Gross domestic product by industry, February 2022

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-04-29

February 2022

1.1%

(monthly change)

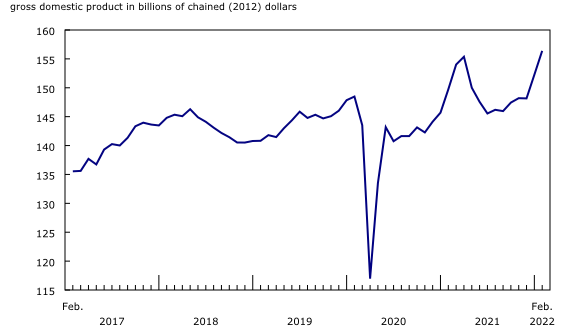

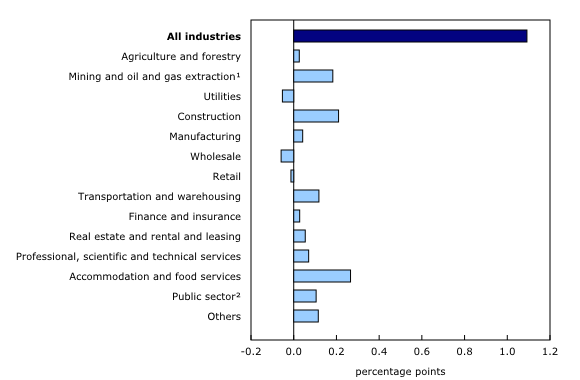

Real gross domestic product (GDP) rose 1.1% in February, the largest monthly growth rate since March 2021, as broad-based increases across most sectors contributed to the ninth consecutive monthly expansion in economic output.

Both services-producing (+0.9%) and goods-producing (+1.5%) industries were up, as 16 of 20 industrial sectors expanded in February.

Advance information indicates that real GDP increased 0.5% for March. Client-facing industries led the growth on continued reopening of activities and easing of restrictions put in place at the onset of Omicron variant. Increases were also recorded in the manufacturing and construction sectors. The wholesale sector posted a decline. This advance information for real GDP by industry indicates a 1.4% increase in the first quarter of 2022. Owing to their preliminary nature, these estimates will be updated on May 31 with the release of the official GDP data for March and the first quarter of 2022.

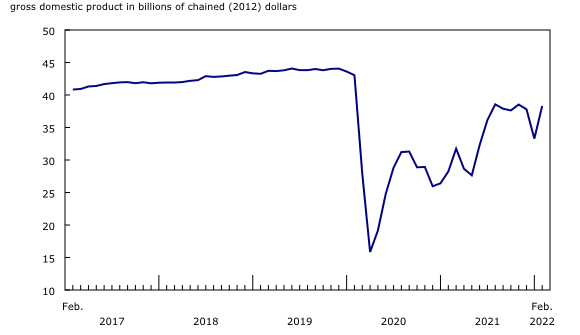

Client-facing industries recapture momentum following easing of Omicron-related restrictions

As the Omicron wave began to peak and then subside across the country, various levels of government began easing and removing restrictions on indoor gatherings introduced in December 2021 and January 2022, reversing the fortunes of client-facing industries that bore the brunt of the Omicron wave.

Accommodation and food services bounce back

The accommodation and food services sector jumped 15.1% in February, offsetting most of the previous two monthly declines, as both subsectors were up.

Food services and drinking places jumped 17.6% in February, more than offsetting the declines in December 2021 and January 2022, as activity increased across the country and at all types of establishments.

Accommodation services rose 8.8% in February following two months of decline. Traveller accommodation services led the growth, lifted by a higher number of domestic and international travellers in the month.

Transportation and warehousing rebounds

Transportation and warehousing rose 3.1% in February as all subsectors were up, with the exception of couriers and messengers (-1.9%).

Rail transportation rose 9.1% in February, the largest monthly growth rate since May 2014, picking up steam following a period of lower activity in late 2021 and January 2022 brought on by below seasonal cold weather and flooding in British Columbia.

Urban transit systems jumped 23.9% in February as ridership increased, largely offsetting declines in the previous two months.

Air transportation (+7.7%) rose for the 10th time in 11 months in February as airlines carried more goods and passengers.

Support activities for transportation rose 2.9%, stemming from increases in support for rail, water and air.

The arts, entertainment and recreation sector rebounds

The arts, entertainment and recreation sector bounced back with an 8.4% increase in February, following two months of decline, as all subsectors were up.

Amusement, gambling and recreation industries (+9.4%) contributed the most to the growth as many provinces reduced or completely removed capacity restrictions at casinos, bingo halls and other gaming terminals along with gyms, yoga studios, libraries and other amusement facilities.

Performing arts, spectator sports and related industries, and heritage institutions grew 7.1% in February as attendance at professional sporting events increased.

Construction is up for a second month in a row

The construction sector expanded 2.7% in February as all subsectors contributed to the growth.

Residential building construction rose 3.7% in February, led by home alterations and improvements and construction of apartment buildings. This was the second consecutively monthly increase.

Non-residential building construction increased 1.4% in February, representing its eighth consecutive gain, with alterations and improvements contributing the most to the gain. Industrial building construction also increased, fuelled by several new manufacturing and maintenance building projects in Ontario and Quebec.

Real estate keeps growing

The real estate and rental and leasing sector expanded 0.4% in February, as all subsectors were up. Contributing the most to the growth were offices of real estate agents and brokers (+2.5%) as home resale activity rose in the month, led by Ontario and the Prairie provinces.

Legal services, which derive much of their activity from real estate transactions, increased 1.2% in February.

Professional, scientific and technical services rise

In addition to legal services, the majority of industries comprising the professional, scientific and technical services sector (+1.0%) also recorded growth in February. Computer systems design and related services (+1.7%) and other professional, scientific and technical services including scientific research and development (+1.4%) contributed the most to the growth; only architectural, engineering and related services (-0.3%) was down. The sector as a whole has grown almost every month since April 2020 and, in February 2022, was 6.6% above its pre-pandemic level.

Finance and insurance are up as home buyers rush to lock in mortgages

Finance and insurance increased 0.4% in February, up for a ninth month in a row. As markets and investors were preparing for rate hikes signalled by central bankers, many home buyers rushed to lock in lower mortgage rates from their lenders, leading to a 0.5% increase in depository credit intermediation and other monetary authorities.

Insurance carriers and related activities rose 0.5% in February and while financial investment services, funds and other financial vehicles edged down 0.2%, its level of activity remained high amid global geopolitical instability toward the end of the month.

Widespread growth in mining, quarrying and oil and gas extraction

The mining, quarrying, and oil and gas extraction sector grew 3.4% in February, the largest monthly growth rate since December 2020, as all subsectors were up.

Oil and gas extraction expanded 3.0% in February following three months of decline. Oil sands extraction grew 3.1% in February, following production disruptions in January, as strong increases in crude bitumen and synthetic crude production in Alberta led the growth. Oil and gas extraction (except oil sands) rose 2.9% as both crude petroleum extraction and natural gas extraction were up.

Mining and quarrying (except oil and gas) increased 4.7% as all subsectors were up. Coal mining jumped double digits (+27.1%) for the third month in a row in February, supporting higher rail movement and exports of the commodity in the months following disruptions brought on by flooding in British Columbia in late 2021.

Metal ore mining increased 1.5%, as all types of metal ore mining grew, while non-metallic mineral mining and quarrying rose 1.4%, led by a 2.9% increase in potash mining.

Support activities for mining, and oil and gas extraction increased 3.3% in February on account of an increase in drilling and rigging services.

Utilities decline following elevated January

Utilities contracted 2.3% in February, following strong growth in January (+4.1%) when below seasonal temperatures in many parts of the country had pushed up demand for both electricity and natural gas for heating purposes.

Wholesale trade declines

Following six months of growth, wholesale trade declined 1.1% in February, as five of nine subsectors were down.

Personal and household goods wholesaling (-5.6%) contributed the most to the decline, reflecting lower imports of pharmaceuticals in February. Building material and supplies declined for the first time in five months, down 4.3% in February, as all industries comprising the subsector contracted.

Offsetting some of the declines was a 1.7% increase in machinery, equipment and supplies wholesaling, buoyed up by large imports of industrial machinery, equipment and parts.

Retail trade edges down

Following 3.0% growth in January, retail trade edged down 0.2% in February, as 7 of 10 subsectors decreased. Excluding motor vehicle and parts dealers, retail trade rose 0.8%.

Following an elevated level of activity in January, motor vehicle and parts dealers contracted 5.5% in February, with lower activity at new car dealers contributing the most to the decline.

Clothing and clothing accessories stores rose 9.7% in February, offsetting much of the previous two declines and benefiting from easing of indoor capacity restrictions across the country.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the following 15 years. The plan is based on 17 specific sustainable development goals.

The release on gross domestic product by industry is an example of how Statistics Canada supports global sustainable development goal reporting. This release will be used to help measure the following goal:

Note to readers

Monthly data on gross domestic product (GDP) by industry at basic prices are chained volume estimates with 2012 as the reference year. This means that the data for each industry and each aggregate are obtained from a chained volume index multiplied by the industry's value added in 2012. The monthly data are benchmarked to annually chained Fisher volume indexes of GDP obtained from the constant-price supply and use tables (SUTs) up to the latest SUT year (2018).

For the period starting in January 2019, data are derived by chaining a fixed-weight Laspeyres volume index to the prior period. The fixed weights are 2018 industry prices.

This approach makes the monthly GDP by industry data more comparable with expenditure-based GDP data, which are chained quarterly.

All data in this release are seasonally adjusted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

An advance estimate of industrial production for March 2022 is available upon request.

For more information on GDP, see the video "What is Gross Domestic Product (GDP)?"

Revisions

With this release of monthly GDP by industry, revisions have been made back to January 2021.

Each month, newly available administrative and survey data from various industries in the economy are integrated, resulting in statistical revisions. Updated and revised administrative data (including taxation statistics), new information provided by respondents to industry surveys, data confrontation and reconciliation process and standard changes to seasonal adjustment calculations are incorporated with each release.

Real-time table

Real-time table 36-10-0491-01 will be updated on May 9.

Next release

Data on GDP by industry for March will be released on May 31.

Products

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is also available.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: