Building construction price indexes, fourth quarter 2022

Released: 2023-02-08

National overview

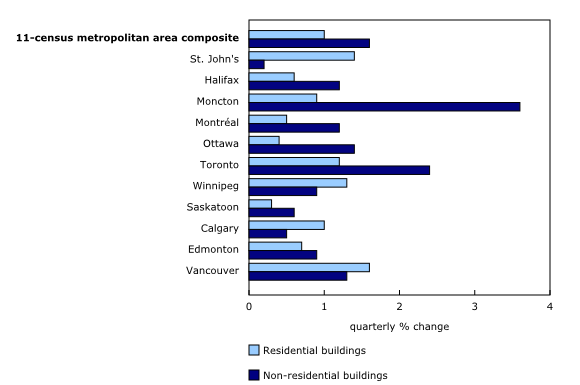

Residential building construction costs increased 1.0% in the fourth quarter, following a 2.5% increase in the previous quarter. Non-residential building construction costs rose 1.6% in the fourth quarter, following a 2.1% increase in the previous quarter.

Skilled labour shortages and cost of materials, particularly fuel, concrete and steel, were reported by contractors as key issues across the construction industry. For non-residential construction, availability of materials was also reported as a key issue.

Rising concrete costs contribute to higher residential construction costs

Residential building construction costs in the fourth quarter were driven by cost increases in equipment (+2.6%), metal fabrications (+2.4%), and concrete (+2.2%). Costs in the wood, plastics and composites division (+0.5%) grew at a slower rate compared with previous highs, which can be attributed to the continued decline in lumber prices.

In the 11-census metropolitan area (CMA) composite, the cost to build high-rise apartments (+1.7%) grew the most of all residential buildings in scope for the survey, followed by low-rise apartments (+1.0%).

Costs to construct residential buildings increased the most in Vancouver (+1.6%), followed by St. John's (+1.4%) and Winnipeg (+1.3%). Most CMAs covered by the survey recorded their lowest quarterly increases of the year in the fourth quarter.

Higher costs for steel and concrete led non-residential construction price growth

Non-residential building construction cost growth was led by cost increases in structural steel framing (+2.5%), followed by concrete and metal fabrications (both up by 2.3%). Of all non-residential buildings surveyed, the cost to build bus depots with maintenance and repair facilities and factories (both up by 1.9%) rose the most in the 11-CMA composite.

While growth in non-residential building construction costs across most CMAs slowed in the fourth quarter, Moncton (+3.6%) was the only CMA to record its largest quarterly price increase of the year. Toronto (+2.4%) and Ottawa (+1.4%) recorded the next largest quarterly increases in non-residential construction costs.

Year-over-year growth in construction costs moderates from previous highs

Construction costs for residential buildings in the 11-CMA composite rose 15.4% year over year in the fourth quarter, whereas non-residential building construction costs rose 11.1% year over year during the same period. Both year-over-year residential and year-over-year non-residential construction cost growth in the current quarter moderated from previous highs.

Toronto led year-over-year growth in construction costs for both residential (+21.9%) and non-residential (+14.5%) buildings, followed by Edmonton for residential buildings (+16.0%) and Moncton for non-residential buildings (+13.3%).

The year 2022 in review

Shortages and rising cost of building materials and skilled labour persist in 2022

A combination of increasing demand for construction and supply challenges due to labour shortages resulted in limited availability and higher prices for materials and labour in the construction industry in 2022. While residential and non-residential construction costs continued to rise during the first half of the year, they rose at a slower rate during the second half of the year.

Supply chain disruptions that started during the COVID-19 pandemic continued to impact the construction industry in 2022, alongside the generalized rise in fuel prices. While lumber prices declined in the second half of the year, the wood, plastics and composites division recorded one of the largest year-over-year increases. This increase, along with the growth in prices of structural steel framing, concrete and metal fabrications, led the rise in construction material costs.

The construction industry job vacancy rate reached a high of 8.3% in April 2022, after which it steadily declined. The resulting upward pressure on wages and several labour contract renegotiations over the spring and summer added to labour costs faced by contractors in 2022.

While the number of building permits and permit values for new residential construction were down in the year compared with 2021, they were higher for new non-residential construction in 2022. Despite a slight decline in the total number and value of building permits for new construction in the year, they were both comparable to 2021, indicating a preservation of demand for new construction through most of 2022.

Double-digit gains in residential building construction costs for second consecutive year

In 2022, the 11-CMA composite for residential building construction costs rose 19.1%, which represents its largest annual increase since the inception of the Residential Building Construction Price Index in 2017.

Yearly construction costs for residential buildings rose the most for single-detached houses (+20.9%) and townhouses (+20.4%) from 2021 to 2022.

Cost increases hit double digits in all CMAs, except for Moncton (+7.3%), showing the largest annual growth in Toronto (+25.2%) and Edmonton (+21.3%).

Non-residential construction costs register record increase

The 11-CMA composite for non-residential construction cost increased 12.5% in 2022 compared with 2021. This was the highest annual increase since the beginning of the Non-Residential Building Construction Price Index in 1981. Bus depots with maintenance and repair facilities (+14.9%), and factories (+14.7%) saw their construction costs rise the most on an annual basis. The wood, plastics and composites, structural steel framing, and metal fabrications divisions led the increase in costs for these buildings.

Non-residential building construction costs increased the most in Toronto (+16.2%), followed by Ottawa (+13.6%) and Montréal (+12.9%). Except for Calgary, Edmonton and Vancouver, where costs rose significantly in 2007, all CMAs covered by the survey recorded their highest annual increase of construction costs in 2022 since the index's inception.

Note to readers

The building construction price indexes are quarterly series that measure the change over time in the prices that contractors charge to construct a range of commercial, institutional, industrial and residential buildings in 11 census metropolitan areas (CMAs): St. John's, Halifax, Moncton, Montréal, Ottawa–Gatineau (Ontario part), Toronto, Winnipeg, Saskatoon, Calgary, Edmonton, and Vancouver.

These buildings include six non-residential structures: an office building, a warehouse, a shopping centre, a factory, a school, and a bus depot with maintenance and repair facilities. In addition, indexes are produced for four residential structures: a single-detached house, a townhouse, a high-rise apartment building (five storeys or more) and a low-rise apartment building (fewer than five storeys).

The contractor's price reflects the value of all materials, labour, equipment, overhead and profit to construct a new building. It excludes value-added taxes and any costs for land, land assembly, building design, land development and real estate fees.

With each release, data for the previous quarter may have been revised. The index is not seasonally adjusted.

With the release of data from the fourth quarter of 2022, table 18-10-0135 has been archived and replaced by table 18-10-0276. The information that was in table 18-10-0135 is still in the new table. However, the new table also shows data by construction division. Data is now available for 23 divisions and for a composite of these divisions. Newly integrated divisional data is available starting from the first quarter of 2017.

Products

The Building Construction Price Indexes Data Visualization Tool is now available. It provides access to current and historical data from the Building Construction Price Index (BCPI) for four residential and six non-residential building types, for the CMAs of St. John's, Halifax, Moncton, Montréal, Ottawa–Gatineau (Ontario part), Toronto, Winnipeg, Saskatoon, Calgary, Edmonton, and Vancouver as well as for a composite of these 11 CMAs, in a dynamic and customizable format.

The Technical Guide for the Building Construction Price Index is now available. This document provides details on the methodology used to calculate the BCPI.

Statistics Canada launched the Producer Price Indexes Portal as part of a suite of portals for prices and price indexes. This webpage provides Canadians with a single point of access to a wide variety of statistics and measures related to producer prices.

The video "Producer price indexes" is available on the Statistics Canada Training Institute webpage. It provides an introduction to Statistics Canada's producer price indexes—what they are, how they are made, and what they are used for.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: