Distributions of household economic accounts for income, consumption, saving and wealth of Canadian households, 2018

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2019-03-27

High income households save, while those with lower incomes do not

Average net saving for all Canadian households was $852 in 2018, while the highest income quintile (the top 20% income earners in Canada) saved $41,393 per household. Conversely, households in the lowest income quintile had net dissaving of $27,935, as on average they consumed more than their annual income and either had to incur debt or draw down previous savings to finance their consumption.

Some individuals in the bottom quintile may have significant wealth, such as retired individuals who have significant assets to draw on when needed. For example, households with a major income earner aged 65 years or older have negative net saving, as the majority are drawing on wealth, such as pension assets, rather than wages and salaries. In 2018, households with a major income earner aged under 35 years saved $4,782 per household, compared with those aged 65 or older who had average net dissaving of $17,129.

Households relying mainly on investment income hold about one-fifth of non-pension related financial assets

Households with investment as a main source of income—who earned an average of $158,000 and held 21% of all financial assets, excluding life insurance and pensions, despite representing 4% of all households—accounted for 8.4% of disposable income in 2018. Households with wages and salaries as a main source of income—who earned an average of $94,000—accounted for 67.4% of disposable income in 2018, while those receiving pension-related benefits—who received an average of $48,000—accounted for 15.6% of disposable income.

Share of wealth for highest income earners rises in Ontario and British Columbia, but declines in the Prairie provinces

Wealth for households in the highest income quintile was 2.4 times higher than the overall average in 2018. The top 20% of income earners had a net worth averaging $1.8 million per household, compared with about $200,000 for the bottom 20%. The top 20% of income earners held 48.7% of household wealth in 2018, and their share has remained relatively stable over time, especially since 2015.

Recent trends in the distribution of wealth (net worth) vary across provinces and regions. In Ontario and British Columbia, individuals in the top national quintile increased their share of household wealth from 2015 to 2018. The share of top income earners in Ontario increased from 41.0% to 42.6% while the share of top income earners in British Columbia increased from 17.6% to 19.2%. These gains occurred along with a larger number of households earning higher incomes, coupled with higher-than average increases in asset values, such as residential properties, that outweighed increases in liabilities, such as mortgages.

In contrast to Ontario and British Columbia, the highest income earners in the Prairie provinces saw their share of wealth decline relative to other regions, from 24.1% in 2015 to 20.8% in 2018. This reflected both a larger number of households earning lower incomes, coupled with a relatively smaller increase in asset values in the Prairie region.

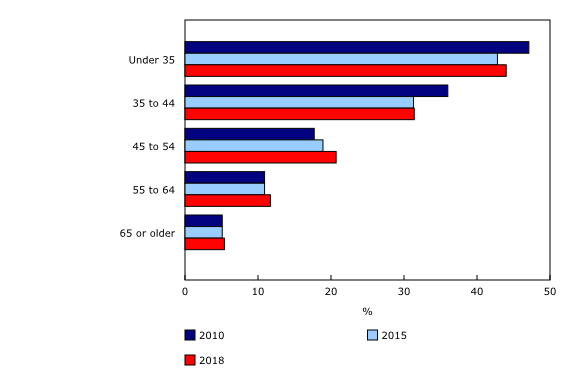

Older households increase debt relative to assets

Households with a major income earner aged 55 to 64 continued to hold the most wealth of all age categories as they accumulated assets for retirement. These households held an average of $1.2 million in 2018, and their share of overall wealth increased from 27.1% in 2010 to 31.2% in 2018. The increase reflected both the growing representation of this age group in the Canadian population, as well as higher than average increases in the value of their real estate and other non-financial assets.

Along with increasing asset values, households are holding on to debt later in life, particularly the 45 to 54 age group. In general, older income earners have a greater capacity to access credit relative to other households, and are consequently in a favourable positon to manage debt. Since 2010, households with a major income earner aged 45 or older increased their debt relative to the value of their assets. Conversely, younger households—those under 45 years of age—decreased their ratios over the period.

While households with older major income earners tended to grow their debt at the same rate as the value of their assets, these trends were not uniform by region. From 2010 to 2018, older households in the Prairie provinces increased their debt-to-asset ratios by more than any other region, from 11.0% to 12.7% for those aged 55 to 64, and from 4.5% to 7.6% for those aged 65 or older. Similarly, households in the Atlantic region with a major income earner aged 65 or older increased their debt-to-asset ratios from 6.0% to 6.8%.

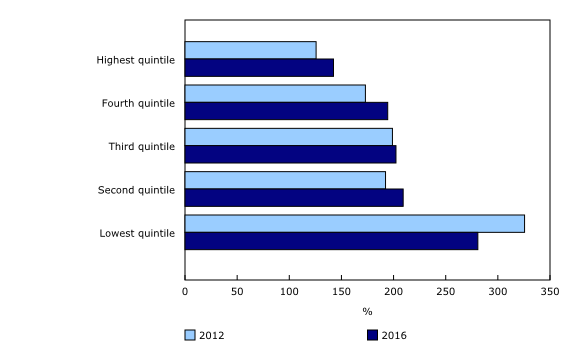

Debt-to-income ratios highest for homeowners with mortgages and low-income earners

Debt-to-income ratios in the Distributions of Household Economic Accounts are available up to the year 2016.

For every dollar of income, households owed $1.82 (182.3%) in outstanding debt in 2016. Debt-to-income ratios decrease as homeowners increase income and pay down mortgages. Homeowners with a mortgage had a debt-to-income ratio of 309.2%. Renters, who generally have lower wealth than homeowners, had a substantially lower ratio at 67.6%.

The debt-to-income ratio for homeowners without a mortgage increased from 2012 to 2016, as the average annual growth in consumer credit and non-mortgage loans (+2.1%) outpaced their growth in income (+0.5%).

Income earners in the lowest quintile, many of whom are under the age of 35, had the highest debt-to-income ratio by quintile in 2016 at 280.8%. Their debt-to-income ratio decreased by 45 percentage points from 2012 to 2016, along with rising home prices and tightening mortgage qualification rules that may have squeezed out first-time homebuyers.

Conversely, while higher income earners have the lowest debt-to-income ratio, they have increased in recent years. Those in the fourth income quintile increased their ratio by 21 percentage points to 194.4% while those in the highest income quintile increased their ratio by 17 percentage points to 142.4%.

The increase in the debt-to-income ratio for the highest income households was largest in the Prairie provinces, as those in the fourth income quintile increased by 27 percentage points to 222.4% and those in the highest income quintile increased their ratio by 32 percentage points to 160.6%. In contrast, households in the highest income quintile in Ontario increased their debt-to-income ratio by 15 percentage points to 127.2%, while the ratio in British Columbia remained stable at 166.7% in 2018.

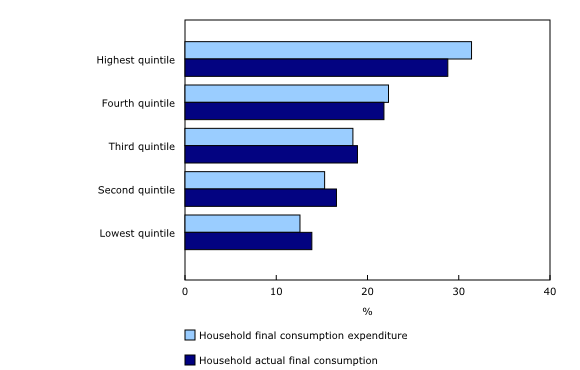

Social transfers in kind impact distribution of actual consumption

Social transfers in kind, such as education and health care services accessed by households but financed by governments and non-profit institutions, have the effect of redistributing consumption across Canadian household groups.

In 2018, the lowest 20% of income earners accounted for 12.6% of household final consumption expenditure. When we consider the impact of social transfers in kind from governments and non-profit institutions, their share of actual consumption increases to 13.9%.

The opposite impact is observed for the top 20% of income earners. Prior to accounting for social transfers in kind, the top 20% represented 31.4% of household final consumption expenditure in 2018. Accounting for social transfers in kind, their share of actual consumption decreases to 28.8%.

Social transfers in kind can also be thought of as an income, available to households in the form of the services they access. The inclusion of social transfers in kind have a similar impact on adjusted income for households in the lowest income quintile. In 2018, the share of income in the lowest income quintile increased from 5.9% to 8.7% due to the inclusion of social transfers in kind, while the share of income for those in the highest income quintile decreased from 40.9% to 36.3%.

On average, households received $20,500 in social transfers in kind in 2018, half of which was for health care and one-third was for education. While households with major income earners aged 65 or older received about the same amount of social transfers in kind as other households, a larger amount ($16,000) was provided in support of their health care needs.

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nation's transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The distributions of household economic accounts for income, consumption, saving and wealth of Canadian households are an example of how Statistics Canada supports the reporting on the Global Goals for Sustainable Development. This release will be used in helping to measure the following goal:

Note to readers

Statistics Canada regularly publishes macroeconomic indicators on household disposable income, final consumption expenditure, net saving and wealth as part of the Canadian System of Macroeconomic Accounts (CSMA). These accounts are aligned with the most recent international standards and are compiled for all sectors of the economy, including households, non-profit institutions, governments and corporations along with Canada's financial position vis-à-vis the rest of the world. While the CSMA provide high quality information on the overall position of households relative to other economic sectors, the Distributions of Household Economic Accounts (DHEA) help provide additional granularity to address questions such as vulnerabilities of specific groups and the resulting implications for economic wellbeing and financial stability, and are an important complement to standard quarterly outputs related to the economy.

With this release, an expanded suite of DHEA estimates are available for income and consumption for the period from 1999 to 2018, and for wealth for the period from 2010 to 2018.

Household actual final consumption supplements traditional estimates of household consumption expenditure in that it includes "social transfers in kind," that is, the value of services and some specific goods consumed by households that are financed by governments and non-profit institutions. The provision of these services to households can also be thought of as income, provided to the user in kind rather than as a money transfer. The parallel broader income concept is "adjusted disposable income." More information on these new measures are available within Household actual final consumption, 2008 to 2018, and within Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X). See section Household Actual Final Consumption under Satellite Accounts and Special Studies.

New distributions for the DHEA include main source of household income and housing tenure. Cross-tabulations are available for equivalized disposable income quintile by age group in the income, consumption and wealth series. As well, the wealth series includes cross-tabulations for province and region by age group, and for province and region by national equivalized disposable income quintile.

Indicators cited in this release include: quintile, or household disposable income quintile, which is equivalized to the number of consumption units per household but not adjusted for social transfers in kind; and net saving, derived from unequivalized household disposable income less household final consumption expenditure plus the value of pension entitlements. Adjusted household disposable income includes disposable income plus social transfers in kind. Measures of household financial risk include the debt-to-asset ratio and the debt-to-income ratio, which is currently only available up to 2016 as DHEA wealth estimates are not yet fully integrated with DHEA income estimates.

Products

The article "Distributions of Household Economic Accounts, estimates of asset, liability and net worth distributions, 2010 to 2018, technical methodology and quality report," which is part of the Income and Expenditure Accounts Technical Series (13-604-M), is available.

Details on the sources and methods behind these estimates can be found in Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X). See section "Distributions of Household Economic Accounts" under Satellite Accounts and Special Studies.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: