related to COVID-19

For more information on the impact of COVID-19 on consumer spending, please consult our additional publications, which are available in the Prices Analytical Series (62F0014M):

Canadian Consumers Prepare for COVID-19 (released April 8)

Canadian Consumers Adapt to COVID-19: A Look at Canadian Grocery Sales up to April 11 (released May 11)

Adjusting the Consumer Price Index to the new spending realities during the pandemic (released October 8).

Note that table 18-10-0263-01 (Monthly adjusted price index, provisional) and table 18-10-0264-01 (Monthly adjusted consumer expenditure basket weights) were updated on January 12, 2021.

Note to readers

The Consumer Price Index (CPI) measures the change in prices of consumer goods and services over time. To accurately reflect trends in the market, Statistics Canada periodically updates the methods applied to various components of the CPI.

Upcoming enhancement: New approach to estimating the computer equipment, software and supplies index

With the release of January 2021 CPI data on February 17, 2021, the computer equipment, software and supplies index will be updated with an enhanced methodology and new data sources. This index represents 0.42% of the 2017 CPI basket and is part of the recreation, education and reading component.

Detailed documentation describing the new computer equipment, software and supplies index approach will be available with the January 2021 CPI release.

Upcoming enhancement: Resale housing data to be incorporated into the Mortgage Interest Cost Index

Following the release of the Residential Property Price Index, the CPI is incorporating resale house prices into the house subindex of the Mortgage Interest Cost Index (MICI). This enhancement will be published with the February 2021 CPI (on March 17, 2021), and does not represent a change in methodology. More information on this enhancement will be included in the February 2021 release of the CPI.

The MICI represents 3.57% of the 2017 CPI basket and is part of the shelter component of the CPI. More information on the MICI model can be found in Chapter 10 of The Canadian Consumer Price Index Reference Paper.

COVID-19 and the Consumer Price Index

Statistics Canada continues to monitor the impacts of the novel coronavirus (also known as COVID-19) on Canada's Consumer Price Index (CPI).

Goods and services in the Consumer Price Index (CPI) that were not available to consumers in December because of COVID-19 restrictions received special treatments, effectively removing their impact on the monthly CPI. The following subindexes were imputed from the monthly change in the All-items index: travel tours, components of spectator entertainment, recreational services, and some components of use of recreational facilities and services in some areas.

Because of new restrictions put in place, the price indexes for beer served in licensed establishments, wine served in licensed establishments and liquor served in licensed establishments were imputed in Quebec, using the indexes to which consumers likely redirected their expenditures—beer purchased from stores, wine purchased from stores and liquor purchased from stores.

Consistent with previous months affected by the COVID-19 pandemic, prices for suspended flights were excluded from the December CPI calculation because passengers were ultimately unable to consume them. As a result, select subcomponents of the air transportation index were imputed from the parent index (air transportation).

A document entitled Technical Supplement for the December 2020 Consumer Price Index is available in the Prices Analytical Series (62F0014M) publication, with further details on the imputations used to compile the December 2020 CPI.

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on February 1, 2021. For more information, consult the document Real-time CANSIM tables.

Next release

The Consumer Price Index for January 2021 will be released on February 17, 2021.

Products

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: