Annual wages, salaries and commissions of T1 tax filers, 2022

Released: 2024-04-12

Highest inflation rate in 40 years takes an outsized bite out of annual wages and salaries in 2022

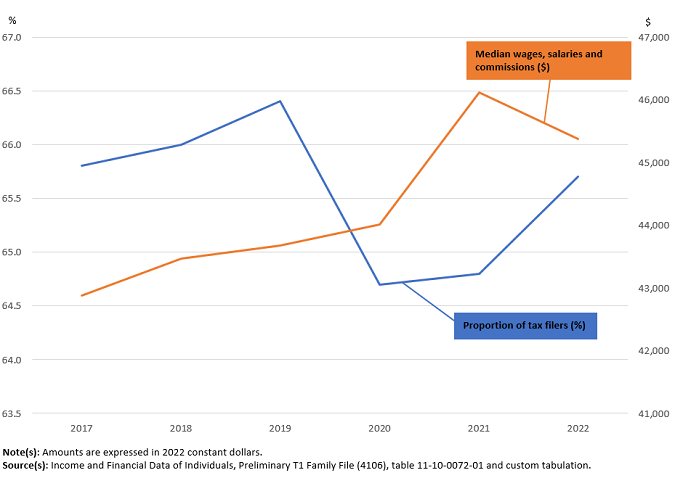

The Consumer Price Index rose 6.8% on an annual average basis in 2022, the largest increase in 40 years, taking an outsized bite out of real annual wages, salaries and commissions reported by tax filers in that year. In 2022, tax filers reported median wages of $45,380, down 1.6% from 2021 after adjusting for inflation.

This decline coincided with a recovery of employment in lower wage sectors in 2022, which followed periods of COVID-19 pandemic-related shutdowns in 2020 and 2021. For example, the arts, entertainment and recreation sector and the accommodation and food services sector accounted, respectively, for 1.6% and 7.1% of total employment in 2022, compared with 1.4% and 6.3% in 2021. Median annual wages within each of these sectors increased in 2022 (+13.8% in arts, entertainment and recreation; +11.9% in accommodation and food services) but remained the lowest of all sectors.

Tax filers working in sectors that were less affected by the pandemic saw decreases in their inflation-adjusted median annual wages in 2022, with the largest declines in educational services (-5.3%) and public administration (-5.2%). Those working in the transportation and warehousing (-3.2%), agriculture, forestry, fishing and hunting (-2.5%), utilities (-2.5%), construction (-2.2%), and health care and social assistance (-2.1%) sectors also saw declines in their inflation-adjusted median annual earnings.

In 2022, median annual wages decreased in most provinces and territories, after adjusting for inflation. The Northwest Territories had the largest decrease (-7.2%) among all provinces and territories, but maintained the highest annual median wage. This decrease was followed by Yukon (-4.1%), Alberta (-3.7%), Saskatchewan (-3.6%) and Manitoba (-3.4%). Increases were seen in Nunavut (+2.0%), Quebec (+1.1%) and New Brunswick (+0.9%).

Earnings of lower wage earners increase

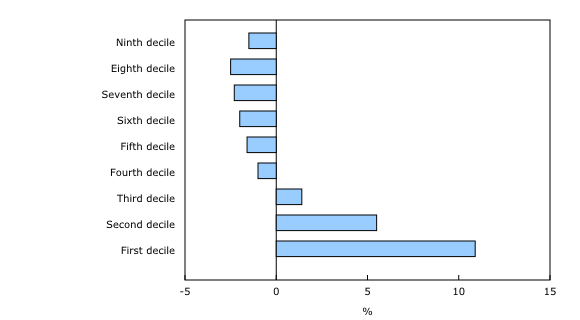

Consistent with increases in wages for lower-wage industries, inflation-adjusted wages also rose for low-wage workers from 2021 to 2022, highlighted by a 10.9% increase in earnings at the first wage decile and a 5.5% increase at the second decile.

Meanwhile, higher wage earners saw a decrease in earnings from 2021 to 2022, with the largest declines for workers in the "upper-middle" of the earnings distribution. For example, workers at the eighth decile saw inflation-adjusted annual earnings decline by 2.5% in 2022. The eighth decile corresponds to the amount where 8 out of 10 workers have lower earnings and 2 out of 10 workers have higher earnings.

Higher median annual wages in 2022 than in 2019

Despite the decline from 2021 to 2022, inflation-adjusted annual median wages, salaries and commissions were higher in 2022 compared with 2019, the last complete pre-pandemic year, largely due to the combination of relatively strong wage growth and low inflation observed in 2021. From 2019 to 2022, wage growth was fastest in British Columbia (+11.8%), Quebec (+7.0%) and Yukon (+6.7%), while wages declined in the Prairie provinces and Newfoundland and Labrador (-0.5%).

Did you know we have a mobile app?

Get timely access to data right at your fingertips by downloading the StatsCAN app, available for free on the App Store and on Google Play.

Note to readers

Data for this release are produced using the preliminary version of the T1 Family File, which is based on an early version of the T1 file received by Statistics Canada from the Canada Revenue Agency.

The term "earnings" in the release includes the annual wages, salaries and commissions declared by tax filers.

All figures for previous years are in 2022 constant dollars and have been adjusted for inflation using the Consumer Price Index, table 18-10-0005-01.

This release provides data on wages, salaries and commissions from all sources of tax filer aged 15 years and older. They could have worked full and part time as well as full and part year. The income is received throughout the year for paid employment as reported on T1 Income Tax and Benefit returns. It is based on the employment income recorded on their T4 Statement of Remuneration Paid. In addition to employment income, wages, salaries and commissions includes training allowances, tips, gratuities and royalties received from employers during the tax year. Tax-exempt employment income of tax filers reported on the T90 tax form is also included. Self-employment income is excluded.

Sectors refers to the two-digit sector assigned to a tax filer using the North American Industry Classification System. A sector is assigned to each tax filer based on the industry that accounted for the highest share of their total employment income during the tax year over all of their T4 slips. The category "not available" in the main sector table represents tax filers for whom an industry code could not be assigned.

The median is the value in the middle of a group of values (i.e., half of people have wages, salaries and commissions above this value and half of people have wages, salaries and commissions below this value).

Products

The document "Technical Reference Guide for the Preliminary Estimates from the T1 Family File (T1FF)" (11260001) presents information about the methodology, concepts and data quality for the data available in this release.

Tables 11-10-0072-01 and 11-10-0073-01 associated with this release are available for free on the Statistics Canada website for Canada, provinces and territories, census metropolitan areas, and census agglomerations. Additional data on wages, salaries and commissions of tax filers (11230001, various prices) are available for other levels of geography. These custom services are available upon request.

The Income, pensions, spending and wealth statistics portal, which is accessible from the Subjects module of the Statistics Canada website, provides users with a single point of access to a wide variety of information related to income, pensions, spending and wealth.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: