Control and sale of alcoholic beverages, April 1, 2020 to March 31, 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-02-15

Alcohol sales increase despite COVID-19 pandemic-related restrictions and closures

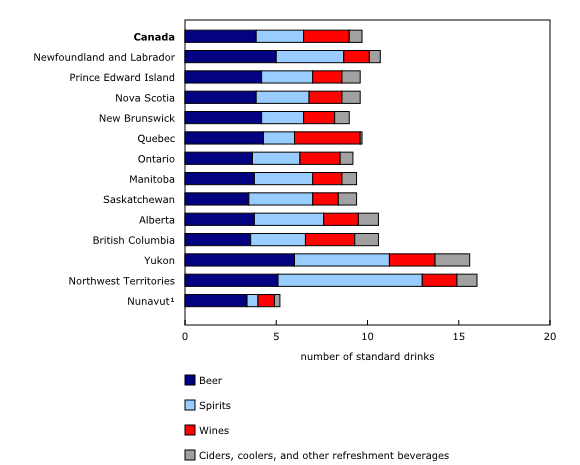

Liquor authorities sold the equivalent of 9.7 standard alcoholic beverages a week per Canadian of legal drinking age in 2020/2021, totalling 3,180 million litres. This was up 2.1% from a year earlier. Beer remained the alcoholic beverage of choice for Canadians, but it continued to lose market share to spirits, ciders and coolers.

Overall, $25.5 billion worth of alcoholic beverages were sold in the fiscal year ending March 31, 2021, up 4.2% from a year earlier. This was the largest sales increase in over a decade. Most of the liquor authorities attributed this growth to the pandemic and its impact on purchasing habits. Liquor authorities reported a smaller number of transactions with bigger basket sizes, more local liquor spending as a result of travel restrictions, and increased purchases for off-premise consumption that outweighed the sales declines in the hospitality sector. The gain in sales of alcoholic beverages was also partially driven by inflation, which rose 2.1% for alcoholic beverages purchased from stores from March 2020 to March 2021.

Net income and other government revenue derived from the control and sale of alcoholic beverages, including excise taxes, retail sales taxes, specific taxes on alcohol, and licence and permit revenues, increased 5.2% to $13.5 billion.

Taste for spirits, ciders and coolers continues to grow

While beer remained the alcoholic beverage of choice for Canadians in 2020/2021, accounting for 36.0% of total alcohol sales, it lost 2.1% of its market share. Wine, which accounted for 31.4% of total sales, also lost market share (-0.6%). The lost market share of beer and wine was gained by spirits (+0.9%) and ciders and coolers (+1.8%). Spirits represented 25.4% of total alcohol sales, while ciders and coolers accounted for 7.2%.

Beer sales per person reach new low

Total beer sales by liquor stores, agencies and other retail outlets fell 1.4% to $9.2 billion in the 2020/2021 fiscal year, the second consecutive annual decrease.

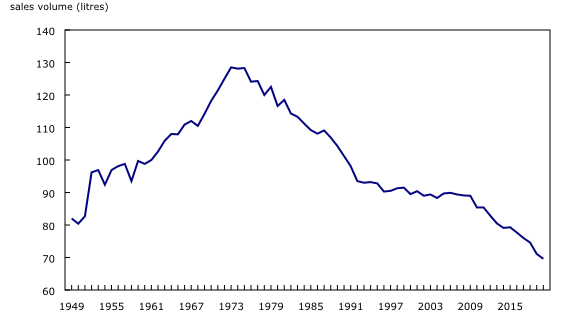

By volume, beer sales declined 2.3% to 2,120 million litres, which is equivalent to 3.9 standard bottles of beer per week, per person of legal drinking age. This was a new all-time low for beer volume sales per person since Statistics Canada began tracking alcohol sales in 1949.

Wine still drink of choice in Quebec and British Columbia

Canadians of legal drinking age bought the equivalent of 2.5 glasses of wine per week in 2020/2021.

Wine sales rose 2.1% to $8.0 billion in 2020/2021, a slower pace than the 5.2% increase in the previous year.

While beer was the alcoholic beverage of choice across much of Canada in 2020/2021, wine claimed the top spot in Quebec (43.5% of total sales) and British Columbia (33.4%). Residents of the Northwest Territories (14.5%) were least likely to buy wine.

Red was the wine of choice for just over half of Canadians who bought wine (53.3%), followed by white wine (33.2%); sparkling wine (6.5%); and rosé, fortified and other wines (7.0%).

By volume, wine sales increased 2.0% to 537 million litres.

Gin and spirits gain popularity

Canadians of legal drinking age bought the equivalent of 2.6 shots of spirits per week in 2020/2021. By volume, spirits sold increased 5.7% to 191.7 million litres.

Over the past decade, gin was the spirit with the highest growth. From 2010/2011 to 2020/2021, the volume of gin sales rose 81.8%. Quebec was the largest contributor to increased gin sales, followed by Ontario.

Spirit sales rose 8.0% from a year earlier to $6.5 billion in the fiscal year ending March 31, 2021. This was the largest increase in spirit sales since 1983.

Spirits were the biggest seller in the Northwest Territories (45.7% of total sales) and accounted for the smallest share of sales in neighbouring Nunavut (9.6%). Overall, sales of Canadian spirits increased 5.7%, while imported spirit sales rose 9.9%.

Nationally, whisky (29.6%), vodka (24.6%) and rum (14.9%) were the most popular spirits sold in 2020/2021, accounting for over two-thirds (69.0%) of total spirit sales.

Sales of ciders, coolers and other refreshment beverages have largest increase of any beverage category since 1949

Canadians bought $1.8 billion worth of ciders and coolers in 2020/2021, up 40.2% from the previous fiscal year. This was the largest increase of any beverage category since Statistics Canada began tracking alcohol sales in 1949. Sales grew in all provinces and territories.

Residents of Yukon (12.3% of total sales) were the most likely to buy ciders and coolers, while those of Quebec (1.6%) were the least likely to do so.

In terms of volume, 330.5 million litres of ciders and coolers were sold in 2020/2021, up 39.5% from the previous fiscal year.

Note to readers

Comparability and limitations of the data

Statistics on sales of alcoholic beverages by volume should not be equated with data on consumption. Sales volumes include only sales as reported by the liquor authorities and their agencies, including sales by wineries, breweries, and other outlets that operate under license from the liquor authorities.

Statistics on sales of alcoholic beverages by dollar value should not be equated with consumer expenditures on alcoholic beverages. The sales data refer to the revenues received by liquor authorities and their agents, and a portion of these revenues include sales to licensed establishments such as bars and restaurants, some of which would be considered as business intermediate expense.

The value of sales of alcoholic beverages excludes all sales taxes, the value of returnable containers, and deposits. Absolute volume of sales of alcoholic beverages is calculated by multiplying the sales volume by the percentage of alcohol content for each product category.

Standard drink

According to Health Canada guidelines, a standard drink is defined as a 341 mL (12 oz.) beer, cooler, or cider with 5% alcohol content, a 142 mL (5 oz.) glass of wine with 12% alcohol content, or a 43 mL (1.5 oz.) spirit drink with 40% alcohol.

Legal drinking age versus per capita

Standard drinks per week per person are calculated for each person of legal drinking age in Canada. The legal drinking age is 19 years and older in every province and territory except Quebec, Manitoba and Alberta where it is 18 years and older.

Per capita sales by value and volume are based on the population of inhabitants aged 15 years and older. This allows comparability with other countries, the Organisation for Economic Co-operation and Development and the World Health Organization as they also present alcohol per capita data using the population of inhabitants aged 15 years and older.

Products

The infographic "Alcohol Sales in Canada, April 2020 to March 2021," which is part of Statistics Canada – Infographics (11-627-M), is now available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: