Fewer charitable donors, less money donated in 2022

Released: 2024-03-14

Just under 5 million Canadian tax filers (17.1% of all tax filers) declared making charitable donations in 2022, 0.3% fewer than a year earlier, despite the number of tax filers increasing 3.0% year over year. The total amount donated fell for the first time since 2016, decreasing 3.1% to $11.4 billion. This decrease in total donations followed the previous year's increase of 11.5%, the largest since 2005.

More mid-sized donations, fewer large ones

While both the number of donors and total donations decreased, tax filers made more mid-sized donations and fewer smaller ones, leading to a 5.6% increase in median donations to $380 in 2022. There were 1.6% fewer donations of $499 or less and 1.4% more donations of $500 to $25,000.

The number of tax filers reporting donations of $100,000 or more fell by 12.4% in 2022, after rising by one-third (+33.6%) in 2021, while the total amount they donated declined by 13.4%.

An increasing share of total donations comes from higher-income tax filers

In 2022, 6.2% of tax filers with an income below $40,000 reported making a charitable donation, compared with 39.2% of those with an income of $100,000 or more. The median income of charitable donors ($71,240) was significantly higher than the median income of all tax filers ($41,930).

Tax filers with incomes of $100,000 or more (13.0% of tax filers) continued to account for the largest share of charitable giving in 2022 (+0.9 percentage points to 59.1%) despite a notable decrease in the total value of donations from those with income from $200,000 to $499,999. While this group of higher income tax filers had a 14.1% increase in the number reporting donations, the average donation amount fell 23.1% from 2021 to 2022.

Conversely, Canadians with incomes of less than $40,000, representing 48.8% of all tax filers and 17.5% of all donors, accounted for 7.4% of the total value of donations in 2022, a smaller share than that seen in 2021 (8.7%).

The highest income group ($1 million or more annually) reported the highest median donation in 2022 (-5.2% to $5,150) followed by those making $500,000 to $999,999 (+1.0% to $1,930). These two income groups accounted for 1.2% of all donors in 2022, but over one-fifth (22.5%) of the total donation value reported.

Seniors remain the most charitable Canadians

The older the tax filer, the more likely they are to make charitable donations. In 2022, 4.8% of tax filers under the age of 25 reported charitable donations. As the age of the tax filer rises, this proportion grows, peaking at 23.9% for those aged 65 or older. Overall, 3.2% of charitable donors in 2022 were aged 24 years or younger, while 34.2% were aged 65 and older.

For every $100 donated in 2022, $1 came from those aged 24 and younger, while $48 came from those aged 65 and older. Seniors had the highest median donation ($590).

Men are more likely to declare charitable donations than women and give more overall

Men (18.1%) were more likely to report charitable donations on their 2022 tax returns than women (16.2%). However, the share of women reporting a charitable donation has risen from 42.0% in 1997 to 48.9% in 2022. Nevertheless, men continue to donate more overall, accounting for 63.4% of total charitable donations, up from 62.7% in 2016.

Men claimed a median value of $410 on their 2022 tax return, up 2.5% from a year earlier, while women claimed $350, up 6.1%.

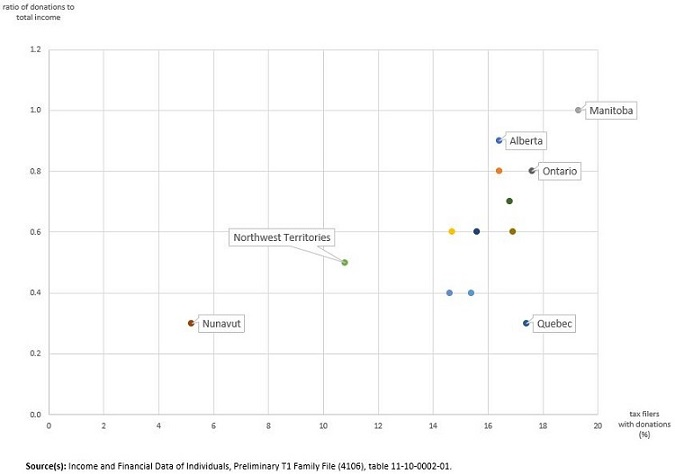

British Columbia and Ontario are leading the decrease in charitable donations

The overall decline in charitable donations in 2022 was driven by British Columbia (-11.8%) and Ontario (-6.0%). Newfoundland and Labrador recorded the largest relative decline (-13.2%).

Charitable giving grew at the fastest pace in Northwest Territories (+27.7%), Alberta (+8.2%) and Quebec (+6.8%).

Manitoba remained Canada's most charitable province in 2022 with just under one in five tax filers (19.3%) declaring a donation on their tax form, with a median donation of $590 (+7.3% from 2021). These donations were equal to a value equivalent to nation-leading 1.0% of total income.

Conversely, 1 in 20 tax filers in Nunavut (5.2%) declared a charitable donation on their tax form in 2022, donating an amount equal to 0.3% of all income declared in the province. Nevertheless, Nunavut had the highest median donation nationally at $900.

Median donations declined in Newfoundland and Labrador (down 2.5% to $390) and Prince Edward Island (down 1.9% to $520) in 2022.

Tax filers in Steinbach and Winkler have the highest median donations in Canada

Steinbach (-1.7% to $2,230) and Winkler (+0.0% to $1,820) remained Canada's most charitable urban centres of 10,000 or more people in 2022.

Abbotsford-Mission ($1,000) had the highest median donation among Canadian cities of 100,000 or more tax filers for the 21st consecutive year, while Québec (22.1%) had the largest share of donors.

Did you know we have a mobile app?

Get timely access to data right at your fingertips by downloading the StatsCAN app, available for free on the App Store and on Google Play.

Note to readers

In this release, charitable donation data are based on a preliminary version of the T1 Family File (tax filer data).

Statistics on changes in amounts between years do not take inflation into account. The Consumer Price Index rose 6.8% in 2022.

The median is the value in the middle of a group of values (e.g., half of people make donations above this value and half of people make donations below this value).

All data in this release have been tabulated according to the 2021 Standard Geographical Classification used for the 2021 Census.

Canadians contribute in many ways to charitable organizations. This release reports only on donations to charities and approved organizations for which official tax receipts were provided and claimed on tax returns. To verify whether a charity is registered under the Income Tax Act, tax filers can consult the charity listings available on the Canada Revenue Agency website. It is possible to carry donations forward for up to five years after the year in which they were made. Donations reported for the 2022 taxation year could include donations that were made in any of the five previous years. According to tax laws, tax filers are permitted to claim both their donations and those made by their spouse to receive better tax benefits. Consequently, the number of people who made charitable donations may be higher than the number who claimed tax credits.

Charitable donations made through crowdfunding platforms for individuals or organizations not linked to charities registered under the Income Tax Act are not captured in this data release. Moreover, several charitable organizations will not issue a tax receipt for small donations. Other small donations, such as those made by text message without issued tax receipts or donations at checkout counters of retail stores, are also not covered.

Another source of donation data at Statistics Canada is the General Social Survey (GSS) on Giving, Volunteering and Participating. This survey collects information on all monetary donations reported by individuals, regardless of whether the donation resulted in a tax credit. For 2018, data from this survey revealed close to $11.9 billion in total donations by Canadians, while donations by individuals, as reported on their tax forms, totalled just over $9.9 billion (for comparability, the territories were removed from the tax-reported amount). The large difference in median amounts reported also points to the fact that many small donations are not captured in the tax data.

The GSS also focuses on volunteering. While the youngest age group (15 to 24 years old) had the lowest participation rate with respect to charitable donations, this same age group had the highest participation rate in volunteer activities.

Products

The document "Technical Reference Guide for the Preliminary Estimates from the T1 Family File" (11260001) presents information about the methodology, concepts and quality for the data available in this release.

Tables 11-10-0130-01, 11-10-0002-01 and 11-10-0003-01 for this release are available for free on the Statistics Canada website for Canada, the provinces and territories, census metropolitan areas, and census agglomerations.

Additional data on charitable donors (13C0014, various prices) are also available for Canada, the provinces and territories, economic regions, census divisions, census subdivisions, census metropolitan areas, census agglomerations, census tracts, and postal-based geographies. These custom services are available upon request.

The Income, pensions, spending and wealth statistics portal, which is accessible from the Subjects module of the Statistics Canada website, provides users with a single point of access to a wide variety of information related to income, pensions, spending and wealth.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: