Canada's international investment position, fourth quarter 2022

Released: 2023-03-10

$839.7 billion

Fourth quarter 2022

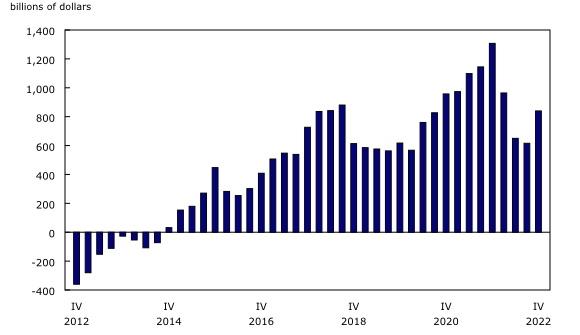

Canada's net foreign asset position, the difference between its international financial assets and international liabilities, increased by $223.9 billion to $839.7 billion at the end of the fourth quarter, the first increase after three consecutive quarterly declines.

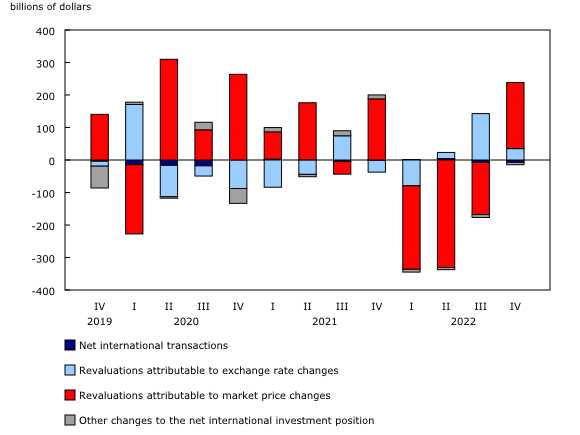

Overall, changes in market prices led to a $203.4 billion increase in Canada's net foreign asset position. Over the fourth quarter, the US (+7.1%) and European (+14.3%) stock markets rose, and the Canadian stock market gained 5.1%. At the end of the fourth quarter, 65.1% of Canada's international assets and 42.4% of its international liabilities were held in the form of equities.

The revaluation effect from fluctuations in exchange rates (+$35.0 billion) supported the overall increase in Canada's net foreign asset position. Over the fourth quarter, the Canadian dollar depreciated against the euro (-7.4%), the British pound (-7.5%) and the yen (-7.7%), while it gained 1.2% against the US dollar.

At the end of the fourth quarter, 96.2% of Canada's international assets were denominated in foreign currencies, compared with 41.1% of its international liabilities. The US dollar accounted for 64.0% of Canada's international assets and 32.2% of its international liabilities at the end of the quarter.

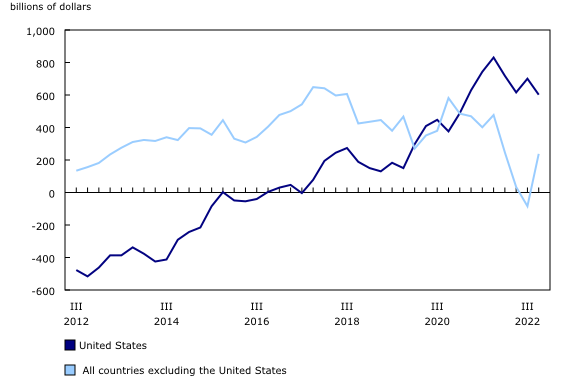

On a geographical basis, Canada's net foreign asset position with the United States was down by $98.5 billion to $601.8 billion at the end of the fourth quarter. Canada's net international investment position with countries other than the United States showed a different trend, increasing from a net liability position of $84.5 billion at the end of the third quarter to a net foreign asset position of $237.9 billion at the end of 2022.

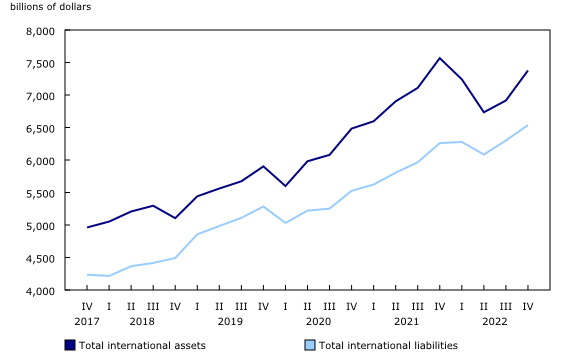

Canada's international assets increase substantially

Canada's international assets were up by $462.1 billion (+6.7%) to $7,377.4 billion at the end of the fourth quarter, the largest quarterly gain on record. The upward revaluation attributable to market price changes (+$356.4 billion) led the growth. Considerable acquisitions of foreign assets (+$130.6 billion) in the quarter, mainly in the form of loan assets, also contributed to the growth.

In contrast, Canada's international liabilities were up $238.2 billion (+3.8%) to $6,537.7 billion. This increase was primarily the result of an upward revaluation due to fluctuations in market prices (+$153.0 billion). Strong foreign borrowings (+$137.8 billion), mainly in the form of loans, as well as debt securities, also contributed to the increase.

Canada's net foreign asset position falls in 2022

In 2022, fluctuations in market prices significantly impacted Canada's net foreign asset position. Global stock markets declined significantly after strong gains in the previous year. In addition, the substantial rise in interest rates led to lower prices for debt instruments. Overall, Canada's net foreign asset position fell $467.7 billion in 2022 after reaching a high of $1,307.4 billion at the end of 2021.

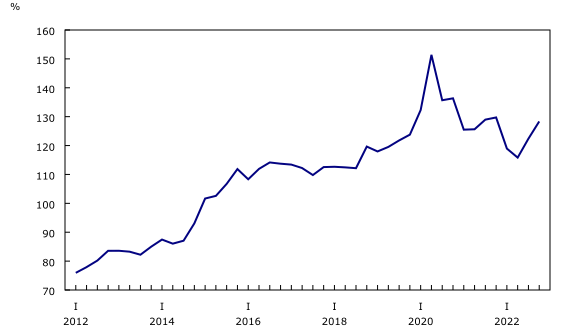

Canada's net international investment position as a proportion of gross domestic product (GDP) decreased to 30.1% at the end of 2022, down from 49.9% at the end of 2021.

At the end of 2022, Canada's gross external debt, or the value of Canadian debt instruments held by foreign investors, reached $3,579.7 billion, an increase of $178.0 billion over the year. The financial sector contributed the most to the gain, led by borrowings in the form of new bonds placed abroad by deposit-taking corporations. Gross external debt of the government sector fell by $73.1 billion to $613.0 billion in 2022. This followed strong increases in 2020 and 2021, led by the federal government's borrowing activities in the context of the COVID-19 pandemic.

Canada's gross external debt amounted to 128.4% of GDP at the end of 2022, down slightly from the end of 2021 (129.7%).

Note to readers

Definitions

The international investment position is the value and composition of Canada's assets and liabilities to the rest of the world.

Canada's net international investment position is the difference between Canada's assets and liabilities to the rest of the world. An excess of international liabilities over international assets can be referred to as Canada's net foreign debt. An excess of international assets over international liabilities can be referred to as Canada's net foreign assets.

Foreign direct investment is presented on an asset–liability principle basis (that is, a gross basis) in the international investment position. Foreign direct investment can also be presented on a directional principle basis (that is, a net basis), as shown in supplementary foreign direct investment tables 36-10-0008-01, 36-10-0009-01 and 36-10-0659-01. The difference between the two foreign direct investment conceptual presentations resides in the classification of reverse investment such as (1) Canadian affiliates' claims on foreign parents and (2) Canadian parents' liabilities to foreign affiliates. Under the asset–liability presentation, (1) is classified as an asset and included in direct investment assets and (2) is classified as a liability and included in direct investment liabilities.

Next release

International investment position data for the first quarter of 2023 will be released on June 13.

Products

The Economic accounts statistics and International trade statistics portals are available from the Subjects module of the Statistics Canada website.

The Canada and the World Statistics Hub (13-609-X) is available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world through interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China, and Japan.

The product Canada's international trade and investment country fact sheet (71-607-X) is available online. This product provides easy and centralized access to Canada's international trade and investment statistics, on a country-by-country basis. It contains annual information for nearly 250 trading partners in summary form, including charts, tables and a short analysis that can also be exported in PDF format.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: