Insights on inflation in Canada

Released: 2023-06-28

In 2022, the annual growth in the Consumer Price Index (CPI) rose to a 40-year high of 6.8%. While year-over-year growth in the CPI has subsided since then, it remains higher than what has been experienced in Canada on average over the past four decades. This increase in the CPI—which captures the cost of a fixed basket of goods and services relevant to Canadian consumers—reflects inflationary pressures occurring broadly across the economy. The price of final domestic demand (FDD), which captures not only the price pressures experienced by households but also those faced by businesses and government, has risen at a similar rate to CPI inflation. The gross domestic product (GDP) deflator, the price of goods and services produced domestically, has risen even faster because of export prices.

Today, Statistics Canada is releasing a series of three articles in Economic and Social Reports that examines these broader measures of inflation from different perspectives. The first article examines the role of import prices in driving FDD inflation. The results shed light on the extent to which the recent inflation is driven by forces largely external to Canada. The second and third articles focus on the role of key internal factors, in particular labour costs, non-labour costs and the margin between output prices and costs. These articles provide insights into whether, at a high level, labour compensation is in line with rising prices, and whether costs are being more than fully passed on to consumers.

Higher import prices contributed up to one half of final domestic demand inflation in the last three quarters of 2022

The total supply of goods and services in Canada depends on our domestic production and imports. This supply of goods and services is either exported or used to satisfy FDD in Canada. The price of FDD reflects not only the price of goods and service faced directly by households, but also the prices faced by government and by businesses in their purchases of goods and services.

As the price of imports rise, so too will the price of FDD and many of its components, including the prices faced by households. The article "Import prices and inflation in Canada" found that import prices began contributing to the growth in the price of FDD in the third quarter of 2021. In that quarter, the increase in import prices accounted for 25.3% of FDD price inflation (1.1 percentage points of the 4.3 percentage point increase in FDD price inflation). This contribution grew in subsequent quarters, reaching 51.9% in the second quarter of 2022, 47.4% in the third quarter and 51.0% in the fourth quarter. The estimates of these contributions represent an upper bound of the impact of import prices given that it is assumed the rise in import prices is fully passed through to the prices faced by households, businesses, and governments (Chart 1).

While it is beyond the scope of the article to examine the source of the increase in import prices, it highlights that the rise in import prices occurred at the same time as a robust demand for imports, a large depreciation of the Canadian dollar relative to the US dollar, and high energy prices associated with geopolitical events. The potential size of the contribution of import prices to inflation suggests that monitoring import prices and a global coordination of inflation control will be important considerations as long as inflation remains high.

Labour costs have not contributed disproportionately to the increase in output prices

Given that labour is a major input into production, labour costs (wages and salaries, employer's social contributions for employees, and imputed labour income for self-employed workers) will be an important contributor to the rise in the price of goods and services produced domestically, many of which are consumed by households. The key question is how labour costs and non-labour costs (corporate profits and profit income of proprietors, interest, depreciation, rent and indirect business taxes) have evolved relative to the GDP deflator.

The article "Inflationary pressures, wages and profits" found that unit labour costs (labour costs per unit of output) accounted for all of the growth in the GDP deflator in 2020. In 2021, the contribution of unit non-labour costs became more dominant at 67.5% (5.5 percentage points of the 8.2% growth in the GDP deflator). In 2022, the contributions were more equal but the contribution of unit non-labour costs was still larger at 55.5% (4.1 percentage points of the 7.3% growth in the GDP deflator) (Table 1).

Over all three years (2020, 2021 and 2022), unit non-labour costs contributed slightly more than unit labour costs (51.7% vs. 48.3%) to the cumulative growth in the GDP deflator. The contribution of unit non-labour costs was larger than its share of GDP in 2019 (43.0%). By itself, this finding is not sufficient to conclude that businesses overall are taking the opportunity in a high inflationary environment to increase their prices above their underlying costs of production in order to garner higher profits. This is because the growth in the GDP deflator is partly attributable to higher prices in the mining and oil and gas extraction industry, where prices are determined globally. Furthermore, interest rates (and the required return on capital) and depreciation have also been rising, not only profits. A reassessment can be done if the higher growth in unit non-labour costs persists and when more detailed data are available.

Markups increased more slowly than inflation

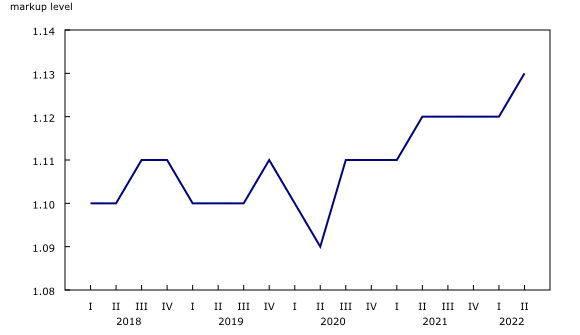

In contrast to the two previous articles that focused on specific cost drivers, the study "Markups and inflation: Evidence from firm-level data" examines the extent to which markups may have contributed to inflation. Markups are measured as the ratio of price over marginal costs (the incremental costs of producing an additional unit of output, including labour costs, imported inputs into production and other costs). The change in the ratio sheds light on whether firms are absorbing some of the increase in costs or more than fully passing them on.

The study finds that, from the last two years before the COVID-19 pandemic to the second quarter of 2022, the aggregate markup for non-financial businesses, excluding oil and gas industries, increased by 2.6% (Chart 2). This increase is relatively small compared with measures of inflation over the same period. For example, CPI inflation excluding energy rose by 10.5% over that period.

While it is not possible to provide changes in the markup for detailed industries, the study shows that, from the last two years before the pandemic to the second quarter of 2022, the markup in retail trade increased by 2.4%, slightly less than aggregate markup. In comparison, markups in manufacturing rose by 5.3% and markups in wholesale trade rose by 1.6% over the same period.

Markups have been used to study the changes in the degree of competitive pressure in the economy over long periods. Over short periods of time, such as the period after the pandemic, markups can be affected by both demand and supply shocks, but the direction and magnitude of the effects are dependent on the specific economic model and its assumptions. Regardless of the reason for the change in the markup, given the size of the observed change, it does not appear that it is a main driver of inflation.

For more information on other articles released today, please see the release titled "Economic and Social Reports, June 2023."

Products

The articles titled "Import prices and inflation in Canada", "Markups and inflation: Evidence from firm-level data" and "Inflationary pressures, wages and profits" are now available in the June 2023 online issue of Economic and Social Reports, Vol. 3, no. 6 (36280001).

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: