Annual wages, salaries and commissions of T1 tax filers, 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2023-03-15

Median annual wages and number of wage earners rise in 2021

In 2021, annual median wages, salaries and commissions increased by 4.8% to $43,190 for tax filers who had wages, while the number of wage earners rose by 194,910 individuals, according to tax filer data.

Median annual wages increased in all provinces and two territories. The increases ranged from 1.9% in Newfoundland and Labrador to 7.2% in British Columbia. Among all the provinces and territories, only Nunavut saw a decrease in the median wage in 2021 (-3.1% to $36,950), however, the median wage in Nunavut remains higher than in 2019 (+3.6%).

While monthly trends in employment and wages are most commonly reported through the Labour Force Survey, tax filer data presents a picture of annual wages and salaries. Estimates can be disaggregated to small geographic areas, industries or detailed age groups.

New habits and public health restrictions continue to impact where wages are earned

During 2021, the second year of the COVID-19 pandemic, the world had adapted to a new reality, and annual trends in wages and salaries reflected various dimensions of the pandemic response as the sectors which saw the largest increase in workers from 2020 to 2021 were also those where the pandemic response engaged workers. The largest increase was in public administration where the number of wage earners rose by 123,020. Most notably, the federal public service subsector increased by 85,650 wage earners (+19.0%) over 2020.

Professional, scientific and technical services had the second largest increase in the number of wage earners in 2021, rising by 77,620 wage earners (+7.1%). This increase in professional, scientific and technical services could be partly due to the expansion of teleworking in many industries providing new opportunities to workers to work in this sector, as well as growth opportunities for employers. Other sectors showing growth included health care and social assistance (+65,140 wage earners) and construction (+45,510 wage earners).

Online shopping nearly doubled during the first year of the pandemic, a shift that persisted throughout 2021. This increased the demand for courier and delivery services, with 46.1% more wage earners (+21,190 individuals) in that subsector, the highest proportional increase among all subsectors. The median wage in this subsector was $38,070 in 2021.

In 2021, the number of wage earners also declined in some sectors, including wage earners in accommodation and food services (-85,380) and in retail trade (-36,470). The two subsectors where the number of wage earners decreased the most were food services and drinking places (-68,790; -7.5%) and accommodation services (-16,580; -10.2%). On the other hand, both subsectors noted increases in their median wages in 2021, with food services and drinking places rising to $14,160 (+15.9%) and accommodation services increasing to $18,390 (+17.0%). Some explanations for the increases in wage-earning for these two subsectors could be an increase in number of hours worked; an increase in hours of operation for businesses; higher hourly wages; or fewer seasonal and part-time workers employed in these sectors. The Survey of Employment, Payrolls and Hours recorded that the year-over-year growth of the average weekly earnings (including overtime) for all employees was particularly notable starting in June 2021 for both subsectors. Compared with 2019, wage earners in accommodation services, and food services and drinking places still had lower median wages despite the large increases from 2020 to 2021.

Among the subsectors that shrank, the two with the largest proportional decreases in the number of wage earners in 2021 were air transportation (-17.7%; -12,350) and non-metallic mineral product manufacturing (-16.6%; -9,010). These declines may have been due to continued restrictions on non-essential travel and a supply chain squeeze for raw materials.

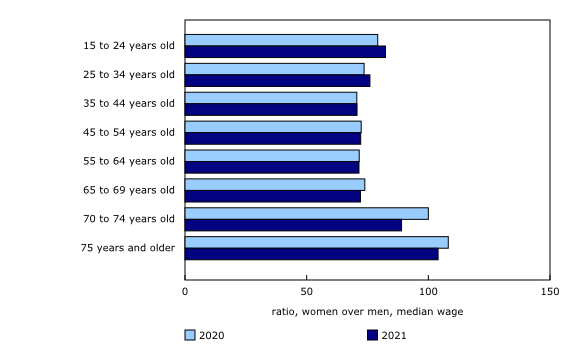

Wage gap falls between young men and young women

In 2021, the median wage increased for both sexes, to $50,230 (+4.3%) for men and $37,190 (+6.2%) for women. The larger increase in the median wage for women reduced the difference from men, with the median wage for women 26.0% lower than the median wage for men in 2021, a smaller difference than the 27.3% seen in 2020. This narrowing of the difference in median wages for men and women was most prominent in individuals under the age of 35. In 2021, older seniors (75 years and older) were the only age group where median wages were higher for women than men. In 2021, this age group represented 1.7% of wage earners.

Earnings of lower wage workers return to pre-pandemic levels

To see the impact of the pandemic on lower-earning workers, one needs to look beyond the median. Looking at wage earners at the 25th percentile is one way to assess the effects of the pandemic. The 25th percentile is the point on the earnings distribution where one-quarter of workers earned less, and three-quarters earned more.

After a drop in 2020 (-10.6% to $14,820), the 25th percentile of wages for 2021 ($16,680) rebounded to a level similar to that seen in 2019 ($16,580). While this recovery was a positive sign, growth in earnings from 2019 to 2021 of lower-wage workers was less than the growth in earnings of the median worker, suggesting a small increase in earnings inequality.

Wage earners below the 25th percentile most commonly worked in the retail, food service and entertainment industries, as half of the workers in these industries had wages below this level. These industries are among the largest employers of minimum wage workers. These tax filers could also be working part-time, for part of the year or occupied seasonal positions. Assuming a wage of $13/hour (the minimum hourly wage was between $12 and $15 in most provinces and territories in 2021), an annual wage of less than $16,680 would mean working less than 25 hours per week for 52 weeks.

In most census metropolitan areas, median annual earnings are back up to their 2019 levels

In all census metropolitan areas (CMAs), median annual earnings for 2021 were above 2019 values, excluding Windsor and Red Deer. The drop in the median wages in 2020 in these two CMAs was too large to be compensated by the 2021 growth as they were among the three CMAs with the fastest declines in 2020. St. Catharines–Niagara was the third CMA, but there, the large increase in 2021 was more than enough to compensate the 2020 drop.

In 2021, median annual wages increased the most in the CMAs of St. Catharines–Niagara (+9.1%), Kelowna (+7.7%), Nanaimo (+7.7%), Vancouver (+7.3%) and Peterborough (+7.2%). In June 2021, British Columbia raised the minimum wage from $14.60 to $15.20, the highest among all provinces, which may be a factor underlying the increases in median annual wages in CMAs in that province.

In 2021, the number of wage earners increased in Sherbrooke (+4.4%), Trois-Rivières (+4.4%), Drummondville (+4.4%) and Saguenay (+4.1%), while the number of wage earners decreased in Toronto (-0.2%), Hamilton (-0.4%), Edmonton (-0.5%) and Greater Sudbury (-0.6%).

Note to readers

The term "earnings" in the release includes the wages, salaries and commissions declared by tax filers.

The term "wage earner" in this release refers to tax filers with wages, salaries and commissions.

This release provides data on wages, salaries and commissions from all sources received throughout the year for paid employment as reported on T1 Income Tax and Benefit returns. Data for this release are produced using the preliminary version of the T1 Family File, which is based on an early version of the T1 file received by Statistics Canada from the Canada Revenue Agency.

The extension by the Canada Revenue Agency of the deadlines for filing 2019 tax returns and for the payment of taxes without penalty impacted the completeness of the 2019 data used in this release. The number of tax filers appearing in the preliminary income tax data, generally speaking individuals who filed taxes before September, edged down by 0.8% in 2019, increased by 2.5% in 2020 and was up by 0.9% in 2021, while the number of tax filers in the preliminary tax file increased on average by 1.3% yearly since 2009. Therefore, caution should be used with these data when interpreting moderate changes in counts of earners between 2019 and 2021. The increase in the number of earners between 2019 and 2021 could be overstated by approximately 1.3 percentage points.

These estimates cover all tax filers 15 and older (as of December 31 of the year) who reported wages, salaries or commissions. This group includes workers employed full and part time, as well as full and part year. It excludes tax filers who only reported income from self-employment during the year.

Wages, salaries and commissions reported by tax filers on their T1s are based on the employment income recorded on their T4 Statement of Remuneration Paid. In addition to employment income, wages, salaries and commissions includes training allowances, tips, gratuities and royalties received from employers during the tax year. Tax-exempt employment income earned by registered Indians is also included. Self-employment income is excluded.

Sectors refers to the two-digit sector assigned to a tax filer using the North American Industry Classification System (NAICS Canada 2017 Version 3.0). A sector is assigned to each tax filer based on the industry that accounted for the highest share of their total employment income during the tax year over all of their T4 slips. The category "not available" in the main sector table represents tax filers for whom an industry code could not be assigned.

Data source on employment, median hourly wages and hours worked is the Labour Force Survey.

Data source on average weekly earnings is the Survey of Employment, Payrolls and Hours.

The median is the value in the middle of a group of values (i.e., half of people have wages, salaries and commissions above this value and half of people have wages, salaries and commissions below this value).

The 25th percentile is the value in a distribution where one-quarter of values are below and three-quarters of values are above.

All figures for previous years are in constant dollars and have been adjusted for inflation using the Consumer Price Index, table 18-10-0005-01.

All data in this release have been tabulated according to the 2021 Standard Geographical Classification used for the 2021 Census.

A census metropolitan area (CMA) is formed by one or more adjacent municipalities centred on a population centre (also known as the core). A CMA must have a total population of at least 100,000, of which 50,000 or more must live in the core.

Products

The document Technical Reference Guide for the Preliminary Estimates from the T1 Family File (11260001) presents information about the methodology, concepts and data quality for the data available in this release.

Data on wages, salaries and commissions (11230001, various prices) and Canadian tax filers (17C0010, various prices) are now available for Canada, provinces and territories, economic regions, census divisions, census subdivisions, census metropolitan areas, census agglomerations, census tracts, and postal-based geographies. These custom services are available upon request. Tables 11-10-0072-01 and 11-10-0073-01 for this release are available for free on the Statistics Canada website for Canada, provinces and territories, census metropolitan areas, and census agglomerations.

The Income, pensions, spending and wealth statistics portal, which is accessible from the Subjects module of the Statistics Canada website, provides users with a single point of access to a wide variety of information related to income, pensions, spending and wealth.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: