Distributions of household economic accounts for income, consumption, saving and wealth of Canadian households, 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-06-26

This release of the Distributions of Household Economic Accounts provides new data up to reference year 2019 and introduces new distributions by generation. Generation groups are defined as follows and are based on the birth year of the major income earner: pre-1946 for those born before 1946, baby boom (boomers) for those born between 1946 and 1964, Generation X for those born between 1965 and 1980 and millennials for those born after 1980. Although these estimates pre-date the COVID-19 pandemic, they provide an important benchmark to measure the full effect of the pandemic on the distributions of household wealth (net worth), income, consumption and net saving.

Boomers hold the most wealth, but the gap between this group and younger generations is narrowing

Trends in wealth shares by generation follow life-cycle patterns of wealth accumulation. Households with a major income earner in the baby boom generation held on average almost $1.2 million in net worth in 2019, accounting for about 50% of all wealth in the year prior to the pandemic. Their share of household wealth remained relatively constant from 2010 to 2019, while the share of wealth for the pre-1946 generation, at about 15% in 2019, decreased as they drew down assets in retirement. Meanwhile, the wealth shares of Generation Xers and millennials, who together account for the remaining 36% of wealth, increased as they have accumulated assets throughout their working lives.

Debt-to-asset ratios of millennials and Generation Xers decrease

While millennials nearly doubled their average mortgage debt from 2010 ($56,400) to 2019 ($109,300), the value of their real estate assets grew faster. The average debt-to-asset ratio for millennials decreased from 45.6% in 2010 to 39.7% in 2019. Similarly, the debt-to-asset ratio for Generation Xers decreased from 38.3% in 2010 to 23.2% in 2019 as the growth in real estate, pension plans and investment funds outpaced debt.

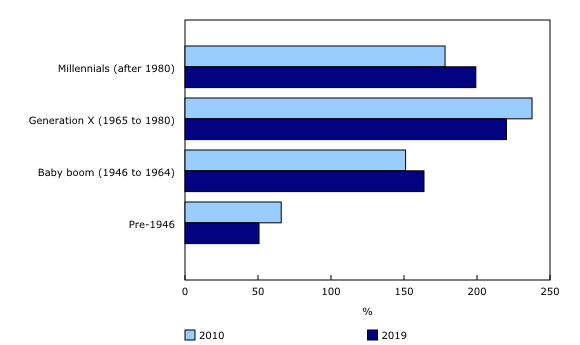

Generation Xers have highest debt-to-income ratio, but ratio for millennials increases

While the debt-to-income ratio was highest in 2019 for Generation X relative to all of the other age groups, at 220%, that ratio has decreased by 18 percentage points since 2010. In contrast, millennials have increased their ratio by 21 percentage points, from 178% in 2010 to 199% in 2019. While growing real estate values for millennials have more than compensated for their increased debt holdings since 2010, disposable income has not kept pace, growing at an average rate of 5% per year compared with 6% for total debt.

Younger generations more susceptible to fluctuations in employment income

Along with higher debt-to-income ratios, Generation Xers and millennials are more susceptible to reductions in disposable income in 2020, as the effects of the COVID-19 pandemic have negatively impacted employment. Younger generations derive most of their disposable income from compensation of employees, mainly through wages and salaries, while older generations receive mainly fixed income payments through pension benefits and old age security. Generation X and millennials accounted for 74% of compensation of employees in 2019, while boomers and the pre-1946 generation accounted for 69% of private pension benefits and transfer payments, mainly from governments.

Generation X spends the most

Consumption patterns also differ across generations, depending on their needs and preferences. On average, households in Generation X spent the most of any group, at $100,100 in 2019, followed by boomers, millennials, and finally the pre-1946 generation, at $54,300. While Generation X households spend more in most categories, boomers spend more on insurance and financial services, the pre-1946 generation spend more on health, and millennials spend more on education.

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The distributions of household economic accounts for income, consumption, saving and wealth of Canadian households are an example of how Statistics Canada supports the reporting on the Global Goals for Sustainable Development. This release will be used in helping to measure the following goal:

Note to readers

Statistics Canada regularly publishes macroeconomic indicators on household disposable income, final consumption expenditure, net saving and wealth as part of the Canadian System of Macroeconomic Accounts (CSMA). These accounts are aligned with the most recent international standards and are compiled for all sectors of the economy, including households, non-profit institutions, governments and corporations along with Canada's financial position vis-à-vis the rest of the world. While the CSMA provide high quality information on the overall position of households relative to other economic sectors, the Distributions of Household Economic Accounts (DHEA) help provide additional granularity to address questions such as vulnerabilities of specific groups and the resulting implications for economic wellbeing and financial stability, and are an important complement to standard quarterly outputs related to the economy.

With this release, an expanded suite of DHEA estimates are available, including distributions by generation group for income, consumption and saving for the period from 1999 to 2019, and for wealth for the period from 2010 to 2019. Distributions by generation are defined as follows and are based on the birth year of the major income earner: pre-1946 for those born before 1946, baby boom for those born between 1946 and 1964, Generation X for those born between 1965 and 1980 and millennials for those born after 1980. Generation Z, those born after 1996, have been combined with the millennial generation as their sample size is relatively small.

Products

The data visualization product "Distributions of Household Economic Accounts, Wealth: Interactive tool," which is part of Statistics Canada – Data Visualization Products (71-607-X) is now available.

The article "Distributions of Household Economic Accounts, estimates of asset, liability and net worth distributions, 2010 to 2019: Technical methodology and quality report," which is part of the Income and Expenditure Accounts Technical Series (13-604-M), is now available.

Details on the sources and methods behind these estimates can be found in Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X). See section "Distributions of Household Economic Accounts" under Satellite Accounts and Special Studies.

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structure.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: