Distributions of household economic accounts for income, consumption and saving of Canadian households, second quarter 2022

Released: 2022-10-03

The latest release of estimates from the Distributions of Household Economic Accounts reveals that in the second quarter, income inequality reached an all-time high since the beginning of the COVID-19 pandemic, with average disposable income declining for households with the lowest income (-5.7%) and the youngest age group (-2.6%). Inflationary pressures had a negative impact on net saving, regardless of their demographic or economic characteristics, as cost-of-living increases outweighed growth in disposable income.

The results in this release focus on the changes in average disposable income, consumption, and net saving across households with different demographic and economic characteristics, including age group and income quintile; a measure of economic inequality that ranks households by income, from lowest to highest, and then divides them equally into five groups. Households are grouped by age according to the age of the major income earner. It is important to recognize that not all households, even those with similar characteristics, necessarily experience the same economic situations. Unless otherwise stated in the text below, comparisons over time are based on the second quarter of 2022 relative to the same quarter of 2021.

Income gap highest since start of pandemic

The gap in the share of disposable income between households in the two highest income quintiles and the two lowest income quintiles reached 46.3% in the second quarter, up 0.2 percentage points, the highest it has been since the beginning of the pandemic.

Wage gains for households with the lowest income more than offset by expiry of pandemic benefits

The lowest income households (bottom 20%) with the lowest income increased their wages and salaries by more than those with the highest income amidst tight labour market conditions, as evidenced by a historically low unemployment rate of 4.9% in June. Although average disposable income for the top 20% of households was seven times higher ($46,805) than those in the bottom 20% ($6,415), the households with the lowest income grew their wages and salaries by 11.3%, while the households with the highest income grew their wages and salaries by 1.2%. During a period when businesses began to reopen following pandemic-related restrictions in the previous year, employers needed more workers in industries such as food and accommodation services, which tend to offer lower pay.

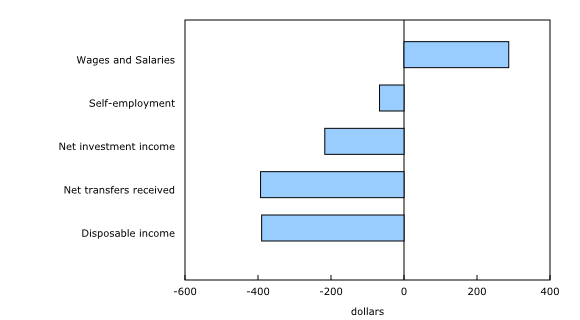

Despite strong gains in wages and salaries for the lowest income households (bottom 20%), their average disposable income decreased by $390 (-5.7%), as gains in wages and salaries were more than offset by larger government transfer reductions, mainly due to the expiry of most pandemic-related benefits.

Households across a range of demographic and economic characteristics were affected by the expiry of most pandemic-related support measures at the end of 2021. Households in the lowest income quintile were most significantly affected, as the share of pandemic benefits for that income group fell to 1.1% in the second quarter of 2022, down from 12.2% a year earlier. In contrast, the contribution of these benefits was negligible for the highest income households over the previous year, as their share fell from 0.8% of disposable income in the second quarter of 2021 to essentially zero a year later.

Households with the highest income gain from increases in employment and investment earnings

Trends in disposable income for the households with the highest income were driven mainly by employment and investment earnings rather than by transfers. Due mainly to a combination of gains in wages and salaries, self-employment income, and investment returns (including interest and dividend income), average disposable income for the highest income households (top 20%) reached $46,805 in the second quarter, up $617 (+1.3%).

Core working-age groups increase income through strong employment gains

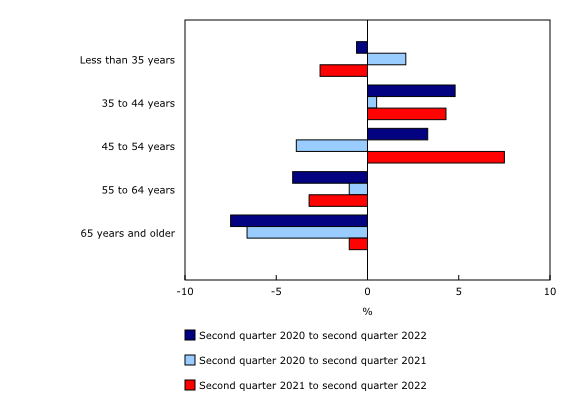

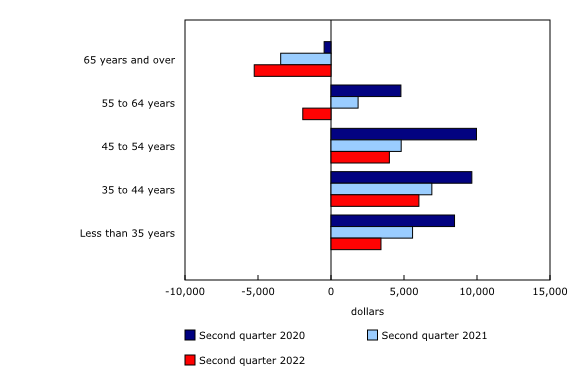

Along with recent business re-openings and employer efforts to fill job vacancies, average wages and salaries increased for each household group aged less than 65 years. Only households in core working-age groups (aged 35 to 54 years) increased their overall disposable income, mainly due to strong growth in wages and salaries. Average disposable income for those aged less than 35 years was $22,913, down $618 (-2.6%), while disposable income for those aged 35 to 54 years reached $29,240, up $1,602 (+5.8%).

Meanwhile, seniors aged 65 years and older had an average disposable income of $15,180, down $156 from a year earlier (-1.0%), as reductions in employment income were driven partly by retirements.

With the expiry of most pandemic-related support measures, their contribution to disposable income for households in each age group declined to reach essentially zero in the second quarter. Pandemic transfers as a share of disposable income were down from 4.2% a year earlier for the youngest age group (aged less than 35 years) and from 2.7% for the core working-age group (aged 35 to 54 years).

Inflationary pressures weigh on net saving, regardless of income level

Households in each income quintile increased their spending on most goods and services, especially on food and accommodation services, clothing and footwear, and transport. Average net saving declined the most for the third (middle) income quintile, down 218.4%, when it moved from a net saving position to a net dissaving position, as it had been prior to the pandemic.

In general, households with higher disposable income tend to have a better ability to absorb general cost-of-living increases, as a smaller portion of their budgets are dedicated to spending on necessities. Households in the highest income quintile reduced their net saving the least (-16.2%) relative to other households since the second quarter of 2021. Furthermore, only households in the highest income quintile were able to maintain their net saving at a higher level than that recorded at the beginning of the pandemic, in the first quarter of 2020.

Net saving declines most for older groups, but accumulated assets support spending

Households in every age group decreased their average net saving, especially older age groups such as those aged 55 to 64 years (-204.1%) and seniors (-52.6%). While net saving for households with an older major income earner decreased more relative to younger age group households, this may not necessarily imply a worsening of their economic well-being, since households in older age groups tend to have accumulated significant pension and other financial assets from which they may draw to fund their consumption.

Based on the latest estimates presented in this release, average wages for vulnerable groups, such as those in lower income quintiles and younger age groups, tend to be more significantly affected by shifts in economic conditions. Over time, the ability of vulnerable groups to maintain their average net saving—and, by extension, their economic well-being—will largely depend on their ability to secure higher wages in the face of labour shortages and on-going inflationary pressures. In general, households in higher income quintiles and core working-age groups tend to be better equipped to weather economic storms due to their higher skills and more secure jobs.

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The distributions of household economic accounts for income, consumption and saving are an example of how Statistics Canada supports the reporting on the Global Goals for Sustainable Development. This release will be used in helping to measure the following goal:

Note to readers

Statistics Canada regularly publishes macroeconomic indicators on household disposable income, final consumption expenditure and net saving as part of the Canadian System of Macroeconomic Accounts (CSMA). These accounts are aligned with the most recent international standards and are compiled for all sectors of the economy, including households, non-profit institutions, governments and corporations, along with Canada's financial position vis-à-vis the rest of the world. While the CSMA provide high quality information on the overall position of households relative to other economic sectors, the Distributions of Household Economic Accounts (DHEA) provides additional granularity to address questions, such as vulnerabilities of specific groups and the resulting implications for economic well-being and financial stability and are an important complement to standard quarterly outputs related to the economy.

The DHEA estimates released today provide estimates of income, consumption and saving and their sub-components by various household distributions for the second quarter of 2022. Estimates for the first quarter of 2022 have been revised to include the latest CSMA benchmarks.

As with all data, the DHEA estimates are not without their limitations. While some distributions are estimated using timely microdata or micromodels, such as wages and salaries, others, including household final consumption expenditures and social transfers in kind, rely on assumptions or use data from prior reference periods. Users should keep these limitations in mind when analyzing the estimates included in this release.

All values are expressed in quarterly nominal unadjusted rates, unless otherwise specified. As a result, the estimates presented in this release are not adjusted for variations over time that may occur due to seasonal patterns and/or price inflation.

Products

Details on the sources and methods behind these estimates can be found in the publication Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X). See the section "Distributions of Household Economic Accounts " under Satellite Accounts and Special Studies.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: