Study: Lone-parent families, older people and people living alone are more likely to remain in low income, 2018

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-06-11

Each year, some Canadians fall into low income, while others rise out of it. For example, over one-quarter (28.1%) of Canadians who were in low income in 2017 had exited it by 2018.

The study released today examines the low-income exit rate in Canada—an indicator that can be used to track the amount of time it takes for people to rise out of low income.

Studies in Canada and around the world suggest that people living in low income over an extended period are disadvantaged in terms of life and health expectancies, and that this disadvantage may persist over time.

Although a potential surge in low income in 2020 as a result of the COVID-19 pandemic was avoided by temporary government support programs, the rising long-term unemployment rate in 2021 suggests a possible increase in poverty and low-income persistence in the future.

Examining low-income persistence prior to the pandemic can help identify areas and population groups that could benefit from poverty-reduction strategies that aim to help Canadians recover from the financial upheaval caused by the COVID-19 pandemic.

Women and older tax filers stay in low income longer

Data from the Longitudinal Administrative Databank show that over one-quarter (28.1%) of Canadians who were in low income in 2017 had exited it by 2018. If the low-income exit rate were to remain at this level, the median length of time that people stay in low income once they fall into it would be 2.5 years; that is, half of all tax filers who fall into low income would remain in that situation for more than 2.5 years, while the other half would stay in low income for less than 2.5 years.

Male tax filers (29.7%) were more likely than female tax filers (26.8%) to exit low income in 2018 after being in that situation in 2017, and the median length of time that men stayed in low income (2.3 years) was shorter than that of women (2.6 years).

Younger tax filers were more likely than older tax filers to exit low income and to spend less time in a low-income situation.

For example, just over one-third (34.7%) of tax filers aged 18 to 24 who were in low income in 2017 had exited it by 2018, and the median length of time that they remained in low income was 2.0 years.

Just under one-third (31.7%) of tax filers aged 25 to 54 who were in low income in 2017 had exited this situation in 2018, and their median length of time in a low-income situation was 2.2 years.

Conversely, one in five Canadian tax filers aged 55 to 64 (20.9%) or aged 65 and older (20.0%) who were in low income in 2017 had exited it by 2018. Those aged 55 to 64 (3.3 years) and aged 65 and older (3.5 years) also tended to stay longer in a low-income situation, with their median length of time in low income more than one year longer than that of tax filers aged 18 to 24.

Lone-parent families and people living alone are less likely to leave low income than couple families

Over one-third (37.9%) of tax filers in couple-parent families with children living in low income in 2017 had exited it by 2018, compared with less than one-quarter (23.3%) of tax filers in lone-parent families.

With an exit rate of 23.3%, lone-parent families (3.0 years) tended to remain in low income for longer periods—more than one year longer than couple-parent families with children (1.8 years).

Compared with tax filers living in couple-parent families, tax filers in low income in 2017 who lived alone were less likely to have exited low income by 2018 (22.2%). In addition, the median length of time that they stayed in a low-income situation was longer (3.1 years).

Immigrant tax filers who have lived in Canada longer are less likely to fall in low income

Data from the 2019 Canadian Income Survey show that recent immigrants are more likely to be in poverty than immigrants who have lived in Canada longer. Administrative data also indicate that newer immigrants are likelier to be in a low-income situation.

However, immigrants who have lived in Canada longer found it more difficult to exit low income once they had fallen into it. For example, among immigrant tax filers who had lived in Canada for more than 10 years, 24.4% of those who lived in low income in 2017 had moved out of it in 2018. In comparison, 36.1% of immigrant tax filers who had lived in Canada for five years or less and who were in low income in 2017 were able to exit this situation by 2018.

Thus, immigrants who had lived in Canada for a longer period were less likely to fall into low income, but if they did, they were more likely to stay in that low-income situation for a longer period. In contrast, newer immigrants were relatively more mobile; while they were more likely to fall into low income, they also tended to exit their low-income situation more quickly.

Tax filers in Atlantic Canada have much lower exit rates than those in Alberta

One-third (33.8%) of tax filers in Alberta who were in low income in 2017 had exited this situation by 2018, the highest rate among the provinces. Albertans in low income also tended to stay in that situation for a shorter period, their median length of time spent in low income being the shortest among the provinces, at 2.0 years.

Conversely, less than one-quarter of tax filers in Newfoundland and Labrador (22.5%), Nova Scotia (22.9%), and New Brunswick (23.5%) who lived in low income in 2017 had exited that situation by 2018. In addition, tax filers from these provinces tended to stay longer (a median of about 3.0 years) in their low-income situation before moving out of it.

Canadians are rising out of low income at a faster pace than they were five years earlier

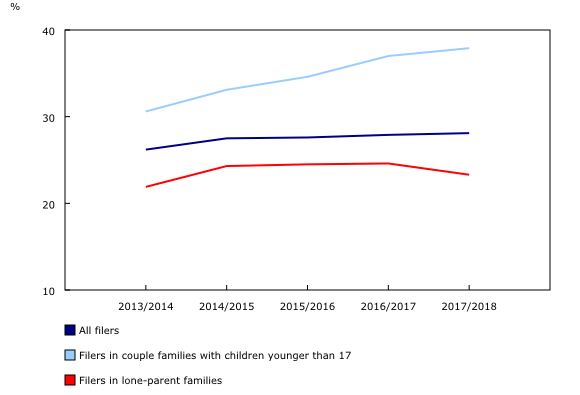

Overall, Canadian tax filers were rising out of low income at a faster pace in 2018 (28.1%) than in 2014 (26.2%), with much of the increase in pace attributable to couple families with children, which exited their low-income situation more quickly in 2018 than in 2014.

For example, well over one-third (37.9%) of couple families with children exited low income in 2018, up from 30.6% in 2014. In terms of median length of time, these families spent five months fewer in low income in 2018 than in 2014.

In contrast, the exit rate for low-income tax filers in lone-parent families edged up from 21.9% to 23.3% over the same period, while the median length of time that they spent in low income fell from 3.2 years to 3.0 years. The exit rate for low-income tax filers living alone rose from 21.3% (3.3 years) to 22.2% (3.1 years).

Tax filers in resource-rich provinces have stayed longer in low-income situations since the oil crash

Although tax filers in Alberta were most likely to rise out of low income in 2018 (33.8%), their exit rate was down from 39.2% in 2014. The same held true for low-income tax filers in Newfoundland and Labrador (22.5% in 2018 versus 24.5% in 2014) and Saskatchewan (27.4% in 2018 versus 29.1% in 2014). Part of this slowdown was attributable to the oil crash in the mid-2010s and to the subsequent weakness in natural resource production in these provinces over this period.

Conversely, low-income tax filers in Ontario (29.6% in 2018 versus in 25.9% 2014) and Quebec (24.9% in 2018 versus 22.4% in 2014) were more likely to move out of low income in 2018 than they were in 2014.

Additional results can be found in a new research paper, "Low-income persistence in Canada and the provinces, 1992 to 2018."

Note to readers

This study uses aggregated estimates from Statistics Canada tables 11-20-0024-1, 11-10-0025-01 and 11-10-0026-01, which were produced annually based on data from the Longitudinal Administrative Databank (LAD). The LAD consists of a 20% longitudinal sample of tax filers in Canada.

In this article, a tax filer is referred to as being in low income if their adjusted census family after-tax income falls below 50% of the national median adjusted census family after-tax income. A tax filer's adjusted census family after-tax income is defined as their census family after-tax income divided by the square root of their census family size.

A census family is defined as a married or common-law couple with or without children or a lone parent with at least one child living in the same dwelling. The census family is the only family unit available in the LAD.

The low-income exit rate refers to the percentage of tax filers who exit low income in a given year when they were in low income in the year immediately before.

In deriving the median length of time in low income, it is assumed that the duration of low income follows an exponential distribution, a popular assumption often made to simplify the analysis. Under this assumption, the median duration is equal to –log(0.5)/p, where log refers to the natural logarithm and p can be approximated by the low-income exit rate. This paper uses the median duration rather than the average duration because the median is less affected by extremely long periods of low income. However, the percentage gap between groups in terms of low-income duration remains the same whether the median or the average is used.

More details on the definitions and sampling restrictions can be found in Statistics Canada tables 11-10-0024-01, 11-10-0025-01 and 11-10-0026-01.

Products

The paper "Low-income persistence in Canada and the provinces" is now available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: