Activities of multinational enterprises in Canada and abroad, 2021 (actual) and 2022 (preliminary)

Released: 2023-12-07

In 2022, foreign and Canadian multinational enterprises operating in Canada generated $197.1 billion in capital investment (+9.0%), employed almost 5 million people (+4.7%), and exported and imported over $1 trillion in merchandise goods (+23.9%).

Data on the activities of multinational enterprises (MNEs) in Canada are now available with an increased timeliness for selected types of activities. Preliminary data on gross fixed capital formation, number of jobs and merchandise trade are available for reference year 2022.

Outside of Canada, affiliates of Canadian MNEs continued to grow their employment (+5.2%) and their sales surpassed $1 trillion (+6.7%) in 2021.

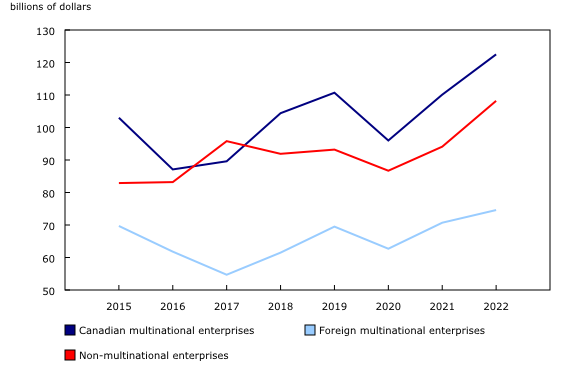

Increase in capital investment by Canadian multinationals outpaces that of foreign multinationals

Gross fixed capital formation, also known as capital investment, increased by $30.4 billion in 2022 to reach $305.2 billion, a second consecutive increase after the onset of the COVID-19 pandemic. Together, Canadian and foreign MNEs accounted for nearly two-thirds of all capital investment in the corporate sector in 2022.

Following sharp declines in 2020, capital investment by MNEs went up over the next two years, with Canadian MNEs (+$14.1 billion in 2021 and +$12.4 billion in 2022) outpacing foreign MNEs (+$8.0 billion in 2021 and +$3.9 billion in 2022) in both years.

Investments by Canadian MNEs were concentrated in non-residential construction, where their spending rose by $9.4 billion in 2021, followed by an additional $9.1 billion increase in 2022. These investments were largely made in the transportation and warehousing sector, as well as the mining, quarrying, and oil and gas extraction sector. Most of this additional investment occurred in Alberta and British Columbia. Overall, Ontario ($32.5 billion) and Alberta ($30.9 billion) were the provinces in which Canadian MNEs had the most capital investment in 2022.

Although Canadian MNEs had considerably higher spending than foreign MNEs on non-residential construction in 2022, foreign MNEs invested more than Canadian MNEs in intellectual property products. From 2016 to 2022, investment by foreign MNEs in intellectual property products doubled.

Employment at multinationals surpasses pre-pandemic levels

In 2021, the number of jobs at MNEs in Canada hit 4.73 million, approaching their pre-pandemic level (4.74 million in 2019). Employment continued to grow in 2022, reaching 4.95 million.

Employment at foreign MNEs went up by 7.3% in 2021 and by 5.9% in 2022, largely in the professional, scientific and technical services sector as well as in the manufacturing sector. Employment growth at Canadian MNEs (+7.5%) slightly surpassed that of foreign MNEs in 2021, but the growth rate slowed to 3.4% in 2022.

Meanwhile, employment at the affiliates abroad of Canadian MNEs rose by approximately 85,000 in 2021 (the latest data available) to reach 1.73 million. Half of the increase was attributable to those operating in the United States, with growth also observed in Australia and Germany.

Multinationals import and export over $1 trillion worth of goods

Following a growth of 17.0% in 2021, the value of international merchandise trade by MNEs increased by a further 23.9% in 2022 to reach nearly $1.2 trillion.

The value of goods imports by MNEs went up by $98.2 billion in 2022 to reach $560.3 billion. Foreign MNEs in Ontario alone (+$50.8 billion) were responsible for over half of this increase. Foreign MNEs tend to import goods from related parties, which is a common global goods production and distribution arrangement between a parent corporation and its affiliate in another country. In 2022, nearly three-fifths (58.1%) of foreign MNEs' imports were from a related party, as compared with around one-sixth (16.1%) of Canadian MNEs' imports.

At the same time, the value of goods exports by MNEs reached $616.7 billion in 2022, up $129.2 billion from the previous year. Roughly half of the year-over-year increase was attributed to MNEs in Alberta, primarily in the mining, quarrying, and oil and gas extraction sector. Overall, foreign MNEs recorded a higher share of exports to a related party (58.1%) than Canadian MNEs (37.0%).

Growth in sales by Canadian multinationals faster in Canada than abroad in 2021

Sales by affiliates abroad of Canadian MNEs went up $65.3 billion (+6.7%) in 2021, to surpass $1 trillion. The increase primarily came from affiliates operating in the United States, followed by Germany. Growth in sales abroad was partially mitigated by a strong appreciation in the Canadian dollar.

Meanwhile, Canadian MNEs increased their sales from domestic operations by $138.9 billion (+12.5%) in 2021, after a decline of $100.3 billion in 2020. For the first time since 2014, the growth of Canadian multinationals' sales at domestic operations was larger than the growth at their affiliates abroad. The increase in sales by the domestic operations of Canadian MNEs was led by the mining, quarrying, and oil and gas extraction (+$41.7 billion) and the manufacturing (+$35.7 billion) sectors.

Note to readers

This release integrates analysis from both the Activities of Multinational Enterprises in Canada and Activities of Canadian Multinational Enterprises Abroad programs under the broad framework of multinational enterprises.

Activities of multinational enterprises in Canada cover foreign multinationals (firms in Canada controlled by a foreign parent) and Canadian multinationals (Canadian-controlled firms with a foreign affiliate).

Activities of Canadian multinational enterprises abroad cover affiliates abroad that are Canadian majority-owned. The figures represent the total sales, employment and assets of those affiliates. These affiliates also include those who are ultimately controlled by foreign enterprises. As such, a slight share of worldwide activities of Canadian multinationals can be ultimately controlled from abroad, a common practice at the international level.

"Activities of Multinational Enterprises: Interactive Tool" has been developed to allow users to quickly, easily and efficiently browse these data.

''Canadian majority-owned affiliates abroad'', ''affiliates abroad'' and ''affiliates of Canadian multinationals abroad'' are used interchangeably.

The most recent reference year available for data on the affiliates of Canadian multinationals abroad is 2021.

Data on the Activities of Multinational Enterprises in Canada for 2022 are preliminary. Selected activities, including: gross fixed capital formation, number of jobs and merchandise trade are available for this reference year.

The primary statistical unit used in the provincial and industry level analyses is the establishment level. All other variables are presented at the enterprise level.

For goods exports, a related party is defined as a party who holds or controls 10% or more of the outstanding voting stock or share of the other party it is transacting with. For imports, the threshold is 5%.

Gross domestic product at basic prices (value added) data for 2021 and 2022 are not available at the time of this release. They will be made available at a later date.

Gross fixed capital formation is disaggregated by multinational status using microdata from multiple programs. For the most recent two years of data, the microdata is benchmarked for each component (machinery and equipment, non-residential construction, and intellectual property) on a provincial basis to the gross domestic product, expenditure-based tables (table 36-10-0222-01). The industry breakdown is estimated based on historical trends. Data older than two years are benchmarked on an industry and provincial basis to the values produced in the supply and use tables (table 36-10-0478-01).

Products

The updated Canada and the World Statistics Hub (13-609-X) is available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China and Japan.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available. This publication will be updated to maintain its relevance.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: