StatCan COVID-19: Data to Insights for a Better Canada Staying partially open: Trends in businesses’ needs for personal protective equipment since October

StatCan COVID-19: Data to Insights for a Better Canada Staying partially open: Trends in businesses’ needs for personal protective equipment since October

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Since the beginning of the COVID-19 pandemic there has been an unprecedented demand for personal protective equipment (PPE), resulting in global uncertainty about supplies and inventories. The onset of the second wave in the fall, led to further tightening of public health measures across the country to curb the spread of COVID-19. The Personal Protective Equipment Survey (PPES) provides a portrait of demand and supply of PPE in Canada allowing decision makers to respond to the evolving needs of Canadian businesses. This article examines the evolution of private sector businesses’ demand and supply of PPE using data from the December 2020 Personal Protective Equipment Survey (PPES).

Demand for PPE among businesses that needed, or expected to need, PPE remained unchanged in December. More businesses were less concerned about PPE shortages in December than in October and August. Of the businesses expecting shortages of required PPE, insufficient products or equipment available from suppliers remained the largest cause of concern.

Businesses’ need for personal protective equipment holds-steady in December

More than two-thirds (66.9%) of businesses reported in December that they needed, or expected to need, PPE to operate in accordance with COVID-19 related public health guidance. This was essentially unchanged from October when 66.3% of the businesses reported needing PPE.

Businesses in the services-producing sectors were more likely to need PPE

Demand for PPE continued to be the highest among businesses in private health care and social assistance (86.2%), accommodation and food services (82.0%), retail trade (81.5%), and manufacturing (77.2%).

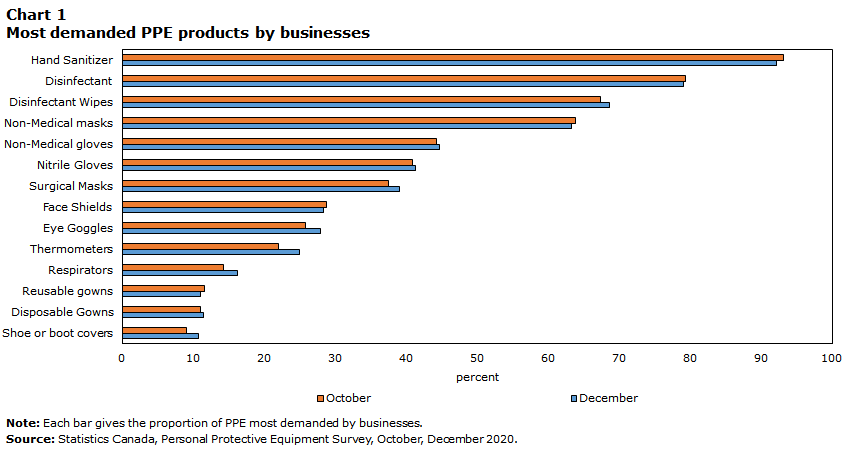

Similar to October, close to 8 out of 10 businesses (77.8%) that reported needing PPE in December, required at least 4 of the 14 types of PPE covered in the PPE survey to safely operate.Note Items of PPE related to cleaning and disinfecting hands and surfaces, and masks are greatly demanded with businesses mostly requiring hand sanitizers (92.2%), disinfectant (79.0%), disinfectant wipes (68.6%), non-medical masks (cloth masks, reusable masks) (63.3%), non-medical gloves (44.7%) and nitrile gloves (41.3%). There was little change in the proportion of PPE products demanded by businesses between October and December—see chart 1. This is expected as businesses continue to implement cleaning practices and provide disinfectants to their employees, and in some cases their clients or patients to operate in accordance with the public health guidelines aimed at curbing the spread of COVID-19.

Data table for Chart 1

| Product | December | October |

|---|---|---|

| percent | ||

| Hand Sanitizer | 92.2 | 93.2 |

| Disinfectant | 79.0 | 79.3 |

| Disinfectant Wipes | 68.6 | 67.4 |

| Non-Medical masks | 63.3 | 63.9 |

| Non-Medical gloves | 44.7 | 44.2 |

| Nitrile Gloves | 41.3 | 40.9 |

| Surgical Masks | 39.1 | 37.5 |

| Face Shields | 28.3 | 28.8 |

| Eye Goggles | 28.0 | 25.8 |

| Thermometers | 25.0 | 22.0 |

| Respirators | 16.2 | 14.2 |

| Reusable gowns | 11.0 | 11.6 |

| Disposable Gowns | 11.4 | 11.0 |

| Shoe or boot covers | 10.7 | 9.1 |

|

Note: Each bar gives the proportion of PPE most demanded by businesses Source: Statistics Canada, Personal Protective Equipment Survey, October,December 2020 |

||

Businesses were less concerned about shortages of PPE in December than in October

More than two-thirds (69.2%) of businesses requiring PPE to operate, did not expect shortages in any one type of PPE that they required within the next three months.

30.8% of the businesses that reported requiring PPE to operate had concerns about potential shortages within the next three months.Note This represents an 8.3-percentage point reduction in businesses that have concerns about PPE shortages from October. The decline in concerns for potential shortages of PPE among businesses that require it to operate may be driven by recent declines in employment as well as potential expectations of supply (Statistics Canada, 2020a).

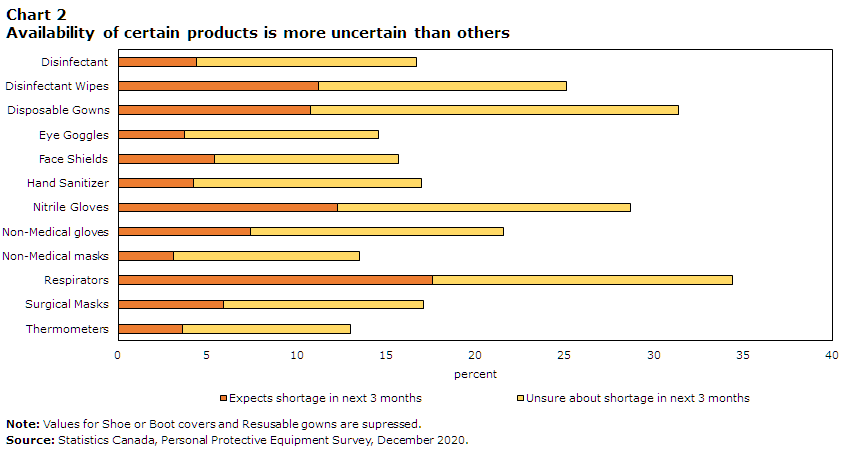

Concerns about the availability of certain types of PPE vary by sector. Businesses in private health care and social assistance were more likely (25.6%) to expect a shortage in any one type of PPE that they required within the next three months. These were followed by businesses in accommodation and food services (15.7%), manufacturing (13.2%), and retail trade (12.0%). Concern about PPE shortages also vary by the type of PPE. Respirators (17.6%) remain the main PPE that businesses expect to have a shortage in among the different types of PPE that are required. These are followed by nitrile gloves (12.3%), disinfectant wipes (11.2%) and disposable gowns (10.8%) - see Chart 2.

Data table for Chart 2

| Product | Expects shortage in next 3 months | Unsure about shortage in next 3 months |

|---|---|---|

| percent | ||

| Disinfectant | 4.4 | 12.3 |

| Disinfectant Wipes | 11.2 | 13.9 |

| Disposable Gowns | 10.8 | 20.6 |

| Eye Goggles | 3.7 | 10.9 |

| Face Shields | 5.4 | 10.3 |

| Hand Sanitizer | 4.2 | 12.8 |

| Nitrile Gloves | 12.3 | 16.4 |

| Non-Medical gloves | 7.4 | 14.2 |

| Non-Medical masks | 3.1 | 10.4 |

| Respirators | 17.6 | 16.8 |

| Surgical Masks | 5.9 | 11.2 |

| Thermometers | 3.6 | 9.4 |

|

Note: Values for Shoe or Boot covers and Resusable gowns are supressed. Source: Statistics Canada, Personal Protective Equipment Survey, December 2020. |

||

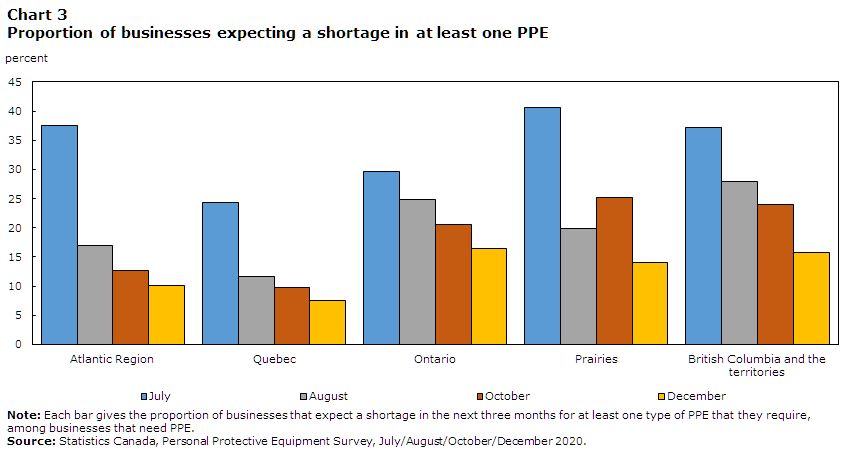

Demand and shortage expectations of PPE varied across the provinces

Demand for PPE varies across the country, with businesses in British Columbia and the territories being more likely to need, or expect to need, PPE (76.0%) than businesses in Quebec (58.6%).

Results from the December 2020 PPES indicate a continued decline in businesses’ expectations of possible shortages in any one type of PPE that they require within the next three months. This trend was consistent across all regions with businesses in Quebec having the least (7.6%) expectation of a shortage in any one type of PPE that they require.

Data table for Chart 3

| Region | July | August | October | December |

|---|---|---|---|---|

| percent | ||||

| Atlantic Region | 37.5 | 17.0 | 12.7 | 10.1 |

| Quebec | 24.3 | 11.7 | 9.7 | 7.6 |

| Ontario | 29.7 | 24.9 | 20.5 | 16.5 |

| Prairies | 40.6 | 19.9 | 25.1 | 14.1 |

| British Columbia and the territories | 37.2 | 28.0 | 24.0 | 15.7 |

|

Note: Each bar gives the proportion of businesses that expect a shortage in the next three months for at least one type of PPE that they require, among businesses that need PPE. Source: Statistics Canada, Personal Protective Equipment Survey, July/August/October/December 2020. |

||||

Ongoing concerns with shortages of specific PPEs for some businesses

In December, 13.9% of businesses indicated that they expected shortages in at least one type of PPE that they require within the next three months. A 5.6 percentage point decline in businesses expecting a shortage from October (19.5%). Among the businesses still expecting shortages in at least one type of PPE that they require, insufficient products or equipment available from suppliers remained the leading cause for concern. This reason explained over three-fifths of the expected shortages in face shields, shoe or boot covers, disinfectant wipes, and nitrile groves, and over four-fifths of expected shortages in disposable gowns. Other reasons given by respondents listed in order of frequency included: delay in receipt of supplies from suppliers, no supplier identified, and insufficient purchasing power to buy quantities of PPE needed to secure the suppliers.

Data table for Chart 4

| Product | Expects a shortage of PPE in the next three months because of insufficient products/equipment available from suppliers |

|---|---|

| percent | |

| Disposable Gowns | 83.1 |

| Face Shields | 69.0 |

| Shoe/Boot Covers | 66.9 |

| Nitrile Gloves | 65.7 |

| Disifectant Wipes | 60.7 |

| Surgical Masks | 58.3 |

| Eye Goggles | 52.2 |

| Non-medical Gloves | 50.3 |

| Disinfectant | 50.0 |

| Respirators | 47.1 |

| Hand Sanitizer | 42.6 |

| Thermometers | 36.2 |

| Non-medical Masks | 26.9 |

|

Note: Each bar gives the proportion of businesses that expect a shortage of PPE because of insufficient products/equipment available from suppliers, among businesses that expect a shortage of PPE. Values for Resusable gowns are supressed.

Source: Statistics Canada, Personal Protective Equipment Survey, December 2020. |

|

Share of businesses involved in manufacturing and distribution of personal protective equipment holds steady

One-tenth (10.0%) of businesses in the manufacturing, retail trade, and wholesale trade sectors were involved in the manufacturing and distribution of PPE in December, essentially unchanged from October (10.8%).Note

In December, 0.7% of businesses were involved in the manufacturing of PPE, essentially unchanged from October (0.6%).

Personal protective equipment shortage is not a concern among small or medium businesses

Small businesses have been found to be disproportionately negatively impacted by the COVID-19 pandemic compared to medium or large businesses (e.g., Gu, 2020; Statistics Canada, 2020b). This raised concerns that small businesses might have difficulties sourcing funds to acquire the required PPE for them to operate safely in accordance with the public health guidelines. However, data collected in the PPES show that small businesses were less likely to need PPE than medium or large businesses, with two thirds (66.6%) of small businesses requiring PPE to operate, compared with more than four-fifths (82.5%) of medium and large businesses. December results are consistent with PPES findings from October. Also, similar to October, the main cause of shortage expectations in at least one type of PPE among both small and medium to large businesses was insufficient products or equipment available from the supplier; and not as a result of insufficient funds.

Data sources

Data for this analysis come from the PPES for December 2020. This voluntary survey aims to collect information on private-sector businesses’ supply, demand, and inventories of PPE. Along with the results of this analysis, these data are used to help the federal government model usage and inventories of PPE in Canada, and forecast potential shortfalls in these items. Results from the December iteration were based on responses from 4,859 businesses operating in Canada.References

Gu, W. 2020. Economic Impact of the COVID-19 Pandemic on Canadian Businesses across Firm Size Classes. Economic Insights, no. 119. Statistics Canada Catalogue no. 11-626-X.

Statistics Canada. 2020a. “Labour Force Survey, December 2020.” The Daily. January 8. Statistics Canada Catalogue no. 11-001-X.

Statistics Canada. 2020b. “Canadian Survey on Business Conditions: Impact of COVID-19 on businesses in Canada, third quarter 2020, November 2020.” Statistics Canada Catalogue no. 45-28-0001.

- Date modified: