Survey of Non-Bank Mortgage Lenders, second quarter 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-12-10

Although the pandemic has caused unprecedented economic and social disruptions since mid-March, the housing market in many parts of the country remained strong. This was reflected by the higher number of residential mortgages (+16.4%) that non-bank lenders extended in the second quarter, compared with the same quarter a year earlier. In response to COVID-19, many non-bank lenders provided relief to borrowers through mortgage deferrals, reporting 100,372 mortgages deferred—for a value of $25.4 billion.

Non-banks extend more residential mortgages as pandemic spurs home purchases

As reported by the New Housing Price Index, the housing market remained strong in Canada in the second quarter and new home sales rose in many parts of the country, especially in the suburbs and satellite communities of Canada's largest cities.

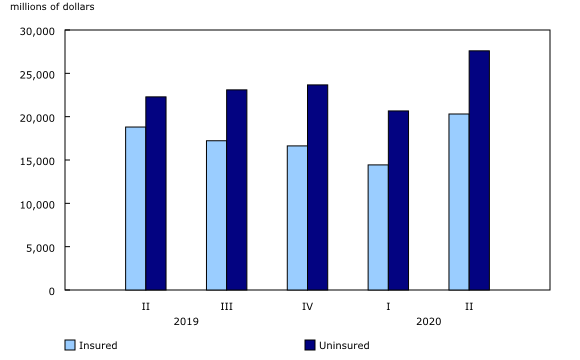

Mortgages extended are the mortgages approved, issued and added to the balance sheet during the quarter. The value of residential mortgage loans extended by non-banks grew by more than one-third (+36.5%) to $47.9 billion in the second quarter. At the same time last year, the value of mortgage loans extended grew by 25.4%. The total number of mortgages extended also rose by more than one-third (+35.7%) to 193,821 in the second quarter of 2020.

The growth in mortgages extended was likely driven by multiple factors, including low interest rates that incentivize mortgage refinancing, home re-mortgaging to generate income and increasing demand for larger homes during the pandemic.

Mortgages extended during the second quarter represented 14.5% of the total value and 11.4% of the total number of outstanding residential mortgages at the end of the second quarter, up from 10.6% and 8.4%, respectively, in the first quarter.

The average value of insured mortgages extended rose by $4,904 from the previous quarter to $266,960 in the second quarter, while the average value for uninsured mortgages declined by $1,220 to $234,351.

The majority of mortgages extended were uninsured (60.8%). The value of insured mortgages extended increased by 40.7% to $20.3 billion, while the value of uninsured mortgages extended grew by 33.6% to $27.6 billion. The number of insured (+38.1%) mortgages also grew at a faster pace than uninsured mortgages (+34.3%).

Non-banks defer twice as many uninsured mortgages as insured mortgages

For the first time, Statistics Canada is publishing data on mortgages deferred by non-bank lenders. Despite these challenging times, many respondents reported their deferred mortgage figures and Statistics Canada thanks them for their collaboration.

In an effort to support borrowers, large Canadian banks provided the option to defer mortgage repayments in the second quarter. Although non-bank lenders were not required to do the same, many followed suit and offered their customers the option to defer their mortgages if they were experiencing financial issues in the wake of the COVID-19 pandemic.

Non-bank lenders reported that they deferred 100,372 mortgages during the second quarter, for a value of $25.4 billion. The average value of a deferred mortgage was $253,475.

Two-thirds of the mortgages deferred were uninsured (65,346 mortgages) and were valued at $16.8 billion. The other one-third were insured (35,026 mortgages) and were valued at $8.6 billion.

Value of mortgages in arrears for over 90 days increases

Unemployment spiked in the early spring in the wake of COVID-19 and remained well above pre-pandemic levels by the end of the second quarter. This may have contributed to the 11.5% increase in the number of mortgages in arrears for over 90 days, despite the loan deferrals and government assistance programs designed to help Canadians navigate these exceptional times.

There were 4,392 non-bank mortgages in arrears for over 90 days in the second quarter and the value of these mortgages grew by almost one-fifth (+19.6%) to just under $1.1 billion. The average value of these mortgages was $245,517—up from $228,954 the previous quarter.

Two-thirds of the non-bank mortgages in arrears for over 90 days were uninsured. The number of these mortgages was up 12.2% from the previous quarter to 2,500 mortgages, while the value of these mortgages rose by over one-fifth (+21.7%) to $702.6 million.

One-third of the mortgages in arrears for 90 days or more were insured. The number of these mortgages was up 10.6% to 1,892 mortgages, while the value of these mortgages rose 15.8% to $375.7 million.

Nevertheless, these mortgages represented 0.33% of the total value and 0.26% of the total number of outstanding non-bank mortgages at the end of the second quarter.

With physical distancing measures and relief measures still in place at the time of this release, the economic effects on mortgage lending are expected to be more pronounced in the second half of 2020 and into 2021.

Total value of outstanding residential mortgages edges up

The total value of outstanding residential mortgages held by non-bank lenders edged up 0.2% from the first quarter to $331.0 billion in the second quarter, while the overall number of outstanding mortgages held steady at 1,699,229.

The average value of outstanding mortgages was $194,806, relatively unchanged from the previous quarter.

Uninsured mortgages, which represented $196.2 billion or 59.3% of total outstanding non-bank mortgage value, edged down in value (-0.3%) and number (-0.4% to 1,107,589) in the second quarter. In contrast, the value (+0.9% to $134.8 billion) and number (+0.8% to 591,640) of outstanding insured mortgages edged up.

For more information on housing statistics, visit the Housing Statistics Portal.

Note to readers

The Survey of Non-Bank Mortgage Lenders is a recent initiative to collect information at the national level. This initiative will help complete the overall picture of the residential mortgage market in Canada. Until recently, residential mortgage data from non-bank lenders were collected only by some organizations at the provincial level, for certain industries, and at varying levels of detail.

The survey covers non-bank residential mortgage lenders, such as local credit unions, mortgage finance companies, trusts, insurance companies, mortgage investment corporations and private lenders. The entities included are not only those that issue residential mortgages, but also those that purchase them.

Please refer to Survey of Non-bank Mortgage Lenders, first quarter 2020, for quarterly comparisons.

Some figures may not add up to 100% as a result of rounding.

Data are not seasonally adjusted.

Definitions:

Outstanding mortgages refer to the mortgage balances remaining on the lender's balance sheet as of the end of the quarter.

Mortgages extended are the mortgages approved, issued and added to the balance sheet during the quarter.

Mortgages in arrears are mortgage loans overdue at the end of the quarter.

Mortgages deferred are mortgages for which an agreement is in place between the lender and the borrower to pause or suspend a borrower's mortgage payments and other accommodations for a specified period of time.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: