Household economic well-being during the COVID-19 pandemic, experimental estimates, first quarter to third quarter of 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-03-01

Over the first three quarters of 2020, disposable income for the lowest-income households increased 36.8%, more than for any other households. At the same time, the youngest households recorded the largest gain in their net worth (+9.8%). These changes were driven by unprecedented increases in transfers to households, as the value of government COVID-19 support measures exceeded losses in wages and salaries and self-employment income.

As the pandemic unfolded in Canada, households experienced extraordinary changes in their economic well-being. While quarterly releases of gross domestic product and the national balance sheet provide an aggregate view of these impacts, new experimental sub-annual distributions of household economic accounts (DHEA), released today, provide insight into how the pandemic and the associated government support measures have affected the economic well-being of different groups of households in Canada.

Gap between lowest- and highest-income households declines in 2020

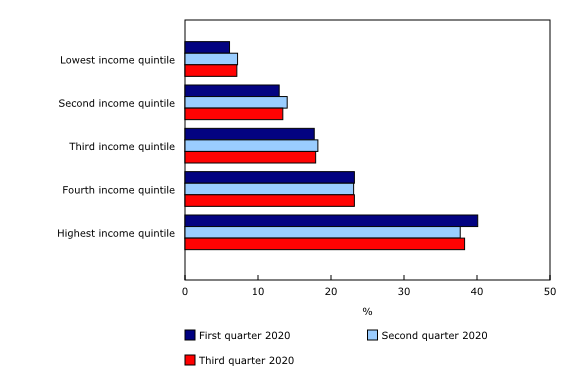

Although the everyday experiences of particular households may have differed, on average, the gap in household disposable income between the lowest- and highest-income earners declined in 2020. Households in the lowest income quintile increased their share of disposable income from 6.1% in the first quarter to a high of 7.2% in the second quarter of 2020, while those in the highest income quintile decreased their share from 40.1% to 37.7% over the same period.

Changes in income distribution were led by strong growth in current transfers received by the lowest-income households as the value of government COVID-19 support measures exceeded losses in wages and salaries and self-employment income.

Stronger rebound in disposable income for lower-income and younger households

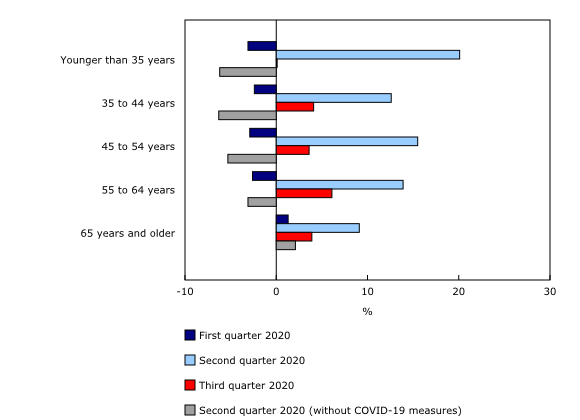

In the early months of 2020, because of volatility in financial markets and as the emergence of COVID-19 cases led to various restrictions in economic activity across the country, disposable income declined for all households in Canada. Led by significant increases in government support measures, household disposable income rebounded in the second quarter, with the largest gains for the lowest-income earners (+33.6%) and youngest households (+20.1%).

Hypothetically, if the federal government had not introduced its support measures to counteract the negative impacts of the pandemic, overall household disposable income would have fallen by 3.6% in the second quarter. The largest declines would have occurred for middle- and lower-income earners, as well as younger households.

As the economy began to recover in the third quarter of 2020, relatively muted gains in disposable income occurred for higher-income earners (+5.5%) and workers aged 55 to 64 (+6.1%), while lower-income earners and younger households held onto gains achieved earlier in the second quarter.

Lowest-income and youngest households experience largest decline in wages and salaries

As the pandemic began to unfold in Canada, compensation of employees, of which wages and salaries are the biggest component, fell the most in the first quarter of 2020 for lower-income earners (-3.7% for the lowest income quintile and -2.3% for the second income quintile) and the youngest households (-1.6%). As more economic restrictions were implemented to combat the spread of the virus, wages and salaries declined for all households in the second quarter, with lower-income households recording the steepest losses. As economic restrictions were loosened in many parts of the country throughout the summer, wages and salaries rebounded in the third quarter, with notable gains for all households. Despite these improvements, wages and salaries did not return to their first-quarter level for many households, except those with a major income earner younger than 35 or aged 55 or older.

Mixed income, earned through self-employment, declined for all households in both the first and the second quarters of 2020, with the largest cumulative declines occurring for the lowest-income households (-31.9%), as well as those with a major income earner aged 55 to 64 (-17.2%). As with wages and salaries, self-employment income rebounded sharply in the third quarter as economic activity recovered. The same households that saw the biggest declines in self-employment income in the first two quarters recorded the largest gains in the third quarter.

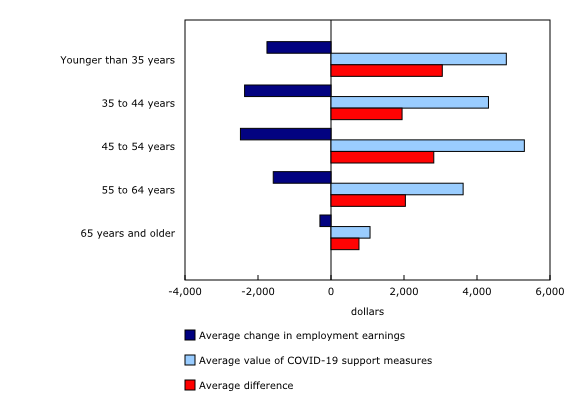

The value of COVID-19 support measures exceeds losses in wages and salaries and self-employment income

The introduction of various COVID-19 support measures led to an unprecedented increase in current transfers (+57.6%) to all households in the second quarter of 2020. Although households did experience notable declines both in wages and salaries and in self-employment income in the second quarter, the value of COVID-19 support measures provided by governments more than compensated for those losses. The difference between the value of COVID-19 support measures and decreased wages and salaries and self-employment income in the second quarter was most pronounced for middle-income households, as on average they gained roughly $2,500 more than they lost. On average, young and middle-aged households gained around $3,000 more through COVID-19 support measures than they lost in wages and salaries and self-employment income in the second quarter.

As lockdowns were eased and people returned to work in the third quarter, the value of government COVID-19 support measures declined for all households. Still, households received on average between $1,000 and $2,600 through COVID-19 support measures in the third quarter of 2020.

COVID-19 support measures have largest impact on lower-income and younger households

Although a larger proportion of the total value of government COVID-19 support measures went to middle- and upper-income earners and middle-aged households, the impact of the benefits was greater for lower-income and younger households. Over the first three quarters of 2020, the value of government COVID-19 support measures represented 16.4% of disposable income for the lowest-income earners and 11.3% for the youngest households, compared with 4.3% for the highest-income earners and 4.2% for the oldest households.

Households increase their net saving in 2020

Households experienced unprecedented gains in net saving in 2020 because of a combination of higher disposable income, driven by the introduction of COVID-19 support measures, and lower consumer spending as a result of lockdowns that limited economic activity. While all households increased their net saving in the second quarter, the improvement did not carry through to the third quarter for the lowest-income households. Middle-income earners saw some of the biggest improvements, as they moved from a net dissaving to a net saving position—the first time that this has been observed for middle-income earners in the DHEA estimates, which date back to 1999.

Lowest-income and youngest households see largest gains in wealth

Similar to the trends in net saving, households increased their wealth in 2020 despite negative economic pressures introduced by the pandemic. Relative to 2019, household net worth grew by 5.2% up to the third quarter of 2020, reaching an average of $786,000 per household.

However, households did not benefit equally from the overall increase in net worth. Wealth for households in the lowest quintile of disposable income grew more than for other households, up 6.3% as of the third quarter of 2020 relative to 2019, compared with 4.8% for those in the highest income quintile. Gains in net worth for the lowest-income households occurred as increases in the value of their real estate holdings outweighed increases in the value of mortgage debt acquisitions, while they reduced their non-mortgage debt balances more than higher-income households.

Meanwhile, fluctuations in wealth for the highest-income earners were driven more by volatility in financial markets, as they held more in investment funds relative to lower-income earners. The highest 20% of income earners accounted for 55% of the $470 billion reduction in the value of financial assets that occurred in the first quarter of 2020 relative to the end of 2019. Similarly, along with a recovery in financial markets, the highest-income earners accounted for more than half of the subsequent $677 billion increase in financial asset values as of the end of the third quarter of 2020.

The trends in net worth also varied by age. Although households with a major income earner younger than 35 held the least wealth of any age group as of the third quarter of 2020, at $220,200, compared with almost $1.3 million for those with a major income earner aged 55 to 64, they increased their average net worth by more than older households. Driven by gains in value in the acquisition of real estate and consumer goods—such as cars, appliances and electronics—that outpaced growth in debt obligations, households with a major income earner younger than 35 grew their net worth by 7.7%, while net worth for those with a major income earner aged 55 or older grew by 4.7%.

Low lending rates facilitate home buying for lower-income and younger households

Although the pandemic greatly reduced job security for many households in 2020, lower-income earners and younger households acquired mortgage debt at a faster pace than other households as they were encouraged by dramatically reduced mortgage lending rates offered by financial institutions. While mortgage lending rates dropped to historic lows, falling to about 2% by the end of the third quarter, average mortgage debt for the lowest-income households increased 5.4% from the end of 2019, while households with a major income earner younger than 35 increased their mortgage debt by 5.8%.

Even though lower-income earners (+7.7%) and younger households (+7.9%) increased their mortgage liabilities by more than other households, they were also less leveraged as real estate values grew at an even faster pace. From the end of 2019 to the third quarter of 2020, the ratio of mortgage debt to real estate assets decreased from 32.9% to 32.2% for the lowest-income earners, and from 51.7% to 50.7% for the youngest age group.

Meanwhile, because of relatively limited real estate acquisitions for higher-income earners and older age groups, their ratio of mortgage debt to real estate assets remained unchanged, at around 20.0% for those in the highest income quintile, about 19.0% for those aged 55 to 64 years, and close to 7.0% for those aged 65 years and older.

Lower-income households limit balances on credit cards and non-mortgage loans

Non-mortgage debt—credit card balances, car loans, etc.—fluctuated more than mortgage debt over time, as it decreased for households in each income quintile with the onset of the pandemic in the first half of the year, and then grew in the third quarter as lockdown measures were eased. Over the entire period, households in the lowest income quintile restricted their non-mortgage debt acquisitions more than other households. From the end of 2019 to the third quarter of 2020, average non-mortgage debt decreased by 1.8% for households in the lowest income quintile, compared with a reduction of 1.0% for those in the highest income quintile.

Younger households limit non-mortgage borrowing despite acquiring more consumer goods

Households with a major income earner younger than 45 tended to reduce their credit card and non-mortgage loan balances in the first half of 2020 and limited their borrowing to purchase consumer goods in the third quarter as restrictions on retail operations eased. Although the value of consumer goods held by those younger than 35 increased by 4.9% in the third quarter, the highest growth of any age group, most of these purchases were financed through savings or debt consolidation rather than through additional borrowing; their non-mortgage debt grew by 2.3% in that same quarter. The total value of consumer goods held by those younger than 35 was up 4.7% as of the third quarter of 2020 compared with 2019, while non-mortgage debt remained unchanged over that period.

Large shifts in debt-to-income ratios for lower-income and younger households

The debt-to-income ratio fluctuated greatly throughout 2020, especially for lower-income earners and younger workers. Along with reductions in income attributable to the onset of the pandemic, households in the lowest income quintile increased their ratio from 289.5% at the end of 2019 to 301.8% by the first quarter of 2020. Their ratio dropped to 227.0% in the second quarter as governments introduced support measures for those who lost their jobs or had a reduction in work hours. As business shutdowns eased in the third quarter, the debt-to-income ratio for the lowest-income earners stabilized as they regained employment or increased their hours of work. In contrast with other households, the debt-to-income ratio for those in the second income quintile grew by 4.7 percentage points, reaching 182.2% in the third quarter, because of a combination of increased mortgage debt and reductions in government benefits that outweighed gains in employment income.

While the debt-to-income ratio for younger and core-age workers benefited from the introduction of a range of government benefits in the second quarter of 2020 to mitigate the economic impacts of the pandemic, ratio reductions for those aged 55 and older were driven by a combination of reduced debt and moderate growth in disposable income.

In contrast with other age groups, households with a major income earner younger than 35 increased their debt-to-income ratio in the latter half of 2020, rising from 186.7% in the second quarter to 191.8% in the third quarter. Similar to lower-income earners, the youngest households increased their debt-to-income ratio in the third quarter as increased mortgage acquisitions outweighed income gains. Despite recent increases in the debt-to-income ratio for lower-income and younger households, their ratios remained far below those that existed prior to the pandemic.

As the economy continues to evolve in response to the challenges introduced by the pandemic, future DHEA releases will shed further light on the state of household economic well-being, including developments in the trends for income, consumption, saving and wealth.

Note to readers

Statistics Canada regularly publishes macroeconomic indicators on household disposable income, final consumption expenditure, net saving and wealth as part of the Canadian System of Macroeconomic Accounts (CSMA). These accounts are aligned with the most recent international standards and are compiled for all sectors of the economy, including households, non-profit institutions, governments and corporations, along with Canada's financial position vis-à-vis the rest of the world. While the CSMA provides high-quality information on the overall position of households relative to other economic sectors, the distributions of household economic accounts (DHEA) provide additional granularity to address questions such as vulnerabilities of specific groups and the resulting implications for economic well-being and financial stability, and are an important complement to standard quarterly outputs related to the economy.

The sub-annual DHEA estimates released today provide experimental estimates of income, consumption, saving and wealth and their sub-components by various household distributions for the first three quarters of 2020. Annual estimates for 2019 have also been revised to include the latest CSMA benchmarks.

As with all data, these experimental sub-annual DHEA estimates are not without their limitations. For the most part, these experimental data rely on the same concepts and methods as the annual DHEA. However, to produce the DHEA on a sub-annual basis, new data sources were used and assumptions were made. DHEA estimates for wages and salaries were derived using Statistics Canada's Social Policy Simulation Database and Model, which incorporates data from the Labour Force Survey for employment by industry and wage level. The distributions of the Canada Emergency Response Benefit were aligned with microdata from Employment and Social Development Canada. Aggregate data on DHEA liabilities were distributed to household groups using sub-aggregate data purchased from a consumer credit rating agency. Because of scarcity in available microdata sources, aggregate estimates of DHEA household final consumption expenditure and household assets were allocated according to the DHEA distributions for reference year 2019.

In an effort to estimate the impact of the COVID-19 pandemic on the economic well-being of households in Canada, these experimental DHEA estimates hold constant the demographic and socioeconomic characteristics of 2019 when estimating changes in income, consumption, saving and wealth throughout the first three quarters of 2020. It is therefore assumed that all households remained in their same distributional category as they did in the 2019 DHEA (e.g., age group, equivalized disposable income quintile, household composition). By holding constant the socioeconomic and demographic characteristics of 2019, it is possible to estimate changes in various household economic indicators without intersecting changes from households moving across distributional groups. This approach allows for a clearer identification of the economic impacts of the COVID-19 pandemic on household distributions, as well as the associated impacts of economic restrictions and government support measures on household economic well-being.

The DHEA estimates released today are benchmarked to the quarterly income and expenditure accounts and the national balance sheet accounts published in December 2020. All values are expressed in quarterly nominal unadjusted rates, unless otherwise specified.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: