Farm income, 2023

Released: 2024-05-29

Realized net income for Canadian farmers rose 18.3% to $14.5 billion in 2023, as growth in receipts offset the rise in expenses. The increase in 2023 followed a 4.1% decline in 2022 and a 69.6% increase in 2021. Excluding cannabis, realized net income in 2023 was up 16.2% to $14.2 billion.

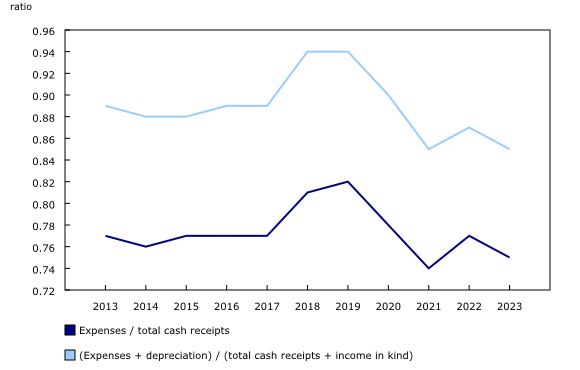

Realized net income is the difference between a farmer's cash receipts and operating expenses, minus depreciation, plus income in kind.

In 2023, total farm cash receipts rose 4.4% compared with 2022. Higher prices for cattle and calves resulted in increased livestock receipts (+$3.3 billion), while higher crop marketings contributed to increased crop receipts (+$1.7 billion). Program payments decreased $758.4 million in 2023, as much of the relief related to the 2021 drought had been paid out in 2022.

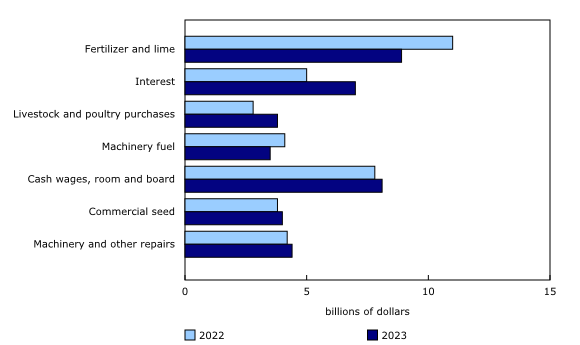

Total expenses (after rebates) increased at a more modest pace (+2.4%) than receipts in 2023. Farmers faced higher costs for interest expenses (+39.1%) and livestock and poultry purchases (+36.5%), while key agricultural inputs, such as fertilizer and lime (-18.9%) and machinery fuel (-14.1%) declined following gains in 2022.

Changes in realized net income ranged from an increase of $1.9 billion in Saskatchewan to a decline of $244.3 million in Quebec. The gains in Saskatchewan were mainly the result of a drop in fertilizer prices, the largest expense item in the province, while lower hog receipts were the main factor in the decrease in Quebec.

Farm cash receipts rise due to higher cattle and calves' prices and crop marketings

Farm cash receipts, which include crop and livestock revenues, as well as program payments, rose 4.4% from 2022 to $99.6 billion in 2023.

Strong cattle receipts were responsible for most of the increase in total farm cash receipts in 2023, along with increased crop marketings. The 2022 crop harvest pushed marketings higher for 2023, as crop production in 2022 returned to normal levels following the drought in Western Canada in 2021. Crop prices dropped in 2023 following their record highs in 2022 as global wheat and corn supplies improved.

Farm cash receipts were up in every province. Saskatchewan (+$1.6 billion) posted the largest increase, followed by Alberta (+$1.1 billion).

Strength in cattle markets drives the rise in livestock receipts

In 2023, livestock receipts climbed 9.8% to $37.3 billion, the third consecutive year of growth, where the 2023 gain was attributable to increases across the cattle and calves, poultry and dairy sectors. The increase in livestock receipts followed a 11.9% rise in 2022 and a 13.7% gain in 2021.

Cattle receipts increased 25.4% to $13.5 billion in 2023, primarily due to a rise in slaughter cattle receipts (+21.2%). Higher feed costs and tight supplies following drier growing conditions pushed farmers to further thin their herds to help contain rising costs. This resulted in the Canadian cattle herd falling to its lowest level since January 1, 1989. In 2023, the number of cattle slaughtered decreased 4.5% compared with 2022, while demand for beef remained robust, putting further upward pressure on prices. Slaughter cattle prices rose 27.4% in 2023, driven by strong demand in Canadian and US markets.

The supply-managed sector, which accounted for about 40% of total livestock receipts, grew 5.7% to $14.9 billion in 2023. A 3.9% rise in dairy receipts (unprocessed milk from bovine) to $8.6 billion accounted for just over one-third of the increase in the supply managed sector. Unprocessed milk prices were up 3.3% in 2023, following an 11.3% rise in 2022. On the other hand, total poultry receipts rose 8.1% compared with 2022, as farmers continued to face challenges posed by the avian influenza virus and rising production costs.

In 2023, receipts for hogs dropped 10.3% to $5.9 billion, driven by an 11.4% reduction in prices. Slaughter hogs were responsible for more than three-quarters of the decline in total hog receipts. Furthermore, all provinces reported decreases in farm cash receipts for hogs, with Quebec (-15.8%) and Ontario (-10.1%) reporting the largest declines. In 2023, a major pork processing facility closed in Quebec, following losses from increased operating costs, labour challenges, and reduced global demand for exports. In response, Quebec introduced a voluntary herd reduction program to encourage producers to leave the industry, and this further contributed to the decline in receipts.

Higher wheat marketings and potato prices drive the rise in crop receipts

Following three years of double-digit increases, crop receipts rose 3.1% to $55.7 billion in 2023. Wheat (excluding durum) was responsible for 59.5% of the increase in total crop receipts in 2023, while fresh potatoes were responsible for 13.5%.

Marketings for most major grains surged in 2023, while domestic crop prices dropped in response to higher opening inventories. However, prices in 2023 were elevated when compared with the previous five years. Farmers faced drier growing conditions in 2023 compared with 2022, resulting in a smaller harvest.

Farm cash receipts for wheat (excluding durum) increased 10.6% to $10.3 billion in 2023. Prices for wheat (excluding durum) dropped 11.6%, while marketings rose 25.0%, compared with their 2022 levels.

Farm cash receipts for fresh potatoes grew 12.9% from 2022 to $2.0 billion in 2023. Prices rose 12.8% as a result of contract settlements between producers and processors, while potato marketings were flat. Wet harvest conditions in the Atlantic provinces resulted in reduced harvested potato area.

Farm cash receipts for maple syrup and other maple products fell 39.3% from 2022 to $425.2 million in 2023. Production was down mainly due to unfavourable weather and temperature fluctuations, reducing the yields in 2023 for all maple-producing provinces.

Excluding cannabis, crop receipts were up 3.5% to $52.8 billion in 2023.

Eastern payment gains masked by western decline

In 2023, total direct payments to Canadian producers fell 10.3% to $6.6 billion, following a gain of 23.6% in 2022.

In 2023, direct payments to Alberta, Saskatchewan and Manitoba declined as the 2021 drought-related crop insurance payments ended in 2022. The sharp declines in the western provinces overshadowed the increased payments made to farmers in the eastern provinces, following several weather events such as Hurricane Fiona.

Increases in direct payments ranged from 15.1% in New Brunswick to 94.2% in Nova Scotia. In 2023, eastern provinces faced wildfires, as well as multiple extreme weather events such as hurricanes, tropical storms and a derecho, impacting agriculture production and farms across the provinces.

Interest expenses rise, while fertilizer and fuel expenses drop

Total farm operating expenses (after rebates) rose 2.3% to $74.7 billion in 2023—a modest gain compared with the increase in 2022 (+19.4%).

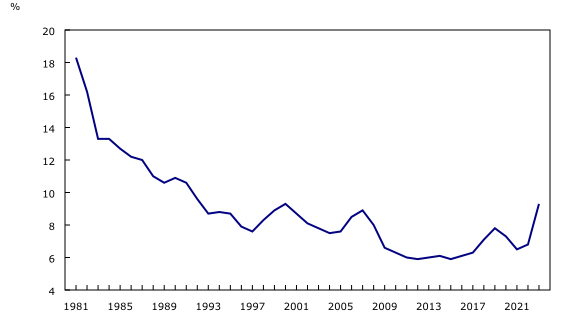

In 2022, the Bank of Canada began to raise interest rates in response to widespread inflation in the Canadian economy. Interest expenses (after rebates) were up 39.1% to $6.9 billion in 2023 on higher average interest rates (+33.7%) and debt levels (+4.1%). This was the largest increase in interest expenses since 1981 (+50.1%). For reference, in 1981, interest expenses comprised a large share (18.3%) of total operating expenses. However, in 2023, the interest expense share was 9.3%—the highest in over 20 years.

Livestock and poultry purchases rose 36.5% to $3.8 billion in 2023. Prices for cattle and calves rose sharply, contributing to higher livestock and poultry purchases.

Fertilizer expenses for Canadian farmers fell 18.9% to $8.9 billion in 2023. Fertilizer prices in 2023 weakened as supplies improved and key products involved in its production, such as natural gas, recorded price decreases. Fertilizer prices faced upward pressure in 2022 from high natural gas prices, Russia's invasion of Ukraine, as well as the 35% tariff placed on most goods coming from Russia, including fertilizers. Russia's invasion of Ukraine continued to impact fertilizer markets in 2023.

Machinery fuel expenses for farmers fell 14.1% to $3.5 billion in 2023. Fuel prices began to rise in 2021 as economies around the world opened up after taking measures to limit the spread of the COVID-19 pandemic. In 2022, fuel prices were supported by supply-chain disruptions and were also influenced by sanctions imposed on Russia following its invasion of Ukraine.

Total farm expenses (after rebates), which include operating expenses and depreciation, increased 2.4% to $85.1 billion in 2023, as depreciation charges rose 2.7%. Total farm expenses were up in every province except Saskatchewan (-2.1%).

Total net income declines

Total net income decreased by $8.9 billion from 2022 to $12.8 billion in 2023.

Total net income is realized net income adjusted for changes in farmer-owned inventories of crops and livestock. It represents the return to owner's equity, unpaid farm labour, management and risk. In 2023, the year-end inventories were lower compared with 2022 due to increased marketings. Inventories in 2022 were higher as result of better growing conditions, which led to higher production following the drought in 2021.

Excluding cannabis, total net income decreased $9.1 billion to $12.7 billion in 2023.

Did you know we have a mobile app?

Download our mobile app and get timely access to data at your fingertips! The StatsCAN app is available for free on the App Store and on Google Play.

Note to readers

Realized net income can vary widely from farm to farm because of several factors, including the farm's mix of commodities, prices, weather and economies of scale. This and other aggregate measures of farm income are calculated on a provincial basis employing the same concepts used to measure the performance of the overall Canadian economy. They are measures of farm business income, not farm household income.

Preliminary farm income data for the previous calendar year are first released in May of each year, five months after the reference period. Revised data are then released in November of each year, incorporating data received too late to be included in the first release. Data for the year prior to the reference period are also subject to revision.

Additional financial data for 2023, collected at the individual farm business level using surveys and other administrative sources, will be made available later this year. These data will help explain differences in the performance of various types and sizes of farms.

A summary set of farm income components excluding cannabis-related receipts and expenses is available upon request. For confidentiality reasons, non-cannabis estimates for some of the provinces are not available.

For details on farm cash receipts for the first quarter of 2024, see the "Farm cash receipts" release in today's Daily.

For the latest information on the Census of Agriculture, visit the Census of Agriculture portal.

For more information on agriculture and food, visit the Agriculture and food statistics portal.

Products

The interactive data visualization tool "Net farm income, by province," is available on the Statistics Canada website.

The Agriculture and food statistics portal, accessible from the Subjects module of the Statistics Canada website, provides users a single point of access to a wide variety of information related to agriculture and food.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: