Charitable donors, 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-03-08

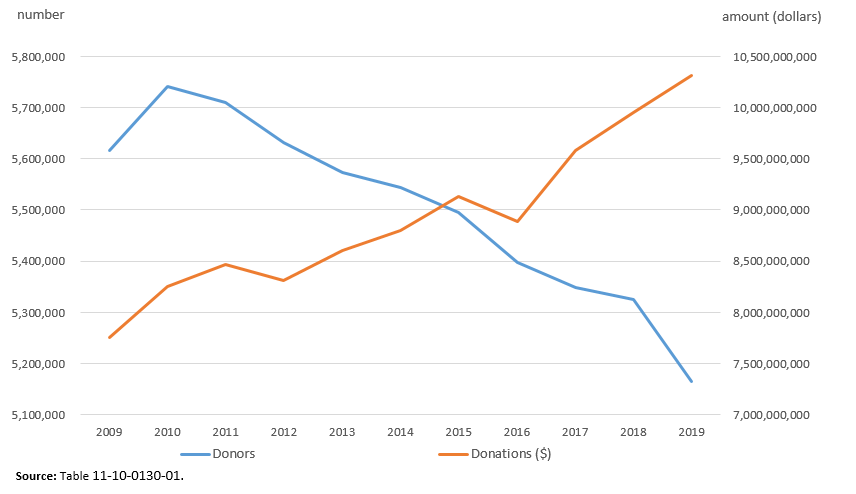

While fewer Canadians reported making charitable donations, according to their 2019 personal tax return, a small group of donors are responsible for increasing the overall amount of donations.

These data on donations are derived from the preliminary version of the T1 Family File (please see "Note to readers" for more information). While data from this release do not yet reflect the potential impact of the COVID-19 pandemic on donations, they do provide useful insight into the economic well-being of Canadians prior to the pandemic and could serve as a baseline for measuring the impact of the COVID-19 pandemic on various aspects of the economy in the future.

Total donations claimed on tax returns rose for the third consecutive year, up 3.6% from a year earlier to $10.3 billion in 2019. This general trend of fewer donors, countered by an increase in overall value of donations, began in 2010.

Big donors responsible for higher total donations

Most donors typically donate a few hundred dollars; however, there was a notable increase in the number of donors making a large donation.

Although there has been a general downward trend in the total number of donors, the majority of the decrease was found among those donating smaller amounts. On the other hand, there was a notable increase in donors reporting donations of $5,000 or more. Despite there being fewer donors, the increase in donation amounts by a smaller group contributed to an overall increase in the value of reported donations.

Median donations relatively unchanged across the country

When considering the donation habits of most tax filers, the median donation amount is a good indicator.

Nationally, the median donation claimed by tax filers was $310 in 2019, meaning that half of the filers who claimed charitable donations gave at least $310, while the other half donated $310 or less. Donors in Nunavut claimed the highest median donation ($630), followed by donors in Alberta ($500). Donors in Quebec reported the lowest median donation ($130). While Nunavut had the highest median donation amount, it also had the lowest proportion of tax filer donors (6.2%) of all provinces and territories.

Among census metropolitan areas, donors in Abbotsford–Mission, British Columbia, led the country with the highest median charitable donation for the 18th year in a row. Their median donation was $900 in 2019, followed by donors in Lethbridge, Alberta ($770). Although donors in Abbotsford–Mission made significantly higher donations, the proportion of tax filers who made donations was one of the lowest across all census metropolitan areas.

Canadians with higher incomes are more likely to report making a donation

For small donation amounts, there is limited incentive to report charitable donations on tax returns (15% non-refundable tax credit if the amount is $200 or less).

Individuals with incomes over $80,000 are more likely to report making donations, compared with Canadians earning a lower income. It is not surprising to see that people with higher incomes are more likely to make and claim donations on their tax returns. Not only is there a greater incentive for higher income earners to reduce their taxes by making a donation, but the tax credit increases with larger donation amounts. Although such tax credits may encourage high income earners to make more donations, the proportion of tax filers reporting donations is still on a downward trend for all income levels.

Share of tax filers reporting donations declining for all age groups

For younger Canadians who may not yet have very high incomes, the idea of using donations as a means to reduce income tax may not be top of mind. The lack of disposable income among younger Canadians may also influence their ability to make monetary donations.

For the 25- to 64-year-old age group, a significant drop in the reporting of donations on tax returns was observed over time. The drop was more gradual for those aged 65 and older; since 2012, they have been the group most likely to report donations.

Not all donations are reported by tax filers

Charitable donations promoted through crowdfunding platforms for individuals or organizations not linked to charities registered under the Income Tax Act are not captured in this data release. Several charitable organizations will not issue a tax receipt for small donations. Other small donations, such as donations by text message where no tax receipts are issued, or donations at checkout counters of retail stores, are also not covered.

Another source of donation data at Statistics Canada is the General Social Survey – Giving, Volunteering and Participating. This survey collects information on all monetary donations reported by individuals, regardless of whether or not the donation resulted in a tax credit. For 2018, this survey reported close to $11.9 billion in total donations by Canadians, while donations by individuals, as reported on their tax forms, totalled just under $9.9 billion (for comparability, territories were removed from the tax-reported amount). The large difference in median amounts reported also points to the fact that many small donations are not captured in the tax data.

The General Social Survey also focuses on volunteering. While the youngest age group (15 to 24 years old) had the lowest participation rate with respect to charitable donations, this same age group had the highest participation rate in volunteer activities.

Tax filers reporting donations and median donation amounts, Canada, provinces and territories

Note to readers

Donation data in this release are based on a preliminary version of the T1 Family File (tax filer data).

Deadline extensions granted by the Canada Revenue Agency for filing taxes and for the payment of taxes without penalty impacted the completeness of the 2019 preliminary income tax data used in this release. The number of tax filers in the preliminary income tax data, generally individuals who filed taxes before September, edged down by 0.8% in 2019, while the number of tax filers in the preliminary tax file has increased, on average, by 1.3% yearly since 2009. The 2019 decrease was likely caused by a number of potential tax filers not yet included in the tax file because of late filings. Therefore, caution should be used with these data when interpreting moderate changes in counts and aggregate amounts between 2018 and 2019.

Canadians contribute in many ways to charitable organizations. This release reports on charitable donations that are reported on tax files. These data include only amounts given to charities and approved organizations for which official tax receipts were provided and claimed on tax returns. To verify if a charity is registered under the Income Tax Act, tax filers can consult the charity listings available on the Canada Revenue Agency webpage. It is possible to carry donations forward for up to five years after the year in which they were made. Therefore, donations reported for the 2019 taxation year could include donations that were made in any of the five previous years. According to tax laws, tax filers are permitted to claim both their donations and those made by their spouses to receive better tax benefits. Consequently, the number of people who made charitable donations may be higher than the number who claimed tax credits.

All dollar amounts in this release are expressed in current dollars and have not been adjusted for inflation.

All data in this release have been tabulated according to the 2016 Standard Geographical Classification used for the 2016 Census.

A census metropolitan area is formed by one or more adjacent municipalities centred on a population centre (also known as the core). It must have a total population of at least 100,000, of which 50,000 or more live in the core.

Products

The document "Technical Reference Guide for the Preliminary Estimates from the T1 Family File (T1FF)" (11260001) presents information about the methodology, concepts and quality for the data available in this release.

Data on charitable donors (13C0014, various prices) and Canadian Tax filers (17C0010, various prices) are now available for Canada, the provinces and territories, economic regions, census divisions, census metropolitan areas, census agglomerations, census tracts, and postal-based geographies. These custom services are available upon request. Tables for this release are available for free on the Statistics Canada website for Canada, the provinces and territories, census metropolitan areas, and census agglomerations.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: