Retail trade, October 2022

Released: 2022-12-20

$62.0 billion

October 2022

1.4%

(monthly change)

$943.0 million

October 2022

2.9%

(monthly change)

$280.4 million

October 2022

5.9%

(monthly change)

$1,714.1 million

October 2022

5.9%

(monthly change)

$1,410.8 million

October 2022

3.2%

(monthly change)

$13,974.6 million

October 2022

2.6%

(monthly change)

$22,474.6 million

October 2022

-0.3%

(monthly change)

$2,183.8 million

October 2022

2.2%

(monthly change)

$2,155.2 million

October 2022

3.7%

(monthly change)

$8,116.3 million

October 2022

1.5%

(monthly change)

$8,505.7 million

October 2022

1.3%

(monthly change)

$86.2 million

October 2022

2.3%

(monthly change)

$76.9 million

October 2022

3.8%

(monthly change)

$50.7 million

October 2022

7.1%

(monthly change)

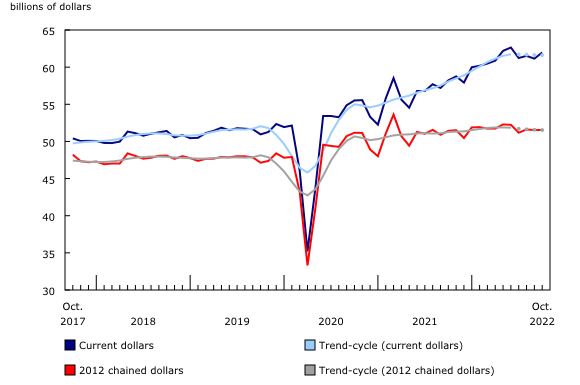

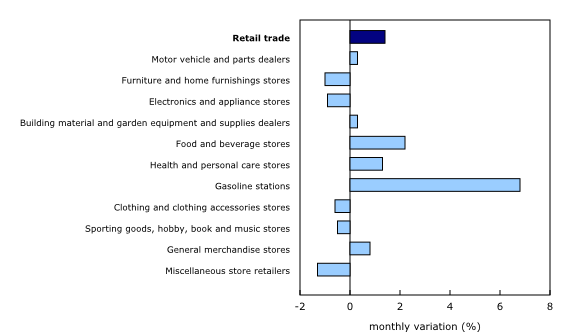

Retail sales increased 1.4% to $62.0 billion in October, posting its largest increase in five months. Sales were up in 6 out of 11 subsectors, representing 84.4% of retail trade. The increase was led by higher sales at gasoline stations (+6.8%) and food and beverage stores (+2.2%).

Core retail sales—which exclude gasoline stations and motor vehicle and parts dealers—increased 0.9%.

In volume terms, retail sales were unchanged in October.

Given the continually evolving economic situation, Statistics Canada is providing an advance estimate of retail sales, which suggests that sales decreased 0.5% in November. Owing to its early nature, this figure will be revised. This unofficial estimate was calculated based on responses received from 42.3% of companies surveyed. The average final response rate for the survey over the previous 12 months has been 90.4%.

Higher sales at gasoline stations lead retail sales

Leading the increase in retail sales in October were higher sales at gasoline stations (+6.8%), which recorded their first gain in four months. In volume terms, sales at gasoline stations decreased 3.3%. Gasoline prices increased 9.2% on an unadjusted basis in October after the announcement of future oil production cuts by the Organization of the Petroleum Exporting Countries Plus and a weaker Canadian dollar.

Sales at motor vehicle and parts dealers were up 0.3% in October. The increase was led by higher sales at new car dealers (+1.0%), which posted their largest gain in four months. Higher sales were also reported at used car dealers (+1.4%). The largest decline in this subsector came from other motor vehicle dealers (-7.3%), followed by automotive parts, accessories and tire stores (-0.6%).

Core retail sales rise on gains at food and beverage stores

Posting its second increase in five months, core retail sales rose 0.9% in October, led by higher sales at food and beverage stores (+2.2%). Increases were observed in three out of four store types in this subsector, led by higher sales at supermarkets and other grocery (except convenience) stores (+2.5%). The Consumer Price Index (CPI) noted that prices of food purchased from stores rose 10.1% on a year-over-year basis and continued to outpace the all-items CPI growth for an 11th consecutive month.

Also contributing to the gain in core retail were higher sales at general merchandise stores (+0.8%). According to the Retail Commodity Survey, food is the top commodity sold in this subsector and typically accounts for roughly one-third of sales.

Higher sales at health and personal care stores (+1.3%), which posted its largest increase since May, also contributed to the increase in core retail sales in October.

The largest decrease to core retail sales occurred at miscellaneous store retailers (-1.3%).

Retail sales up in nine provinces

Retail sales increased in nine provinces in October, led by higher sales in Quebec (+2.6%). Sales were up 4.9% in the census metropolitan area (CMA) of Montréal.

Retail sales were also up in Alberta (+1.5%). Leading the increase were higher sales at gasoline stations.

In Ontario, retail sales decreased 0.3%, led by declines at motor vehicle and parts dealers. In the CMA of Toronto, sales increased 0.3%.

Retail e-commerce sales in Canada

On a seasonally adjusted basis, retail e-commerce sales were down 4.6% in October.

On an unadjusted basis, retail e-commerce sales were down 3.6% year over year to $3.4 billion in October, accounting for 5.2% of total retail trade. The share of e-commerce sales out of total retail sales fell 0.5 percentage points compared with October 2021.

Note to readers

All data in this release are seasonally adjusted and expressed in current dollars, unless otherwise noted.

Seasonally adjusted data are data that have been modified to eliminate the effect of seasonal and calendar influences to allow for more meaningful comparisons of economic conditions from period to period. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

The percentage change for the advance estimate of retail sales is calculated using seasonally adjusted data and is expressed in current dollars.

This early indicator is a special product being provided in the context of the COVID-19 pandemic to offer Canadians timely information on the retail sector. The data sources and methodology used are the same as those outlined on the Monthly Retail Trade Survey information page.

Trend-cycle estimates are included in selected charts as a complement to the seasonally adjusted series. These data represent a smoothed version of the seasonally adjusted time series and provide information on longer-term movements, including changes in direction underlying the series. For information on trend-cycle data, see Trend-cycle estimates – Frequently asked questions.

Both seasonally adjusted data and trend-cycle estimates are subject to revision as additional observations become available. These revisions could be extensive and could even lead to a reversal of movement, especially for the reference months near the end of the series or during periods of economic disruption.

Seasonally adjusted estimates for cannabis store retailers are presented in unadjusted form since no seasonal pattern has been established by official statistics yet. Establishing such a pattern requires several months of observed data. In the interim, the seasonally adjusted estimates for cannabis store retailers will be identical to the unadjusted figures.

Statistics Canada's retail e-commerce figures include the electronic sales of two distinct types of retailers. The first type does not have a storefront. These businesses are commonly referred to as pure-play Internet retailers and are classified under the North American Industry Classification System (NAICS) code 45411—electronic shopping and mail-order houses. The second type has a storefront and is commonly referred to as a brick-and-mortar retailer. If the online operations of a brick-and-mortar retailer are separately managed, they, too, are classified under NAICS code 45411.

Some common e-commerce transactions, such as travel and accommodation bookings, ticket purchases, and financial transactions, are not included in Canadian retail sales figures.

For more information on retail e-commerce in Canada, see "Retail E-Commerce in Canada."

Total retail sales expressed in volume terms are calculated by deflating current-dollar values using consumer price indexes.

Find more statistics on retail trade.

Real-time tables

Real-time tables 20-10-0054-01 and 20-10-0079-01 will be updated soon.

Next release

Data on retail trade for November 2022 will be released on January 20, 2023.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: