Investment in building construction, September 2023

Released: 2023-11-20

$18.9 billion

September 2023

5.3%

(monthly change)

Investment in building construction increased 5.3% to $18.9 billion in September. The residential sector rose 7.3% to $12.9 billion, and the non-residential sector was up 1.2% to $6.0 billion.

On a constant dollar basis (2012=100), investment in building construction increased 4.9% to $10.8 billion.

Strong gains in residential investment

Investment in residential building construction went up 7.3% to $12.9 billion for the month of September. Growth in residential investment was driven by Ontario (+6.7%; +$325.1 million), Quebec (+9.1%; +$191.6 million), Alberta (+10.6%; +$164.6 million) and Manitoba (+33.6%; +$102.2 million).

Single family home investment increased 6.4% to $6.3 billion in September. After seven consecutive monthly declines, Manitoba (+58.5%; +$78.2 million) posted its largest-ever recorded monthly increase in single family investment in September.

Multi-unit construction rose 8.2% to $6.6 billion in September, with all provinces reporting gains. Ontario (+7.3%; +$180.2 million) led the way, while Alberta (+21.6%; +$141.0 million) contributed its largest monthly increase since April 2018.

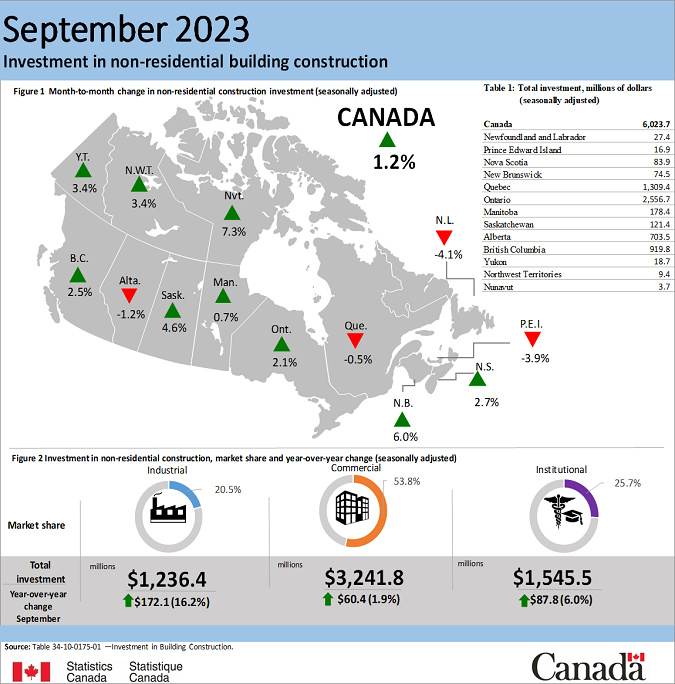

Institutional investment drives non-residential sector

Investment in non-residential construction was up 1.2% to $6.0 billion in September 2023. The increase was driven mainly by Ontario, which accounted for 72.8% of the sector gains.

Industrial construction investment increased 1.2% to $1.2 billion for the month of September. Despite stabilizing in recent months, industrial investment was still up 16.2% from September 2022.

Institutional construction investment rose 4.3% to $1.5 billion in September 2023. Ontario (+11.4%; +$58.7 million) led the way, with a large hospital renovation in Toronto and the construction of a correctional facility in Thunder Bay contributing to growth in the province.

Commercial construction investment edged down 0.2% to $3.2 billion in September.

Third quarter declines due to residential sector

Across Canada, investment in building construction fell 2.8% to $54.7 billion in the third quarter, the fourth consecutive quarterly decrease. The residential sector was down 4.4% to $36.7 billion in the third quarter, while the non-residential sector rose 0.5% to $17.9 billion.

Investment in residential building construction was down by 4.4% from the second quarter to $36.7 billion in the third quarter, driven by declines in single family home investment. Multi-unit construction edged up 0.1% to $18.7 billion in the third quarter, with Alberta (+19.1%; +$328.6 million) posting its largest quarterly increase in this component since the second quarter of 2018. This partially offset declines in Ontario (-3.1%; -$238.7 million) and British Columbia (-4.0%; -$170.7 million) in the third quarter of 2023.

Investment in non-residential construction was up 0.5% to $17.9 billion in the third quarter, the 11th consecutive quarterly increase. Investment in institutional construction accounted for much of the increase, up 2.4% to $4.5 billion. Industrial construction investment edged up 0.2% to $3.7 billion, while commercial investment decreased 0.3% to $9.8 billion.

For more information on construction, please visit the Construction statistics portal.

For more information on housing, please visit the Housing statistics portal.

Note to readers

Data are subject to revisions based on late responses, methodological changes and classification updates. Unadjusted data have been revised for the previous two months. Seasonally adjusted data have been revised for the previous three months.

Data presented in this release are seasonally adjusted with current dollar values unless otherwise stated. Using seasonally adjusted data allows month-to-month and quarter-to-quarter comparisons by removing the effects of seasonal variations. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Monthly estimates for constant dollars are calculated using quarterly deflators from the Building Construction Price Index (18-10-0276-01). The monthly indexes used for the deflation process were part of a methodology review to increase the quality of the constant dollar and seasonally adjusted series. The indexes previously displayed a step pattern due to lower frequency collection.

Detailed data on investment activity by type of building and type of work are now available in the unadjusted current dollar series.

The trade and services subcomponent includes buildings such as retail and wholesale outlets, retail complexes and motor vehicle show rooms. More detailed information can be found on the Integrated Metadatabase at Types of Building Structure - 2.2.1 - Trade and services.

Next release

Data on investment in building construction for October will be released on December 18.

Products

Statistics Canada has a "Housing Market Indicators" dashboard. This web application provides access to key housing market indicators for Canada, by province and census metropolitan area. These indicators are automatically updated with new information from monthly releases, giving users access to the latest data.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: