Quarterly financial statistics for enterprises, first quarter 2023

Released: 2023-05-24

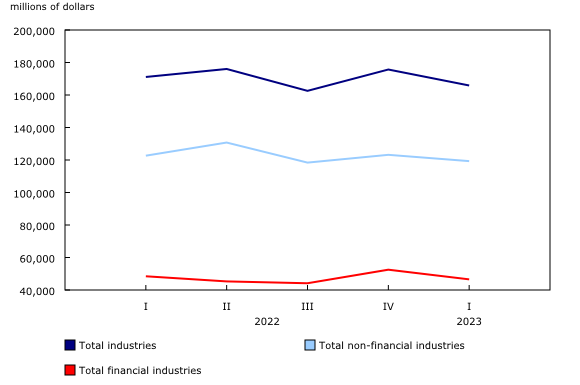

$165.9 billion

First quarter 2023

The combination of higher interest rates, inflationary pressures, and labour challenges have impacted Canadian enterprises in several different ways. Collectively these macroeconomic headwinds drove down net income before taxes (NIBT) in the first quarter.

Canadian corporations reported a 5.6% decrease (or -$9.8 billion) to $165.9 billion in NIBT in the first quarter, impacting both the financial sector (-11.3%) and the non-financial sector (-3.1%).

Consult the Quarterly Survey of Financial Statistics: Visualization Tool for a comprehensive overview of the quarterly changes in the financial performance of enterprises.

Oil and gas extraction industry leading the decline in net income before taxes for the non-financial sector

In the non-financial sector, NIBT decreased $3.9 billion (-3.1%) from the fourth quarter of 2022 to $119.3 billion in the first quarter of 2023. Overall, NIBT was down in 17 of 39 non-financial industries.

The oil and gas extraction industry largely contributed to the drop in NIBT, down $3.4 billion (-24.9%) in the first quarter, mainly attributable to lower oil prices.

NIBT for transportation and transportation support activities decreased by $2.2 billion (-28.9%) in the first quarter, mainly due to lower revenues, as a large non-recurring dividend income was posted in the fourth quarter of 2022.

NIBT for motor vehicle and trailer manufacturing was down by $756 million in the first quarter of 2023, driven by higher expenses.

The decline in NIBT for the non-financial sector was partly offset by an increase in NIBT for the mining and quarrying industry, up by $2.2 billion during the first quarter. This increase was mainly attributable to higher revenues as commodity prices increased during the quarter.

Net income before taxes for the financial sector decreases

NIBT for the financial sector decreased by $6.0 billion (-11.3%) in the first quarter. It was down in 6 of the 13 financial industries.

NIBT for the securities and commodity exchanges and portfolio management and miscellaneous financial investment activity industry recorded a $3.8 billion decrease on lower revenues in the first quarter, as large investment gains were posted in the fourth quarter of 2022.

NIBT for the banking and depository credit intermediation industry edged up $343 million in the first quarter of 2023, partly attributable to an increase in net interest income.

In focus: Effects of overnight rate increases on the banking and depository credit intermediation industry

In the past year, inflation reached levels not seen in the past 40 years which urged central banks to tighten financial conditions by hiking their policy interest rates. The Bank of Canada adopted a restrictive monetary policy to gradually bring down inflation to its 2% target. Therefore, it increased its overnight rate by 4.25% from the first quarter of 2022 to the first quarter of 2023. In the first quarter of 2023, Canada's central bank announced the decision to pause rising interest rates, stating that "the Governing Council indicated that it expected to hold the policy interest rate at its current level, conditional on economic developments evolving broadly in line with the Monetary Policy Report outlook."

The overnight rate changes in the past year have impacted the operating activities and profitability for the depository credit intermediation industry. Data from the Quarterly Survey of Financial Statements are used to analyze the changes in the net interest income and the balance of mortgage and consumer loan assets for the industry from the first quarter of 2020 to the first quarter of 2023.

Overview of interest income

Depository credit intermediation's interest revenue from mortgages in Canada has been volatile, oscillating in the range of -16% to +11% from quarter to quarter since the onset of the COVID-19 pandemic in the first quarter of 2020 to the fourth quarter of 2021. However, with the series of interest rate hikes starting in early March 2022, mortgage interest income went up from $9.2 billion in the first quarter of 2022 to $15.7 billion in the first quarter of 2023. This is a $6.5 billion increase within a year, the highest gains on record for this series.

Interest revenue from consumer loans also responded to rising borrowing rates, increasing from $6.5 billion in the first quarter of 2022 to $9.2 billion at the end of the first quarter of 2023. This represents a yearly growth of 40.4% (or +$2.7 billion) in interest revenue from consumer loans.

Overall, interest revenue for mortgage loans, consumer loans and other assets was up by $24.9 billion from the first quarter of 2022 to the first quarter of 2023.

During the same period, interest expenses rose by $22.9 billion, largely driven by a sharp increase of $18.6 billion in deposit interest expenses due to higher rates. A rise in the overnight rate influenced both interest revenue and interest expenses for this industry, bringing the net interest income from $15.4 billion in the first quarter of 2022 to $17.4 billion in the first quarter of 2023, representing an increase of $2.0 billion.

Trends in mortgages and consumer loans amid rising rates

The volume of loans has been influenced by eight consecutive rises in the overnight rate and these changes in volume can explain the performance of the net interest income from the first quarter of 2022 to the first quarter of 2023.

According to the Bank of Canada's Financial System Review released in June 2022, "Five-year fixed mortgage rates have reached levels last seen in 2010." With tighter overnight rates observed since the first quarter of 2022, borrowers had to qualify for a new mortgage at a higher interest rate. Also, some borrowers had to renew their mortgages at higher rates.

A restrictive monetary policy makes borrowing more expensive, especially for long-term loans such as mortgages. Mortgage loan asset holdings from the balance sheet for the depository credit intermediation industry indicate that the growth rate for mortgage loans was fluctuating from +1.8% to +3.8% from the second quarter of 2020 to the fourth quarter of 2021. Following the increase in the overnight rates in the first quarter of 2022 through the first quarter of 2023, the growth of mortgage loans slowed down, ranging from -0.4% to +2.5%.

Consumer loans have experienced a different trend than mortgage loans. The growth rate for non-mortgage loans was volatile, ranging from -5.4% to +2.8% during the period of the first quarter of 2020 to the fourth quarter of 2021. Non-mortgage loans were impacted by higher interest rates, as the growth rate oscillated from 0.0% to +5.4% during the first quarter of 2022 to the first quarter of 2023. Persistently high interest rates and inflation are likely to continue to put a financial strain on households as they continue to access credit to fund their spending.

Provision for credit losses

Provision for credit losses for the banking and other depository credit intermediation industry declined from their 2020 pandemic levels in 2021, but crept back up in the third quarter of 2022 as the impact of the interest rate hikes was starting to have a cooling effect on some sectors of the economy. Provision for credit losses increased 307.1% in the first quarter of 2023 when compared with the first quarter of 2022, reflecting unfavourable changes in the economic outlook and credit quality. According to TransUnion, the rate of consumers 90 or more days late on their debt service payments has risen for instalment loans, credit cards, and auto loans. Insolvency filings for consumers and businesses are also on the rise, while still below pre-pandemic levels.

Note to readers

Changes to the Quarterly Survey of Financial Statements

Since the first quarter of 2023, the Quarterly Survey of Financial Statements (QSFS) figures are now based on the North American Industry Classification System 2022 classification structure. Given the new classification structure has marginal impact on the QSFS estimates, the structure of the QSFS data tables did not need to be updated to account for this change. This change should not alter the direct data comparison between this quarter and the previous one.

Starting in the first quarter of 2023, the Canadian insurance companies have implemented the new International Financial Reporting Standards 17 standard on insurance contracts which had an impact on how they have reported their data each quarter. The QSFS questionnaires were adjusted to reflect those changes, which also impacted the information published each quarter in the QSFS tables. The structure of the data table (33-10-0227) was updated to introduce new variables, while some other variables had to be deleted to account for those changes. Given the difference in the concepts measured, data users should be careful by doing direct data comparison between the fourth quarter of 2022 and the first quarter of 2023 in the insurance industries.

The QSFS sample was also refreshed in the first quarter of 2023. This change should not alter the direct data comparison between this quarter and the previous one.

This release of the QSFS for the first quarter of 2023 includes revised estimates for all quarters of 2021 and 2022 resulting from a benchmarking exercise against the Annual Financial and Taxation Statistics for Enterprises.

The QSFS has been the subject of many changes since the first quarter of 2020. For a summary of those changes, see the note to readers in the QSFS release for the third quarter of 2022.

Business performance and ownership statistics portal

The Business performance and ownership statistics portal, accessible from the Subjects module of the Statistics Canada website, provides users with a single point of access to a wide variety of information on business performance and ownership in Canada.

Next release

Financial statistics for enterprises for the second quarter of 2023 will be released on August 24.

Products

Aggregate balance sheet and income statement data for Canadian corporations are now available.

Data from the Quarterly Survey of Financial Statements are also available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: