Labour Force Survey, July 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-08-07

Context: COVID-19 restrictions continue to ease

The July Labour Force Survey (LFS) results reflect labour market conditions as of the week of July 12 to 18, four months after the beginning of the economic shutdown resulting from the COVID-19 global pandemic. By then, businesses and workplaces across Canada were continuing to re-open, building on the resumption of economic activities that began in May and continued in June. Although public health restrictions had been substantially eased in most parts of the country—with the exception of some regions of Ontario, including Toronto—some measures remained in place, including physical distancing requirements and restrictions on large gatherings.

Adapting new measures to assess the labour market as lifting of COVID-19 restrictions continues

This LFS release continues the recent practice of integrating the international standard concepts such as employment and unemployment with supplementary indicators to help monitor the labour market as restrictions are lifted and capture the full scope of the impacts of COVID-19.

A series of survey enhancements were continued in July, including supplementary questions on working from home, workplace adaptations and financial capacity. New questions were added on concerns related to returning to usual workplaces and receipt of federal COVID-19 support payments.

For the first time, this release also includes information on the labour market conditions of population groups designated as visible minorities. Through the addition of a new survey question and the introduction of new statistical methods, the LFS is now able to more fully determine the impact of the COVID-19 economic shutdown on diverse groups of Canadians.

Data from the LFS are based on a sample of more than 50,000 households. In July, Statistics Canada continued to protect the health and safety of Canadians by adjusting the processes involved in survey operations. We are deeply grateful to the many Canadians who responded to the survey. Their ongoing cooperation ensures that we continue to paint an accurate and current portrait of the Canadian labour market and Canada's economic performance.

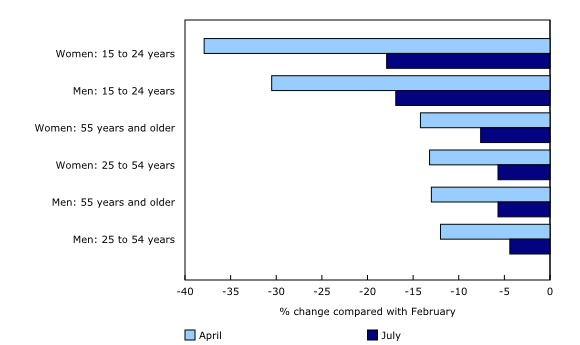

Employment continues to rebound in July

From February to April, 5.5 million Canadian workers were affected by the COVID-19 economic shutdown. This included a drop in employment of 3.0 million and a COVID-related increase in absences from work of 2.5 million.

Employment rose by 419,000 (+2.4%) in July, compared with 953,000 (+5.8%) in June. Combined with gains of 290,000 in May, this brought employment to within 1.3 million (-7.0%) of its pre-COVID February level.

The number of Canadians who were employed but worked less than half their usual hours for reasons likely related to COVID-19 dropped by 412,000 (-18.8%) in July. Combined with declines recorded in May and June, this left COVID-related absences from work at just under 1 million (+972,000; +120.3%) above February levels.

By the week of July 12 to July 18, the total number of affected workers stood at 2.3 million, a reduction since April of 58.0%.

Most employment gains in July were in part-time work

Most of the employment gains in July were in part-time work, which increased by 345,000 (+11.3%), compared with a much smaller increase of 73,000 (+0.5%) in full-time work.

The COVID-19 labour market shock was felt particularly hard in part-time work. From February to April, losses in part-time work (-29.6%) were significantly heavier than in full-time employment (-12.5%). This was due to a number of factors, including part-time work being more prevalent in industries that were most affected by the COVID-19 economic shutdown, namely retail trade and accommodation and food services.

Growth in part-time employment has outpaced full-time growth in each of the past three months. With July gains, part-time work is now closer to its pre-COVID level (-5.0%) than full-time employment (-7.5%).

The relatively flat growth in full-time work in recent months is reflected in an increase in the proportion of part-time workers doing so involuntarily. In July 2019, 22.2% of those working less than 30 hours per week would have preferred full-time work (not seasonally adjusted). One year later, this proportion had increased 7.6 percentage points to 29.7%, an indication that the COVID-19 economic shutdown and subsequent re-opening has resulted in a reduction, at least temporarily, in the number of hours being offered by employers.

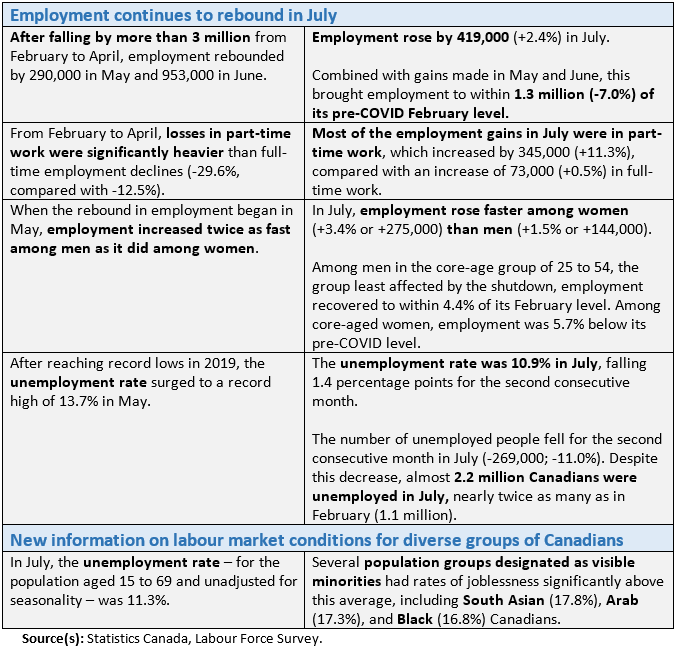

Stronger employment gains for women in July, but men continue to be closer to pre-shutdown levels

In July, employment rose faster among women (+3.4% or +275,000) than men (+1.5% or +144,000). Due to heavier employment losses among women in March, however, employment in July was closer to its pre-shutdown level for men than for women.

As of July, men in the core-age group of 25 to 54, who were least affected by the shutdown, had recovered to within 4.4% of their February employment level. Employment for women in this age group was within 5.7% of pre-COVID levels. Female youth (aged 15 to 24) were the furthest from their February employment level (-17.9%), followed by young men (-16.9%) in the same age group.

Employment was little changed in July among both male and female core-aged workers with children under 18 (not adjusted for seasonality). As in June, employment in July was furthest away from pre-shutdown levels among mothers whose youngest child was aged 6 to 17.

The number of Canadians working from home continues to fall in July

Among those who were employed and not absent from work, the number working from home dropped by 400,000, compared with an increase of 300,000 in the number working at locations other than home. Despite this decline, the number of Canadians who worked from home in July (4.1 million) remained significantly higher than the number who usually do so (1.6 million).

Unemployment rate continues to drop from May's record high

The unemployment rate was 10.9% in July, falling 1.4 percentage points for the second consecutive month and down from a record high of 13.7% in May. The unemployment rate was 5.6% in February.

While the unemployment rate fell among all major age-sex groups in July, it was higher for men (11.3%) than for women (10.4%). The unemployment rate for male youth aged 15 to 24 (26.7%) continued to be higher than that of all other groups, including female youth (21.3%). Among those in the core working age of 25 to 54, the unemployment rate was virtually the same for men (8.8%) and women (8.7%).

The number of unemployed people fell for the second consecutive month in July, down 269,000 (-11.0%). Despite this decrease, almost 2.2 million Canadians were unemployed in July, nearly twice as many (+92.6%) as in February (1.1 million).

In any given month, the net change in unemployment is the result of the difference between the number of people becoming unemployed and those leaving unemployment, either because they became employed or left the labour force. In July, 1.1 million Canadians moved out of unemployment while 841,000 entered unemployment. The majority of those who left unemployment became employed (63.3%).

Temporary layoffs continue to decline rapidly while the number of job searchers continues to rise

The unemployed include three main groups of people: those on temporary layoff who expect to return to a previous job within six months; those who do not expect to return to a previous job and are looking for work; and those who have arrangements to begin a new job within four weeks. In response to the COVID-19 economic shutdown, unemployment surged from February to April, driven by an increase of 1.1 million in the number of people on temporary layoff.

In July, temporary layoffs declined strongly for a second consecutive month, down 384,000 (-45.5%). Among those on temporary layoff in June, approximately half became employed in July, either returning to their old job or starting a new one (not seasonally adjusted). Despite the sharp declines in June and July, the number of people on temporary layoff (460,000) was more than four times higher than it was in February.

In July, the number of people searching for work increased 115,000 (+7.1%), mainly the result of people entering the labour force to look for work. Since the beginning of the COVID-19 economic shutdown in March, the number of job searchers has risen by 689,000 (+66.6%), including increases of 331,000 (+58.8%) among core-aged people aged 25 to 54 and 297,000 (+108.5%) among youth aged 15 to 24. Increases were similar for women and men.

The number of people who wanted a job but did not search continues to fall

From February to April, the number of people who wanted a job but did not meet the definition of unemployed because they did not look for work, likely for reasons related to the COVID-19 economic shutdown, increased by 1.1 million. The number of people in this situation dropped in July (-266,000; -28.0%), falling for the third consecutive month, but still 299,000 (+77.8%) higher compared with the February level.

If those who wanted to work but did not look for a job were included as unemployed in July, the adjusted unemployment rate would be 13.8%, a decline of 2.5 percentage points compared with the adjusted rate in June but still higher than the 7.3% recorded in February.

Gaps persist in labour force participation rate for women

The labour force—the number of people counted as either employed or unemployed—rose 150,000 (+0.8%) in July, the third consecutive monthly increase. Labour force participation increased by 75,000 (+0.7%) among men and 75,000 (+0.8%) among women.

The labour force participation rate—the labour force as a proportion of the population aged 15 and older—rose to 64.3% in July, to within 1.2 percentage points of its pre-COVID February level (65.5%). Among core-aged men, the participation rate (90.7%) was within 0.4 percentage points of its February level (91.1%).

Among core-aged women, on the other hand, a gap of 1.4 percentage points remains between labour participation rates in February (83.4%) and July (82.0%), an indication that women continue to engage in non-employment-related activities—including caring for children and family members—at a higher rate than prior to COVID-19.

Labour underutilization rate continues to decline, falling below 25%

Labour underutilization occurs when people who could potentially work are not working or when people could work more hours than they are currently. The "labour underutilization rate" combines those who were unemployed, those who were not in the labour force but who wanted a job and did not look for one, and those who were employed but worked less than half of their usual hours for reasons likely related to COVID-19. As the economy continued to recover in July, labour underutilization eased.

In July, under one-quarter (22.4%) of the potential labour force was fully or partially underutilized. This was down notably from more than one-third in April (36.1%), but substantially higher than pre-pandemic levels (11.2% in February).

The rate in July declined at a slower pace than in June, with the largest decline among youth (down 5.8 percentage points to 34.7%), followed by people aged 55 and older (down 4.3 percentage points to 23.3%), and core-aged people (down 4.1 percentage points to 19.5%).

While the labour underutilization rate was similar for men and women prior to the COVID-19 pandemic, the rate has been higher for women since February. In July, the gap reduced as the rate fell more for women (-5.4 percentage points to 22.9%) than for men (-3.5 percentage points to 22.0%).

New information on labour market conditions for diverse groups of Canadians

To address gaps in the understanding of the impact of COVID-19 on population groups designated as visible minorities, two enhancements were made to the LFS in July. First, for respondents interviewed in July and in the future, a new question was added asking respondents aged 15 to 69 to report the population groups to which they belong. This provides the opportunity to measure the current and future labour market conditions of diverse groups but does not provide historical information to determine the possible impacts of COVID-19 prior to July.

Second, for all respondents, including those interviewed before July, Statistics Canada developed an experimental method to integrate data from other sources so that population group characteristics could be added to the information collected through direct interviews prior to July. This allows an analysis of the possible impacts of COVID-19 on population groups designated as visible minorities (See Note to readers for more explanation of this methodology).

When used in conjunction with labour market information coming from the 2016 Census of Population, LFS information can be used to paint a fuller picture of the impact of COVID-19 on the labour market conditions of diverse groups of Canadians.

Unemployment rate in July higher for South Asian, Arab and Black Canadians

A key aspect of the COVID-19 economic shutdown and the associated labour market shock has been unprecedented increases in unemployment, including a historically high unemployment rate observed in May (13.7%). After falling for two consecutive months, the unemployment rate in July was 10.9% for the population aged 15 and older.

The national unemployment rate disguises significant variation across population groups. When unadjusted for seasonality, the national unemployment rate for those aged 15 to 69 was 11.3% in July. Several groups had rates of joblessness significantly above this average, including South Asian (17.8%), Arab (17.3%), and Black (16.8%) Canadians. Among South Asian Canadians, women (20.4%) had a significantly higher unemployment rate than men (15.4%). Black women also had a higher unemployment rate than Black men (18.6% vs 15.1%).

For several population groups—including West Asian, Korean and Japanese Canadians—it was not possible to calculate separate unemployment rates with the current LFS sample size.

Among those who were not a member of a population group designated as a visible minority and who did not identify as Aboriginal, the unemployment rate was 9.3% in July (not adjusted for seasonality).

South Asian and Chinese Canadians experience large COVID-related increases in unemployment

Over time, LFS data produced using a new experimental data integration method will be used to examine various aspects of the labour market situation of diverse population groups. Initially, development and refinement of the method has been focused on adding to an understanding of the impact of COVID-19 through a comparison of year-over-year changes in the unemployment rate.

Based on data from this method, South Asian (+9.1 percentage points) and Chinese (+8.4 percentage points) Canadians experienced relatively large increases in their unemployment rates from July 2019 to July 2020.

The year-over-year increase in the unemployment rate was somewhat lower among Black Canadians (+6.3 percentage points) and Filipino Canadians (+6.2 percentage points). Among Filipino Canadians, the labour participation rate—a measure of the proportion of the population aged 15 and older who are either employed or unemployed—declined by 7.5 percentage points year over year. This suggests that a relatively large proportion of Filipino Canadians who lost employment as a result of COVID-19 have at least temporarily left the labour force rather than looking for new work.

The year-over-year unemployment rate increase was the smallest (+4.4 percentage points) among those who were not in a population group designated as a visible minority and who did not identify as an Aboriginal person.

Elevated unemployment rates among population groups may reflect disparities in employment by industry

The higher July unemployment rate of population groups designated as visible minorities may in part be attributable to their greater concentration as workers in some of the industries hardest hit by the COVID-19 economic shutdown. For example, from February to April, employment in the accommodation and food services industry dropped by 50.0%, more than in any other industry. Based on data from the 2016 Census, the proportion of people employed in this industry was highest among Korean (19.1%), Filipino (14.2%) and Southeast Asian (14.0%) Canadians, compared with 5.9% among those who were not a member of a group designated as a visible minority and did not identify as Aboriginal people.

Differences in unemployment rates may also reflect differences within industries in the likelihood of some groups losing employment as a result of COVID-19 and subsequently returning to work. In retail trade, for example, LFS data collected in July show that members of groups designated as visible minorities accounted for a lower proportion of employment in the month (24.6%) than of the pool of people who last worked in retail trade and were unemployed (35.8%).

Many Filipino and Black Canadians work in health care and social assistance industry

While COVID-19 led to significant job losses and an increase in working from home, many Canadians continued to work at their usual workplace, including in industries, such as health care and social assistance, which entail a high degree of physical proximity to others and a corresponding risk of exposure to COVID-19.

Filipino and Black Canadians make a significant contribution to the health care and social assistance industry. Nearly one-quarter (23.6%) of employed Filipino Canadians and one-fifth (20.3%) of employed Black Canadians worked in this industry in July, compared with 13.7% of all workers. For both groups, the importance of health care and social assistance as a source of employment was essentially unchanged from the 2016 Census.

Within the health care and social assistance industry, Filipino employees earned an average of $26.86 per hour in July, while Black employees earned $23.36 per hour. Health care and social assistance employees who were not a member of a group designated as a visible minority and not Aboriginal earned an average of $29.90 per hour.

Upward trend in employment rate continues in July for very recent immigrants

The employment rate among very recent immigrants (five years or less) rose for a third consecutive month in July, up 2.1 percentage points to 60.5%, entirely driven by a decline in the size of this population group (not seasonally adjusted). The month-over-month increase in this group's employment rate was greater than the increases observed among landed immigrants of more than five years (+0.8 percentage points to 54.5%), and those born in Canada (+0.9 percentage points to 59.1%).

No employment gain among the Aboriginal population in July

In July, employment was unchanged among Aboriginal people living off-reserve, compared with an increase of 1.7% (+284,000) among the non-Aboriginal population (not adjusted for seasonality). In July, employment for this group was at 93.1% of its February level, compared with 95.5% for the non-Aboriginal population.

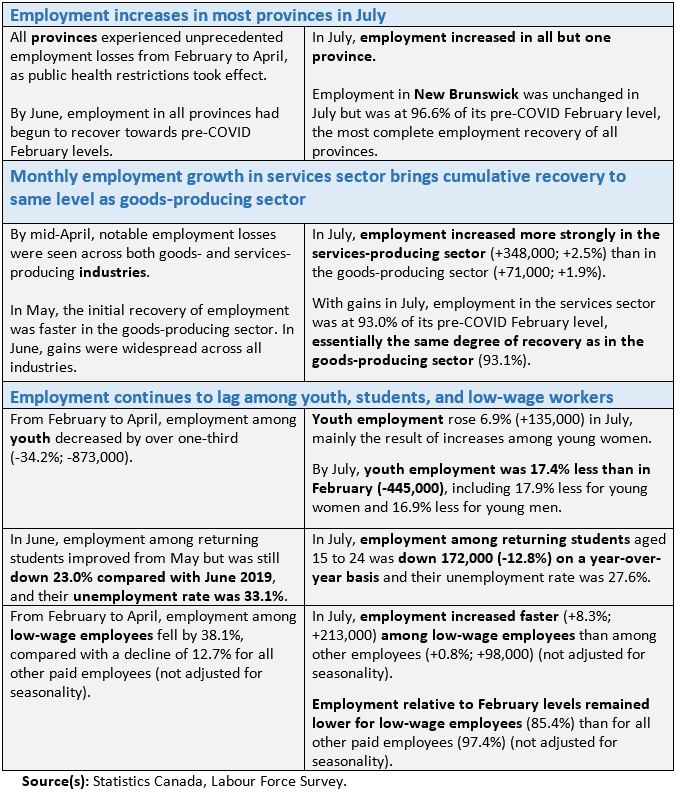

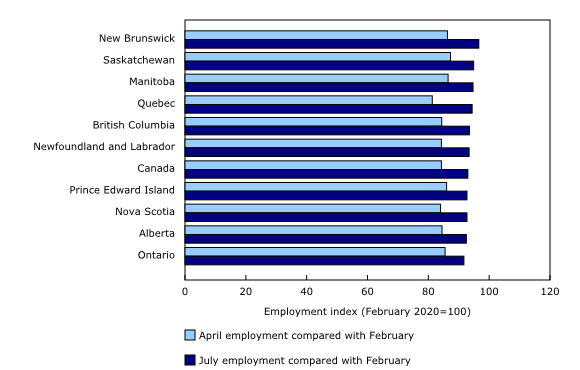

Employment increases in most provinces in July

In Ontario, employment rose by 151,000 (+2.2%) in July, building on an increase of 378,000 in June and bringing employment to 91.7% of its pre-pandemic February level. The initial easing of COVID-19 restrictions occurred later in Ontario than in most other provinces. Additional easing was introduced in most regions of the province on July 17, at the end of the LFS reference week.

Gains in Ontario employment in July were nearly all in part-time work, while the increase in June was in both full-time and part-time. The proportion of people who were employed but worked less than half of their usual hours for reasons likely related to COVID-19 was 10.9% in July, down from 14.1% in June. The unemployment rate in Ontario fell by 0.9 percentage points to 11.3% in July.

Employment in the census metropolitan area (CMA) of Toronto increased by 2.2% in July. This was the same rate of increase as the province, despite the loosening of the COVID-19 restrictions occurring later in the provincial capital than in most other regions. Employment in Toronto reached 89.9% of its February level.

Employment in Quebec increased by 98,000 (+2.4%) in July, adding to gains in the previous two months and bringing employment to 94.4% of its pre-COVID level. The increase in employment in July was all in part-time work. The unemployment rate decreased 1.2 percentage to 9.5%, the third consecutive monthly decrease.

Employment rose more slowly in the Montréal CMA (+28,000; +1.3%) than in the rest of Quebec and reached 94.4% of its February level.

The number of employed British Columbians increased by 70,000 (+3.0%) in July, reaching 93.5% of the February employment level. The proportion of people who were employed but worked less than half of their usual hours was 12.0% in July, down from 14.6% in June. The unemployment rate fell by 1.9 percentage points to 11.1%.

In the Vancouver CMA, employment increased by 48,000 (+3.8%) to reach 89.9% of the February level, a degree of recovery lower than the province as a whole.

In Alberta, employment increased by 67,000 (+3.2%) in July, including gains in both full-time and part-time work. The unemployment rate for the province fell by 2.7 percentage points in July to 12.8%, the first decline since the COVID-19 economic shutdown.

In Saskatchewan, employment rose by 13,000 (+2.5%) while the unemployment rate fell 2.8 percentage points to 8.8%.

Employment in Manitoba increased (+12,000) for the third consecutive month and the unemployment rate declined by 1.9 percentage points to 8.2%.

Employment in Newfoundland and Labrador increased by 4,300 (+2.1%) in July and the unemployment rate dropped 0.9 percentage points to 15.6%.

In Nova Scotia, employment rose by 3,400 (+0.8%) in July, reaching 92.7% of its February level. The unemployment rate in the province declined by 2.2 percentage points to 10.8%.

Employment in Prince Edward Island rose by 1,100 in July (+1.5%), adding to the gains in the previous two months. The unemployment rate declined by 3.5 percentage points to 11.7%.

In New Brunswick, employment was little changed in July after recording employment gains of 39,000 from April to June. Employment in the province—which was among the first to begin easing COVID-19 restrictions—was at 96.6% of its pre-COVID February level, the most complete employment recovery of all provinces to date.

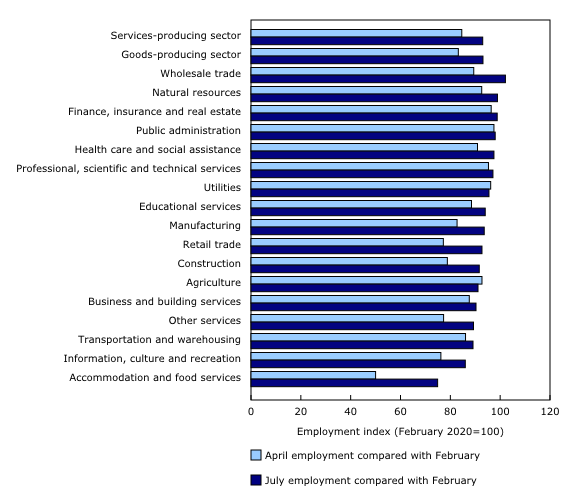

Monthly employment growth in services sector brings cumulative recovery to same level as goods-producing sector

In July, employment increased strongly in the services-producing sector (+348,000; +2.5%), driven by gains in wholesale and retail trade and in accommodation and food services. Growth in the goods-producing sector was more modest (+71,000; +1.9%). With the gains in July, employment in the services sector reached 93.0% of its pre-COVID February level, essentially the same level of recovery as in the goods-producing sector (93.1%).

Despite large gains in July, employment remains well below pre-COVID-19 levels in accommodation and food services

In July, as the continued easing of COVID-19 restrictions allowed Canadians to return to restaurants and outdoor patios, employment rose by 101,000 (+12.3%) in accommodation and food services, the third consecutive monthly increase. Despite these gains, employment in the industry was only 74.9% of its February level.

In July, part-time employment accounted for 42.9% of overall employment in accommodation and food services (not seasonally adjusted). This was a 5.2 percentage point increase from July 2019, an indication that COVID-19 has resulted in at least a temporary shift in the composition of jobs within this industry.

Work tasks in accommodation and food services usually require a high degree of physical proximity, either between co-workers or through interactions with clients. In July, 9 in 10 workers in the industry (88.6%) reported having access to personal protective equipment.

Employment recovery in retail trade now on par with the all-industry average

The number of people employed in retail trade grew by 91,000 (+4.6%) in July, bringing employment to 92.7% of its February level. Employment in retail was among the industries hardest hit by the initial COVID-19 workplace restrictions, with employment in April falling to 77.2% of its February level.

Due to the relatively high proportion of retail trade jobs requiring close physical proximity with others, easing of COVID-19 restrictions was accompanied by important workplace adaptations and other protective measures. In July, 90.9% of workers reported that they or their employer had reorganized the workplace or work practices due to COVID-19.

Employment in health care and social assistance only slightly below its pre-COVID-19 level

As most provinces continued to ease COVID-19 restrictions in July, including restrictions on non-essential health care services, employment in the health care and social assistance industry increased by 41,000 (+1.7%), reaching 97.5% of its pre-COVID-19 level.

Among health care and social assistance workers who were working outside their homes in July, 93.5% reported having access to personal protective equipment.

Continued easing of COVID-19 restrictions leads to employment growth in the 'other services' industry, including personal care services

Employment in the 'other services' industry increased by 40,000 (+5.8%) in July, bringing employment to 89.3% of its February level. This industry includes personal care services establishments, such as hair and beauty salons, which progressively reopened in many provinces from June to July.

First employment increase in professional and technical services following the COVID-19 economic shutdown

In July, the number of people employed in professional and technical services—which include computer system design services, and advertising and related services—rose by 33,000 (+2.2%), reaching 97.1% of the February employment level. COVID-19-related employment losses have been relatively small in this industry. Employment levels have hovered around 95% of the February employment level since March.

A relatively small proportion of jobs in professional and technical services require close physical proximity with others, and workers in the industry have shifted to working from home on a large scale. The proportion working from home in July (69.1%) continued to exceed the share who usually do so (29.1%) and slightly decreased from June (73.3%) (not seasonally adjusted).

Employment continues to rebound in goods-producing industries

After avoiding large job losses in the first month of the COVID-19 economic shutdown, both the construction and manufacturing industries experienced heavy losses in April, followed by an initial recovery in May and a large rebound in June.

The number of people employed in construction increased by 34,000 (+2.5%) in July, reaching 91.6% of its February level. In the manufacturing industry, employment gains totalled 29,000, bringing employment to 93.6% of its February level.

After a decline in June, employment in natural resources rose by 11,000 (+3.7%) in July, bringing employment in the industry to 98.9% of its February level. Employment in agriculture was unchanged from June.

Most workers in goods-producing industries reported that they or their employer had put in place measures to reduce the risk of exposure to COVID-19. While adaptation measures remained relatively less common in agriculture, the proportion of agricultural workers reporting access to personal protective equipment increased to 64.6% in July from 47.8% in June (not seasonally adjusted).

Despite gains in July, employment continues to lag among youth, students, and low-wage workers

Youth employment grows in July but remains far below pre-COVID levels

As the economy continued to reopen in July, employment gains were recorded in industries with higher concentrations of young workers, such as accommodation and food services, and retail trade. As a result, youth (aged 15 to 24) employment rose 6.9% (+135,000) in the month, mainly the result of increases among young women.

From February to April, employment among youth decreased by over one-third (-34.2%; -873,000). By July, youth employment was 17.4% less than in February (-445,000), including 17.9% less for young women and 16.9% less for young men.

Summer students continue to face challenging labour market conditions

Returning students aged 15 to 24—those who were enrolled full-time in March and intend to return in September—continued to face challenging labour market conditions in July. Employment for this group was down 172,000 (-12.8%) on a year-over-year basis, with the decline split between part-time and full-time work (not seasonally adjusted). The situation was somewhat better for returning students than for non-student youth, who recorded a year-over-year decline of 196,000 (-16.0%) (not seasonally adjusted).

In July, approximately three-quarters of the employment decline for returning students aged 15 to 24 was recorded in Ontario (-128,000 on a year-over-year basis, not seasonally adjusted), where restrictions were eased later than in other provinces.

The employment rate for returning students aged 15 to 24—that is, the proportion of this group who were employed—declined in almost all provinces on a year-over-year basis. The exceptions were Newfoundland and Labrador and in Saskatchewan, where the rate was little changed. In Ontario, the employment rate of returning students was 39.9% in July, down 12.1 percentage points compared with July 2019 and the lowest among the provinces. The highest employment rate among returning students was recorded in Quebec (62.3% in July, down from 67.9% in July 2019) (not seasonally adjusted).

Nationally, on a year-over-year basis, the employment rate for youth aged 15 to 24 declined by 8.8 percentage points to 47.1% for returning students, compared with a drop of 10.9 percentage points to 68.1% for non-student youth (not seasonally adjusted).

For youth aged 20 to 24, the declines in the employment rate were similar for returning students and non-students (-12.6 percentage points to 56.8% and -10.9 percentage points to 69.9%, respectively, not seasonally adjusted).

Despite employment gains in July, recovery remains slow among low-wage workers

In July, employment increased faster (+8.3%; +213,000) among employees who earned less than $16.03 per hour (two-thirds of the 2019 annual median wage of $24.04/hour) than among other employees (+0.8%; +98,000) (not adjusted for seasonality).

Nevertheless, employment relative to February levels remained lower for low-wage employees (85.4%) than for all other paid employees (97.4%) (not adjusted for seasonality). Employment among female low-wage workers reached 81.8% of the pre-COVID level in July, compared with 90.7% for men (not adjusted for seasonality).

Canadians continue to receive COVID-19 support benefits

More than half of recent CERB recipients were employed in July, but many had reduced hours

On July 31, the Government of Canada announced that recipients of the Canada Emergency Response Benefit (CERB) will soon transition to either Employment Insurance (EI) or a new benefit for those who are not eligible for EI. The July LFS results provide insights into the employment and job search status of recent CERB recipients.

As of the LFS collection period of July 19 to 28, just under one in five (18.4%) Canadians aged 15 to 69 reported having received either the CERB, the Canada Emergency Student Benefit (CESB), or regular EI benefits in the four weeks before their LFS interview. Among returning students aged 18 to 24, more than one-quarter (27.5%) had received the CESB, while 17.5% had received the CERB.

Of those who reported receiving CERB in the four weeks before their interview, more than half (56.2%) were employed during the LFS reference week, including both those who had stopped receiving benefits as of the LFS reference week and those who continued to receive support.

More than one-third (38.1%) of the employed CERB recipients worked less than half their usual hours in July, compared with 5.4% of employed non-recipients. Employed CERB recipients occupied jobs where usual weekly earnings—not accounting for these lost hours—averaged $590.46, compared with $1132.86 for non-recipients.

Among recent CERB recipients who were not employed in July, about 6 in 10 were unemployed, including 40.6% who were looking for work and a further 15.8% who were on temporary layoff. Those who last worked in the higher-paying group of management occupations were more likely to be looking for work (59.1%) than those who last worked in lower-paid sales and service occupations (32.7%).

About 4 in 10 not-employed recent CERB recipients were not in the labour force in July, meaning that they were not looking for work. Among recent CERB recipients in this situation with at least one child under 18 at home, mothers were more likely to be out of the labour force (52.7%) than fathers (40.8%).

Little change in proportion of people living in households reporting difficulty meeting financial needs

Since April, the LFS has included a supplementary question about difficulty meeting basic household financial needs, such as rent or mortgage payments, utilities, and groceries. In July, the proportion of Canadians living in households reporting such difficulties was little changed at 19.6%. The share has consistently hovered around one in five since April.

Looking ahead

Canadians express concerns about returning to their usual work location

In July, the vast majority (85.8%) of Canadians who had adjusted to COVID-19 by starting to work from home expected that they would continue to do so for the following four weeks. When asked to consider challenges related to eventually returning to their usual work location, more than half (54.5%) were concerned about contracting COVID-19 in the workplace, while nearly half (48.5%) worried about infecting a family member. Just under one-third (31.9%) had concerns about using public transit.

Teleworking parents, particularly mothers, concerned about childcare and return to work

Based on supplementary LFS questions asked in July, more than one-third (35.6%) of parents with children under 18 years old who have adjusted to COVID-19 by starting to work from home were concerned that returning to their usual work location would involve challenges related to childcare or caregiving. This share was highest among mothers with at least one child under the age of six (56.1%).

As COVID-19 public health restrictions continue to evolve in August—and as the re-opening of schools draws nearer—Statistics Canada will continue to measure the recovery of the economy from the unprecedented shutdown of activities that occurred in March and April. In addition to monitoring changes in full-time and part-time employment and absences from work, the LFS will be instrumental in monitoring the pace of recovery by province and industry and in measuring differences in the degree of recovery across diverse groups of Canadians.

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The Labour Force Survey is an example of how Statistics Canada supports the reporting on the global sustainable development goals. This release will be used to help measure the following goals:

Note to readers

The Labour Force Survey (LFS) estimates for July are for the week of July 12 to 18.

The LFS estimates are based on a sample and are therefore subject to sampling variability. As a result, monthly estimates will show more variability than trends observed over longer time periods. For more information, see "Interpreting Monthly Changes in Employment from the Labour Force Survey."

This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level.

The LFS estimates are the first in a series of labour market indicators released by Statistics Canada, which includes indicators from programs such as the Survey of Employment, Payrolls and Hours (SEPH); Employment Insurance Statistics; and the Job Vacancy and Wage Survey. For more information on the conceptual differences between employment measures from the LFS and those from the SEPH, refer to section 8 of the Guide to the Labour Force Survey (71-543-G).

LFS estimates at the Canada level do not include the territories.

Since March 2020, all face-to-face interviews were replaced by telephone interviews to protect the health of both interviewers and respondents. In addition, all telephone interviews were conducted by interviewers working from their home and none were done from Statistics Canada's call centres. In July, approximately 40,000 interviews were completed, about the same number as in June.

The distribution of LFS interviews in July 2020 compared with June 2020, was as follows:

Personal face-to-face interviews

• June 2020 0.0%

• July 2020 0.0%

Telephone interviews – from call centres

• June 2020 0.0%

• July 2020 0.0%

Telephone interviews – from interviewer homes

• June 2020 69.2%

• July 2020 69.4%

Online interviews

• June 2020 30.8%

• July 2020 30.6%

The employment rate is the number of employed people as a percentage of the population aged 15 and older. The rate for a particular group (for example, youths aged 15 to 24) is the number employed in that group as a percentage of the population for that group.

The unemployment rate is the number of unemployed people as a percentage of the labour force (employed and unemployed).

The participation rate is the number of employed and unemployed people as a percentage of the population aged 15 and older.

Full-time employment consists of persons who usually work 30 hours or more per week at their main or only job.

Part-time employment consists of persons who usually work less than 30 hours per week at their main or only job.

Total hours worked refers to the number of hours actually worked at the main job by the respondent during the reference week, including paid and unpaid hours. These hours reflect temporary decreases or increases in work hours (for example, hours lost due to illness, vacation, holidays or weather; or more hours worked due to overtime).

In general, month-to-month or year-to-year changes in the number of people employed in an age group reflect the net effect of two factors: (1) the number of people who changed employment status between reference periods, and (2) the number of employed people who entered or left the age group (including through aging, death or migration) between reference periods.

Supplementary indicators used in July 2020 analysis

To continue capturing the effect of the COVID-19 pandemic on the labour market, the supplementary indicators used in April have been slightly adapted in May, June and July. Therefore, they are not directly comparable to the supplementary indicators published in April and March 2020.

Employed, worked zero hours includes employees and self-employed who were absent from work all week, but excludes people who have been away for reasons such as 'vacation,' 'maternity,' 'seasonal business' and 'labour dispute.'

Employed, worked less than half of their usual hours includes both employees and self-employed, where only employees were asked to provide a reason for the absence. This excludes reasons for absence such as 'vacation,' 'labour dispute,' 'maternity,' 'holiday,' and 'weather.' Also excludes those who were away all week.

Not in labour force but wanted work includes persons who were neither employed, nor unemployed during the reference period and wanted work, but did not search for reasons such as 'waiting for recall (to former job),' 'waiting for replies from employers,' 'believes no work available (in area, or suited to skills),' 'long-term future start,' and 'other.'

Unemployed, job searchers were without work, but had looked for work in the past four weeks ending with the reference period and were available for work.

Unemployed, temporary layoff or future starts were on temporary layoff due to business conditions, with an expectation of recall, and were available for work; or were without work, but had a job to start within four weeks from the reference period and were available for work (don't need to have looked for work during the four weeks ending with the reference week).

Labour underutilization rate (specific definition to measure the COVID-19 impact) combines all those who were unemployed with those who were not in the labour force but wanted a job and did not look for one; as well as those who remained employed but lost all or the majority of their usual work hours for reasons likely related to COVID-19 as a proportion of the potential labour force.

Potential labour force (specific definition to measure the COVID-19 impact) includes people in the labour force (all employed and unemployed people), and people not in the labour force who wanted a job but didn't search for reasons such as 'waiting for recall (to former job),' 'waiting for replies from employers,' 'believes no work available (in area, or suited to skills),' 'long-term future start,' and 'other.'

Time-related underemployment rate combines people who remained employed but lost all or the majority of their usual work hours as a proportion of all employed people.

New information on population groups

Beginning in July, the LFS includes a question asking respondents to report the population groups to which they belong. Possible responses, which are the same as in the 2016 Census, include:

• White

• South Asian e.g., East Indian, Pakistani, Sri Lankan

• Chinese

• Black

• Filipino

• Arab

• Latin American

• Southeast Asian e.g., Vietnamese, Cambodian, Laotian, Thai

• West Asian e.g., Iranian, Afghan

• Korean

• Other

For LFS records interviewed before July, population group characteristics were assigned using an experimental sample matching data integration method. This involved directly integrating LFS and census information for approximately 20% of LFS records. For the remaining 80%, population group characteristics were assigned using information available at the population level from both LFS and census. Further development of this method will continue in the coming months.

According to the Employment Equity Act, visible minorities are "persons, other than Aboriginal peoples, who are non-Caucasian in race or non-white in colour." In the text, data for the population who identify as Aboriginals are analyzed separately. The remaining category is described as "people not designated as visible minorities" or "people who are not a visible minority."

Seasonal adjustment

Unless otherwise stated, this release presents seasonally adjusted estimates, which facilitate comparisons by removing the effects of seasonal variations. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

The seasonally adjusted data for retail trade and wholesale trade industries presented here are not published in other public LFS tables. A seasonally adjusted series is published for the combined industry classification (wholesale and retail trade).

Next release

The next release of the LFS will be on September 4.

Products

More information about the concepts and use of the Labour Force Survey is available online in the Guide to the Labour Force Survey (71-543-G).

The product "Labour Force Survey in brief: Interactive app" (14200001) is also available. This interactive visualization application provides seasonally adjusted estimates available by province, sex, age group and industry. Historical estimates going back five years are also included for monthly employment changes and unemployment rates. The interactive application allows users to quickly and easily explore and personalize the information presented. Combine multiple provinces, sexes and age groups to create your own labour market domains of interest.

The product "Labour Market Indicators, by province and census metropolitan area, seasonally adjusted" (71-607-X) is also available. This interactive dashboard provides easy, customizable access to key labour market indicators. Users can now configure an interactive map and chart showing labour force characteristics at the national, provincial or census metropolitan area level.

The product "Labour Market Indicators, by province, territory and economic region, unadjusted for seasonality" (71-607-X) is also available. This dynamic web application provides access to Statistics Canada's labour market indicators for Canada, by province, territory and economic region and allows users to view a snapshot of key labour market indicators, observe geographical rankings for each indicator using an interactive map and table, and easily copy data into other programs.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

- Date modified: