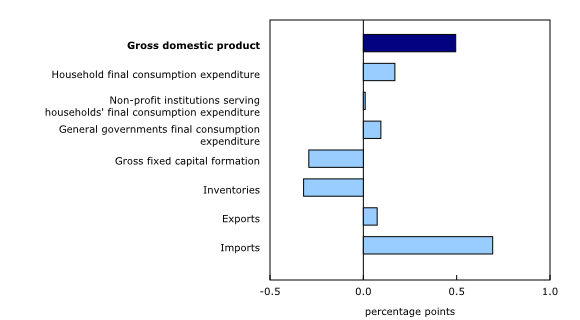

Gross domestic product, income and expenditure, third quarter 2018

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2018-11-30

Canada's real gross domestic product (GDP) grew 0.5% in the third quarter, following a 0.7% increase in the second quarter. Final domestic demand was unchanged, constrained by falling investment, while export volumes edged up 0.2%. Strength in the mining and petroleum refining industries boosted corporate earnings.

Expressed as an annualized rate, real GDP was up 2.0% in the third quarter. In comparison, real GDP in the United States grew 3.5%.

Strength in mining and petroleum refineries

Strength in mining and petroleum refineries boosted growth in the third quarter. These industries benefited from higher prices and foreign demand. Generally, production recoveries drew on domestically produced inputs. Strength was also evident in service industries including real estate. Overall corporate earnings increased in the third quarter, led by a 3.0% nominal increase in the gross operating surplus of non-financial corporations.

Household spending slows

Growth in household spending slowed from 0.6% in the second quarter to 0.3% in the third quarter. Outlays for durable goods declined 0.7%, as motor vehicles purchases (-1.6%) fell for the third straight quarter. A 1.4% rise in outlays for semi-durable goods pushed overall goods spending to 0.2%. Household spending on services slowed to 0.3%, following 0.8% growth in the second quarter.

Housing investment continues to decline

Total residential investment (-1.5%) continued to fall in the third quarter. Investment in new residential construction declined 4.7%, the largest decrease since the second quarter of 2009. Renovation outlays (-2.0%) were also down. However, ownership transfer costs rose 7.1% following two quarters of declines.

Business non-residential investment falls

Non-residential investment in buildings and engineering structures fell 1.3% in the third quarter, following six consecutive quarterly increases. A notable drop in investment in engineering structures (-2.3%) was partly offset by increased investment in non-residential buildings (+1.3%). The decline in engineering structures was driven by the deceleration of investment in the oil and gas sector.

Machinery and equipment investment by businesses decreased 2.5%, the sharpest drop since the third quarter of 2016. The declines in investment in aircraft and other transportation equipment (-51.0%), industrial machinery and equipment (-2.1%), and furniture, fixtures, and prefabricated structures (-2.3%) contributed to the drop.

Slower inventory accumulation

Business inventory accumulation slowed from $13.2 billion in the second quarter to $6.9 billion in the third quarter. Retailers reduced inventories, with motor vehicle inventories falling by $4.1 billion in the third quarter.

Manufacturers' inventory increased for both durable and non-durable goods, while wholesalers continued to build up stocks, but at a slower pace. The economy-wide stock-to-sale ratio increased to 0.82.

Imports fall while export volumes edge up

Import volumes declined 2.0% in the third quarter, with imports of refined petroleum products falling 27.2%. The drop in petroleum imports coincided with increased domestic production following the completion of maintenance work at certain Canadian refineries that had reduced output in the second quarter.

Imports of aircraft and other transportation equipment and parts (-22.0%) also fell. Volumes of service imports declined 2.5%, mainly on lower demand for commercial (-3.1%) and travel (-2.7%) services.

Growth in export volumes slowed to 0.2% in the third quarter, following a 3.1% increase in the second quarter. Total goods exports rose 0.4%, led by shipments of metal ores and non-metallic minerals (+27.6%). This largely reflected the resumption of operations at mines affected by work stoppages in the second quarter.

Exports of services declined 0.8%.

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

Gross domestic product, income and expenditure is an example of how Statistics Canada supports the reporting on the Global Goals for Sustainable Development. This release will be used in helping to measure the following goals:

Note to readers

This release reflects a number of revisions. The 2015 benchmark supply and use tables have been incorporated in the income and expenditure accounts. The release also incorporates updates from the latest surveys and administrative data. A new base year has been adopted (from 2007 to 2012), and the trade classification was updated.

As a result, growth in Canada's real gross domestic product (GDP) was revised downward from 1.0% to 0.7% in 2015 and from 1.4% to 1.1% in 2016. More up-to-date information reinforced the published estimates of weaker growth in 2015. Consequently, starting from the first quarter of 2015, estimates embody a number of revisions, and may differ from those published in the second quarter of 2018.

Percentage changes for expenditure-based statistics (such as household final consumption expenditure, gross fixed capital formation, exports, and imports) are calculated from volume measures that are adjusted for price variations. Percentage changes for income-based statistics including gross operating surplus are calculated from nominal values; that is, they are not adjusted for price variations.

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

There are two ways of expressing growth rates for GDP and other time series found in this release:

- Unless otherwise stated, the growth rates in this release represent the percentage change in the series from one quarter to the next, such as from the second to the third quarter of 2018.

- Quarterly growth can be expressed at an annual rate by using a compound growth formula, similar to the way in which a monthly interest rate can be expressed at an annual rate. Expressing growth at an annual rate allows comparisons with official GDP statistics from the United States. Both the quarterly growth rate and the annualized quarterly growth rate should be interpreted as an indication of the latest trend in GDP.

Revisions

Data on GDP for the third quarter have been released along with revised data from the first quarter of 2015. These data incorporate new and revised data, as well as updated data on seasonal trends.

Real-time tables

Real-time tables 36-10-0430-01 and 36-10-0431-01 will be updated on December 10.

Next release

Data on GDP by income and expenditure for the fourth quarter of 2018 will be released on March 1, 2019.

Products

The document, "The 2015 to 2017 revisions of the Income and Expenditure Accounts," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is now available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: