Railway carloadings, February 2022

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-04-26

26.7 million metric tonnes

February 2022

-2.4%

(12-month change)

Highlights

In February, the volume of cargo carried by Canadian railways reached 26.7 million tonnes of freight, edging down 2.4% from February 2021 levels. Higher rail carloadings of some energy products helped to offset the ongoing, sharp decline in grain shipments.

While this marked the sixth consecutive month of year-over-year decline in tonnage, the overall freight volume was just below the five-year average of 27.0 million tonnes for February.

To further explore current and historical data in an interactive format, please visit the Monthly Railway Carloadings: Interactive Dashboard.

Grains continue to dampen volumes

The decline in total freight carried in February reflected a lower volume of domestic loadings, both non-intermodal (mainly commodities) and intermodal (mainly containers).

Non-intermodal freight loadings in Canada decreased for the sixth month in a row, down 5.6% year over year to 20.5 million tonnes in February, led by ongoing, sharp declines in the loadings of some agricultural and food products―in particular, grain.

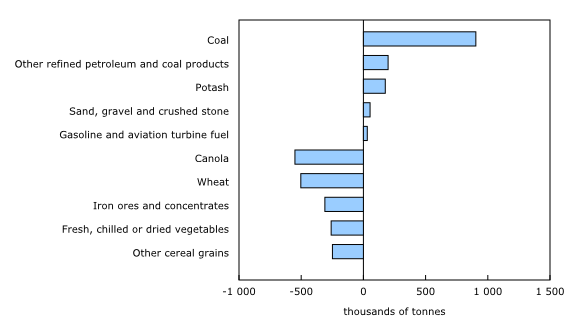

With the depletion of stocks throughout 2020, along with lower grain crop production attributable to the drought across the Prairies in summer 2021, grain shipments by rail have been declining since early 2021. For example, loadings of canola posted a year-over-year decline for the 12th straight month, dropping 57.8% (-550 000 tonnes) from February 2021.

Similarly, loadings of wheat fell for the 10th consecutive month, down 29.7% (-503 000 tonnes) in February from the same month in 2021, after three consecutive months of steep year-over-year declines.

Loadings of fresh, chilled or dried vegetables dropped 68.8% (-259 000 tonnes) from February 2021, coming on the heels of even steeper year-over-year declines in January 2022 (-80.1%) and December 2021 (-72.6%).

February loadings of other cereal grains continued their slide that began in October 2021, falling 52.3% (-249 000 tonnes) year over year, after January's record drop of 71.0%.

Significant decreases were also reported for iron ores and concentrates, with loadings dipping by 7.1% (-310 000 tonnes) year over year in February, representing the third consecutive month of decline.

Energy commodities going up

These above-mentioned tonnage declines were partially offset by increases in carloadings of some energy commodities. Coal led the pack, with loadings rising sharply by 38.9% (+904 000 tonnes) year-over-year in February, the largest gain in tonnage in almost nine years.

It appears that global demand for fuels is on the rise. For example, loadings of other refined petroleum and coal products, on an upward trend since April 2021, rose sharply by 64.4% (+199 000 tonnes) from February 2021, following a steep January increase (+42.5%). And as COVID-19-related travel restrictions ease, loadings of gasoline and aviation turbine fuel were up by 26.7% (+31 000 tonnes), representing their 11th month of year-over-year growth.

The overall increase in railway movements of energy commodities is indicative of higher volumes, which, along with higher prices, pushed exports of energy products to record levels in February as reported in the Canadian international merchandise trade release.

In addition, loadings of potash posted a year-over-year increase after two months of decline, rising 11.9% (+176 000 tonnes) from February 2021.

Other significant increases were also reported for sand, gravel and crushed stone, with loadings up 38.2% (+54 000 tonnes) in February compared with the same period a year ago.

Intermodal traffic continues to drop

Domestic intermodal shipments—mainly containers—continued their decline for a sixth straight month, down 6.2% year over year to 2.6 million tonnes in February. The extent to which this slide is related to ongoing supply chain disruptions caused by container imbalances and port congestion is unclear.

American freight remains up

In February, freight traffic arriving from the United States remained well above the volume posted in the previous year for the 12th month in a row. Tonnage increased by 25.4% year-over-year to 3.6 million tonnes—the highest level ever recorded for the month of February.

Note to readers

The Monthly Railway Carloadings Survey collects data on the number of rail cars, tonnage, units and 20-feet equivalent units from railway transporters operating in Canada that provide for-hire freight services.

Cargo loadings from Armstrong, Ontario, to the Atlantic coast are classified to the eastern division (eastern Canada), while loadings from Thunder Bay, Ontario, to the Pacific coast are classified to the western division (western Canada).

Survey data are revised on a monthly basis to reflect new information.

The data in this release are not seasonally adjusted.

The Transportation Data and Information Hub provides Canadians with online access to comprehensive statistics and measures on the country's transportation sector.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: