Job vacancies, fourth quarter 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-03-23

Highlights

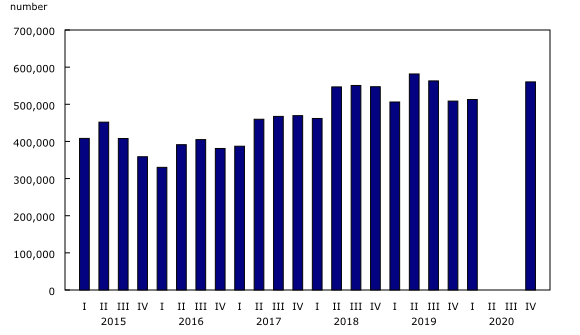

There were 560,200 job vacancies in the fourth quarter of 2020, up 51,600 (+10.2%) from the fourth quarter of 2019.

The job vacancy rate rose 0.5 percentage points year over year to 3.5% in the fourth quarter of 2020.

Health care and social assistance accounted for more than two-thirds of the increase in job vacancies.

Job vacancies fell sharply in accommodation and food services, and arts, entertainment and recreation.

Data from the Job Vacancy and Wage Survey (JVWS) for the fourth quarter of 2020 are now available. This is the first quarterly analysis since December 2019, as data collection activities were suspended from the start of the pandemic in March to September 2020. New monthly estimates were released starting with the October reference month.

JVWS estimates complement information available from other sources—notably the Labour Force Survey (LFS) and the Survey of Employment, Payrolls and Hours (SEPH)—by providing insights into the prevalence of vacant positions across a range of sectors and occupations. The job vacancy rate is a key measure of unmet labour demand and, in conjunction with other indicators such as payroll employment and the unemployment rate, provides valuable insight into the labour market. For example, a high job vacancy rate could represent either an increased pace of recruiting or difficulty on the part of employers in finding or retaining suitable candidates.

Job vacancies and job vacancy rate both up

There were 560,200 job vacancies in the fourth quarter of 2020, up 51,600 (+10.2%) from the fourth quarter of 2019. The job vacancy rate—representing vacant positions as a proportion of all positions (vacant and occupied)—was 3.5% in the fourth quarter of 2020, up 0.5 percentage points from a year earlier. In all previous quarters, the job vacancy rate had ranged from 2.2% to 3.5%.

More than two-thirds of the increase in job vacancies was in health care and social assistance

Most of the increase in the total number of vacancies in the fourth quarter of 2020 was in health care and social assistance, up by 36,400 (+56.9%) on a year-over-year basis. This brought vacancies in the sector to a record high of 100,300. Increases were spread across all subsectors, led by hospitals (+15,700) and nursing and residential care facilities (+10,800). The job vacancy rate in health care and social assistance grew by 1.7 percentage points year over year to 4.7% in the fourth quarter of 2020, one of the highest rates among all sectors.

Prior to COVID-19, payroll employment (based on the SEPH) in health care and social assistance had been on a long-term upward trend, in line with population aging. Following the initial COVID-19 economic shutdown, employment in the sector reached a recent low in May 2020, before trending up and returning to pre-COVID levels in December (monthly data, seasonally adjusted).

Results from the Canadian Survey on Business Conditions showed that 26.8% of businesses in health care and social assistance expect to face labour shortages in the first few months of 2021, higher than the average for all sectors (19.5%).

Job vacancies in retail trade up in the fourth quarter of 2020

Vacancies in retail trade rose by 19,200 (+28.3%) in the fourth quarter of 2020, the second largest increase among the sectors. This brought the number of vacancies to 87,200, representing 15.6% of all vacancies. The increase was driven by general merchandise stores (+12,000) and food and beverage stores (+5,100). At the same time, the number of job vacancies declined in clothing and clothing accessories stores (-2,800). Year over year, the job vacancy rate in retail trade increased by 1.0 percentage point to 4.3%, the highest rate for this sector since comparable data became available.

While some retail stores have faced closures as a result of public health measures, others, notably those deemed essential, have seen an increase in consumer demand. For example, sales at supermarkets and other grocery stores—deemed essential at the start of the pandemic—rose 11.5% in 2020. The degree of payroll employment recovery in retail trade has been uneven across the subsectors following the spring economic shutdown and renewed public health measures during the autumn.

December SEPH results showed that general merchandise stores and food and beverage stores had higher employment levels compared with 12 months earlier, while employment in clothing and clothing accessories stores continued to be the furthest from its pre-pandemic level within retail trade. Overall, retail trade remained the second largest sector in terms of payroll employment in 2020, representing 11.8% of total employment.

Notable job vacancy declines in sectors most affected by COVID-19 public health measures

The accommodation and food services sector has been the sector most affected by public health measures, with restrictions on indoor dining or limited capacity. Unlike in retail trade, employment declines were widespread and both subsectors in accommodation and food services were among the furthest from recovery in December 2020.

Job vacancies in this sector fell by 15,000 (-24.3%) on a year-over-year basis, with declines in both subsectors: food services and drinking places (-11,700) and accommodation services (-3,300). At the same time, payroll employment (according to the SEPH) in the sector fell by 350,100 (-25.7%), and the job vacancy rate was little changed at 4.4%.

Another sector that was strongly affected by public health measures was arts, entertainment and recreation. Compared with the fourth quarter of 2019, job vacancies in this sector declined by 4,700 (-42.6%), led by decreases in amusement, gambling and recreation industries, which includes recreational, sports and fitness centres. The job vacancy rate in this sector was 2.8% in the fourth quarter of 2020, down 0.6 percentage points compared with one year earlier.

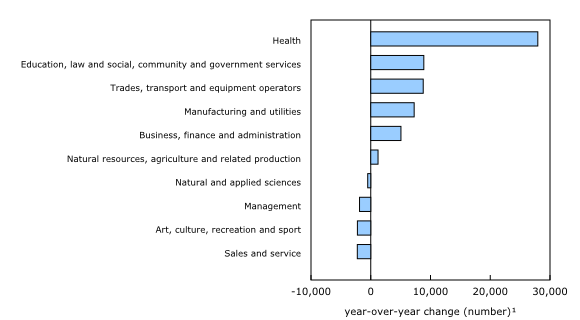

Some occupations more affected by COVID-19 than others

Along with data by industrial sectors, the JVWS also produces estimates by occupations, which provide information on the type of work usually performed.

In the fourth quarter of 2020, job vacancies in health occupations—most of which are in the health care and social assistance sector—rose by 28,000 (+74.6%), accounting for more than half of the overall increase compared with a year earlier. The increase was faster for full-time positions and for temporary jobs. While job vacancies were up in all occupations within this broad category, the largest gains were in professional occupations in nursing (+10,800) and assisting occupations in support of health services (+9,600).

As immigrants account for a large share of employees in some key occupations within the health care and social assistance sector, the slowdown in immigration during the pandemic could have an effect on these occupations within the sector. Data from the LFS for December 2020 showed that 42.8% of nurse aides, orderlies and patient service associates were immigrants (employees, three-month averages).

Overall, job vacancies were little changed in sales and service occupations, a group that includes retail and wholesale sales and customer and personal service occupations. However, many occupations within this group were among those that recorded the sharpest increases and declines due to the impact of public health measures on demand. For example, job vacancies in other sales support and related occupations were up by 11,000 (+94.5%), the result of more vacancies for store shelf stockers, clerks and order fillers. Likewise, vacancies rose by 5,200 for retail salespersons and by 3,100 for cleaners. On the other hand, the largest declines in job vacancies were for occupations in food and beverage service, chefs and cooks and food counter attendants, kitchen helpers and related support.

Job vacancies up in six provinces

From the fourth quarter of 2019 to the fourth quarter of 2020, the number of job vacancies rose in six provinces, with more than three-quarters (79.3%) of the total increase coming from Quebec and Ontario. The number of job vacancies was little changed in Newfoundland and Labrador, Prince Edward Island, Saskatchewan, Alberta, and in the three territories.

More unemployed people per job vacancy

In addition to job vacancies, it is important to also consider other indicators such as the number of jobs and number of unemployed people to paint a fuller picture of the health of the labour market.

During the first wave of the COVID-19 pandemic, the number of unemployed people (as measured by the LFS) grew to record high levels. While unemployment has declined since then, it was 571,000 (+54.0%) higher during the three months ending in December 2020 compared with the same period in 2019. In the fourth quarter of 2020, there were 2.9 unemployed people per job vacancy, up from 2.1 in one year earlier. This was the highest ratio for a fourth quarter since 2016, when it was 3.2. Comparing job vacancies and unemployment can give an indication of how easily workers find jobs and if the skills employers need differ from the ones available in the labour market. A high unemployment-to-job vacancy ratio can indicate a potential skill mismatch.

Average offered hourly wage up

Compared with the fourth quarter of 2019, the average offered hourly wage for all job vacancies rose by $0.75 to $22.50 per hour. Changes in the average offered hourly wage can be caused by a number of factors, including wage growth, shifts in the industries and occupations or types of jobs (e.g., full time or part time) being recruited for.

A decrease in the average offered hourly wage in Alberta (-$0.95 to $23.00) brought this province down from the highest average offered hourly wage among the provinces to the third-highest (after British Columbia at $24.00 per hour and Ontario at $23.10 per hour). There were notable declines in the average offered hourly wage in several sectors in Alberta, including mining, quarrying, and oil and gas extraction, transportation and warehousing, and manufacturing. From the fourth quarter of 2019 to the fourth quarter of 2020, driven by the increase in the number of unemployed, Alberta's unemployment-to-job-vacancy ratio rose from 3.6 to 5.5, making it the second-highest in the country, behind Newfoundland and Labrador (6.0).

Looking ahead

The most recent LFS release showed that employment in retail trade and accommodation and food services had rebounded in February, following January losses tied to public health measures. At the same time, there was continued strength in the sectors least affected by public health measures, including health care and social assistance, and professional, scientific and technical services. Overall, employment in February 2021 was 599,000 (-3.1%) below pre-pandemic levels in February 2020, while the unemployment rate was down 1.2 percentage points to 8.2%, the lowest rate since March 2020 (seasonally adjusted).

JVWS results for the first quarter of 2021—to be released on June 22—will shed additional light on the challenges faced by both employers and workers as the labour market continues to adapt to the effects of COVID-19.

Note to readers

The Job Vacancy and Wage Survey (JVWS) provides comprehensive data on job vacancies and wages by industrial sector and detailed occupations for Canada, the provinces, territories and economic regions. Job vacancy and offered wage data are released quarterly.

Estimates by sector are based on the North American Industry Classification System 2017 Version 3.0. Estimates by geographical area are based on the Standard Geographical Classification 2016. Estimates by occupation reflect the National Occupational Classification (NOC) 2016 Version 1.3. The NOC is a four-tiered hierarchical structure of occupational groups with successive levels of disaggregation. The structure is as follows: 1) 10 broad occupational categories, also referred to as one-digit NOC; 2) 40 major groups, also referred to as two-digit NOC; 3) 140 minor groups, also referred to as three-digit NOC; and 4) 500 unit groups, also referred to as four-digit NOC.

Due to the COVID-19 pandemic, data collection for the JVWS was suspended for the second and third quarters of 2020.

In January 2020, a new electronic questionnaire was introduced. Minor changes to the content are documented in the most recent Guide to the Job Vacancy and Wage Survey (75-514-G).

Beginning with the reference period of October 2020, preliminary monthly estimates from the JVWS are released on a monthly basis alongside the Survey of Employment, Payrolls and Hours releases (SEPH). These estimates provide more timely information on the number of job vacancies and the job vacancy rate by province and by industrial sector.

JVWS data are not seasonally adjusted. Therefore, quarter-to-quarter comparisons should be interpreted with caution as they may reflect seasonal movements.

This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level.

SEPH data used in this Daily are not seasonally adjusted three-month moving averages from November 2020 (unless otherwise specified), to better align the data with the reference period of the JVWS.

Labour Force Survey (LFS) data used in this Daily are not seasonally adjusted three-month moving averages from December, 2020 (unless otherwise specified).

Data quality of the Job Vacancy and Wage Survey

The target population of the survey includes all business locations in Canada, excluding those involved primarily in religious organizations and private households. Federal, provincial and territorial, as well as international and other extra-territorial public administrations are also excluded from the survey.

Next release

Quarterly job vacancy data from the JVWS for the first quarter of 2021 will be released on June 22, 2021.

Products

More information about the concepts and use of data from the Job Vacancy and Wage Survey is available online in the Guide to the Job Vacancy and Wage Survey (75-514-G).

The product "Labour Market Indicators, by province, territory and economic region, unadjusted for seasonality" (71-607-X) is also available. This dynamic web application provides access to Statistics Canada's labour market indicators for Canada, by province, territory and economic region, and allows users to view a snapshot of key labour market indicators, observe geographical rankings for each indicator using an interactive map and table, and easily copy data into other programs.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: