Gross domestic product by industry: Provinces and territories, 2023

Released: 2024-05-01

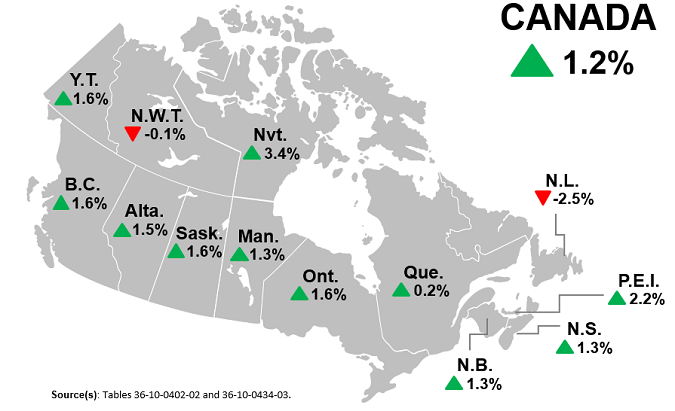

2023

1.2%

(annual change)

2023

-2.5%

(annual change)

2023

2.2%

(annual change)

2023

1.3%

(annual change)

2023

1.3%

(annual change)

2023

0.2%

(annual change)

2023

1.6%

(annual change)

2023

1.3%

(annual change)

2023

1.6%

(annual change)

2023

1.5%

(annual change)

2023

1.6%

(annual change)

2023

1.6%

(annual change)

2023

-0.1%

(annual change)

2023

3.4%

(annual change)

Economic growth slows in 2023

In 2023, for the second consecutive year, real gross domestic product (GDP) grew in every province in Canada, except Newfoundland and Labrador, albeit at a slower pace compared with a year earlier for most.

In the territories, production slowed in Yukon and declined in the Northwest Territories, while Nunavut was the sole Canadian jurisdiction where economic growth meaningfully accelerated, with a nation-leading 3.4% increase in 2023.

Although record population growth helped spur economic activity, tight monetary policy, persistent inflation and several climate change-related events constrained output growth across Canada in 2023.

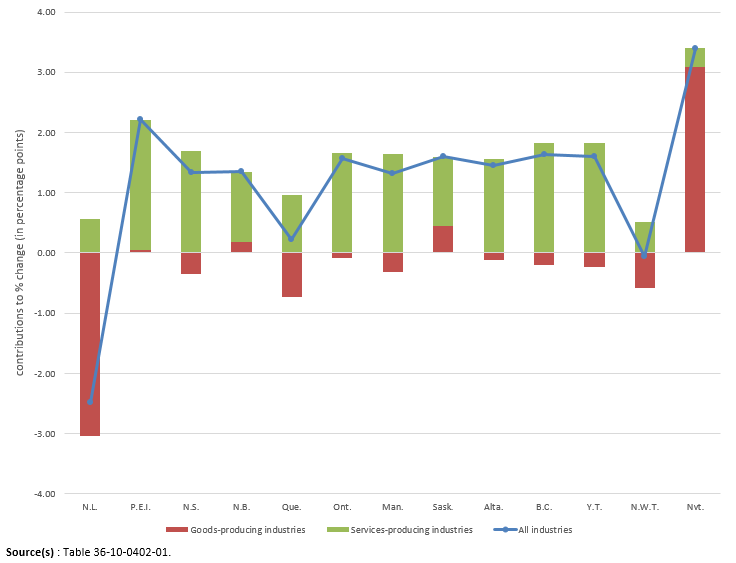

Higher output from services-producing industries in every province and territory bolstered overall economic growth during a challenging year for goods-producing industries in most of Canada in 2023.

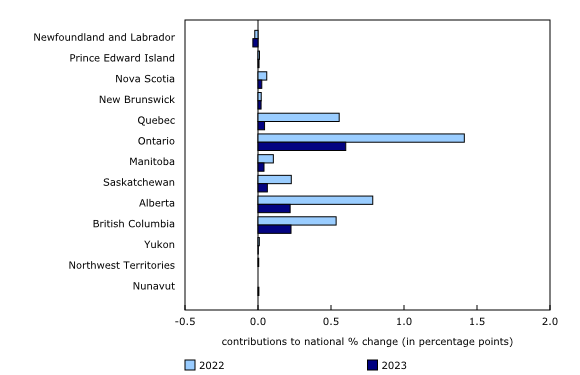

Ontario, British Columbia and Alberta were the largest contributors to economic growth in 2023

Ontario (contribution of +0.60 percentage points) was the largest contributor to Canada's economic growth, accounting for almost half of the 1.2% increase in national GDP in 2023.

British Columbia (+0.23 percentage points) was the second-largest contributor to national economic growth, surpassing Alberta (+0.22 percentage points) and well ahead of Saskatchewan (+0.06 percentage points) and Quebec (+0.05 percentage points).

Newfoundland and Labrador (-0.04 percentage points) was the largest drag on national economic output for the third time in six years.

Services steer several jurisdictions into positive territory…

Growth in the value-added of services-producing industries decelerated in every jurisdiction except Manitoba, Saskatchewan and Nunavut in 2023. Nevertheless, the growth in services kept seven provincial and territorial economies in positive territory in 2023.

Prince Edward Island (+3.0%) had the largest increase in services, led by real estate and rental and leasing (+4.5%) and public administration (+3.8%).

Demand for services was spurred by Canada's highest rate of population growth since 1957 (the peak of the baby boom). The public sector (consisting of educational services, health care and social assistance, and public administration) was a significant contributor to growth in every province and territory. However, educational services in Quebec (-0.5%) contracted because of strike action at elementary and secondary schools late in 2023.

Client-facing industries that had been heavily affected at the start of the COVID-19 pandemic in 2020 continued to recover in 2023. Notably, accommodation and food services rose in every province and territory for the third consecutive year, albeit at a slower pace than in 2021 and 2022.

In 2023, Prince Edward Island (+7.7%) and Alberta (+7.8%) became the first provinces where GDP at food services and drinking places surpassed 2019 pre-pandemic levels.

The arts, entertainment and recreation sector also expanded in every province and territory in 2023, led by Ontario (+18.6%), Prince Edward Island (+13.0%) and Manitoba (+12.3%).

Transportation and warehousing remained below 2019 levels (-7.7% on average) in every province and territory, although most did see increases in GDP in 2023.

Air transportation rose at the fastest pace in Manitoba (+34.7%), Quebec (+34.2%) and British Columbia (+31.4%) as international travellers entering or returning to Canada grew 43.8% in 2023.

Population gains and the continuation of return-to-office requirements by employers were among factors that contributed to double-digit increases for urban transit systems.

…even as production in some service industries declined in 2023

For the second consecutive year, offices of real estate agents felt the effect of higher interest rates in 2023. On an annual basis, activity was down in all areas as potential buyers contended with higher borrowing costs. Canada's largest housing markets of Ontario (-12.7%), Quebec (-13.9%) and British Columbia (-10.5%) reported significant declines in offices of real estate agents and brokers and activities related to real estate. Activity at lessors of real estate grew in eight provinces and Yukon.

Lower activity at goods-producing industries in seven provinces and two territories

Output from goods-producing industries rose in Nunavut (+5.8%), Saskatchewan (+0.9%), New Brunswick (+0.7%) and Prince Edward Island (+0.2%) in 2023 and declined in all other provinces and territories. However, apart from Newfoundland and Labrador and the Northwest Territories, increased activity at services industries more than offset the declines in the goods-producing industries.

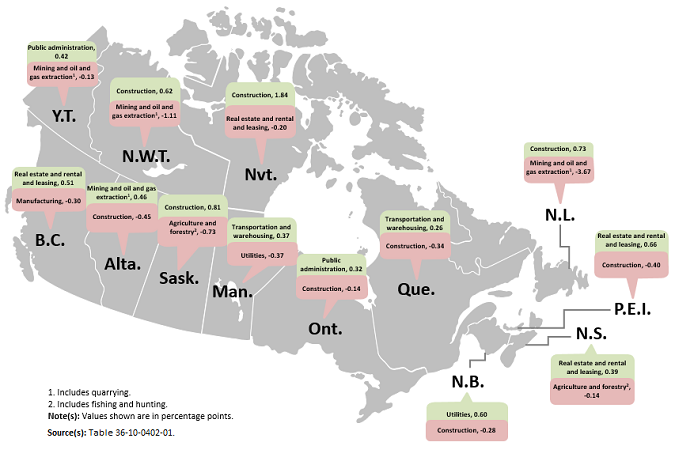

Construction sector volatile in 2023

In 2023, lower activity in the construction sector was the main detractor to growth in five provinces (Prince Edward Island, New Brunswick, Quebec, Ontario and Alberta), but construction was the largest contributor to growth in Nunavut, Saskatchewan, Newfoundland and Labrador, and the Northwest Territories.

In Nunavut, ongoing construction of a new gold mine helped engineering construction (+68.0%) more than offset the declines in residential and non-residential construction.

Residential construction was down in every province and territory in 2023, with six of them reporting double-digit declines in output. The slower pace of home building had the greatest impact on residential building construction in Prince Edward Island (-15.5%), Quebec (-19.1%) and British Columbia (-12.7%).

Drought conditions return in 2023

The agriculture, forestry, fishing and hunting sector was a net drain on most provincial economies in 2023, except in Manitoba (+0.9%) and Ontario (+1.7%).

Crop production (except cannabis, greenhouse, nursery and floriculture production) was down in Saskatchewan (-7.5%) and Alberta (-14.1%), as below-average precipitation stunted production.

The dry conditions were also felt in the utilities sector, where electric power generation, transmission and distribution fell in Manitoba (-10.2%) and Quebec (-7.3%).

Volatility reigns in the mining, quarrying, and oil and gas extraction sector

In Newfoundland and Labrador, decreases in conventional oil and gas extraction (-13.3%) and metal ore mining (-11.1%) contributed to the 2.5% decline in economic output in the province in 2023.

Nova Scotia saw a fourth consecutive year of double-digit declines in gold and silver ore mining (-29.7%).

In Alberta, conventional oil and gas extraction (+6.7%) and oil sands extraction (+1.6%) rose for a third consecutive year. Combined, these two industries accounted for more than one-third of Alberta's total increase in GDP.

In the Northwest Territories, all components of the mining, quarrying, and oil and gas extraction sector contracted in 2023, turning the territory's overall economic growth negative.

Did you know we have a mobile app?

Download our mobile app and get timely access to data at your fingertips! The StatsCAN app is available for free on the App Store and on Google Play.

Sustainable development goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The release on real gross domestic product by industry for provinces and territories is an example of how Statistics Canada supports the reporting on the Global Goals for Sustainable Development. This release will be used in helping to measure the following goal:

Note to readers

The provincial and territorial gross domestic product (GDP) by industry data at basic prices are chained volume estimates with 2017 as their reference year. This means data for each industry and aggregate are obtained from a chained volume index multiplied by the industry's gross value-added in 2017.

Percentage changes for GDP by industry are calculated using volume measures, that is, adjusted for price variations.

The Economic Accounts Statistics Portal and the data visualization product Gross domestic product (GDP) by industry, provinces and territories: Interactive tool also display the latest available results.

Statistics Canada compiles "Contributions to Percentage Change" and "Contribution to National Percentage Change" figures, which provide users with additional dimensions for their analysis by delineating, respectively, how industries in the provinces or territories contribute to their own relative total economy and in turn how provinces and territories contribute to the real growth of the Canadian economy.

For more information on GDP, see the video "What is Gross Domestic Product (GDP)?"

On June 7, 2024, a more comprehensive picture of each jurisdiction's 2023 economic performance will be presented in an Analysis in Brief article titled: Gross domestic product, 2023: An in-depth look at provincial and territorial economies.

Revisions

Estimates of provincial and territorial GDP by industry for 2023 are included with this release. No revisions have been made to data for previous years. Revised estimates of provincial–territorial GDP by industry for 2021 to 2023 will be published on November 7, 2024, with the incorporation of the new benchmark Supply and Use Tables for reference year 2021.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: