A portrait of landlords and their rental income: A tax data perspective

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-11-02

The almost constant rise of housing prices combined with low interest rates in recent years has contributed to a trend in individuals acquiring a secondary dwelling as an investment option. For other owners who may not be able to afford a second property, having a rental unit as part of their main residential property can also help them with their housing-related expenses, while possibly providing a source of income.

In 2020, 7.9% of families declared rental income, up from 7.0% in 2008 (+335,850 families). Median annual family net rental income (rental income after deductions) was $2,750 in 2020, indicating that net rental income does not represent a large portion of the total income (2.3%) of most of these families. The rate of families declaring rental income was highest in Vancouver, where 11.2% of families reported rental income.

The growth in the proportion of families with rental income has coincided with the period of low interest rates since 2008, suggesting that families took advantage of the low borrowing costs to develop a secondary income source or in the hopes of future capital gains. Higher borrowing costs in 2022 could lead to a decline in the share of families with rental income in that year, or to a reduction in net rental income for these families.

The data used in this release covers Canadian tax filers who are required by the Canada Revenue Agency to report rental income on their T1 form. This includes individuals who rent their personal properties or are in unincorporated partnerships in the residential rental market. It does not include trusts/corporations. Therefore, these data represent only a portion of landlords. Net rental income equals gross rental income minus expenses such as property taxes; repairs and renovations; interest on mortgages; condo fees; and more, as well as a capital cost adjustment to account for possible depreciation (see Note to readers for a more detailed explanation of allowable deductions).

Couple families are more likely to have rental income

Overall, couple families (11.3%) were more likely to have rental income than lone-parent families (5.1%) and persons not in families (4.1%) in 2020. Couple families, who also have the highest median total income, have access to more cash flow than other family types and therefore may be more likely to have a property to rent. While couples with children (13.1%) had rental income more often than other family types, couples without children earned the highest median net rental income ($3,190).

Typical landlord in 2020: In a couple, living in a big census metropolitan area and working

Data from tax sources allows for a high level of disaggregation, enabling the development of a detailed portrait of this group of landlords. For example, in 2020, just over four in five rental income earners were in couple families (81.0%), close to half of rental income earners were aged 45 to 64 (46.7%) and most lived in the census metropolitan area (CMA) of Toronto (21.2%), Montréal (13.5%) or Vancouver (10.7%).

As for their other sources of income, approximately two out of three rental income earners (66.0%) also received wages, salaries and commissions. This proportion was similar among tax filers without rental income (64.6%). However, the median wage, salary and commission income of rental income earners with wages was $59,800 in 2020, which is more than 50% higher than tax filers without rental income ($38,570). Net rental income earners (13.3%) were more likely to receive business self-employment income than tax filers without rental income (7.4%).

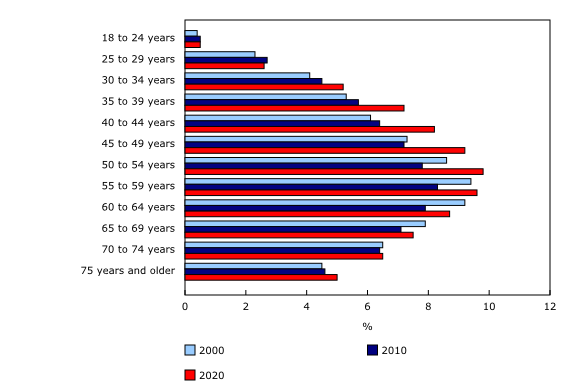

A trend towards younger rental income earners

Looking at data over the last two decades reveals that younger people have become much more likely to receive rental income in recent years. The share of 30- to 34-year-olds receiving net rental income rose from 4.1% in 2000 to 5.2% in 2020, the share of 35- to 39-year-olds rose from 5.3% to 7.2% and the share of 40- to 44-year-olds rose from 6.1% to 8.2%. This increase in the shares of young people receiving rental income would reflect an increasing need or desire to lighten the burden of rising housing costs with rental income, as well as the attractiveness of housing as an investment asset for younger people in recent years.

Couples share the risks and the rewards

Multiple family members can be involved in the renting of a property, in which case each of them would have to report their share of rental income. Sharing net rental income could help place rental income earners into a lower income-tax bracket, or it could be the result of family members combining their resources to purchase a rental property. How common this is would depend on the family type. In 2020, more than half of couple families with rental income (51.7%) had at least two net rental income earners, and this proportion has been increasing since 2000. In contrast, relatively few (4.1%) of the lone-parent families with rental income had two or more people declaring rental income and mostly consisted of adult children living with their parents.

Revenues from renting increasingly likely to outweigh costs

Occasional or even regular annual losses, if not too significant, can be offset by the profits at the time of resale of the dwelling or by higher levels of rent in the future due to proper maintenance and improvements to the dwelling. On the other hand, landlords seeking an immediate income source may try to earn positive net rental income each year.

In 2020, just over three-quarters (76.3%) of families were turning an annual profit on their rental property as they have positive net rental income, up from 63.1% in 2008. Net rental income in 2020 was $4,880 among families who reported positive net rental income, while families with negative net rental income reported a median of -$3,180.

Vancouver has the highest share of tax filers with rental income in 2020

The proportion of families with rental income varies significantly from CMA to CMA. Vancouver (11.2%) and Victoria (10.4%) reported the highest rates of families who received rental income in 2020, while Toronto (9.8%), Kelowna (9.4%) and Montréal (9.1%) rounded out the top 5. Multiple factors could motivate owners to rent a property, including housing costs, opportunities to earn income or capital gains, and local market factors such as availability of units and demand for housing.

Note to readers

Individual and family income data for 2020 are available from the T1 Family File. Data are derived from personal income tax returns filed in spring 2021, and are available for Canada, the provinces and territories, and various sub-provincial and sub-territorial geographic areas. Data are not adjusted on the basis of Statistics Canada's population estimates. The population covered by the T1 Family File includes tax filers and their dependants. Since only tax filers can have rental income in the T1 Family File, the focus of this release is on tax filers.

In this release, the term families refers to census families and persons not in a census family. A census family refers to a married or a common-law couple, with or without children at home, or a lone-parent family.

In this release, income has been adjusted for inflation, as measured by the Consumer Price Index, and all dollar amounts are expressed in 2020 dollars.

Net rental income is the gross rental income minus expenditures. The allowable expenses are composed of current expenses, capital expenses and uncollectible rent. Current expenses include repairs and maintenance; property taxes; utilities (if included in the rent); condo fees, renovations and expenses that extend the useful life of the rented property or improve it beyond its original condition; prepaid expenses; advertising; insurance; interest and bank charges; office expenses; professional fees (includes legal and accounting fees); salaries, wages and benefits for people who take care of the property; travel expenses related to management of the property; motor vehicle expenses (not including capital cost allowance); and other expenses (such as landscaping cost, lease cancellation payments). Capital expenses include the purchase price of rental property; legal fees and other costs connected with buying the property; and the cost of furniture and equipment included with the rent of the property. For more information, please consult the Canada Revenue Agency publication T4036 Rental Income. In situations where the rental units belong to several owners, only the share of the tax filers is included in the net rental income, while the gross income includes income of all parties. Tax filers with gross income but null net income are included in the statistics.

In this release, rental income earners and landlords are used interchangeably.

In the data tables associated with the annual release of the T1FF, Income of families and individuals: Subprovincial data from the T1 Family File, the net rental income is included in the source of income category called "Other income".

Total income includes employment income, dividend and interest income, government transfers, pension income and other income. In accordance with international standards, capital gains are excluded from total income.

The median is the point at which half of the observations are higher and half are lower.

The average is the sum of the observations divided by the number of observations.

All tax data in this release have been tabulated according to the 2016 Standard Geographical Classification used for the 2016 Census. The location of the tax filer is the source of information for the geography.

A census metropolitan area (CMA) is formed by one or more adjacent municipalities centered on a population centre (also known as the core). A CMA must have a total population of at least 100,000, of which 50,000 or more must live in the core.

Products

The Technical Reference Guide for the Annual Income Estimates for Census Families, Individuals and Seniors, T1 Family File, Final Estimates (72-212-X), presents information about the methodology, concepts and data quality for the T1FF data used for this release.

Tabulations on net rental income for Canada, provinces and territories, census metropolitan areas, census agglomerations, census tracts, federal electoral districts, economic regions, census divisions, census subdivisions, and postal-based geographies are also available as a custom service, upon request.

The Income, pensions, spending and wealth portal, which is accessible from the Subjects module of the Statistics Canada website, provides users with a single point of access to a wide variety of information related to revenue, pensions, spending and wealth.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: