National tourism indicators, second quarter 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-09-30

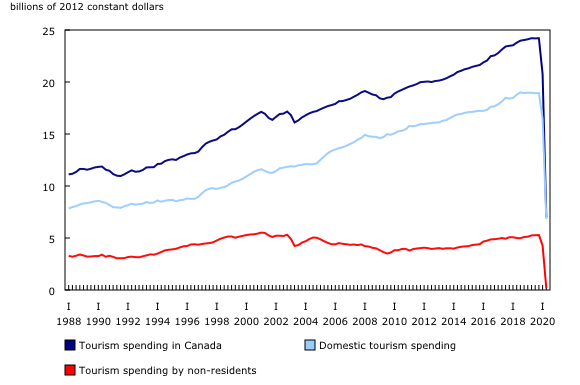

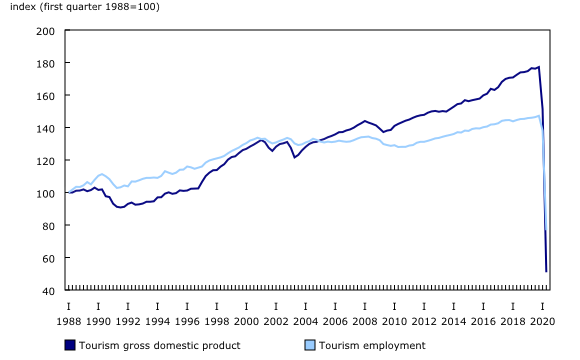

Tourism spending in Canada fell by two-thirds (-66.3%) in the second quarter, in the wake of continued travel restrictions and physical distancing measures throughout Canada. The decline was over fourfold higher than the previous record drop (-14.3%) in the first quarter. Tourism gross domestic product (GDP) fell at a faster pace (-66.4%) than jobs attributable to tourism (-44.4%) in the second quarter.

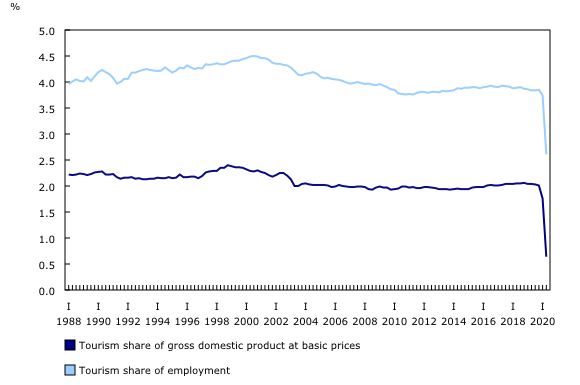

The contraction in the tourism sector in the second quarter was six times larger than that of the economy-wide GDP (-66.4% versus -11.5%) and twice as large as the overall job losses nationally (-44.4% versus -20.2%). As a result, tourism's share of GDP fell from 1.8% in the first quarter of 2020 to a record low of 0.6% in the second quarter, while its share of employment fell from 3.7% to 2.6%. Prior to 2020, tourism's share of GDP has fluctuated between 1.9% and 2.4%, and its share of employment has fluctuated between 3.7% and 4.5%.

Tourism spending on transportation fell by over three-quarters (-77.5%), contributing to almost one-half of the decline in tourism spending in the second quarter. All forms of transportation that require close proximity of passengers collapsed, led by air (-94.9%), rail (-88.5%) and interurban bus (-79.1%) travel. This left travel by passenger vehicle as the main alternative for tourists in the second quarter. Nevertheless, spending on vehicle fuel was down by over half (-51.6%).

Spending on accommodation fell by almost two-thirds (-65.4%), while spending on non-tourism products such as groceries and clothing (-60.3%) and food and beverage services (-60.0%) was down by over half.

Conversely, pre-trip expenditures rose 3.0% as tourism spending may have shifted towards items such as camping equipment, boats and motor homes that could be used once travel restrictions are eased.

Meanwhile, employment attributable to tourism fell sharply (-44.4%) in the second quarter, following a 6.2% decline in the first quarter. Declines were especially severe in tourism industries with a traditionally large share of part-time workers such as food and beverage services (-52.7%), accommodation (-54.3%) and recreation and entertainment (-52.8%).

Tourism spending in Canada by Canadians down sharply

Tourism spending in Canada by Canadians fell by 58.6% in the second quarter, following a 13.0% decline in the previous quarter. Spending on nearly all products was down, with air travel (-94.3%), which also includes Canadians flying internationally on Canadian carriers, non-tourism products (-51.2%) and vehicle fuel (-49.3%) contributing most to the decline. The single category to post growth in domestic demand was pre-trip expenditures (+3.0%).

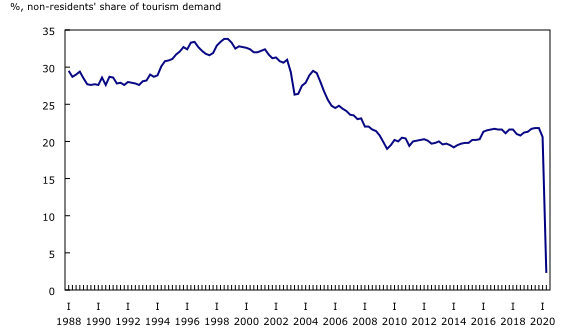

Spending by international visitors nearly ceases

Tourism spending by international visitors to Canada virtually ground to a halt (-96.2%) in the second quarter as the border remained closed to non-essential foreign travellers. As a result, spending by non-residents as a share of total spending declined from 20.6% in the first quarter to 2.3% in the second quarter, leaving spending by Canadians as the sustaining force for the Canadian tourism sector. Overnight travel from abroad fell 96.9%, while same-day car travel from the United States declined 90.8%.

Government revenue attributable to tourism increases in 2019

Tourism is an important source of revenue for all levels of government, particularly federal, provincial and territorial governments, which collected 95.3% of the revenue generated by tourism in 2019. The remainder was collected by municipal and Aboriginal governments.

Government revenue directly attributable to tourism rose 2.7% from 2018 to $29.7 billion in 2019. Domestic tourism spending accounted for just over three-quarters (76.0%) of this revenue, with the remainder coming from tourism exports.

Taxes on products sold to final consumers ($16.4 billion), such as goods and services tax and harmonized sales tax, were the largest source of government revenue attributable to tourism, followed by corporate and individual income tax ($7.1 billion).

Every $100 spent by non-resident visitors generated, on average, $30.88 in government revenue, down from $31.09 in 2018. Resident visitors generated $27.49 in revenue for every $100 spent in 2019, essentially unchanged from a year earlier. Overall, every $100 in tourism spending generated $28.24 in government revenue, down slightly from 2018.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The national tourism indicators are an example of how Statistics Canada supports the reporting on the global goals for sustainable development. This release will be used in helping to measure the following goal:

Note to readers

Growth rates for tourism spending and gross domestic product (GDP) are expressed in real terms (that is, adjusted for price changes), using reference year 2012, as well as adjusted for seasonal variations, unless otherwise indicated. Employment data are also seasonally adjusted. Tourism's share of economy-wide GDP is calculated from seasonally adjusted nominal values. Tourism's share of economy-wide employment is calculated using seasonally adjusted values. Government revenue attributable to tourism is expressed in nominal terms. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Associated percentage changes are presented at quarterly rates unless otherwise noted.

Economy-wide GDP is obtained from table 36-10-0104-01. Economy-wide employment is obtained from table 36-10-0207-01. Overnight travel from abroad is obtained from table 24-10-0043-01. Same-day car travel from the United-States is obtained from table 24-10-0005-01.

With the second quarter release of the national tourism indicators, data for the first quarter have been revised. In addition, data for reference years 2014 to 2018 have been revised for government revenue attributable to tourism tables.

The national tourism indicators are funded by Destination Canada.

Next release

Data on the national tourism indicators for the third quarter will be released on January 8, 2021.

Products

The data visualization product "Provincial and Territorial Tourism Satellite Account," which is part of Statistics Canada – Data Visualization Products (71-607-X), is available.

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structure.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: