Consumer Price Index, November 2024

Released: 2024-12-17

The Consumer Price Index (CPI) rose 1.9% on a year-over-year basis in November, down from a 2.0% increase in October. Slower price growth was broad-based, with prices for travel tours and the mortgage interest cost index contributing the most to the deceleration. Excluding gasoline, the all-items CPI rose 2.0% in November, following a 2.2% gain in October.

Prices for food purchased from stores rose 2.6% year over year in November, down slightly from 2.7% in October. Despite the slowdown, grocery prices have remained elevated. Compared with November 2021, grocery prices rose 19.6%. Similarly, while shelter prices eased in November, prices have increased 18.9% compared with November 2021.

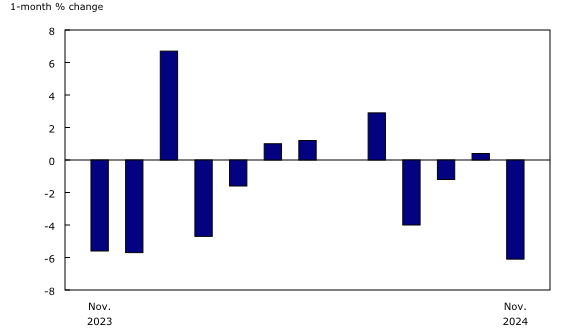

On a monthly basis, the CPI was unchanged in November, following a 0.4% increase in October. On a seasonally adjusted monthly basis, the CPI rose 0.1%.

Gasoline prices fall in November

Year over year, gasoline prices fell to a lesser extent in November (-0.5%) compared with October (-4.0%). The smaller year-over-year decline was a result of a base-year effect as prices fell 3.5% month over month in November 2023.

On a monthly basis, gasoline prices were unchanged in November.

Rent prices accelerate while mortgage interest costs continue to decelerate

The shelter component grew at a slower pace in November, rising 4.6% year over year following a 4.8% increase in October.

On a yearly basis, prices for rent accelerated in November (+7.7%) compared with October (+7.3%), applying upward pressure on the all-items CPI. Rent prices accelerated the most in Ontario (+7.4%), Manitoba (+7.9%), and Nova Scotia (+6.4%).

Conversely, the mortgage interest cost index decelerated for the 15th consecutive month in November (+13.2%) after rising 14.7% in October. The mortgage interest cost and rent indices contributed the most to the 12-month all-items CPI increase in November.

Black Friday and related sales contribute to lower prices

Black Friday and related specials are typically offered during the month of November. These discounts partially contributed to lower prices across several major components, and were particularly notable in the household operations, furnishings and equipment, as well as the clothing and footwear indices.

On a monthly basis, the household operations, furnishings and equipment index declined 0.9% in November, driven by lower prices for cellular services (-6.1%) and furniture (-2.1%).

The clothing and footwear index declined 0.8% on a monthly basis, driven by prices for women's clothing (-0.8%) and children's clothing (-4.9%). The monthly decline for children's clothing was the largest on record for the month of November.

Prices for travel services fall at a slower pace

Year over year, prices for travel services fell to a lesser extent in November (-6.7%) compared with October (-7.1%). The smaller decline was due to higher prices for traveller accommodation (+8.7%). Driving the upward movement was an acceleration in Ontario, as hotel prices rose 23.7% following a 1.3% gain in October. On a monthly basis, prices for traveller accommodation in Ontario were up 11.0%, the swiftest monthly increase ever recorded for the month of November, coinciding with a series of high-profile concerts.

Prices for travel tours declined more in November (-12.0%) compared with October (-6.5%) on a yearly basis. The decline was partly due to a base-year effect, attributable to higher demand and higher prices for destinations in the United States in November 2023.

Explore the Consumer Price Index tools

Check out Statistics Canada's Food Price Data Hub, which features a variety of food price related statistics, articles and tools.

Check out the Personal Inflation Calculator. This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation for the average Canadian household—the Consumer Price Index (CPI).

Browse the Consumer Price Index Data Visualization Tool to access current (Latest Snapshot of the CPI) and historical (Price trends: 1914 to today) CPI data in a customizable visual format.

Regional highlights

Year over year, prices rose at a slower pace in November compared with October in five provinces.

While Atlantic Canadian provinces experienced an acceleration in prices in November, the rest of the country had slower or flat price growth. The regional disparity was mainly attributed to fuel oil and other fuels. Fuel oil is more commonly used to heat homes in Atlantic Canada, and as such, contributed more to price growth in these provinces compared with others.

Did you know we have a mobile app?

Download our mobile app and get timely access to data at your fingertips! The StatsCAN app is available for free on the App Store and on Google Play.

Note to readers

Visit the Consumer Price Index portal to find all Consumer Price Index (CPI) data, publications, interactive tools, and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Upcoming Enhancement: Resale housing data for additional cities to be incorporated into the Mortgage Interest Cost Index

With the release of the January 2025 CPI, the Mortgage Interest Cost Index (MICI) will be enhanced by expanding its use of the Canadian Real Estate Association MLS Home Price Index.

The MICI represents 5.58% of the 2023 CPI basket and is part of the shelter component of the CPI.

Detailed documentation on the MICI house sub-index is available in "Shelter in the Canadian CPI: An overview, 2023 update."

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on December 23. For more information, consult the document, "Real-time data tables."

Next release

The CPI for December 2024, along with the Consumer Price Index Annual Review, will be released on January 21, 2025.

Products

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the first century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index (CPI) and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

The podcast ''Eh Sayers Episode 18 - Why Food Inflation Is Such A Hard Nut To Crack'' is also available.

Find out answers to the most common questions posed about the CPI in the context of the COVID-19 pandemic and beyond.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: