Survey of Non-Bank Mortgage Lenders, third quarter 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-03-03

The housing market continued to grow in the third quarter, with low mortgage interest rates and an increase in the country's gross domestic product. When compared with the same quarter a year earlier, the number of residential mortgage loans extended by non-bank lenders increased by 40.7% in the third quarter of 2020. Conversely, the number of residential mortgage deferrals and residential mortgages in arrears over 90 days both decreased in the third quarter, relative to the second quarter.

Non-banks report continued growth in the number and value of residential mortgages extended in the third quarter

After declining for the prior two consecutive quarters, Canada's gross domestic product experienced a steep rebound in the third quarter. The housing market continued to grow in the third quarter, with a record rise in housing investment and the largest jump in the price of new homes in 14 years.

The total value of residential mortgage loans extended by non-banks grew 17.2% to $56.2 billion in the third quarter. The total number of mortgages extended also rose to 230,513 (+18.9%), which represents an increase of 40.7% from the third quarter of 2019.

The growth in mortgages extended was possibly driven by multiple factors, such as low mortgage rates, improved job market conditions in the third quarter and a resumption in home resale activity.

Mortgages extended during the third quarter of 2020 represented 16.6% of the total value of outstanding residential mortgages and 13.4% of the total number of those loans at the end of the third quarter. The average value of insured mortgages extended held steady at $267,698 in the third quarter, while the average value for uninsured mortgages declined by $4,806 to $229,545.

The majority (63.1%) of mortgages extended were uninsured. The value of insured mortgages extended increased by 12.2% to reach $22.8 billion, while the value of uninsured mortgages extended grew 20.9% to $33.4 billion. The number of uninsured mortgages (+23.5%) also grew at a faster pace than insured mortgages (+11.9%).

Non-banks defer fewer mortgage loans in the third quarter

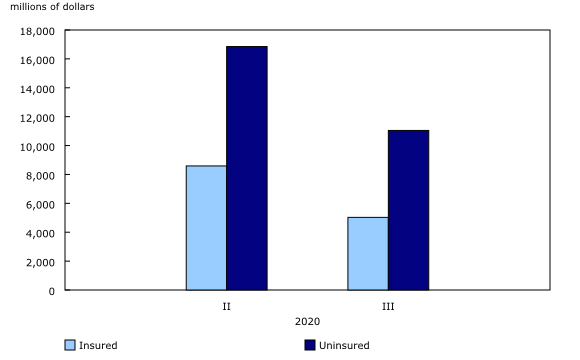

For the second consecutive quarter, many non-bank lenders continued to offer their customers the option to defer their mortgage payments because of the COVID-19 pandemic. Non-bank lenders declared 59,799 mortgages deferred in the third quarter, which represents a reduction of 40.4% from the prior quarter. The total value of deferred mortgages also decreased by 36.8% to $16.1 billion, compared with $25.4 billion in the second quarter. However, the average value of a deferred mortgage was $268,812, up $15,338 from the previous quarter.

Two-thirds (67.8%) of the mortgages deferred were uninsured, and valued at $11.0 billion–down 34.5% from the second quarter. The number of uninsured deferred mortgages decreased by 37.9% to 40,559. One-third of deferred mortgages were insured, and their value decreased by 41.5% to $5.0 billion. The number of insured deferred mortgages decreased by 45.1% to 19,240 in the third quarter.

Value and number of mortgages in arrears for over 90 days decreases

There were 4,069 residential non-bank mortgages in arrears for over 90 days in the third quarter (a decrease of 7.4%), the value of which decreased by 12.9% to $939.6 million. The average value of these mortgages decreased to $230,917 from $245,517 the previous quarter.

The majority (55.5%) of non-bank mortgages in arrears for over 90 days were uninsured and their number decreased by 9.7% from the previous quarter to 2,258 mortgages. Their value also went down, with a decrease of 16.8% to $584.6 million.

Almost half (44.5%) of mortgages in arrears for 90 days or more were insured. Their number went down by 4.3% to 1,811 mortgage loans, whereas the value of these mortgages declined by 5.5% to $355.0 million. These mortgage loans represented 0.28% of the total value and 0.24% of the total number of outstanding non-bank mortgage loans at the end of the third quarter.

With physical distancing and government relief measures still in place at the time of this release, the economic effects of the pandemic on mortgage lending are expected to continue in the next quarter of 2020 and into 2021.

Total value of outstanding residential mortgages increases slightly

The total value of outstanding residential mortgages held by non-bank lenders increased by 2.1% from the second quarter to $338.1 billion in the third quarter. The overall number of outstanding mortgages also increased to 1,724,136 (+1.5%). In comparison, the total value of outstanding residential mortgages held by chartered banks was $1.4 trillion in the third quarter, an increase of 2.4% from the prior quarter.

The average value of outstanding non-bank mortgages was $196,077, which represents a slight increase, compared with the average value of $194,806 reported in the previous quarter.

Uninsured mortgages, which represented 65.7% of the total outstanding non-bank mortgage value, increased in value (+3.0% to $202.1 billion) and number (+2.3% to 1,133,142) in the third quarter. The value of outstanding insured mortgages increased at a slower rate, up 0.9% to $136.0 billion, while the number decreased by 0.1% to 590,994. Chartered banks reported similar quarterly increases—the value of uninsured outstanding mortgages increased by 3.3% to $811.2 billion, whereas the value of insured outstanding mortgages grew 1.1% to reach $482.0 billion.

For more information on housing statistics, visit the Housing Statistics Portal.

Note to readers

The Survey of Non-Bank Mortgage Lenders is a recent initiative to collect information at the national level. This initiative will help complete the overall picture of the residential mortgage market in Canada. Until recently, residential mortgage data from non-bank lenders were collected only by some organizations at the provincial level, for certain industries, and at varying levels of detail.

The survey covers non-bank residential mortgage lenders, such as local credit unions, mortgage finance companies, trusts, insurance companies, mortgage investment corporations and private lenders. The entities included are not only those that issue residential mortgages, but also those that purchase them.

Please refer to Survey of Non-Bank Mortgage Lenders, second quarter 2020, for quarterly comparisons.

Some figures may not add up to 100% as a result of rounding.

Data are not seasonally adjusted.

Please note that no imputation was performed on the data in Table 2. This information should be associated with Table 1 with caution.

Definitions:

Outstanding mortgages are the mortgage balances remaining on the lender's balance sheet as of the end of the quarter.

Mortgages extended are the mortgages approved, issued and added to the balance sheet during the quarter.

Mortgages in arrears are mortgage loans overdue at the end of the quarter.

Mortgages deferred are mortgages for which an agreement is in place between the lender and the borrower to pause or suspend a borrower's mortgage payments and other accommodations for a specified period of time.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: