Government spending by function, 2022

Released: 2023-11-28

Total federal, provincial, territorial and local government spending fell by $7.1 billion in 2022

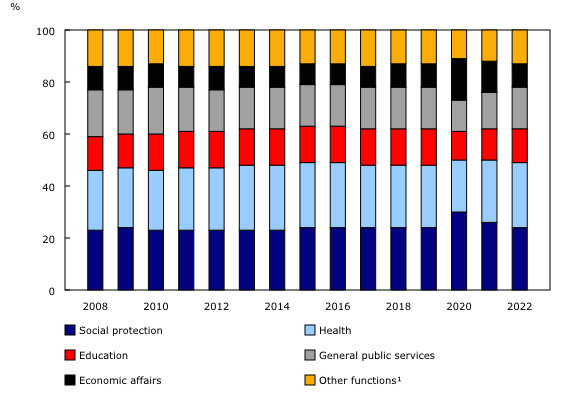

Spending by all levels of government in Canada, excluding consumption of fixed capital, totalled $962.7 billion in 2022, a decline of 0.7% or $7.1 billion from 2021. This was the second consecutive year government spending decreased since reaching an all-time high of $1,049.3 billion in 2020 due to spending in response to the COVID-19 pandemic.

Social protection and economic affairs were the drivers of the spending decrease in 2022 as governments concluded the remaining pandemic response measures. While spending decreased significantly in these two categories, spending in every other category increased, most notably in general public services (+$18.5 billion or +14.2%).

Canadian general government spends less on social protection, more on health

The consolidated Canadian general government—that is, the federal, provincial, territorial, local, and other government entities combined—decreased spending on social protection by 8.2% from 2021 to $235.5 billion in 2022. This made social protection the second largest expense category of government, just behind health, for the first time since 2017. Health spending increased by 3.0% to $235.9 billion in 2022.

Social protection includes programs such as Old Age Security, family benefits, disability payments and unemployment benefits. The decrease in social protection spending in 2022 was driven by lower spending on unemployment (-$31.4 billion) due to the conclusion of federal pandemic response programs.

Government interest payments increase

General public services increased by $18.5 billion or 14.2% in 2022, reaching $149.4 billion. General public services include spending on items like executive and legislative branches of government, fiscal affairs, foreign aid, and public debt transactions.

Of the $18.5 billion increase, interest payments accounted for $12.0 billion. This was an 18.6% increase in interest payments by all levels of government in Canada in 2022. This increase coincides with the Bank of Canada's key policy rate increases throughout 2022 which put upward pressure on borrowing costs. In 2022, interest payments accounted for 7.9% or $76.4 billion of total government expenses.

Canada Emergency Wage Subsidy ends

Spending on economic affairs—which refers to economic activities such as agriculture, energy, mining, or transport—fell 22.9% from $117.4 billion in 2021 to $90.5 billion 2022 and was the largest contributor to the decline in government spending in 2022. The decrease was mainly attributable to the end of the Canadian Emergency Wage Subsidy (CEWS) program.

Health care accounts for over one-third of provincial, territorial and local government spending

Spending on health care by provincial, territorial, and local governments combined grew 4.5% from 2021 to $225.8 billion in 2022, maintaining its position as the largest expense of these governments, at over one-third (34.4%) of total spending.

Per capita spending on health care was the highest provincially in Newfoundland and Labrador ($7,080), Nova Scotia ($6,851) and New Brunswick ($6,727). The lowest health expenses per capita were in Prince Edward Island ($5,239), Ontario ($5,270) and Alberta ($5,378).

Provincially, hospital services accounted for the largest proportion of health care expenses, at just over two-thirds (67.1%), followed by outpatient services (15.8%) and medical products, appliances and equipment (7.0%).

Provincial, territorial and local governments increase social protection measures in 2022

Provincial, territorial and local governments increased spending on social protection by 7.9% from 2021 to $96.3 billion in 2022. This increase was largely a result of higher spending on the protection of vulnerable persons (+$3.7 billion) and family and children (+$1.7 billion).

British Columbia's low-income climate action tax credit and Quebec's seniors' assistance tax credit were the two primary contributors to the increase in spending on vulnerable persons. Meanwhile, every province and territory across Canada had an increase in their spending on family and children in 2022. This is largely explained by provincial and territorial spending on day care as result of receiving transfers from the federal government for the "$10-a-day" child-care initiative.

Among provincial and local governments, spending on social protection on a per capita basis in 2022 was highest in Saskatchewan ($3,307) and Quebec ($3,178), and lowest in New Brunswick ($1,063) and Newfoundland and Labrador ($1,384).

Note to readers

The Canadian Classification of Functions of Government (CCOFOG) organizes government expenses into their main socioeconomic functions. This information provides an important picture of how governments spend money and the role governments play in delivering services.

The CCOFOG is a variant of the international functional expenditure classification that was developed by the Organisation for Economic Co-operation and Development. The CCOFOG replaced the Financial Management System that was used by Statistics Canada until 2008.

Currently, CCOFOG data excludes the acquisition of non-financial assets and the consumption of fixed capital. Future data improvements may include the functionalization of capital expenditures and the consumption of fixed capital.

The consolidated provincial, territorial and local government (PTLG) estimates are recommended for provincial and territorial comparisons since there can be different delineations of responsibilities between levels of government in different jurisdictions. These estimates combine provincial and territorial governments, health and social service institutions, universities and colleges, municipalities and other local public administrations, and school boards, while removing interparty transactions. The consolidated Canadian general government estimates combine the federal government data with PTLG data. They exclude data for the Canada Pension Plan and the Quebec Pension Plan, and for federal and provincial government business enterprises.

The constitutional framework of PTLGs in the territories differs from the framework in the provinces. This leads to differences in the roles and financial authorities of government. These differences, as well as other geographic, demographic and socioeconomic dissimilarities between the North and the rest of Canada, give rise to significant differences in government finance statistics.

Since the size of PTLG estimates varies significantly across jurisdictions because of different population sizes, per capita data are used for expense comparisons. Per capita data are based on population estimates for Canada, the provinces and the territories, available in table 17-10-0009-01.

Annual data correspond to the end of the fiscal year closest to December 31. For example, data for the federal government fiscal year ending on March 31, 2023 (fiscal year 2022/2023) are reported as the 2022 reference year.

Products

The infographic "Overview of Government Spending by Function, 2022/2023," which is part of Statistics Canada – Infographics (11-627-M), is now available.

The Canadian Classification of Functions of Government classification structure and descriptions are now available under the related information module of the Statistics Canada website.

Additional information can be found in the Latest Developments in the Canadian Economic Accounts (13-605-X). The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available. This publication has been updated with Chapter 9. Government Finance Statistics.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: