Analysis in Brief

The impact of the COVID-19 pandemic on inbound visitors to Canada

Skip to text

Text begins

Introduction

On March 11, 2020, the World Health Organization (WHO) declared the new coronavirus (COVID-19) disease a pandemic. In response, borders were closed, and commercial airline activity came to a near standstill in April, rendering non-essential travel virtually impossible. Travel restrictions, including screenings, quarantines, and travel bans, were implemented in more than 130 countries after the COVID-19 outbreak began.Note In Canada, passengers on scheduled and charter services in April were down 97.0%, compared with the same month in 2019, as commercial passenger service was drastically reduced.Note The restrictions resulted in an unprecedented decline in inbound visitorNote spending in Canada in 2020.

The tourism sector makes a notable contribution to the Canadian economy. Indeed, tourism’s quarterly share of Canada’s gross domestic product (GDP) averaged 2.0% for the five years before the pandemic (from the first quarter of 2015 to the fourth quarter of 2019). However, this share declined to 1.8% in the first quarter of 2020 and then to 0.6% in the second quarter, when the arrival of inbound visitors to Canada virtually ground to a halt.Note As a result, quarterly spending by non-residents as a share of total tourism spending declined from an average of 26.1% in the five years before the pandemic to 2.5% in the second quarter of 2020, leaving spending by Canadians as the sustaining force for the Canadian tourism sector.Note

This study tracks tourism-related spending in Canada by inbound visitors from the United States and overseasNote countries from the first quarter of 2018 to the second quarter of 2023, focusing on the periods before and during the pandemic.Note By examining these changes, we assess the rate of recoveryNote and also identify any shifts in tourism behaviours and spending patterns.

The paper begins with an overview of the data sources, followed by a selective review of studies related to the tourism sector. Next, it delves into the various pandemic-era restrictions that were put in place to combat the spread of COVID-19. An overview of the effects of these restrictions on the travel behaviour of inbound visitors is then presented, covering the aggregated figures (total number of visitors and total amount of spending) and the categorical breakdowns (spending categories and tourism regions). The paper concludes by highlighting significant recovery patterns that have emerged thus far, which could shed light on potential post-pandemic shifts in tourism behaviour.

Data sources

The data sources used for this study are the Visitor Travel Survey and the Frontier Counts program.

Statistics Canada’s Visitor Travel Survey (VTS) provides quarterly statistics on United States and overseas visitors to Canada, their characteristics of travel and their spending levels. From the first quarter of 2018 to the first quarter of 2020, spending data were derived from a Small Area Estimation model. Collection activity related to the VTS was suspended in March 2020 because of the COVID-19 pandemic; estimates from the second quarter of 2020 to the first quarter of 2023 were produced using a model based on historical 2019 VTS estimates combined with alternate data and adjusted with Frontier Counts results. As of April 2023, VTS collection partially resumed, with the Air Exit Survey (AES) restarting in five major Canadian airports. The non-air component of VTS (visitors arriving by modes of transportation other than air) uses modelled data based on historical VTS estimates while the air component is based on estimates obtained from AES survey results.

The Frontier Counts program at Statistics Canada receives administrative data from the Canada Border Services Agency (CBSA) on all international arrivals into the country, consisting of both non-resident visitors to Canada and Canadian residents returning from abroad.

Literature Review

Studies assessing the impact of the pandemic on tourism in Canada initially focused on international travel, the first area to experience the effects of borders being closed by governments across the world. For example, Omariba and McKeown (2020) examined the steep decline in the number of international arrivals to Canada by commercial air in March and April 2020, using the primary inspection kiosk information gathered by CBSA at major Canadian airports.Note This study found that the number of overseas residents arriving at major Canadian airports dropped by 97.7% in April 2020 compared with April 2019, and the number of US residents entering Canada by air decreased by 99.5% over the same period. Snoddon et al. (2020) traced the impacts of restrictions and border closures on the Canadian airline industry, situating them within an international comparison.Note The authors cited an articleNote showing that the impacts of the first wave of the pandemic were far greater than those of either the events of September 11, 2001, or the 2003 SARS outbreak.

Other subject-matter areas at Statistics Canada focused on the economic impact of COVID-19 on tourism. For instance, the National Tourism Indicators (fourth quarter of 2020) reported that tourism spending in Canada was almost cut in half (-48.1%) in 2020.Note The Labour Force Survey (December 2020) reported employment losses suffered in accommodation and food services, as well as in information, culture, and recreation, over multiple months.Note Liu (2020) explored different scenarios to evaluate the impact of pandemic restrictions on the Canadian economy by focusing on tourism industries.Note He evaluated the possibility of lifting restrictions and the speed of recovery of businesses and the economy. Written in October 2020, Liu’s study noted that the tourism sector's GDP could decline sharply due to these restrictions. The analysis emphasizes that tourism, which includes industries like transportation, accommodation, food services, and recreation, could face substantial losses, contributing to a broader economic downturn.

Destination Canada (2020) explored the impact of restrictions on the tourism sector by looking at two scenarios—containing COVID-19 and not containing COVID-19—and providing some projections for future years on the spending, employment, government revenue and GDP losses in Canada, by province and by country of origin.Note Additionally, there is a comparison in the study between the COVID-19 pandemic and similar crises in previous years.

By 2021, some of the studies began focusing on spending totals but did not address the spending patterns themselves. Tam et al. (2021) investigated the impact of the pandemic on the tourism sector in the second quarter of 2021. This research mainly focused on revenue loss and high unemployment in the sector and discussed the possibility of recovery for these businesses over the coming years.Note

The present analysis will complement these studies by providing details on how, when, or where visitor spending in Canada occurred before and during the pandemic. Given the severe losses experienced by industries such as transportation, accommodation, food services, and recreation, this analysis offers valuable data that can help these sectors better prepare for future disruptions.

COVID-19 restrictions

The WHO declared COVID-19 a pandemic on March 11, 2020, and on March 13, the Canadian government issued an advisory recommending that Canadians avoid all non-essential travel abroad. On March 16, all international flights were redirected to four airports: Montréal/Pierre Elliott Trudeau International Airport, Toronto/Lester B. Pearson International Airport, Calgary International Airport, and Vancouver International Airport. Effective March 18, Canada closed its border to all travellers, except for Canadian citizens, permanent residents, and US citizens. Additionally, a mandatory 14-day quarantine period was required for those returning from abroad. Finally, the Canada–US border was closed on March 21 to all non-essential travel. As of April 2020, the use of the ArriveCAN mobile application became mandatory for all travellers entering and exiting Canada. Although there was a slight easing of public health measures during the summer of 2020, restrictions on international travel remained in place throughout the rest of the year.

In the first quarter of 2021, the federal government announced additional restrictions for international air travellers arriving in Canada, including a mandatory COVID-19 molecular test upon arrival and a compulsory hotel stopover while awaiting the results as part of the 14-day quarantine period. These restrictions, coupled with the federal government’s advisory to refrain from non-essential travel, remained in place throughout the second quarter of 2021.

With the increase in vaccination rates, the federal government started to relax travel restrictions in the summer of 2021. As of July, mandatory testing upon arrival, with a hotel stay as part of a 14-day quarantine, was no longer required for fully vaccinated air travellers. Effective August 9, US citizens who were fully vaccinated were allowed to enter the country for non-essential travel, and on September 7, Canada extended entry to fully vaccinated foreign nationals for discretionary travel.

In late November 2021, the WHO declared Omicron a new variant of concern. In response, on December 15, the Government of Canada readvised Canadians to avoid non-essential travel outside Canada and, on December 21, reinstated the requirement for all travellers arriving in Canada to provide a negative COVID-19 molecular test.

In February 2022, Canada announced a phased easing of the travel requirements issued in late 2021. At the end of February, restrictions regarding where international passenger flights could arrive in Canada were lifted, and these flights were again permitted to land at all international Canadian airports. Throughout the second quarter of 2022, fully vaccinated Canadians were no longer required to provide a negative COVID-19 test when returning to Canada. Finally, as of October 1, 2022, all COVID-19 border requirements, including vaccination, mandatory use of the ArriveCAN application, and testing and quarantine requirements, were removed for all travellers entering Canada by land, air, or water.

Impact on number of visitors

Canada welcomed 31.3 million inbound visitors in 2018—24.4 million US residents and 6.9 million visitors from overseas countries (Chart 1). This was followed by 32.4 million inbound visitors in 2019—25.0 million US residents and 7.5 million overseas residents.

After the declaration of the COVID-19 pandemic and the closure of borders in March 2020, the number of inbound visitors declined sharply in the second quarter of 2020, reaching only a fraction of the volume observed during the same quarter in 2018. This was true for the numbers of both US and overseas visitors, which fell to 3.5% (224,700 visitors) and 2.8% (50,800 visitors) of their pre-pandemic levels, respectively.

In the second quarter of 2021, the rate of recovery for both US and overseas visitors was just over 5% of the level in 2018. In the third quarter of 2021, the number of inbound visitors surpassed the 1.0 million mark for the first time since the start of the pandemic, when it reached 1.5 million—1.2 million US visitors and 308,400 overseas visitors.

The number of inbound visitors continued to recover throughout 2022, after a temporary pause in the first quarter because of the Omicron variant and the subsequent reinstatement of COVID-19 restrictions. This positive recovery trend persisted into the first and second quarters of 2023. The first quarter of 2023 recovered 76.0% (3.7 million) of the level from the same quarter in 2018, and the second quarter reached 90.1% (7.4 million) of the level from the same quarter in 2018. For both quarters, the recovery rates for US and overseas visitors were similar.

Data table for Chart 1

| US Residents | Overseas Residents | |

|---|---|---|

| number of visitors (thousands) | ||

| 2018 | ||

| Quarter 1 | 3,828 | 1,026 |

| Quarter 2 | 6,436 | 1,785 |

| Quarter 3 | 9,244 | 2,730 |

| Quarter 4 | 4,904 | 1,322 |

| 2019 | ||

| Quarter 1 | 3,756 | 1,034 |

| Quarter 2 | 6,723 | 2,045 |

| Quarter 3 | 9,463 | 3,007 |

| Quarter 4 | 5,016 | 1,385 |

| 2020 | ||

| Quarter 1 | 3,094 | 830 |

| Quarter 2 | 225 | 51 |

| Quarter 3 | 347 | 101 |

| Quarter 4 | 325 | 96 |

| 2021 | ||

| Quarter 1 | 258 | 88 |

| Quarter 2 | 338 | 96 |

| Quarter 3 | 1,223 | 308 |

| Quarter 4 | 1,478 | 493 |

| 2022 | ||

| Quarter 1 | 999 | 334 |

| Quarter 2 | 3,597 | 1,021 |

| Quarter 3 | 5,723 | 1,636 |

| Quarter 4 | 3,646 | 967 |

| 2023 | ||

| Quarter 1 | 2,906 | 785 |

| Quarter 2 | 5,785 | 1,620 |

| Source: Statistics Canada, Table 24-10-0055-01. | ||

Impact on expendituresNote

In 2018, total tourism expenditures by inbound visitors to Canada were $22.0 billion—$10.6 billion by US residents and $11.3 billion by overseas residents. In 2019, total spending increased to $22.8 billion—$11.1 billion by US residents and $11.7 billion by overseas residents—including a record high of $9.4 billion spent in the third quarter of 2019, with US residents spending $4.5 billion and overseas residents spending $4.9 billion.

The impact of the pandemic on the travel and tourism sector was severe, as evidenced by the staggering decline in tourism expenditures. During the second quarter of 2020, spending declined to 3.0% of the level from the same quarter in 2018: US-resident spending declined to 2.9% and totalled $83.4 million, while overseas-resident spending decreased to 3.1%, reaching $90.8 million (Chart 2).

Throughout 2021, uncertainty about travel restrictions resulted in a slow recovery of inbound tourism spending, which did not approach its pre-pandemic levels. Inbound spending during the third quarter of 2021 totalled $1.5 billion, representing a recovery of 16.3%, compared with the same quarter in 2018 and surpassing the $1.0 billion mark for the first time since the onset of the pandemic.

From the third quarter of 2021 to the second quarter of 2023, the recovery of US-resident spending in Canada generally outpaced that of overseas-resident spending, except in two instances: the first quarter of 2022 and the first quarter of 2023, when overseas-resident spending recovery rates were higher.

In the first quarter of 2023, total spending reached $2.7 billion, representing a recovery of 91.3% of the 2018 level. Notably, in the first quarter of 2023, both US residents (90.9%) and overseas residents (91.6%) showed similar recovery rates, compared with the same quarter in 2018.

Total tourism expenditures continued to recover in the second quarter of 2023. By this time, the recovery rate had increased to 119.9%, surpassing the 2018 level and reaching $7.0 billion. In the second quarter of 2023, US-resident spending increased sharply from 2018 (+134.1%) to reach $3.8 billion. Overseas-resident spending in Canada was slightly slower to recover (+106.3%), with total spending reaching $3.1 billion. Both recovery rates indicate that non-resident spending in Canada in the second quarter of 2023 surpassed spending during the same quarter in 2018.

Data table for Chart 2

| US Residents | Overseas Residents | |

|---|---|---|

| recovery (percent) | ||

| 2018 | ||

| Quarter 1 | 100.0 | 100.0 |

| Quarter 2 | 100.0 | 100.0 |

| Quarter 3 | 100.0 | 100.0 |

| Quarter 4 | 100.0 | 100.0 |

| 2019 | ||

| Quarter 1 | 98.5 | 120.1 |

| Quarter 2 | 111.7 | 104.2 |

| Quarter 3 | 101.9 | 102.2 |

| Quarter 4 | 103.8 | 93.2 |

| 2020 | ||

| Quarter 1 | 76.1 | 73.7 |

| Quarter 2 | 2.9 | 3.1 |

| Quarter 3 | 3.9 | 4.6 |

| Quarter 4 | 7.1 | 7.0 |

| 2021 | ||

| Quarter 1 | 6.2 | 11.8 |

| Quarter 2 | 5.8 | 8.2 |

| Quarter 3 | 17.8 | 15.0 |

| Quarter 4 | 44.4 | 36.5 |

| 2022 | ||

| Quarter 1 | 37.3 | 43.0 |

| Quarter 2 | 69.0 | 56.2 |

| Quarter 3 | 71.7 | 61.8 |

| Quarter 4 | 89.1 | 64.9 |

| 2023 | ||

| Quarter 1 | 90.9 | 91.6 |

| Quarter 2 | 134.1 | 106.3 |

| Source: Statistics Canada, Table 24-10-0047-01. | ||

Impact on spending categories

Total tourism expenditures are made up of six spending categories: accommodation, clothes and gifts, food and beverages, recreation and entertainment, transportationNote , and other types of expenditures. In 2018 and 2019, before the pandemic, accommodation and food and beverages were the top two spending categories, making up roughly 60% of total expenditures.

US residents

In the second quarter of 2020, spending by US residents dropped in all categories to 5.3% or lower compared with their 2018 levels, with the exception of the “other types of expenditures” category (i.e., those which do not fall into any of the other five spending categories) which declined to 12.9% of its 2018 level (Chart 3). The largest spending category—accommodation—declined to 2.3% of its level during the same quarter in 2018, reaching $25.2 million. Similarly, the food and beverages category declined to 2.8% ($22.1 million) of its pre-pandemic level in 2018, and the transportation category declined to 5.3% ($24.3 million) of its pre-pandemic level in 2018.

From the second quarter of 2020 to the second quarter of 2021, US-resident spending across the six spending categories remained below 25%. However, a shift began to emerge in the third quarter of 2021, with recovery observed across all categories into the second quarter of 2023. Among these categories, “other types of expenditures” experienced the most substantial recovery up to the fourth quarter of 2022, reaching 103.1% ($76.0 million) of its pre-pandemic level. However, this was outpaced by the recovery in recreation and entertainment from the first quarter of 2023 to the following quarter, steeply recovering 186.5% ($500.1 million) of its 2018 level. Spending on clothes and gifts, which lagged behind other categories, notably from the first quarter of 2022 to the first quarter of 2023, saw a recovery in the second quarter of 2023, reaching 161.4% ($267.1 million) and securing the second-highest position in terms of recovery of US-resident expenditures.

Prior to the pandemic, spending by US residents on food and beverages was roughly double that of spending on transportation. However, from the second quarter of 2020 until the end of 2020, spending on transportation exceeded spending on food and beverages. From the first quarter of 2021, spending on food and beverages began surpassing transportation expenditures, except in the second quarter of 2021, though not to the extent observed prior to the pandemic. From the fourth quarter of 2022, previously observed food and beverages trends signaled a return to pre-pandemic spending habits—roughly double spending on transportation.

Before the pandemic, US-resident spending on recreation and entertainment was consistently more than double the amount spent on “other types of expenditures.” However, during the pandemic, this spending experienced a significant decrease, plummeting to half or less than half of the spending on “other types of expenditures.” The recreation and entertainment spending continued to be less than such spending on “other types of expenditures” until the third quarter of 2021, when recreation and entertainment spending reached $69.2 million, almost double “other types of expenditures” ($36.1 million). Spending on recreation and entertainment remained higher than “other types of expenditures” until the second quarter of 2023.

During the second quarter of 2023, spending by US residents within the six categories surpassed spending recorded in 2018.

Data table for Chart 3

| Spending Category | ||||||

|---|---|---|---|---|---|---|

| Accommodation | Clothes and gifts | Food and beverages | Recreation and entertainment | Transportation | Other types of expenditures | |

| recovery (percent) | ||||||

| 2018 | ||||||

| Quarter 1 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Quarter 2 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Quarter 3 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Quarter 4 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| 2019 | ||||||

| Quarter 1 | 93.4 | 106.4 | 106.7 | 98.4 | 97.2 | 77.2 |

| Quarter 2 | 114.7 | 118.9 | 107.3 | 102.5 | 109.8 | 146.3 |

| Quarter 3 | 97.8 | 110.6 | 102.3 | 115.7 | 101.2 | 98.0 |

| Quarter 4 | 110.4 | 96.4 | 95.4 | 102.9 | 108.4 | 104.4 |

| 2020 | ||||||

| Quarter 1 | 73.9 | 73.9 | 83.0 | 73.0 | 76.4 | 37.4 |

| Quarter 2 | 2.3 | 0.8 | 2.8 | 0.4 | 5.3 | 12.9 |

| Quarter 3 | 3.8 | 3.1 | 3.0 | 1.7 | 6.1 | 13.9 |

| Quarter 4 | 6.7 | 4.4 | 5.5 | 2.8 | 12.5 | 19.0 |

| 2021 | ||||||

| Quarter 1 | 5.5 | 4.8 | 6.5 | 1.8 | 10.4 | 13.5 |

| Quarter 2 | 5.5 | 5.8 | 4.1 | 3.3 | 8.5 | 21.7 |

| Quarter 3 | 18.3 | 23.4 | 14.8 | 16.9 | 17.5 | 39.0 |

| Quarter 4 | 45.4 | 38.4 | 34.6 | 53.7 | 50.1 | 75.1 |

| 2022 | ||||||

| Quarter 1 | 35.8 | 29.5 | 31.8 | 42.5 | 49.2 | 61.0 |

| Quarter 2 | 69.7 | 53.2 | 56.3 | 73.1 | 82.9 | 130.1 |

| Quarter 3 | 67.4 | 48.4 | 71.6 | 83.8 | 83.2 | 85.3 |

| Quarter 4 | 90.1 | 54.5 | 89.9 | 97.4 | 96.8 | 103.1 |

| 2023 | ||||||

| Quarter 1 | 83.6 | 45.3 | 102.4 | 114.8 | 89.6 | 83.5 |

| Quarter 2 | 131.6 | 161.4 | 119.5 | 186.5 | 122.2 | 148.0 |

| Source: Statistics Canada, Table 24-10-0047-01. | ||||||

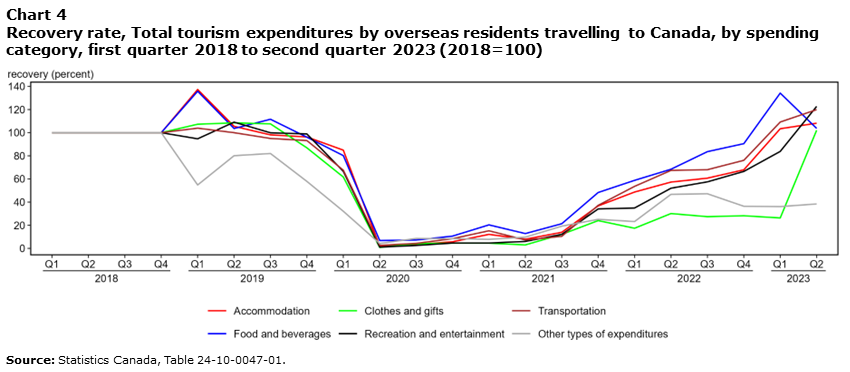

Overseas residents

In the second quarter of 2020, spending by overseas residents in Canada fell to 6.8% of the 2018 levels or less in all categories (Chart 4). Spending in the largest category—accommodation—declined to 1.8% of the level from the same period of 2018, reaching $18.4 million. The second-largest category—food and beverages—declined to $52.1 million, 6.8% of its 2018 level.

From the second quarter of 2020 to the third quarter of 2021, overseas-resident spending across the six expenditure categories remained at close to 20% or less of its 2018 level. However, a shift occurred, with steady recovery seen across most categories from the fourth quarter of 2021 to the second quarter of 2023.

Among the six spending categories, food and beverages consistently exhibited a stronger recovery rate than the other five categories from the fourth quarter of 2022 to the first quarter of 2023, peaking at 134.2% ($474.7 million). However, in the second quarter of 2023, the recovery rate of spending on food and beverages (103.7%) dipped below that of spending on accommodations (108.2%), though spending on food and beverages remained marginally higher than spending on clothes and gifts (102.1%) and significantly outpaced spending on “other types of expenditures” (38.4%). The greatest recovery of overseas-resident spending in Canada was observed in recreation and entertainment (122.7%), followed by spending on transportation (119.9%).

Before the pandemic, spending on accommodation in Canada by overseas residents was greater than spending on food and beverages. However, in the second quarter of 2020, overseas-resident spending on accommodation ($18.4 million) was surpassed by spending on food and beverages ($52.1 million). This trend persisted until the first quarter of 2022, when accommodation spending reached $232.2 million, prevailing over spending on food and beverages ($208.1 million).

Among the six categories, “other types of expenditures” experienced the slowest recovery rate in the second quarter of 2023, reaching $40.5 million. This category consistently maintained the second-lowest position in terms of recovery (behind clothes and gifts) from the fourth quarter of 2021 until the first quarter of 2023.

In the second quarter of 2023, overseas-resident spending in the six categories surpassed such spending in 2018, with the exception of “other types of expenditures.”

Data table for Chart 4

| Spending Category | ||||||

|---|---|---|---|---|---|---|

| Accommodation | Clothes and gifts | Food and beverages | Recreation and entertainment | Transportation | Other types of expenditures | |

| recovery (percent) | ||||||

| 2018 | ||||||

| Quarter 1 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Quarter 2 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Quarter 3 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Quarter 4 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| 2019 | ||||||

| Quarter 1 | 137.3 | 107.3 | 135.8 | 94.7 | 103.9 | 54.8 |

| Quarter 2 | 105.5 | 108.5 | 103.6 | 109.1 | 100.0 | 80.1 |

| Quarter 3 | 98.1 | 107.6 | 111.6 | 99.9 | 95.0 | 82.0 |

| Quarter 4 | 96.3 | 86.9 | 96.1 | 98.9 | 93.2 | 57.9 |

| 2020 | ||||||

| Quarter 1 | 84.9 | 61.7 | 80.2 | 66.6 | 67.6 | 32.1 |

| Quarter 2 | 1.8 | 0.8 | 6.8 | 1.1 | 2.6 | 4.2 |

| Quarter 3 | 3.4 | 4.0 | 7.2 | 2.5 | 4.3 | 8.6 |

| Quarter 4 | 5.7 | 4.5 | 10.6 | 4.6 | 8.4 | 8.4 |

| 2021 | ||||||

| Quarter 1 | 12.1 | 4.5 | 20.3 | 4.6 | 15.2 | 7.8 |

| Quarter 2 | 7.9 | 3.0 | 12.8 | 6.0 | 7.3 | 9.7 |

| Quarter 3 | 13.9 | 12.1 | 21.3 | 12.1 | 10.4 | 19.2 |

| Quarter 4 | 36.7 | 24.0 | 48.3 | 34.1 | 37.2 | 25.1 |

| 2022 | ||||||

| Quarter 1 | 48.7 | 17.4 | 58.8 | 34.9 | 53.6 | 23.2 |

| Quarter 2 | 57.3 | 30.1 | 68.4 | 52.0 | 67.4 | 46.7 |

| Quarter 3 | 60.7 | 27.4 | 83.6 | 57.5 | 68.0 | 47.2 |

| Quarter 4 | 67.9 | 28.2 | 90.5 | 66.5 | 76.1 | 36.4 |

| 2023 | ||||||

| Quarter 1 | 103.4 | 26.3 | 134.2 | 83.8 | 109.2 | 36.1 |

| Quarter 2 | 108.2 | 102.1 | 103.7 | 122.7 | 119.9 | 38.4 |

| Source: Statistics Canada, Table 24-10-0047-01. | ||||||

From the final quarter of 2021 to the second quarter of 2023, recovery of US-resident spending generally outpaced that of overseas-resident expenditures. This is highlighted in the second quarter of 2023, when US-resident spending in each category recovered at least 119% of its 2018 level, while overseas-resident spending recovery was at least 102% in each category, with the exception of “other types of expenditures”.

Impact on tourism regions

This section examines the pattern of total spending in five selected tourism regions across Canada: the Maritimes;Note Montréal; the Greater Toronto Area; the Canadian Rockies; and Vancouver, Coast & Mountains. For the analysis in this section, the top three tourism regions were selected, as well as regions from both the west and east coasts to provide a thorough representation of Canada’s diverse tourism destinations. This study highlights significant regional spending patterns. Due to the unavailability of data on spending in selected tourism regions for the second quarter of 2023 at the time of publication, the analysis in this section excludes tourism regions’ estimates for this quarter.

In 2018 and 2019, before the pandemic, the top three tourism regions among those selected, accounting for over 40% of total tourism expenditures in Canada, were Vancouver, Coast & Mountains; the Greater Toronto Area; and Montréal.

US residents

In the second quarter of 2020, spending by US residents fell to less than 4% of the corresponding 2018 levels in all five tourism regions (Chart 5). Spending in the top tourism region, Vancouver, Coast & Mountains, decreased to 3.2% of spending relative to the same period in 2018, reaching $17.1 million. Similarly, spending in the Greater Toronto Area and Montréal declined to 2.3% ($7.9 million) and 1.6% ($4.2 million), respectively, of pre-pandemic levels in 2018. While spending in the Maritimes dropped to 3.5% ($4.6 million) of the 2018 level, the Canadian Rockies experienced a significant drop to 0.5% ($383,000) of such spending in 2018.

From the second quarter of 2020 to the third quarter of 2021, spending by US residents in the selected tourism regions remained low, hovering around 20% or less of the levels observed in 2018. However, there was a change in the recovery pattern from the fourth quarter of 2021 onward. During this period, the recovery rate exhibited fluctuations but generally followed an upward trajectory. By the first quarter of 2023, the recovery rate surpassed 2018 spending in the Canadian Rockies (166.4%), the Maritimes (150.4%), and the Greater Toronto Area (107.2%). Montréal experienced a recovery rate of 95.0%, while Vancouver, Coast & Mountains recorded the lowest recovery (92.5%), nevertheless approaching 2018 levels.

Data table for Chart 5

| Tourism Region | |||||

|---|---|---|---|---|---|

| Vancouver, Coast and Mountains | Greater Toronto Area | Montréal | Canadian Rockies | Maritimes | |

| recovery (percent) | |||||

| 2018 | |||||

| Quarter 1 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Quarter 2 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Quarter 3 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Quarter 4 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| 2019 | |||||

| Quarter 1 | 92.4 | 107.3 | 106.4 | 161.0 | 140.4 |

| Quarter 2 | 113.4 | 117.7 | 117.4 | 152.0 | 107.3 |

| Quarter 3 | 106.7 | 108.1 | 93.9 | 91.8 | 105.1 |

| Quarter 4 | 108.6 | 100.8 | 98.7 | 114.6 | 64.1 |

| 2020 | |||||

| Quarter 1 | 67.4 | 79.9 | 71.4 | 201.8 | 68.8 |

| Quarter 2 | 3.2 | 2.3 | 1.6 | 0.5 | 3.5 |

| Quarter 3 | 4.6 | 3.4 | 2.9 | 1.5 | 3.7 |

| Quarter 4 | 7.2 | 5.0 | 4.1 | 5.4 | 5.8 |

| 2021 | |||||

| Quarter 1 | 5.9 | 3.9 | 5.4 | 9.0 | 19.9 |

| Quarter 2 | 6.0 | 5.2 | 5.0 | 3.5 | 7.3 |

| Quarter 3 | 18.0 | 18.8 | 17.4 | 13.3 | 20.4 |

| Quarter 4 | 40.0 | 43.5 | 41.2 | 93.3 | 30.0 |

| 2022 | |||||

| Quarter 1 | 37.8 | 33.4 | 40.7 | 66.5 | 63.7 |

| Quarter 2 | 72.5 | 99.9 | 76.4 | 68.1 | 71.7 |

| Quarter 3 | 75.1 | 91.0 | 77.1 | 46.5 | 77.4 |

| Quarter 4 | 85.2 | 101.3 | 80.7 | 139.2 | 59.4 |

| 2023 | |||||

| Quarter 1 | 92.5 | 107.2 | 95.0 | 166.4 | 150.4 |

| Source: Statistics Canada, Table 24-10-0047-01. | |||||

Overseas residents

In the second quarter of 2020, spending by overseas residents declined to less than 5% of the spending recorded in 2018 in the five tourism regions (Chart 6). Spending in Vancouver, Coast & Mountains declined to 4.3% of the level from the same period in 2018, reaching $31.9 million. Likewise, spending in the Greater Toronto Area and Montréal declined to 2.4% ($10.7 million) and 2.3% ($7.0 million), respectively, of spending in 2018. While overseas-resident spending in the Maritimes dropped to 3.2% ($3.9 million) of 2018 spending, the Canadian Rockies experienced a substantial decline to 0.2% ($325,000) of pre-pandemic spending.

Overseas visitors spent less in the Maritimes, compared with the Canadian Rockies, throughout most of 2018 and 2019. However, beginning in the second quarter of 2020 and continuing until the first quarter of 2023, spending by overseas visitors in the Maritimes surpassed spending in the Canadian Rockies. In the first quarter of 2023, overseas spending in the Maritimes amounted to $39.0 million, while $38.5 million was spent in the Canadian Rockies.

During the first quarter of 2023, spending by overseas residents in Vancouver, Coast & Mountains experienced a recovery of 98.3% of 2018 spending, amounting to $420.8 million. This resurgence stands as the most substantial recovery observed to date, surpassing all selected tourism regions. Notably, spending in Vancouver, Coast & Mountains by overseas residents outpaced other tourism regions that had previously seen stronger recovery rates in recent quarters.

From January to March 2023, spending by overseas residents in Montréal recovered 95.4% ($151.4 million) of 2018 spending, maintaining a consistent trend of recovery exceeding 90% since the third quarter of 2022. Concurrently, the Greater Toronto Area experienced a recovery of 94.5%. By contrast, spending in the Maritimes saw a more modest recovery of 81.9%, while spending in the Canadian Rockies recorded the lowest recovery, at 76.5%, notably its most significant recovery to date.

Data table for Chart 6

| Tourism Region | |||||

|---|---|---|---|---|---|

| Vancouver, Coast and Mountains | Greater Toronto Area | Montréal | Canadian Rockies | Maritimes | |

| recovery (percent) | |||||

| 2018 | |||||

| Quarter 1 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Quarter 2 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Quarter 3 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Quarter 4 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| 2019 | |||||

| Quarter 1 | 126.1 | 117.2 | 110.3 | 126.4 | 121.0 |

| Quarter 2 | 101.2 | 133.4 | 95.1 | 86.7 | 90.3 |

| Quarter 3 | 104.2 | 108.0 | 122.0 | 96.8 | 98.0 |

| Quarter 4 | 81.7 | 94.0 | 107.6 | 97.0 | 80.4 |

| 2020 | |||||

| Quarter 1 | 70.6 | 64.4 | 73.5 | 83.1 | 66.9 |

| Quarter 2 | 4.3 | 2.4 | 2.3 | 0.2 | 3.2 |

| Quarter 3 | 6.1 | 4.1 | 4.8 | 0.8 | 4.1 |

| Quarter 4 | 7.7 | 4.8 | 5.4 | 2.8 | 7.5 |

| 2021 | |||||

| Quarter 1 | 14.7 | 9.9 | 10.3 | 2.3 | 14.5 |

| Quarter 2 | 12.1 | 7.8 | 7.7 | 0.9 | 7.3 |

| Quarter 3 | 17.5 | 13.7 | 23.1 | 4.9 | 15.9 |

| Quarter 4 | 32.8 | 30.3 | 56.0 | 31.5 | 33.8 |

| 2022 | |||||

| Quarter 1 | 46.2 | 36.9 | 43.3 | 28.4 | 44.4 |

| Quarter 2 | 56.8 | 63.4 | 62.7 | 24.5 | 53.4 |

| Quarter 3 | 59.6 | 57.9 | 94.8 | 33.0 | 65.4 |

| Quarter 4 | 61.3 | 61.5 | 91.8 | 56.5 | 57.4 |

| 2023 | |||||

| Quarter 1 | 98.3 | 94.5 | 95.4 | 76.5 | 81.9 |

| Source: Statistics Canada, Table 24-10-0047-01. | |||||

From the last quarter of 2021 to the first quarter of 2023, the recovery of US-resident spending in the selected tourism regions was generally higher than that of overseas-resident spending in the same locations. US-resident spending recovered at least 92% overall, while overseas-resident spending recovery during the same period was lower, reaching 76% of the 2018 level.

Summary

Due to the COVID-19 pandemic and the restrictions implemented to stop its spread, there were significant impacts to the number of inbound visitors to Canada, with the lowest volume of arrivals recorded in the second quarter of 2020 (275,500 visitors; 3.4% of visitors observed during the second quarter of 2018). This decline affected all tourism-related sectors, with a reduction in spending by inbound visitors in all spending categories and tourism regions.

During the first and second quarters of 2023, recovery of the number of visitors remained similar for US and overseas residents. However, while spending by US residents during the first quarter of 2023 displayed a recovery similar to that of overseas residents, it notably outpaced such spending during the second quarter across various spending categories.

Both US and overseas residents increased their spending across all six categories in the second quarter of 2023, surpassing expenditures recorded in the same period in 2018, except for “other types of expenditures.”

Among the selected tourism regions, total spending in the Canadian Rockies, the Maritimes, and the Greater Toronto Area experienced the largest overall recovery during the first quarter of 2023, surpassing 2018 spending, and was confirmed by corresponding US-resident spending. In contrast, spending by overseas residents was greater in Vancouver, Coast & Mountains; Montréal; and the Greater Toronto Area, but remained below 2018 levels.

The increase in tourism spending can be partially attributed to escalating costs for food, services, and transportation.Note Additionally, the extended duration of stays by inbound visitors may have also contributed to the increase in spending. Regarding tourism behaviour, as the world began to reopen for tourism, the term “revenge travel” emerged in 2021. This term describes travellers seemingly making up for lost opportunities during the pandemic, taking longer trips or spending more per trip, characterizing the resumption of tourism.

- Date modified: