Provincial and Territorial Cultural Indicators, 2021

Released: 2023-06-26

The year 2021 marked a turning point for culture and sport in Canada, as economic activity related to culture and sport began to rebound from initial COVID-19 pandemic restrictions put in place in the early part of 2020.

In 2021, nominal gross domestic product (GDP) of culture and sport rebounded in all provinces and territories, however this rebound was slower than that for total economy GDP. Canada's GDP attributable to culture and sport increased 8.2% from the previous year, to $60.9 billion, which was slower than the growth of total economy GDP (+13.4%). Despite one of the largest single-year increases, nominal economic activity remained below the pre-pandemic levels of 2019. The contribution of culture and sport to economy-wide GDP declined from 2.7% in 2020 to 2.6% in 2021, due to the slower growth in the culture sector.

Employment attributable to Canada's culture and sport sector dropped significantly from 2019 to 2020, by roughly 99,000 jobs, primarily due to pandemic-related restrictions. In 2021, employment increased (+10.6%), a gain of approximately 69,500 jobs, while economy-wide jobs increased at a lower rate (+8.6%). Overall, there was an increase in culture and sport's share of total economy jobs, which rose from 3.7% in 2020 to 3.8% in 2021.

Given the gradual return to full opening of the economy in 2022, healthy rebounds in both culture and sport GDP and jobs are set to continue.

Culture sector begins to rebound but remains below pre-pandemic levels

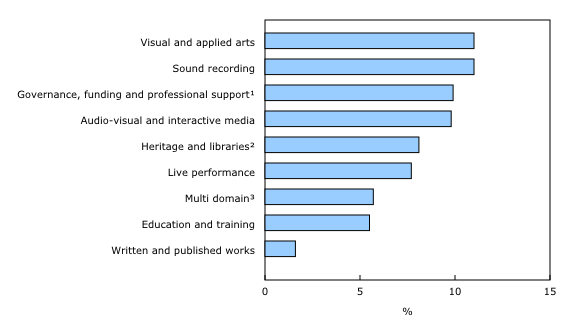

Canada's culture nominal GDP rose 8.3% to $54.8 billion in 2021, with increases in all domains. The largest contributors to this gain were the audio-visual and interactive media (+$1.6 billion or +9.8%) and visual and applied arts (+$1.1 billion or +11.0%) domains. The continued in-person limitations on attendance during the year drove more culture to the digital space, which likely fuelled growth in the software development and computer services industries. At a subdomain level, increases in film and video and in broadcasting led the way.

As a proportion of total economy GDP, culture accounted for 2.3% in 2021, down from 2.7% in 2020.

Similar to GDP, culture jobs increased 11.0% to 634,431 in 2021. The share of culture jobs accounted for 3.3% of all jobs in Canada. Growth was led by job increases in the audio-visual and interactive media domain and the visual and applied arts domain.

Recovery in Canada's sport sector

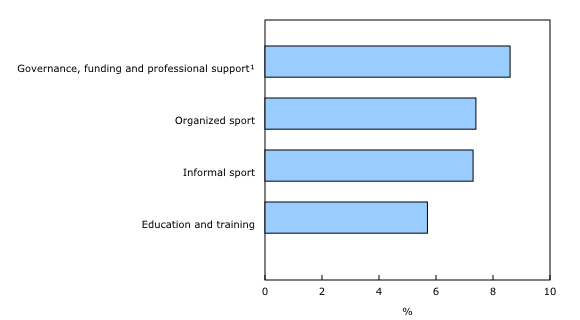

Sport GDP was up 7.0% in 2021, totalling $6.2 billion, with all subdomains increasing. Sport governance saw the largest increase, with GDP growing by 8.6%. Organized sport also saw a large increase, with GDP rising 7.4%. Despite these increases, sport GDP remained below the pre-pandemic levels of 2019 as many COVID-19 restrictions, especially around attendance at professional sport venues, remained in place to varying extents.

Parallel to sport GDP, sport employment increased in all subdomains in 2021. Altogether, sport jobs increased 7.7% from 2020, to 88,794. Jobs in the organized sport subdomain, despite increasing in 2021, remained below pre-pandemic levels in part due to the various restrictions on attendance at venues.

Recovery in culture and sport following the easing of COVID-19 restrictions varied across Canada

All provinces and territories rebounded in 2021, although to varying degrees. Some of the highest growth increases in culture GDP were seen in British Columbia (+12.6% or +$960.0 million), followed by Quebec (+8.2% or +$846.0 million) and Ontario (+7.9% or +$1.8 billion), Canada's three largest provinces. Reflecting the diverse economies across the country, the contribution of culture to economy-wide GDP varied across Canada, ranging from 1.1% in Saskatchewan to 2.8% in Ontario.

Turning to employment, all provinces and territories posted job gains. Culture jobs as a share of the total economy ranged from 1.8% in Nunavut to 4.3% in British Columbia.

All provinces and territories experienced increases in sport GDP, with Ontario (+$167.6 million or +6.8%), Quebec (+$69.5 million or +9.1%) and British Columbia (+$61.3 million or +6.2%) increasing by the largest amounts. As a share of sport GDP to total economy-wide GDP, there was not much variation across Canada. Like sport GDP, increases in employment attributable to sport were seen in all provinces and territories.

Note to readers

The Provincial and Territorial Culture Indicators (PTCI) were developed as an extension of the more comprehensive Provincial and Territorial Culture Satellite Account. The PTCI cover culture (including arts and heritage) and sport across Canada in terms of output, nominal gross domestic product (GDP), and jobs for the period from 2010 to 2021.

The PTCI are a joint initiative of Statistics Canada, other federal agencies, all provincial and territorial governments, as well as non-governmental organizations.

All the GDP figures in this release are expressed in nominal, basic prices. Total economy GDP is calculated using income-based GDP at market prices minus taxes less subsidies on products and imports.

This release focuses on the product perspective of the PTCI—the production of culture and sport goods and services and their contribution to output, GDP and jobs in both culture and non-culture industries and sport and non-sport industries.

Culture GDP is the economic value added associated with culture activities. This is the value added related to the production of culture goods and services across the economy, regardless of the producing industry. Culture jobs are the number of jobs that are related to the production of culture goods and services.

Sport GDP is the economic value added associated with sport activities. This is the value added related to the production of sport goods and services across the economy regardless of the producing industry. Sport jobs are the number of jobs that are related to the production of sport goods and services.

Film and video

The film and video subdomain underwent major enhancements starting with reference year 2015. The sources and methods for estimating this subdomain, notably the Survey of Service Industries: Film, Television and Video Production, have been revised to include improved estimation methods.

The new methodology increases the use of administrative data in combination with survey data to build the estimates. These methodological improvements were applied to all variables (GDP, output and jobs).

Written and published works

Print publishing has continued to decline as industries shift toward producing online content. This decline can be seen within the written and published works domain with the exception of the 2017 reference year. In 2017, the sources and methods for estimating this domain were enhanced to more accurately represent the presence of online publishers. This was a result of the new 2017 North American Industry Classification System.

Audio-visual and interactive media and visual and applied arts

Refinements to the video game publishing and design and development industries, and to the computer systems design and related services industry were introduced in 2016 to improve estimates around video game development and website design. These impact both the design and interactive media subdomains of the visual and applied arts domain and the audio-visual and interactive media domain.

The sources and methods used to estimate both these subdomains have been enhanced and were applied to all variables (GDP, output and jobs). The new methodology will use survey data for each province and territory specifically for the video game industries and website design activity in that geography.

Users can expect significant revisions to both design and interactive media starting in reference year 2016. There will be a noticeable break in the data series in most geographies for the interactive media and design subdomains from 2015 to 2016. This break does not represent a real change in economic conditions. Estimates prior to 2016 are on the old basis and should be used with caution.

Products

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structure.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: