Distributions of household economic accounts for income, consumption, saving and wealth of Canadian households, third quarter 2022

Released: 2023-01-19

This release of the distributions of household economic accounts shows that expenditures and debt rose more than income and assets in the third quarter of 2022, suggesting that increases in the cost of living are having a negative impact on net saving and wealth, especially for more vulnerable households, such as those with the lowest incomes, the least wealth, and in the younger age groups. Net saving for the bottom 40% of income earners was down about 12% in the third quarter of 2022 compared with the start of the COVID-19 pandemic in the first quarter of 2020. In the third quarter of 2022, net worth declined by 10.8% for the bottom 40% of wealth holders and by 9.8% for those aged less than 35 years relative to the same quarter of 2021.

Share of income for lowest income households reduces due to expiry of pandemic benefits and higher borrowing costs

Income inequality, defined as the gap in the share of disposable income between households in the two highest and two lowest income quintiles, declined by 0.5 percentage points in the third quarter of 2022 relative to the same quarter a year earlier. This reduction was largely driven by gains in income for the second quintile (+$837 or +5.5%), while the lowest quintile saw its average income reduce by $455 (-5.5%).

Year-over-year gains in self-employment income for the lowest income households, due mainly to higher crop yields that contributed to greater exports of farm products and income for self-employed farmers, were more than offset by the expiry of pandemic-related government benefits, as well as increasing borrowing costs on mortgage and non-mortgage loans. Borrowing has become more costly for households as the Bank of Canada increased its policy interest rate to 3.25% as of the third quarter of 2022, up 300 basis points from the same quarter a year earlier.

Income stable for highest income households, as gains in self-employment and investment earnings offset by wage reductions

In the third quarter of 2022, the average disposable income of households in the highest 20% of income earners held constant relative to the same quarter a year earlier (-0.9%), as gains in self-employment income (+18.3%) and net investment income (+9.6%)—mainly from increased shareholder dividends and bank deposits—were offset by reductions in wages and salaries (-3.0%). Still, wages and salaries for the highest 20% of income earners remained well above their level at the start of the pandemic (up 17.2% relative to the first quarter of 2020).

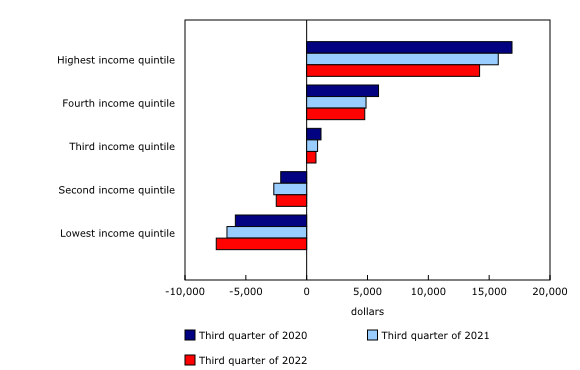

Lower- and middle-income households are those who saw their net saving reduce the most

In the third quarter of 2022, net saving for the bottom 40% of income earners was below levels recorded at the start of the pandemic, down about 12% since the first quarter of 2020. Meanwhile, households in the second-highest (+34.4%) and highest (+20.9%) quintiles increased their net saving since the start of the pandemic.

Over the last year, along with inflationary pressures, households in each income quintile increased their spending on most goods and services, especially food and accommodation services, clothing and footwear, and transport. While average net saving declined for most households, those in the third (middle) income quintile had the largest decline, down 14.8% in the third quarter of 2022 relative to a year earlier.

In general, households with higher disposable income tend to have a better ability to absorb cost-of-living increases, as a smaller portion of their budgets are dedicated to spending on necessities. Households in the fourth income quintile (-2.2%) reduced their net saving the least relative to other households since the third quarter of 2021.

Net worth for least wealthy affected more by a range of economic pressures

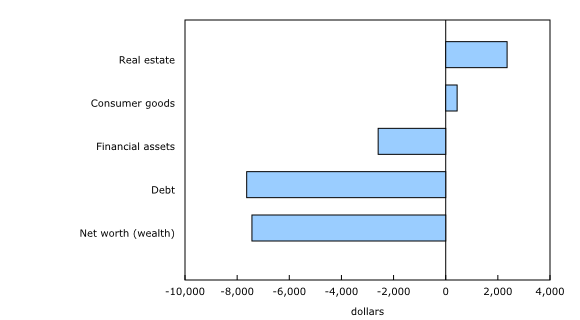

In contrast with earlier in the pandemic, household wealth has recently been assailed by a perfect storm of economic pressures, with asset values declining along with turmoil in financial and housing markets, as well as increasing interest rates and persistently high inflation. On average, regardless of a household's demographic or economic characteristic, gains in household wealth acquired over the previous year have been erased. In the third quarter of 2022, average household net worth was down 6.0% from the same quarter a year earlier.

The household wealth gap—a measure of economic inequality defined as the difference between the share of net worth for households in the highest wealth quintile (top 20%) and that for the two lowest wealth quintiles (bottom 40%)—continued to increase. As of the third quarter of 2022, the wealth gap grew by half a percentage point relative to the same quarter a year earlier. In contrast, the wealth gap had been consistently decreasing earlier in the pandemic, declining by 1.6 percentage points from the first quarter of 2020 to the same quarter of 2022.

While declines in net worth for the least wealthy (lowest 40%) were due mainly to increases in average debt (+7.9%), in contrast, declines in net worth for the wealthiest were derived entirely from reductions in both financial assets (-6.7%) and real estate (-3.3%), while their debt was stable (+0.1%).

Wealth declines across all age groups, but younger households affected the most

Although reductions in net worth occurred across each age group, younger households decreased their net worth at the fastest pace. The average household wealth of the two youngest age groups was down the most of any age group, including those less than 35 years (-9.8%) and those aged 35 to 44 years (-7.7%).

The overall value of real estate declined by 3.4% in the third quarter of 2022 relative to the same quarter a year earlier, continuing a downward trend that began in the second quarter of 2022. Younger households tend to be more susceptible to reductions in real estate values as they derive more of their net worth from that asset category, while older households have had more time over their life cycle to diversify their asset portfolio. Declines in the average value of real estate ranged from a decline of 5.4% for households aged less than 35 years to a decrease of 0.7% for those aged 55 to 64 years.

Financial asset values declined 6.8% in the third quarter of 2022 relative to the same quarter a year earlier, which weighed more heavily on older age groups as they tend to rely more on that asset category as a source of wealth. The share of financial assets to total assets ranged from 56.4% for households aged 65 years and older to 34.0% for those aged less than 35 years. Declines in the average value of financial assets ranged from a decline of 5.2% for those aged 45 to 54 years to a decrease of 8.7% for those aged less than 35 years.

Younger households increasing their debt leverage to fund consumption

Younger households increased their debt leverage along with rising costs of living. The debt-to-income ratio for the youngest households reached 177.9% in the third quarter of 2022, up 3.3 percentage points from the third quarter of 2021, as their debt increased, and their disposable income decreased along with the expiry of pandemic benefits from a year earlier. Increased borrowing costs were also a big factor, as rising interest rates made it more expensive to hold credit card balances and mortgages. Despite recent gains in the debt-to-income ratio for the youngest households, they remain below pre-pandemic rates.

On the other hand, core working-age households decreased their debt-to-income ratios—reaching 238.7% (-1.2 percentage points) for those aged 35 to 44 years and 223.4% (-8.2 percentage points) for those aged 45 to 54 years—as gains in their income, mainly from wages, tended to outweigh increased debt.

Debt-to-asset ratios increased the most for younger households, including those aged less than 35 years (+2.6 percentage points) and those aged 35 to 44 years (+2.5 percentage points), continuing a trend that began in the second quarter of 2022 as debt rose while financial assets and real estate values declined.

In light of recent economic pressures on economic well-being through increasing interest rates and persistently high inflation, households may face further challenges in maintaining their economic well-being, especially vulnerable groups, such as those with the lowest income, the least wealth and in the younger age groups. Indeed, the latest figures from the Monthly Credit Aggregates program, which includes estimates on credit liabilities for the first two months of the fourth quarter of 2022, indicate that household debt was roughly 7% higher compared with the same months of the prior year.

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The distributions of household economic accounts for income, consumption, saving and wealth of Canadian households are an example of how Statistics Canada supports the reporting on the Global Goals for Sustainable Development. This release will be used in helping to measure the following goal:

Note to readers

Statistics Canada regularly publishes macroeconomic indicators on household disposable income, final consumption expenditure, saving and wealth as part of the Canadian System of Macroeconomic Accounts (CSMA). These accounts are aligned with the most recent international standards and are compiled for all sectors of the economy, including households, non-profit institutions, governments and corporations along with Canada's financial position vis-à-vis the rest of the world. While the CSMA provide high quality information on the overall position of households relative to other economic sectors, the Distributions of Household Economic Accounts (DHEA) provide additional granularity to address questions such as vulnerabilities of specific groups and the resulting implications for economic well-being and financial stability. These estimates are an important complement to standard quarterly outputs related to the economy.

The DHEA estimates released today provide estimates of income, consumption, saving and wealth, including their sub-components by various household distributions up to the third quarter of 2022. Estimates have also been revised for prior periods to incorporate the latest CSMA benchmarks, including revisions back to 2019 for income, consumption and saving, and back to 2010 for wealth.

Based on efforts undertaken by a third-party data supplier on consumer credit transactions (Equifax Canada), DHEA estimates for the distributions of debt have also been revised back to the first quarter of 2020 to reflect a re-classification of mortgage-related balances contained within combined home equity lines of credit plans.

Estimates for wealth distributed by wealth quintile are combined for households in the lowest two quintiles for ease of illustration, since the average household in the lowest wealth quintile owed more in liabilities than it owned in assets, such as self-employed workers with negative net business equity and recent graduates with student loan balances.

As with all data, the DHEA estimates are not without their limitations. While some distributions are estimated using timely microdata or micromodels, such as wages and salaries and household debt, other distributions, including those for household final consumption expenditures, social transfers in kind and assets rely on assumptions or use data from prior reference periods. Users should keep these limitations in mind when analyzing the estimates included in this release.

All values are expressed in quarterly nominal unadjusted rates, unless otherwise specified. As a result, the estimates presented in this release are not adjusted for variations over time that may occur due to seasonal patterns and/or price inflation.

Products

The data visualization product "Distributions of Household Economic Accounts, Wealth: Interactive tool," which is part of Statistics Canada – Data Visualization Products (71-607-X) is now available.

The article "Distributions of Household Economic Accounts, estimates of asset, liability and net worth distributions, 2010 to 2021, technical methodology and quality report," which is part of the Income and Expenditure Accounts Technical Series (13-604-M), is now available.

Details on the sources and methods behind these estimates can be found in Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X). See section "Distributions of Household Economic Accounts" under Satellite Accounts and Special Studies.

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structure.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: