Adjusting the Consumer Price Index to the new spending realities during the pandemic

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-10-08

Many Canadians have spent a lot more time and money at home during the COVID-19 pandemic and a lot less on travel and other items. Statistics Canada has adapted to these changes in spending habits by developing the adjusted price index in partnership with the Bank of Canada. The adjusted price index takes into account these sudden shifts in spending patterns when weighting the components which make up the Consumer Price Index (CPI).

The analytical paper "Consumer expenditures during COVID-19: An exploratory analysis of the effects of changing consumption patterns on consumer price indexes," released July 13, provides detailed information on the data and methods used to calculate the adjusted price index series, as well as adjusted weights reflecting consumer spending during the months of March, April and May 2020. The data table Monthly adjusted price index, provisional includes data for June, July and August 2020 as well as revised data for March, April and May. The data table for the Monthly adjusted consumer expenditure basket weights includes data for May, June and July 2020, as well as revised data for February, March and April.

Consumer price inflation during the pandemic

The COVID-19 pandemic led to economic disruptions that affected financial and labour markets across the globe. Very quickly, Canadians were spending differently as they adapted to staying home, travelling less and buying more of certain items and fewer of others. Some businesses reopened over the summer as lockdown measures were eased, starting with the most essential services. By the end of August, many businesses had resumed operations and although some consumer spending patterns began returning to pre-pandemic form, many remained altered.

Shifts in household purchasing patterns have implications for the basket weights used to measure consumer price inflation. A fixed-basket price index, such as the official CPI, can only reflect such changes when basket weights are updated.

Statistics Canada is working with the Bank of Canada and has leveraged their aggregate spending data, representing the majority of consumer goods and services. These data reflect the new consumption patterns during the pandemic and were used to derive the monthly adjusted consumer expenditure basket weights used to calculate the adjusted price index. This adjusted series provides an alternative estimate of consumer price inflation during the pandemic.

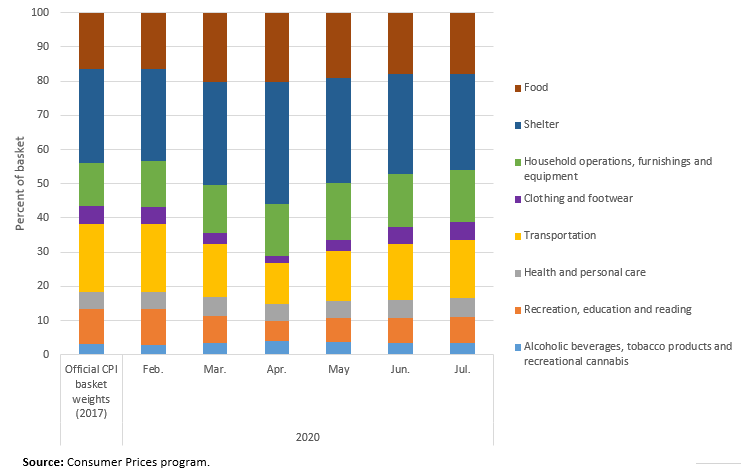

Canadians direct more of their spending to household operations, furnishings and equipment, and less to recreation, education and reading

In July, the monthly adjusted consumer expenditure basket weights were more closely aligned with the 2017 basket weights for the official CPI compared with any month since the initial peak in April of the COVID-19 pandemic, as economic activity resumed in many sectors. However, despite a return to near pre-pandemic expenditure patterns for some components, others remained different. The adjusted weight for the recreation, education and reading component remained low in July relative to the official CPI basket weight due to a lower share of expenditures directed to travel services, as the US-Canada border remained closed and restrictions discouraged domestic travel.

The adjusted basket weight for the household operations, furnishings and equipment component remained elevated in July as Canadians dedicated a larger proportion of spending to financial services and other household services, among other items.

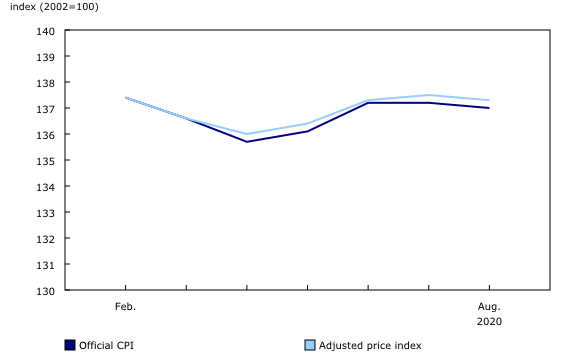

Adjusted price index higher than official CPI in July and August

Although the gap between the adjusted price index and the official CPI narrowed in June as the large monthly increase in air transportation prices took on less importance in the adjusted price index, the adjusted price index was higher than the official CPI in July and August. In both July and August, the adjusted price index rose 0.4% on a year-over-year basis, while the official CPI rose 0.1%.

In August, the air transportation index was the largest contributor to the difference between the one-month changes in the two indexes. While many flights remained cancelled or suspended as a result of the pandemic, airlines offered various incentives such as reduced fees, discounts and promotions throughout July and August to encourage a return to travel. The month-over-month price declines in these two months took on less importance in the adjusted price index as demand for air travel remained low. On average, Canadians shifted their expenditures from air transportation and travel tours to household operations, furnishings and equipment and increased their spending on financial services and other household services. According to some sources, spending on household items has increased compared with the same time last year.

The purchase of passenger vehicles index also posted month-over-month price declines in July and August, which took on less importance in the adjusted price index with Canadians buying fewer passenger vehicles throughout the pandemic compared with the same months in previous years. As a result, dealers offered higher rebates than those observed in recent years, causing monthly price declines.

Month-over-month price declines for meat in July and August took on more importance in the adjusted price index as consumers directed a larger proportion of spending towards meat, moderating the difference between the adjusted price index and the official CPI. Meat prices declined as a result of falling beef and pork prices—mostly due to increasing production following the plant closures caused by COVID-19 outbreaks.

The change in annual average CPI, which is used by most programs employing the CPI for indexation purposes, measures the change in the annual average of the CPI between 12-month periods. The change in annual average for the 12-month period ending in August 2020, compared with the 12-month period ending in August 2019, was 1.2% for the adjusted price index and 1.1% for the official CPI.

Ongoing work

The adjusted price index provides insight into how consumer price indexes can be affected by sudden, extreme shifts in purchasing patterns, and the specific impact of COVID-19 on the Canadian CPI. The continuation of this work relies on regular access to timely, reliable expenditure information at the required level of detail. This information will allow Statistics Canada to monitor how consumer spending patterns evolve during the pandemic; help inform the methods, sources and frequency of future CPI basket updates; and facilitate other research around measures of inflation for different groups, as well as on household types and geographies.

Methodology

How are the monthly adjusted consumer expenditure basket weights for the adjusted price index calculated?

Monthly adjusted consumer expenditure basket weights were derived using the Consumer Price Index (CPI) 2017 basket weights as a benchmark in combination with various data sources and methods from December 2018 to July 2020. Whereas the original study relied on price-updated weights, the current study combined data from different sources and periods to adjust 2017 basket weights for the December 2018 to July 2020 period to calculate adjusted price indexes.

For the period December 2018 to December 2019, growth rates from quarterly, seasonally adjusted Household Final Consumption Expenditures (HFCE) were used to escalate 2017 basket weights for CPI product categories. The HFCE product categories were mapped to the CPI product categories using the closest class when a perfect match was not available. In cases where HFCE data were at a level higher than the CPI product category, or where no reasonable HFCE proxy was available, other data sources were used to estimate monthly spending on the CPI category. Among these were:

Table 17-10-0009-01 Population estimates, quarterly

Table 18-10-0205-01 New housing price index, monthly

Table 20-10-0001-01 New Motor Vehicle Sales

Table 20-10-0008-02 Retail trade sales by industry

Table 21-10-0019-01 Monthly survey of food services and drinking places

Table 25-10-0059-01 Canadian monthly natural gas distribution, Canada and provinces

Labour Force Survey program data

Transaction data from large retailers

Internal-use aggregated residential mortgage data from the Report on New and Existing Lending (A4) collected by the Office of the Superintendent of Financial Institutions

In some cases, more advanced methods were used to combine statistics on period-to-period quantity changes with period-to-period price changes.

For the period from January 2020 to July 2020, year-over-year growth rates from aggregated expenditure information was used to escalate January 2019 to December 2019 monthly adjusted basket weights by product. In cases where aggregated expenditure data were at a level higher than the CPI product class, or where no aggregated expenditure data were available, other data sources were used to estimate monthly spending, as above.

Index calculation

The methodology for calculating the index is unchanged.

The official CPI is calculated using a Laspeyres-type formula, the Lowe index, which is consistent with the fixed basket concept. The Lowe formula expresses the change in the cost between period 0 and period t of buying a fixed basket of basket reference period b, by aggregating the prices of elementary products in the basket using quantities consumed from the basket reference period b as weights which are then used to estimate quantities of goods and services consumed for upper-level index aggregation.

The adjusted price index is a monthly chained Laspeyres index produced using the same geographic and product aggregation structure as the official CPI and using weights derived from the adjustment process described above. The index was calculated using price changes for March through August which are chained together starting in February 2020.

The Personal Inflation Calculator—Coming Soon!

This interactive tool will allow users to calculate a personal inflation time-series. By entering dollar amounts into expense categories, users will create their own unique basket weights! These weights will be combined with official CPI price movements to produce a personalized inflation trend that can be compared to the official measure of inflation.

Note to readers

This work is an extension of the paper "Consumer expenditures during COVID-19: An exploratory analysis of the effects of changing consumption patterns on consumer price indexes." Using various sources of expenditure data, Statistics Canada, in partnership with the Bank of Canada, estimated adjusted consumer expenditure basket weights, reflecting shifts in consumption patterns during the COVID-19 pandemic.

The adjusted price index is experimental and should not be used instead of the official measure of consumer price inflation, the Consumer Price Index (CPI). The official CPI is based on a fixed basket which aligns with international best practices. It should be noted that there is no clear indication yet of whether there will be a long-term impact of COVID-19 on consumer expenditure patterns or whether this impact will be transitory in nature. Frequent updates to the CPI basket of goods and services to account for consumption changes in the absence of a robust and detailed source of expenditure data would compromise the accuracy of the index values.

Timely and reliable access to detailed consumer expenditure information is needed in order to consider a change to the current method of updating CPI basket weights. Currently, there are no statistically robust data to inform monthly updates to the basket weights for all CPI product categories or at geographies below the national level.

Additionally, the CPI is currently built on an annual set of basket weights that are price updated each month. If the CPI were instead built on monthly expenditures, spending patterns for goods and services which are highly seasonal, such as summer clothing or ski equipment, would result in a CPI with significant seasonal variation in weights.

Index levels for the adjusted price index are available from March 2020 to August 2020. Year-over-year changes in the adjusted price index are calculated using base period index levels from the official CPI.

Products

The Monthly adjusted price index, provisional and the Monthly adjusted consumer expenditure basket weights data tables are now available with updated data.

The analytical paper "Consumer expenditures during COVID-19: An exploratory analysis of the effects of changing consumption patterns on consumer price indexes" is available as part of the Prices Analytical Series (62F0014M).

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: