Consumer Price Index: Annual review, 2023

Released: 2024-01-16

157.1

2023

3.9%

(annual change)

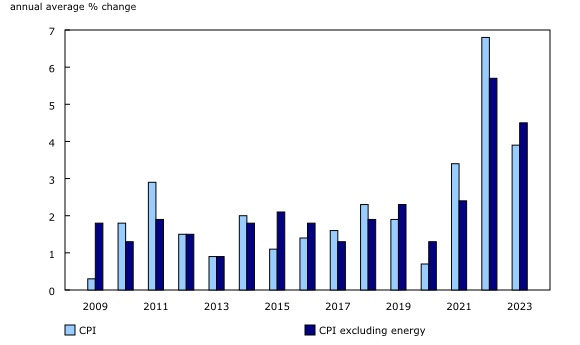

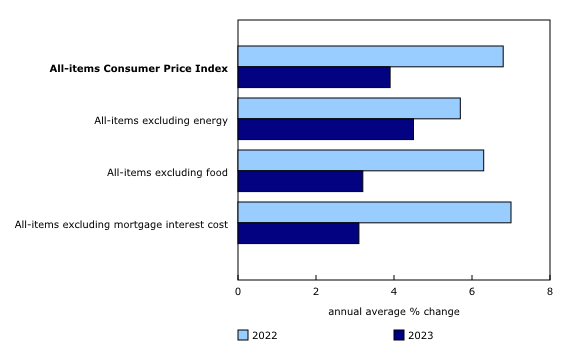

The Consumer Price Index (CPI) rose 3.9% on an annual average basis in 2023, following a 40-year high increase of 6.8% in 2022 and a 3.4% increase in 2021. Aside from 2022, the annual average increase in 2023 is the largest since 1991. Excluding energy, the annual average CPI rose 4.5% in 2023 compared with 5.7% in 2022.

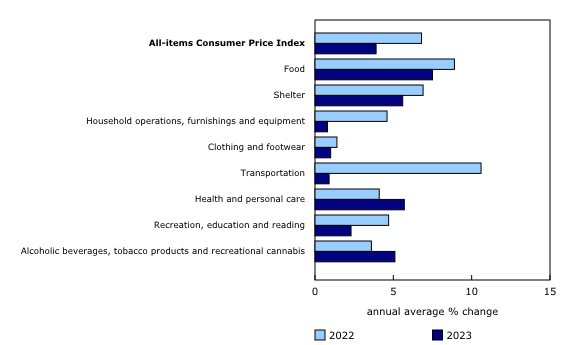

While prices rose in every major component on an annual average basis in 2023, price growth slowed in six of eight components compared with 2022. The transportation component (+0.9%) slowed the most as a result of lower gasoline prices, with notable decelerations also seen in the food (+7.5%) and shelter (+5.6%) components.

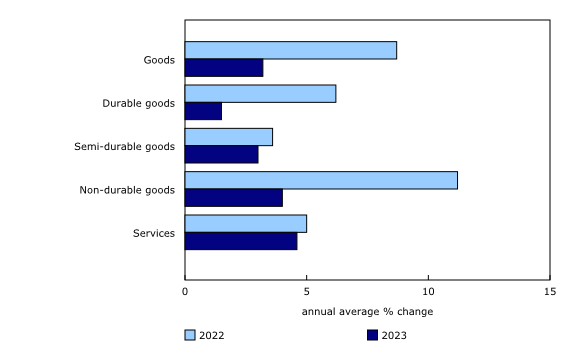

Price growth for goods eased to 3.2% in 2023, down from 8.7% in 2022, amid the continued easing of supply chain pressures. Prices for gasoline, natural gas and food contributed to a slowdown in non-durable goods (+4.0%). Prices for durable goods also increased at a slower pace in 2023 (+1.5%) compared with 2022 (+6.2%), led by passenger vehicles amid improved supply chains and inventories compared with 2022 as the supply of semiconductors continued to improve. Lower prices for furniture and household appliances also contributed to the deceleration.

While price growth for goods slowed 5.5 percentage points in 2023, price growth for services only slowed 0.4 percentage points, resulting in a 4.6% increase. Deceleration in homeowners' replacement cost and other owned accommodation expenses due to base-year effects was almost entirely offset by acceleration in mortgage interest cost, and to a lesser extent, rent.

Despite showing a decelerating trend since January 2023, year-over-year price growth in the all-items CPI hovered between 3% and 4% for the last six months of 2023.

Energy prices lead the deceleration in the Consumer Price Index

Deceleration in the annual average headline inflation was led by lower energy prices, which fell 4.2% on an annual average basis in 2023 following a 22.5% increase in 2022. The slowdown in energy prices was led by gasoline prices, which fell 7.6% in 2023 after a 28.5% increase in 2022 when crude oil prices rose due to a number of factors, including supply uncertainty resulting from Russia's invasion of Ukraine as well as higher global demand as travel increased amid easing COVID-19 restrictions.

Prices for fuel oil, which are also related to crude oil prices, fell in 2023 (-11.2%) compared with 2022 (+59.6%).

Natural gas prices declined 4.2% in 2023 following a 26.9% increase in 2022, when commodity prices increased amid sustained global demand and uncertainty in global energy markets. In 2023, however, consumer natural gas prices eased with commodity prices.

Price growth for food slows, but remains elevated in 2023

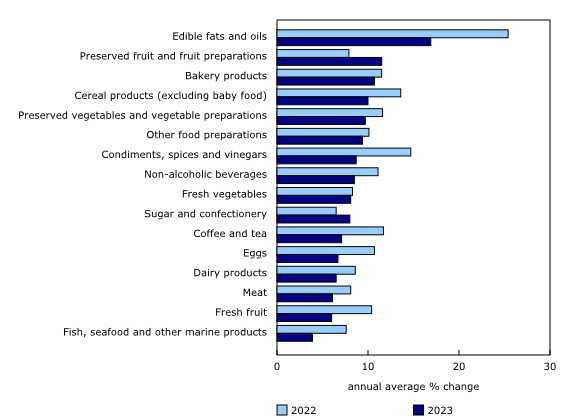

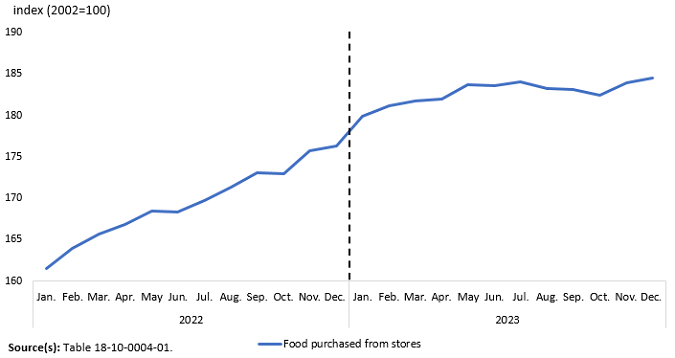

Prices for food purchased from stores rose 7.8% on an annual average basis in 2023. While this was a smaller increase than in 2022 (+9.8%), it was still larger than the annual average increase in the all-items CPI. Grocery price inflation remained broad-based in 2023 with a number of contributing factors, including poor weather in growing regions, higher input costs, diseases such as bird flu and African swine fever, and Russia's invasion of Ukraine. Among the grocery products with the largest price increases were edible fats and oils (+16.9%), preserved fruit and fruit preparations (+11.5%), bakery products (+10.7%), cereal products (+10.0%) and preserved vegetable and vegetable preparations (+9.7%).

Although grocery price levels remained elevated, they were relatively stable over the course of 2023, causing year-over-year growth to decelerate in all but two months, after peaking in January 2023.

Consumers also paid 6.5% more to eat at restaurants on an annual average basis in 2023 following a similar increase in 2022 (+6.7%).

Homeowners' replacement cost and other owned accommodation expenses decelerate, while mortgage interest cost and rent accelerate

On an annual average basis, shelter prices rose at a slower pace in 2023 (+5.6%) compared with 2022 (+6.9%). The slowdown stemmed from deceleration in homeowners' replacement cost (+0.1%) and other owned accommodation expenses (-1.0%), attributable to the cooling of the housing market amid a higher interest rate environment.

At the same time, higher borrowing costs contributed to faster annual average price growth for mortgage interest cost and rent. The mortgage interest cost index rose 28.5% in 2023, the largest increase on record, as more mortgages were initiated or renewed at higher interest rates. This index was the largest upward contributor to the annual average all-items CPI in 2023.

Consumers also paid 6.5% more for rent in 2023 following a 4.6% increase in 2022. In addition to increased immigration, a higher interest rate environment may have stimulated rental demand by increasing the potential cost of homeownership.

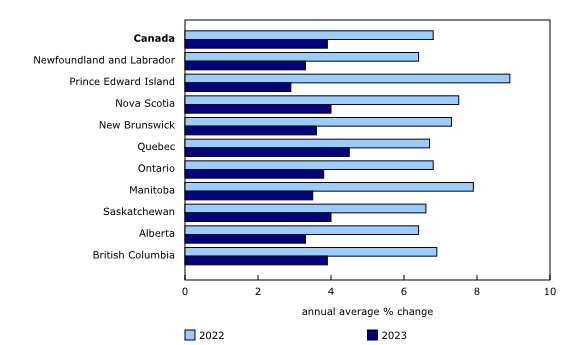

Regional highlights

Annual average prices rose in all provinces in 2023, but at a slower pace than in 2022.

Did you know we have a mobile app?

Get timely access to data right at your fingertips by downloading the StatsCAN app, available for free on the App Store and on Google Play.

Note to readers

This release examines the percentage change between the annual average Consumer Price Index (CPI) in 2022 and 2023.

Annual average indexes are obtained by calculating the average of the 12 monthly index values over the calendar year. The annual average percent change should not be confused with the 12-month percent change that is published every month with the release of the CPI. Unlike the annual average change, the 12-month change compares the monthly index level with the level from the same month a year earlier.

Explore the Consumer Price Index tools

Check out the Personal Inflation Calculator. This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation for the average Canadian household—the CPI.

Visit the Consumer Price Index portal to find all CPI data, publications, interactive tools, and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Browse the Consumer Price Index Data Visualization Tool to access current (Latest Snapshot of the CPI) and historical (Price trends: 1914 to today) CPI data in a customizable visual format.

Products

The Consumer Price Index Data Visualization Tool is available on the Statistics Canada website.

More information about the concepts and use of the Consumer Price Index is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: