Industrial product and raw materials price indexes, April 2024

Released: 2024-05-28

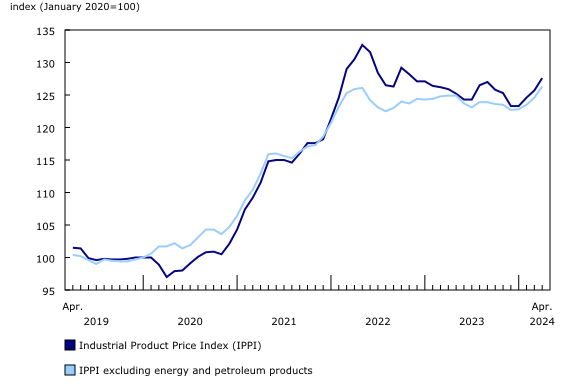

Prices of products manufactured in Canada, as measured by the Industrial Product Price Index (IPPI), rose 1.5% month over month in April 2024 and increased 1.4% year over year. Prices of raw materials purchased by manufacturers operating in Canada, as measured by the Raw Materials Price Index (RMPI), increased 5.5% on a monthly basis in April 2024 and were 3.1% higher compared with April 2023.

Industrial Product Price Index

The IPPI rose 1.5% month over month in April 2024 following increases of 0.9% in March and 1.1% in February.

Prices for primary non-ferrous metal products rose 8.3% month over month in April, the largest monthly increase since March 2022 (+8.4%). Both unwrought silver and silver alloys (+13.5%) and unwrought gold and gold alloys (+9.1%) increased significantly in April 2024. Geopolitical tensions had an impact on precious metal prices in April as conflict in the Middle East risked spreading, spurring safe haven demand. General investment demand was also robust, particularly from investors and some central banks buying gold to diversify their holdings. Industrial metals experienced higher prices in April as well, including unwrought copper and copper alloys (+10.3%) and unwrought aluminum and aluminum alloys (+7.4%). In China, the world's largest metal market, the Caixin China General Manufacturing Purchasing Managers' Index was 51.4 in April, indicating the fastest manufacturing growth since February 2023. This strength contributed to rising industrial metal prices in April 2024. Copper and aluminum were also affected by sanctions imposed by the United States and the United Kingdom against Russian metals that were announced in mid-April 2024, posing a supply risk that pushed up prices. Copper faced its own supply concerns given recent setbacks at major mines, further contributing to the higher prices.

Prices for energy and petroleum products increased for the third consecutive month in April, up 2.5% on a monthly basis. Prices for finished motor gasoline rose 6.7%. Gasoline prices corresponded with the higher price of crude oil and the increased cost of summer blended gasoline. Higher seasonal demand also contributed to the price increase. Meanwhile, refiners completed maintenance in preparation for the summer driving season, limiting the amount of gasoline they could supply to the market. On the other hand, diesel prices fell 0.4% in April. The drop in prices was influenced by reduced seasonal demand for home heating oil, which is chemically similar to diesel fuel.

After two consecutive months of declines, the prices of pulp and paper products gained 4.0% from March to April, mainly because of higher wood pulp prices (+9.5%). This was the largest monthly increase for wood pulp since October 1994 (+10.4%). Significant increases in raw material and other manufacturing costs as well as curtailments in North American paper and pulp operations resulted in tight supply. This pushed up the prices of pulp and paper products in April 2024.

Prices for chemicals and chemical products (+1.3%) increased for the fourth consecutive month in April, driven mostly by higher prices for petrochemicals (+5.3%) and plastic resins (+2.4%). The prices of petrochemicals tend to correlate with the price of their key input, crude oil, which increased in April.

Lumber and other wood products had the largest downward impact on the IPPI's month-over-month movement in April, falling 1.3%. Softwood lumber was the primary contributor to the movement, declining 3.4% following five consecutive months of increases. Demand for lumber was reportedly weak in April, as economic uncertainty and weather conditions weighed on buyers. Data indicates that housing construction recently slowed, helping push down lumber prices. The seasonally adjusted rate of housing starts in the United States increased 5.7% on a month-over-month basis in April, but this followed a large decline in March (-16.8%). In Canada, seasonally adjusted housing starts fell 0.8% in April and 6.8% in March, according to Canada Mortgage and Housing Corporation.

Year over year

The IPPI was 1.4% higher in April compared with the same month in 2023. This increase snapped a streak of six consecutive months of year-over-year declines.

Unwrought gold, silver and platinum group metals and their alloys (+11.8%) was the largest contributor to the IPPI's upward movement in April. Economic and geopolitical uncertainty have boosted investment demand for precious metals over the previous 12 months, having an upward impact on prices. Other notable upward year-over-year contributors include softwood lumber (+10.8%); motor gasoline (+4.4%); and light-duty trucks, vans and sport utility vehicles (+2.1%).

Prices declined year over year in April for unwrought nickel and nickel alloys (-22.5%), grain and oilseed products (-18.5%), and other animal feed (-11.2%). These downward movements mostly reflect declines from elevated price levels.

Raw Materials Price Index

The RMPI increased 5.5% on a monthly basis in April after rising 4.3% in March. These are the two largest month-over-month increases in the RMPI since March 2022 (+11.8%). Excluding crude energy products, the RMPI was up 5.3% from March to April 2024.

Crude energy products increased 5.8% in April. Conventional crude oil (+6.2%) was the main contributor to the increase. There was a sudden spike in crude oil prices at the beginning of April driven by heightened tensions between Iran and Israel. Additionally, the voluntary production cuts by several members of the Organization of the Petroleum Exporting Countries and its partners (OPEC+) contributed to decreased global oil inventories, thereby influencing the higher price of crude oil observed in April.

Prices for metal ores, concentrates and scrap rose 7.7% month over month in April. Gold, silver and platinum group metal ores and concentrates (+10.3%) was the main driver of the increase, but metal prices were up across the board in April. Prices for nickel ores and concentrates increased 5.6% from March. Mine permitting delays and adverse weather conditions in Asia have led to relatively tightened supply recently, exerting upward pressure on prices. Sanctions imposed by the United States and the United Kingdom against Russian metals, including nickel, had a similar effect in April.

Prices for animals and animal products (+5.0%) posted a third consecutive increase in April. Cattle and calves (+5.2%) and hogs (+6.1%) were both up on the month. Canadian meat packers displayed strong demand for cattle in April, contributing to rising prices. According to weekly data from the United States Department of Agriculture (USDA), the number of Canadian cattle slaughtered in American plants was also at a high level in April. Meanwhile, the cattle supply shortage is ongoing. USDA data show that exports of Canadian hogs to the United States were strong as well. Hog demand tends to rise according to a seasonal pattern in the month of April. Both factors influenced hog prices.

Year over year

The RMPI rose 3.1% year over year in April, following a 0.4% gain in March.

Large contributors to the year-over-year price increase in the RMPI include conventional crude oil (+8.1%); gold, silver and platinum group metal ores and concentrates (+16.6%); cattle and calves (+14.1%); and synthetic crude oil (+6.7%).

Partially offsetting the increase, prices declined for nickel ores and concentrates (-22.7%), canola (-17.9%), wheat (-23.9%), and grains (except wheat) (-11.6%), among other commodities. Prices for these four groups fell year over year mainly due to strong global supply over much of the previous 12 months.

Did you know we have a mobile app?

Download our mobile app and get timely access to data at your fingertips! The StatsCAN app is available for free on the App Store and on Google Play.

Note to readers

The Industrial Product Price Index (IPPI) and the Raw Materials Price Index (RMPI) are available at the Canada level only. Selected commodity groups within the IPPI are also available by region.

With each release, data for the previous six months may have been revised. The indexes are not seasonally adjusted.

The IPPI reflects the prices that producers in Canada receive as goods leave the plant gate. The IPPI does not reflect what the consumer pays. Unlike the Consumer Price Index, the IPPI excludes indirect taxes and all costs that occur between the time a good leaves the plant and the time the final user takes possession of the good. This includes transportation, wholesale and retail costs.

Canadian producers export many goods. Canadian producers often indicate goods' prices in foreign currencies, especially in US dollars, which are then converted into Canadian dollars. This is particularly the case for motor vehicles, pulp and paper products, and wood products. Therefore, fluctuations in the value of the Canadian dollar against its US counterpart affect the IPPI. However, the conversion to Canadian dollars reflects only how respondents provide their prices. This is not a measure that takes into account the full effect of exchange rates.

The conversion of prices received in US dollars is based on the average monthly exchange rate established by the Bank of Canada and available in Table 33-10-0163-01 (series v111666275). Monthly and annual variations in the exchange rate, as described in the release, are calculated according to the indirect quotation of the exchange rate (for example, CAN$1 = US$X).

The RMPI reflects the prices paid by Canadian manufacturers for key raw materials. Many of those prices are set on the world market. However, as few prices are denominated in foreign currencies, their conversion into Canadian dollars has only a minor effect on the calculation of the RMPI.

Products

Statistics Canada launched the Producer Price Indexes Portal as part of a suite of portals for prices and price indexes. This webpage provides Canadians with a single point of access to a variety of statistics and measures related to producer prices.

The video "Producer price indexes" is available on the Statistics Canada Training Institute webpage. It introduces Statistics Canada's producer price indexes: what they are, how they are made and what they are used for.

Next release

The industrial product and raw materials price indexes for May will be released on June 21.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: