National balance sheet and financial flow accounts, first quarter 2023

Released: 2023-06-14

National net worth rebounds as international investment position strengthens

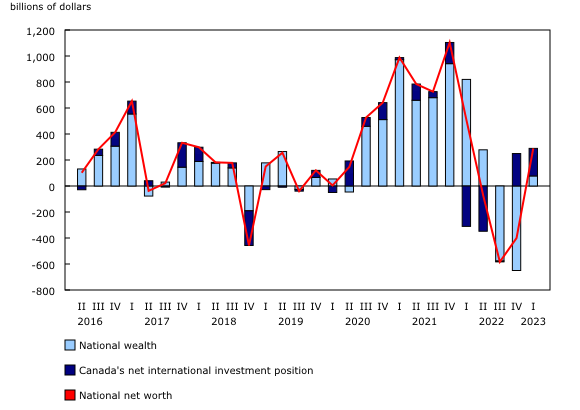

National net worth, the sum of national wealth and Canada's net foreign asset position, rose 1.7% from the fourth quarter of 2022 to $17,109.3 billion at the end of the first quarter of 2023. This followed declines in the last two quarters of 2022 totalling almost one trillion dollars (-5.5%), the largest two-quarter drop since the first quarter of 2009. However, national net worth was 37.5% higher than it was at the end of 2019. Meanwhile, national net worth per capita rose from $425,098 at the end of 2022 to $430,970 in the first quarter of 2023.

The total value of non-financial assets in Canada, also referred to as national wealth, surpassed $16 trillion (+0.5% from the fourth quarter of 2022) in the first quarter of 2023. This was a reversal from the fourth quarter of 2022, in which non-financial assets posted the largest quarterly decrease since the end of 2008. After three consecutive quarterly declines, housing prices changed course in the first quarter of 2023, with a rise that pushed the value of residential real estate up by $261.9 billion. However, the gain in residential real estate was largely offset by a $223.5 billion drop in the value of natural resources (excluding land). After reaching a peak of nearly $2.7 trillion in the second quarter of 2022, natural resources have fallen precipitously, shedding approximately $1.2 trillion in value up to the first quarter of 2023, during which time the spot price of Western Canadian Select crude oil has fallen 30.0%.

Canada's net foreign asset position, the difference between Canada's international financial assets and international liabilities, increased by $212.0 billion to reach $1,103.7 billion in the first quarter of 2023, the highest level since the fourth quarter of 2021, as global equity markets registered gains.

Highlights

On a nominal basis, the Canadian economy expanded during the first quarter of 2023 following two consecutive declines as compensation of employees rose after two quarters of slower growth and corporate incomes continued to stumble. Growth in household spending and improved net trade was offset by slower inventory accumulation and declines in business investment in machinery and equipment. Despite difficulties such as supply chain issues, inflation, and the rising costs of inputs, external pressures faced by businesses eased during the quarter.

The household saving rate declined in the first quarter as government transfers decreased from an elevated fourth quarter and net property income declined as interest expenses outpaced interest revenues. Household mortgage borrowing activity decelerated again, despite an uptick in the housing market, as the Bank of Canada increased the policy interest rate to 4.5% in January and then after two pauses, raised it to 4.75% in June. Households continued to adjust their investment behaviour in response, with significant continued inflows into money market mutual funds and fixed term deposits.

Canada's net foreign asset position improved as global equity markets rose in the first quarter. Meanwhile, the non-financial corporate sector's demand for funds increased, reflecting continued borrowing in the form of non-mortgage loans, which was moderated by listed equity redemptions. The financial corporate sector supply of funds increased sharply after a weak fourth quarter in 2022 and the federal government recorded slight net repayment on its debt as it retired more long-term bonds than it issued in treasury bills.

Household saving rate falls in the first quarter, while spending remains robust

In the first quarter of 2023, seasonally adjusted household compensation (in nominal terms) grew by 1.7% from the fourth quarter of 2022. However, a decline in government transfers to households and rising interest costs relative to interest incomes weighed on the gains in compensation, as household disposable income lost ground (-1.0%) vis-à-vis the fourth quarter. Households also recorded re-payments related to COVID-19 support programs in the first quarter of 2023, which further weighed on incomes. However, despite the decline in disposable income, household consumption remained strong (+2.1%) as consumers expanded their demand for clothing and food and beverage services. As a result, the saving rate fell to 2.9% in the first quarter, well below the 5.8% rate recorded in the fourth quarter of 2022 and slightly higher than the 2.8% recorded at the end of 2019.

Households accumulate fewer deposits, continue to favour money market mutual funds and fixed-term deposits

Household currency and deposits have grown by almost half a trillion dollars since the first quarter of 2020, fuelled most recently by a significant accumulation in the fourth quarter of 2022 (+$53.3 billion). However, the pace of accumulation slowed significantly in the first quarter of 2023 as households added $17.3 billion in deposits, the smallest gain since the third quarter of 2021.

During the first quarter of 2023, households ended their divestment of mutual fund units, recording a net investment of $2.8 billion, following three consecutive quarters of outflows. These net inflows were mainly to money market mutual funds, which saw a fifth consecutive quarter of net investment as investors moved towards short term yield-generating assets. Similarly, among deposit assets, households continued to place funds in higher interest fixed-term deposits, while the share of assets held in chequing, and savings accounts trended lower.

Household net worth rises as financial and real estate markets strengthen

Household sector net worth—the value of all assets minus all liabilities—rose $519.9 billion or 3.4% from the fourth quarter of 2022 to reach $15,704.2 billion in the first quarter of 2023. Household wealth was bolstered by the dual tailwinds of stronger equity and real estate markets despite continued financial market volatility and higher interest rates. The value of real estate rebounded after three consecutive quarters of decline, while domestic and foreign equity markets remained relatively strong, including a 3.7% rise in the S&P/TSX Composite Index and a 7.0% rise in the S&P 500 Index.

The value of households' total financial assets rose 3.0% (+$280.0 billion) in the first quarter, while the value of total non-financial assets rose 2.7% (+$241.9 billion). Financial liabilities, composed primarily of mortgage and non-mortgage debt, rose a modest $2.1 billion from the fourth quarter of 2022.

Residential real estate prices rebound despite subdued sales activity

The value of household residential real estate rebounded, up 3.2% (+$243.6 billion) during the first quarter of 2023, as prices increased while inventory levels remained historically low. This followed three consecutive quarters of declines that, in total, saw household real estate wealth fall by 10.1% (-$849.3 billion). After a slow start to the year in January 2023, prices began to rise in February and March. Nonetheless, the average sale price of resale homes was 17.1% lower than the first quarter of 2022, highlighting the degree to which valuations have tumbled. The decline in real estate activity was even more pronounced, with the total value of homes sold in the first quarter of 2023 sitting nearly 50% below the value recorded in the first quarter of 2022.

Sluggish real estate activity from the fourth quarter of 2022 persisted in the first quarter of 2023 as real estate markets reacted to higher interest rates. The number of resale homes sold over the last two quarters (fourth quarter of 2022 and first quarter of 2023) has lagged any two-quarter stretch dating back to the first quarter of 2009. This slump over these two quarters followed two years of consistently elevated real estate activity.

On a seasonally adjusted current dollar basis, housing investment fell 3.8% in the first quarter of 2023, the fourth consecutive quarterly decrease. The decline in investment was widespread—as new construction (-5.3%), renovations (-1.5%), and ownership transfer costs (-4.2%), which represents resale activity, were all down. The decline in new construction was observed in every province and territory except Yukon and Newfoundland and Labrador.

Household borrowing slowdown continues

On a seasonally adjusted basis, the pace of credit market borrowing continued to decelerate as households demanded $16.5 billion of funds in the first quarter of 2023. Aside from the second quarter of 2020, this was the smallest level of quarterly household borrowing since 2003. Households added a restrained $11.2 billion in mortgage debt, the lowest quarter of mortgage borrowing in the last 20 years. This was the second consecutive quarter of relatively slow mortgage borrowing (+$16.5 billion in the fourth quarter of 2022). This slowdown follows a period of record mortgage borrowing, an all-time high in the second quarter of 2021 (+$58.2 billion) and the second highest amount in the second quarter of 2022 (+$54.0 billion).

The seasonally adjusted stock of household credit market debt (consumer credit, and mortgage and non-mortgage loans) grew 0.6% from the fourth quarter of 2022 to reach $2,840.8 billion in the first quarter of 2023, with mortgage debt ($2,109.7 billion) accounting for almost three-quarters of the total outstanding debt. Non-mortgage loan liabilities expanded 0.6%. While credit card balances with chartered banks continued to steadily climb, growing 2.9% in the first quarter, declines in home equity lines of credit (-0.8%) and other personal loans (-2.2%) partially offset this growth. On a per capita basis, households owed $71,560 in debt.

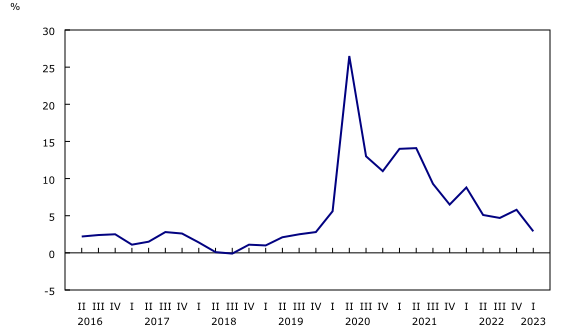

Households' debt service costs climb higher

On a seasonally adjusted basis, household credit market debt as a proportion of household disposable income increased to 184.5% in the first quarter of 2023 from 181.7% in the fourth quarter of 2022. In other words, there was $1.85 in credit market debt for every dollar of household disposable income in the first quarter of 2023. The decline in households' disposable income was a key factor in the rise of this ratio as households had less income in relation to still rising credit market debt.

The household debt service ratio, measured as total obligated payments of principal and interest on credit market debt as a proportion of household disposable income, was 14.90% in the first quarter of 2023, a notable increase from 14.40% in the fourth quarter of 2022. This was the largest quarterly increase since the third quarter of 2020 and pushed the household debt service ratio to its highest point since the third quarter of 2019. The tandem effects of weak household disposable income before the payment of interest (-0.1%) and a sizeable expansion in debt payments (+3.3%) pushed the ratio higher in the first quarter of 2023.

Mortgage interest payments expanded 12.6% from the fourth quarter of 2022 to the first quarter of 2023, continuing a dramatic rise that began in the second quarter of 2022. Mortgage interest payments were 69.7% higher in the first quarter of 2023 compared with the first quarter of 2022 as a result of ongoing rate hikes. Meanwhile, obligated payments of principal declined 6.8% in the first quarter of 2023, as the significant stock of variable rate mortgages likely allowed interest payments to further adjust without a concomitant rise in principal. However, the capacity of fixed payment variable rate mortgages, which accounted for just under one-quarter of all outstanding chartered bank mortgages in the first quarter, to act as a sponge for rising interest costs is likely nearing its peak as borrowers with these products reach their trigger rates. Alongside increases in interest rates, the share of mortgages with an amortization period longer than 25 years has risen sharply and made up 48.2% of all new mortgages in the first quarter of 2023.

The changing economic conditions will likely impact future consumer behaviour. According to the Bank of Canada's first quarter edition of the Survey of Consumer Expectations, "consumers expect to spend less on discretionary services—such as travel, restaurant meals and other social activities—than they did over the last 12 months."

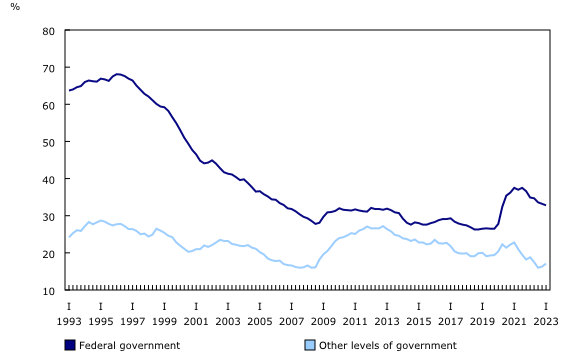

Federal government borrowing rotates towards treasury bills on a net basis

In the first quarter of 2023, federal government net bond repayments totalled $13.9 billion compared with net issuances of $10.3 billion in treasury bills. This switch from longer-term to short-term borrowing occurs during a period in which the yield curve is inverted, as short-term rates are higher than long-term rates. The Bank of Canada continued its quantitative tightening program; the central bank allowed $28.2 billion worth of federal government bonds to mature without replacement in the first quarter.

Interest costs for the government continue to rise. After reaching a record low in the second quarter of 2020, the effective interest cost on federal government debt has increased to pre-pandemic levels. Given the higher interest rate environment, this is expected to persist as debt matures and is re-issued at higher prevailing rates.

General government net financial liabilities as a proportion of GDP declines

The ratio of general government net financial liabilities (the book value of total financial liabilities less the market value of total financial assets) to gross domestic product (GDP) declined to 25.3% in the first quarter of 2023 from 26.0% in the fourth quarter of 2022 as net financial liabilities shrank modestly. The general government sector includes all levels of government and social security funds. The ratio's downward trend continued in the first quarter of 2023 from when it began eight quarters ago, as the net financial position of all levels of government continued to strengthen relative to GDP growth.

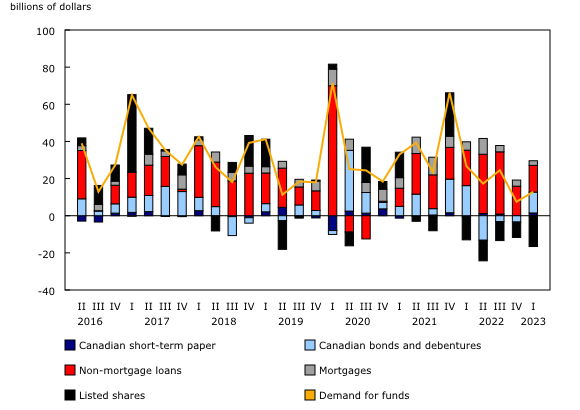

Private non-financial corporations' demand for funds increases despite largest net redemption of listed shares on record

In the first quarter of 2023, the demand for funds by private non-financial corporations increased to $12.9 billion from $7.5 billion in the fourth quarter of 2022. Borrowing was mainly in the form of non-mortgage loans (+$14.4 billion) and bonds (+$11.2 billion) in the first quarter. This was partially offset by the largest net redemption of listed shares on record (-$16.6 billion). This was the fifth consecutive quarter of net redemptions. While prior quarter redemptions were driven by share buybacks, the first quarter of 2023 saw strong merger and acquisition activity that led to consolidation.

According to the Canadian Survey on Business Conditions' second quarter of 2023 release, rising inflation was cited as the most commonly expected obstacle, followed by rising costs and interest rates. Nonetheless, businesses grew more optimistic about the next 12 months compared with the previous quarter. The total number of business bankruptcy filings in the first quarter of 2023 increased 6.7% from the fourth quarter of 2022 to 1,070. By comparison, business bankruptcies filed two years earlier in the first quarter of 2021 totalled 603. Private non-financial corporation sector credit market debt was more than one and a half times greater than GDP (152.0%) in the first quarter of 2023, up from 147.2% at the end of 2022.

Financial sector supply of funds recovers after weak fourth quarter

Financial corporations delivered $85.0 billion of funds to the economy through financial market instruments in the first quarter of 2023, up from $18.3 billion in the fourth quarter of 2022. The supply of funds was primarily in the form of bonds (+$38.4 billion) and non-mortgage loans (+$36.5 billion), which were partially offset by net redemptions of short-term paper (-$4.2 billion) and net repayments of consumer credit (-$2.9 billion). A significant portion of the funds supplied by the financial sector were from chartered banks, which alone injected over $50 billion worth of funds into financial and credit markets.

Meanwhile, on the other side of the balance sheet, sources of new funding for the chartered bank sector declined to $27.1 billion in the first quarter of 2023 from $85.7 billion in the fourth quarter of 2022 as banks took in fewer deposits (+$11.9 billion in the first quarter of 2023 versus +$48.1 billion in the fourth quarter of 2022) and recorded net redemptions in short-term paper of $15.9 billion.

Note to readers

Revisions

This release of the national balance sheet and financial flow accounts for the first quarter of 2023 includes revised estimates from the first quarter to the fourth quarter of 2022. These data incorporate new and revised data, as well as updated data on seasonal trends.

Data enhancements to the national balance sheet and financial flow accounts, such as the development of detailed counterparty information by sector, will be incorporated on an ongoing basis. To facilitate this initiative as well as others, it is necessary to extend the annual revision period (normally the previous three years) at the time of the third quarter release. Consequently, with the third quarter release of the financial and wealth accounts, data will be revised back to 1990 to ensure a continuous time series.

Support measures by governments

Details on some of the more significant federal government COVID-19 support measures are now available in table 36-10-0687: Federal government COVID-19 response measures in the System of Macroeconomic Accounts, quarterly.

Financial and wealth accounts on a from-whom-to-whom basis: Selected financial instruments

The data visualization product "Financial accounts on a from-whom-to-whom basis, selected financial instruments" has been updated with data from the first quarter of 2022 to the first quarter of 2023.

Next release

Data on the national balance sheet and financial flow accounts for the second quarter of 2023 will be released on September 13, 2023.

Overview of the financial and wealth accounts

This release of the financial and wealth accounts comprises the National Balance Sheet Accounts (NBSA), the Financial Flow Accounts (FFA), and the other changes in assets account.

The NBSA are composed of the balance sheets of all sectors and subsectors of the economy. The main sectors are households, non-profit institutions serving households, financial corporations, non-financial corporations, government, and non-residents. The NBSA cover all national non-financial assets and all financial asset-liability claims outstanding in all sectors. To improve the interpretability of financial flows data, selected household borrowing series are available on a seasonally adjusted basis (table 38-10-0238-01). All other data are unadjusted for seasonal variation. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

The FFA articulate net lending or borrowing activity by sector by measuring financial transactions in the economy. The FFA arrive at a measure of net financial investment, which is the difference between transactions in financial assets and liabilities (for example, net purchases of securities less net issuances of securities). The FFA also provide the link between financial and non-financial activity in the economy, which ties estimates of saving and non-financial capital acquisition (for example, investment in new housing) to the underlying financial transactions.

While the FFA record changes in financial assets and liabilities between opening and closing balance sheets that are associated with transactions during the accounting period, the value of assets and liabilities held by an institution can also change for other reasons. These other types of changes, referred to as other economic flows, are recorded in the other changes in assets account.

There are two main components to this account. One is the other changes in the volume of assets account. This account includes changes in non-financial and financial assets and liabilities relating to the economic appearance and disappearance of assets, the effects of external events such as wars or catastrophes on the value of assets, and changes in the classification and structure of assets. The other main component is the revaluation account, showing holding gains or losses accruing to the owners of non-financial and financial assets and liabilities during the accounting period as a result of changes in market price valuations.

At present, only the aggregate other change in assets is available within the Canadian System of Macroeconomic Accounts; no details are available on the different components.

Definitions concerning financial indicators can be found in "Financial indicators from the National Balance Sheet Accounts" and in the Canadian System of Macroeconomic Accounts glossary.

Distributions of household economic accounts

The NBSA for the household sector is allocated across a number of socioeconomic dimensions as part of the distributions of household economic accounts. Data on wealth and its components by income quintile, age group, generation and region are available in tables 36-10-0660-01, 36-10-0661-01, 36-10-0664-01, and 36-10-0665-01.

The methodology for Distributions of household economic accounts wealth estimates can be found in the article "Distributions of Household Economic Accounts, estimates of asset, liability and net worth distributions, 2010 to 2019, technical methodology and quality report."

Products

The document, "An overview of revisions to the Financial and Wealth Accounts, 1990 to 2022," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is now available.

The data visualization product "Financial accounts on a from-whom-to-whom basis, selected financial instruments," which is part of Statistics Canada – Data Visualization Products (71-607-X), is now available.

As a complement to this release, you can also consult the data visualization product "Distributions of Household Economic Accounts, Wealth: Interactive tool," which is part of Statistics Canada – Data Visualization Products (71-607-X).

As a complement to this release, you can also consult the data visualization product "Securities statistics," which is part of Statistics Canada – Data Visualization Products (71-607-X).

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structure.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

The Canada: Economic and Financial Data - International Monetary Fund's Special Data Dissemination Standard Plus product (13-608-X), "Other Financial Corporations Survey," also known as "Assets and liabilities of other financial corporations by sector, market value, quarterly" ( 36-10-0668-01), are available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: