Control and sale of alcoholic beverages, year ending March 31, 2016

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2017-05-02

Canadians still prefer beer, but not like they used to.

Beer remained the alcoholic drink of choice for Canadians, with $9.2 billion in sales in 2015-2016 (41.5% of total alcoholic beverage sales). However the market share of other alcoholic beverages, notably wine, continued to grow.

In all, liquor stores, agencies and other retail outlets sold $22.1 billion worth of alcoholic beverages during the fiscal year ending March 31, 2016, up 3.5% from the previous year.

The total volume of alcohol sold increased by 2.2% to 3,102 million litres in 2015-2016, or 246.4 million litres of absolute alcohol.

The net income realized by provincial and territorial liquor authorities increased by 7.2% to $6.1 billion in 2015-2016. All liquor authorities reported a positive net income and 9 of 13 jurisdictions reported higher net income than the previous fiscal year.

Net income and other government revenue derived from the control and sale of alcoholic beverages, including excise taxes, retail sales taxes, specific taxes on alcohol, and licence and permit revenues, was $11.5 billion in 2015-2016.

Beer sales increase

Liquor stores, agencies and other retail outlets had beer sales totalling $9.2 billion during the fiscal year ending March 31, 2016, up 2.3% from the previous year.

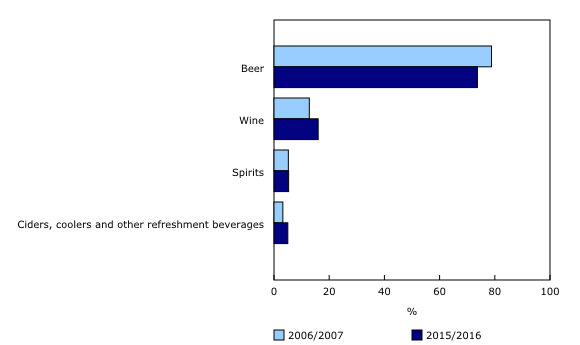

Beer sales as a proportion of all alcoholic beverages sold have declined in recent years. In 2006-2007, beer had a market share of 46.7% in terms of dollar value and wine had a market share of 27.0%. The market share for beer fell to 41.5% by 2015-2016, while wine increased to 31.6%.

Sales of Canadian beer increased by 1.9% in 2015-2016, while sales of imported beer rose by 4.6%. Beer sales had the largest market share of total alcoholic beverage sales in Nunavut (59.4%) and the lowest in British Columbia (35.3%). Nunavut reported the largest increase in beer sales (+6.6%) followed by Prince Edward Island (+4.9%).

The average annual growth rate of total beer sales over the past 10 years was 1.7%. Sales of Canadian beer grew at an annual average rate of 1.1% over the past decade, while sales of imported beer increased on average by 5.1% annually over that period.

In terms of volume sold, liquor stores, agencies and other retail outlets sold 2,286 million litres of beer in 2015-2016. This volume is equivalent to 112.0 million litres of pure alcohol, or 229.5 bottles of beer sold per person over the legal drinking age in Canada (1 bottle = 341 ml, 5% alcohol content). The volume of Canadian beer sold increased to 1,927 million litres, up 1.0% from the previous year, while imported beer sold increased 3.1% to 359 million litres. The average annual growth rate of beer sales (in volume) over the last decade has been 0.1%.

Wine sales growth continues

Liquor stores, agencies and other retail outlets sold $7.0 billion worth of wine during the year ending March 31, 2016, up 4.1% from the previous year. All provinces and territories reported gains, with Newfoundland and Labrador posting the highest growth (+7.2%) followed by Prince Edward Island (+7.0%). Sales of Canadian wine (+4.3%) grew slightly more than did sales of imported wine (+4.1%).

Wine sales had the largest market share in Quebec (43.1% of total sales of alcoholic beverages), while the lowest was in Nunavut (11.9%). Red wines accounted for 54.5% of total wine sales in Canada in 2015-2016, followed by white wines (32.0%) and sparkling wines (5.2%).

Imported red wine sales accounted for 75.5% of all red wines sold in 2015-2016, virtually the same as its proportion in 2006-2007 (76.4%). The share of imported white wines increased, rising from 58.6% in 2006-2007 to 60.8% in 2015-2016.

In terms of volume, wine sales increased 3.3% from 2014-2015 to 496 million litres in 2015-2016. This volume is equivalent to 62.7 million litres of pure alcohol, or 24.4 bottles of wine sold per person over the legal drinking age in Canada (1 bottle = 750 ml, 12% alcohol content). The growth in volume of Canadian wine (+3.4%) slightly outpaced that of imported wine (+3.3%).

Spirit sales up

Liquor stores, agencies and other retail outlets sold $5.1 billion worth of spirits during the year ending March 31, 2016, up 3.6% from the previous year. Spirit sales had the largest market share of total sales in the Northwest Territories (39.6%) and the lowest in Quebec (13.1%). Canadian spirit sales increased 2.1%, while imported spirit sales increased 5.2%.

At the national level, whisky (31.1%), vodka (25.4%) and rum (17.5%) were the most popular spirits sold in Canada in 2015-2016, accounting for nearly three-quarters of all spirit sales. At the provincial/territorial level, whisky had the largest market share in Ontario (38.0% of spirit sales for the province) and the lowest market share in the Northwest Territories (14.9%). Vodka had the largest proportion of spirit sales in Nunavut (57.4%) and the lowest in Newfoundland and Labrador (15.2%). Rum was the top choice for spirits in Newfoundland and Labrador (45.9% of spirit sales), with the lowest proportion sold in Yukon (13.1%).

The average annual growth rate of spirit sales over the last 10 years was 2.9%. Sales of Canadian spirits grew at an annual average rate of 1.1% over the past decade, compared with an annual average growth rate of 5.2% for imported spirits.

In terms of volume, the amount of spirits sold increased 2.9% in 2015-2016 to 164.6 million litres. This volume is equivalent to 62.5 million litres of pure alcohol, or 7.3 bottles of spirits sold per person over the legal drinking age in Canada (1 bottle = 750 ml, 40% alcohol content). Sales of Canadian spirits totalled 93.4 million litres, up 2.3% in 2015-2016, while the volume of imported spirits sales increased by 3.6% to 71.2 million litres. The share of spirit imports has been on the rise for several years, increasing from 36.0% of spirits sold in 2006-2007 to 43.3% in 2015-2016.

Ciders, coolers, and other refreshment beverages: Small market share but with sustained and dynamic growth

Liquor stores, agencies, and other retail outlets sold $0.8 billion worth of ciders, coolers, and other refreshment beverages (CCORB) in 2015-2016, up 10.7% from the previous year. CCORB sales had the largest market share in Saskatchewan at 6.4% of total sales of alcoholic beverages, and the lowest share in Quebec (1.1%).

In terms of volume, liquor stores, agencies and other retail outlets sold 155 million litres of CCORB in 2015-2016, an increase of 12.2% from the previous year. The 155 million litres of CCORB sold, or 9.2 million litres of pure alcohol, is equivalent to 18.9 bottles of ciders, coolers, and other refreshment beverages sold per person over the legal drinking age in Canada (1 bottle = 341 ml, 5% alcohol content).The average annual growth rate of CCORB sales over the last 10 years was 5.9%. Sales of Canadian CCORB grew at an annual average rate of 2.9%, while imported CCORB sales increased at an annual average rate of 17.3%.

In celebration of the country's 150th birthday, Statistics Canada is presenting snapshots from our rich statistical history.

Canadians' taste for alcoholic beverages has evolved significantly over the past 65 years. In fiscal year 1949-1950, beer sales accounted for more than half of all alcohol sales in Canada (51.8%). Wine sales, in turn, have been rising continuously in market share over this 65-year period, from about 5.0% of total alcohol sales in fiscal year 1949-1950 to nearly one-third of total Canadian alcohol sales in fiscal year 2014-2015 (32.5%).

Note to readers

Comparability and limitations of the data

Statistics on sales of alcoholic beverages by volume should not be equated with data on consumption. Sales volumes include only sales as reported by the liquor authorities and their agencies, including sales by wineries, breweries, and other outlets that operate under license from the liquor authorities. Consumption of alcoholic beverages would include all of these sales, as well as any unreported volumes of alcohol sold through ferment-on-premise operations or other outlets, and any unrecorded or illegal transactions.

Statistics on sales of alcoholic beverages by dollar value should not be equated with consumer expenditures on alcoholic beverages. The sales data refer to the revenues received by liquor authorities and their agents, and a portion of these revenues include sales to licensed establishments such as bars and restaurants. The value of sales of alcoholic beverages excludes all sales taxes, the value of returnable containers, and deposits. Absolute volume of sales of alcoholic beverages is calculated by multiplying the sales volume by the percentage of alcohol content for each product category.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: