Industrial product and raw materials price indexes, May 2024

Released: 2024-06-21

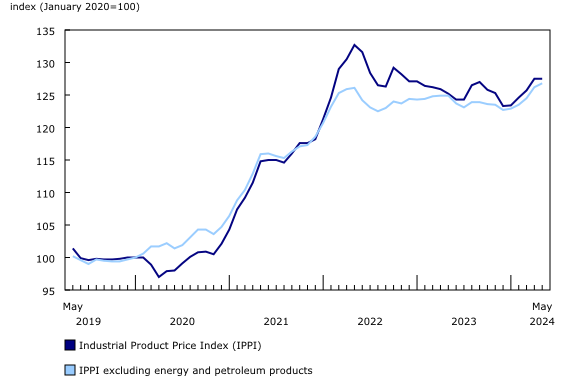

Prices of products manufactured in Canada, as measured by the Industrial Product Price Index (IPPI), were unchanged month over month in May 2024 and rose 1.8% on a yearly basis. Prices of raw materials purchased by manufacturers operating in Canada, as measured by the Raw Materials Price Index (RMPI), declined 1.0% month over month in May 2024 and increased 7.6% year over year.

Industrial Product Price Index

On a monthly basis, the IPPI was unchanged in May following four consecutive months of increases. Lower prices for energy and petroleum products (-3.9%) and lumber and other wood products (-4.9%) were largely offset by price increases for primary non-ferrous metal products (+4.3%) and meat, fish and dairy products (+1.6%). Excluding energy and petroleum products, the IPPI rose 0.5%.

Energy and petroleum products (-3.9%) had the largest downward impact on the IPPI in May. This decrease came after three consecutive month-over-month price increases. Prices for diesel fuel (-5.8%) and finished motor gasoline (-3.3%) were the main contributors to the decrease. These decreases were mainly due to lower prices for crude oil.

Prices for lumber and other wood products (-4.9%) also declined from April to May. Lower prices for softwood lumber (-10.2%) drove the month-over-month decline. This was the largest monthly decrease in softwood lumber prices since June 2022 (-29.4%). Lumber demand was soft in May 2024 amid continued housing affordability challenges. For example, 30-year mortgage rates in the United States, the primary market for Canadian lumber, surpassed 7.0% for the first time this year, in late April. High interest rates have a negative influence on new housing projects, which typically drive demand for lumber. In early May, the United States Federal Reserve indicated that interest rate cuts are likely to occur at a slower pace than many anticipated earlier in 2024. Despite recent operational curtailments at sawmills, the low demand has resulted in sawmills accepting lower prices for their lumber.

Prices increased month over month for multiple product groups in May.

Prices for primary non-ferrous metal products (+4.3%) had the largest upward impact on the IPPI in May, rising for a third consecutive month. Unwrought gold, silver and platinum group metals and their alloys (+3.9%) led the increase, mainly due to higher prices for unwrought silver and silver alloys (+6.9%). Silver prices benefitted from strong industrial demand for the metal, especially relating to silver's use in solar panels. Unwrought copper and copper alloys (+6.7%) and unwrought nickel and nickel alloys (+7.4%) also posted price increases in May. Concerns surrounding stagnating copper supply, as consumption was predicted to increase going forward due to the green energy transition, supported the higher prices. Supply concerns helped push up nickel prices, too, as political unrest in New Caledonia, a major nickel producing region, disrupted production in May.

The prices of meat, fish and dairy products increased 1.6% from April to May, the third straight monthly increase. Prices were up for both fresh and frozen pork (+7.7%) and fresh and frozen chicken (+6.6%). Higher chicken prices were related to strong seasonal demand in the spring. Stronger seasonal demand also impacted pork prices in May, and high demand for exported Canadian pork played a role in the higher prices as well. According to data provided by Statistics Canada's International Merchandise Trade Program, the customs value of Canadian fresh and frozen pork exports has risen on a year-over-year basis since November 2023. The latest data indicate that the customs value of exports was 25.0% higher in April 2024 than in April 2023.

After five consecutive months of decline, prices for fruit, vegetables, feed and other food products were up 1.1% month over month in May 2024. Oilseed cake and meal prices (+11.3%) drove the increase, mainly due to the rise in prices for the raw materials used in the production of oilseed cake and meal: canola prices rose by 3.7% and soybean prices rose by 5.0%. Heavy rains in Brazil disrupted production and supported prices for soybeans. As Brazil is the world's largest soybean producer, events in the country influence prices internationally.

Year over year

The IPPI rose 1.8% year over year in May, the biggest year-over-year increase since January 2023 (+4.8%).

Several metals were the main contributors to the IPPI's year-over-year increase in May 2024: unwrought silver and silver alloys (+23.1%), unwrought gold and gold alloys (+19.3%) and unwrought copper and copper alloys (+24.6%). These metals have experienced strong price gains over the past several months. Diesel fuel (+4.9%) and light fuel oils (+19.9%) were also noteworthy contributors to the IPPI's year-over-year increase.

In contrast, prices declined year over year in May for unwrought nickel and nickel alloys (-10.5%), canola oil (-13.4%) and unwrought platinum group metals, and their alloys (-14.2%). On average, nickel and canola markets were strongly supplied over the 12 months ending in May.

Raw Materials Price Index

The RMPI declined 1.0% month over month in May after posting four consecutive monthly increases. Excluding crude energy products, the RMPI rose 2.4%.

Prices for crude energy products declined 6.4% in May, the first monthly decrease since December 2023 (-9.9%). The decrease in May 2024 was driven by lower prices for conventional crude oil (-7.0%), which fell in May following a 6.2% increase in April. Reduced tensions between Iran and Israel in May compared with April played a role in the May price drop. Observers expected the Organization of the Petroleum Exporting Countries and its partners (OPEC+) to maintain voluntary production cuts for the remainder of 2024, and the Energy Information Administration's May report projected an increase of 1.8 million barrels per day in production outside OPEC+.

Prices for metal ores, concentrates and scrap led the increase of the RMPI excluding energy, rising 4.5% from April to May. A variety of metals increased in price month over month, including nickel ores and concentrates (+7.4%), gold, silver, and platinum group metal ores and concentrates (+1.8%) and lead and zinc ores and concentrates (+6.1%). Zinc prices increased amid signs of improved market conditions and tighter than expected supply.

The prices of crop products (+3.0%) rose for the third consecutive month in May. Higher prices for wheat (+10.7%) and grains (except wheat) (+3.1%) strongly contributed to the increase. Cold weather in Russia and strong rainstorms in Northern Europe have reduced the expected global production of wheat for this crop year. Meanwhile, the continuation of dry conditions throughout the Prairie provinces hampered Canadian production, putting additional upward pressure on prices.

Year over year

The RMPI increased 7.6% on a yearly basis in May following year-over-year gains in March (+0.4%) and April (+2.9%). The larger year-over-year increase in May is partially explained by a base effect, as the RMPI declined significantly on a month-over-month basis in May 2023 (-5.4%). Prices for crude energy products were the main reason for the monthly decline in May 2023, declining 9.8%, in part because of concerns surrounding global economic conditions and oil demand.

Conventional crude oil (+11.0%) was the primary contributor to May 2024's year-over-year increase. Other product groups that experienced notable year-over-year price increases include gold, silver, and platinum group metal ores and concentrates (+17.3%), synthetic crude oil (+12.6%) and hogs (+17.7%).

In contrast, product groups that experienced relatively large price declines in May 2024 relative to May 2023 include canola (-9.8%), nickel ores and concentrates (-9.9%), natural gas (-18.3%) and grains (except wheat) (-6.7%). Strong supply was a key factor that pushed prices down for many of these groups over the 12 months ending in May 2024.

Did you know we have a mobile app?

Download our mobile app and get timely access to data at your fingertips! The StatsCAN app is available for free on the App Store and on Google Play.

Note to readers

The Industrial Product Price Index (IPPI) and the Raw Materials Price Index (RMPI) are available at the Canada level only. Selected commodity groups within the IPPI are also available by region.

With each release, data for the previous six months may have been revised. The indexes are not seasonally adjusted.

The IPPI reflects the prices that producers in Canada receive as goods leave the plant gate. The IPPI does not reflect what the consumer pays. Unlike the Consumer Price Index, the IPPI excludes indirect taxes and all costs that occur between the time a good leaves the plant and the time the final user takes possession of the good. This includes transportation, wholesale and retail costs.

Canadian producers export many goods. Canadian producers often indicate goods' prices in foreign currencies, especially in US dollars, which are then converted into Canadian dollars. This is particularly the case for motor vehicles, pulp and paper products, and wood products. Therefore, fluctuations in the value of the Canadian dollar against its US counterpart affect the IPPI. However, the conversion to Canadian dollars reflects only how respondents provide their prices. This is not a measure that takes into account the full effect of exchange rates.

The conversion of prices received in US dollars is based on the average monthly exchange rate established by the Bank of Canada and available in Table 33-10-0163-01 (series v111666275). Monthly and annual variations in the exchange rate, as described in the release, are calculated according to the indirect quotation of the exchange rate (for example, CAN$1 = US$X).

The RMPI reflects the prices paid by Canadian manufacturers for key raw materials. Many of those prices are set on the world market. However, as few prices are denominated in foreign currencies, their conversion into Canadian dollars has only a minor effect on the calculation of the RMPI.

Products

Statistics Canada launched the Producer Price Indexes Portal as part of a suite of portals for prices and price indexes. This webpage provides Canadians with a single point of access to a variety of statistics and measures related to producer prices.

The video "Producer price indexes" is available on the Statistics Canada Training Institute webpage. It introduces Statistics Canada's producer price indexes: what they are, how they are made and what they are used for.

Next release

The industrial product and raw materials price indexes for June will be released on July 19.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: