Gross domestic product by industry, December 2022

Released: 2023-02-28

December 2022

-0.1%

(monthly change)

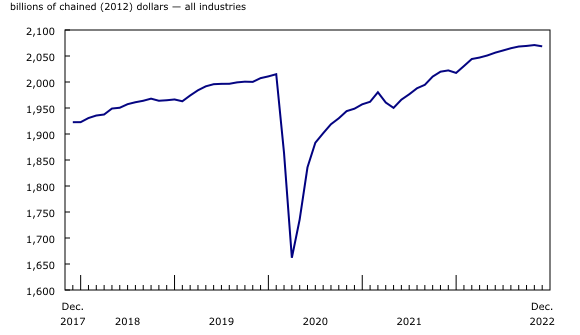

Real gross domestic product (GDP) edged down 0.1% in December, following a 0.1% uptick in November. Goods-producing industries (-0.6%) declined, while service-producing industries (+0.0%) remained essentially unchanged.

Advance information indicates that real GDP increased 0.3% in January 2023. Increases in the mining, quarrying, and oil and gas extraction, wholesale trade, professional, scientific and technical services, and transportation and warehousing sectors were slightly offset by decreases in construction and retail trade. Owing to its preliminary nature, these estimates will be updated based on more complete data on March 31, with the release of the official GDP data for January.

Unplanned maintenance impacts oil and gas extraction, while adverse weather curtails transportation and warehousing

While 12 of 20 industrial sectors grew in December, a decrease in mining, quarrying, and oil and gas extraction, along with a decline in transportation and warehousing contributed to an overall contraction in activity for the last month of 2022. The impact of unplanned seasonal events partially constrained the production and export of crude oil, while adverse weather hampered the transportation and warehousing sector.

Meanwhile, momentum continued in the public sector, up for the 11th consecutive month in December, partially offsetting the overall contraction in GDP in the month.

Mining, quarrying and oil and gas extraction contracts

The mining, quarrying and oil and gas extraction sector was down 4.0% in December.

Oil and gas extraction contracted 3.1% in December, led by oil sands extraction (-4.1%) as lower synthetic oil production in Alberta contributed the most to the decline. Crude oil production was constrained by unplanned maintenance-related events throughout the supply chain which led to lower production. This included an oil spill south of the border, in Kansas, which disrupted the supply of Canadian crude oil to the Keystone export pipeline.

Oil and gas extraction (except oil sands) decreased 1.6% in December, primarily due to lower than seasonal growth in oil extraction in the month after strong offshore production in Newfoundland and Labrador in November upon the completion of maintenance activities in the previous months.

Transportation and warehousing contracts, in part due to adverse weather

Transportation and warehousing decreased 1.0% in December, following three consecutive monthly gains.

Winter storms severely impacted both air and railway transportation in December. Environment and Climate Change Canada issued several warnings and special weather statements for many parts of Canada on December 22, 2022. In December, air transportation (-2.3%) decreased for the first time since January 2022 and its activity level in December was about 68% of January 2020's pre-COVID-19 pandemic level for this industry. Weaker domestic travel activity drove the decline.

Rail transportation fell 7.7%, the largest decline since September 2019; it was the largest contributor to the decline in the transportation and warehousing sector in December 2022. Lower production of potash, coal, and iron ore mining all adversely impacted the rail transportation subsector, resulting in lower carloadings for those commodities. Additionally, two train derailments contributed to the decline, with one in Saskatchewan on December 2, 2022, and a weather-related derailment in Ontario on December 24, 2022.

Wholesale activity lowers

Wholesale trade contracted 1.3% in December, the third decline in four months, as six of nine subsectors were down.

The most notable decline in December was in wholesalers of machinery, equipment, and supplies (-4.0%) and specifically construction and industrial equipment. Farm product wholesalers declined 6.5% in December, following three months of growth on the heels of a good crop yield in 2022. Meanwhile, after a significant increase in November, wholesalers of motor vehicles and motor vehicle parts and accessories declined 1.1% in December, but activity levels remain near those from prior to the pandemic.

Finance and insurance down for second time in three months

Finance and insurance (-0.4%) contracted for the second time in three months in December, as decreases in credit intermediation and monetary authorities (-0.3%) along with financial investment services, funds, and other financial vehicles (-1.5%) were the main contributors to the decline.

A typical seasonal 'Santa Claus rally' was not observed for equities in December. A hawkish narrative along with another interest rate increase by many central banks in their final meetings of 2022 contributed to dampening investor sentiment in the month. Increases in mortgage debt and fixed-term deposits partially offset declines in the sector.

Public sector continues to grow

The public sector rose 0.4% in December, up for the 11th consecutive month as all sectors increased. Health care and social assistance (+0.4%) contributed the most to the growth as all subsectors posted gains. Educational services and public administration were also up in December.

Retail activity rebounds

Retail trade grew 0.8% in December, as 7 of 12 subsectors increased. An increase in motor vehicle and parts dealers (+3.3%), bolstered by higher sales at new car dealers, led the growth in the sector. Gasoline stations (+5.5%) was another large driver of growth in December as gasoline prices fell 13.1% on an unadjusted basis, the largest monthly decline since April 2020. General merchandise stores expanded 2.1% in December 2022, rebounding from the decline recorded in November.

Decreased activity at building material and garden equipment and supplies dealers (-2.6%) and clothing and clothing accessories stores (-1.7%) in December tempered overall growth in the sector.

Real gross domestic product growth decelerates for a second consecutive quarter

Real GDP by industry data show that growth in the Canadian economy decelerated for a second straight quarter, edging up 0.2% in the fourth quarter of 2022, the slowest pace of growth since the second quarter of 2021. Services-producing industries rose 0.5% in the fourth quarter of 2022, up for a sixth consecutive quarter, while goods-producing industries contracted 0.6% in the fourth quarter.

The public sector, transportation and warehousing, and professional, scientific, and technical services were the major drivers of growth in the fourth quarter.

The public sector increased 1.1% in the fourth quarter, with public administration (+1.5%) contributing the most to the growth, in part due to municipal elections in October and an uptick in activity following a decline in September when the funeral for Queen Elizabeth II was observed across many government levels or institutions. Health care and social assistance (+1.2%) was also a large driver of growth in part because increases in respiratory illnesses and flu cases created additional demand on health care services.

Transportation and warehousing continued on its upward trajectory for the third consecutive quarter, increasing 1.6% in the fourth quarter, with air transportation contributing the most to growth in all three quarters. The air transportation subsector faced new challenges in the fourth quarter with winter storms impacting major airports in December, resulting in many flights being cancelled and passengers stranded for days. Still, air transportation grew 13.8% in the fourth quarter, in large part due to the atypical increase in travel in October and November which resulted in part from all restrictions for international arrivals being removed on October 1, 2022.

Professional, scientific, and technical services increased for the sixth consecutive quarter, up 1.0% in the fourth quarter. Computer systems design and related services contributed the most to the increase, up 2.6% in the quarter. Weaker activity in legal services (-3.1%), which derive much of their activity from real estate transactions, tempered growth in the sector, as home sales were down in the fourth quarter. Activity at real estate agents and brokers declined 11.7% in the quarter, continuing the declines observed since the first quarter of 2022 as interest rate hikes continued to push home buyers to the sidelines.

Wholesale trade increased 0.4% in the fourth quarter after posting two consecutive quarterly declines. Motor vehicle and motor vehicle parts and accessories wholesalers contributed the most to the gain, in large part due to increased sales in motor vehicles, particularly sales of electric vehicles in November 2022. Strong global demand for wheat and canola and good crop yields in 2022 helped boost activity in the farm product wholesaler subsector in the fourth quarter, even though a decrease was observed in December. Personal and household goods merchant wholesalers expanded in large part due to increased activity at pharmaceuticals and pharmacy supplies merchant wholesalers due to higher sales of pharmaceutical products reflecting the recent availability and authorization of COVID-19 vaccine boosters targeting the Omicron subvariants.

In the fourth quarter, some client-facing sectors and industries, such as accommodation and food services (-0.5%), recorded declines, while others, such as arts, entertainment and recreation (+3.9%) recorded their lowest growth since the first quarter of 2022 when the Omicron variant severely impacted activity in these sectors and industries. Weaker activity in food services and drinking places drove the decline in the accommodation and food services sector, while arts, entertainment and recreation continued to expand in the fourth quarter but at a slower pace, in part due to increased spectator sports activity including the Toronto Blue Jays playing post-season home games in October.

After increasing in the second and third quarters, the mining, quarrying, and oil and gas extraction sector contracted 2.6% in the fourth quarter of 2022 with lower synthetic oil production in Alberta contributing the most to the decrease. Mining and quarrying (except oil and gas) declined 2.6% largely due to a decrease in the copper, nickel, lead and zinc ore mining industry (-8.8%).

In the fourth quarter, manufacturing (-0.7%) fell for the second consecutive quarter, bringing activity to the lowest quarterly level in 2022, with declines in both non-durable goods (-1.4%) and durable goods (-0.2%) manufacturing.

Activity rises across most sectors in 2022

Despite decelerating growth in the second half of the year, GDP by industry expanded 3.6% in 2022. Economic activity exceeded its 2019 pre-pandemic level, as 19 of the 20 industrial sectors posted gains. Continued interest rate increases across 2022 impacted the activity level in certain areas of the economy as the year progressed. However, the removal of pandemic-related restrictions, the presence of favourable farming conditions, and subsiding supply-chain issues and semi-conductor shortages supported growth in 2022. Value added in services-producing industries continued its ascent in 2022, led by the public sector, professional, scientific and technical services, transportation and warehousing and client-facing industries. Despite a decline in fourth quarter, goods-producing industries recorded strong growth in 2022, led by the manufacturing, agriculture, forestry, fishing and hunting and mining, quarrying and oil and gas extraction sectors.

The public sector and client-facing industries among the largest contributors to growth in 2022

The public sector (educational services, health care and social assistance, and public administration combined) grew 3.0% in 2022 and contributed the most to the increase in services-producing industries, as all components posted gains.

Client-facing industries were also large contributors to growth in 2022, partly due to the removal of pandemic-related restrictions. Growth in the accommodation and food services sector (+23.3%) accelerated in 2022, driven by gains in food services and drinking places. Arts, entertainment and recreation surged 38.3% in the year as all subsectors saw strong gains.

Air transportation jumped over 200% in 2022, recording its first annual increase since 2019, even as many airlines and airports faced labour shortages and inclement weather leading to flight cancellations. Urban transit systems rose 52.7% in 2022, as many public transit users returned to in-person work. Despite these gains, both air travel and urban transit remained below their pre-pandemic levels and for 2022, the transportation and warehousing sector was 8.9% below its level in 2019.

Slower growth or declines in housing-related industries in 2022

The Bank of Canada, like many other central banks, hiked its policy interest rate several times in the course of 2022. In this context, residential building construction (-5.7%) trended downward during most of the year, while growth in real estate and rental and leasing (+0.4%) slowed as activity at the offices of real estate agents and brokers dropped 28.2% in 2022, posting its first annual decline since 2018, as home sales fell across the country.

Goods producing sectors rise in 2022

All goods producing sectors contributed to growth in 2022. The manufacturing sector (+3.6%) drove the increase, buoyed by gains in durable goods manufacturing, primarily transportation equipment and machinery manufacturing. Motor vehicle and motor vehicle parts manufacturing were the main drivers of growth in the transportation equipment subsector as supply-chain issues and semi-conductor shortages subsided in the Canadian market in the year. Plastic and rubber products as well as food product manufacturing were the largest contributors to growth among non-durable goods manufacturing subsectors.

The mining, quarrying and oil and gas extraction sector rose 2.9% in 2022, after expanding 6.8% in 2021, primarily driven by gains in oil and gas extraction, as crude petroleum, natural gas, and oil sands extraction were up. In contrast, mining and quarrying (except oil and gas) fell 2.5% due to a decrease in metallic mineral mining. Non-metallic mineral mining and quarrying expanded 3.0%, primarily due to increased activity in potash mining, as Canadian exports surged following Russia's invasion of Ukraine.

Agriculture, forestry, fishing and hunting expanded 11.7% in 2022. Higher-than-average precipitation and moderate temperatures throughout the year contributed to a significant increase in crop production (except cannabis). This follows a drop in the sector in 2021, primarily due to record-setting heat, drought and forest fires in Western Canada.

After rising 5.4% in 2021, the construction sector increased 1.2% in 2022. Engineering and other construction activities drove the gain, expanding 10.3%; the liquified natural gas project in British Columbia and wind farm projects in Alberta were large contributors to growth. Weaker activity in residential and non-residential building construction tempered growth in the overall sector.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the following 15 years. The plan is based on 17 specific sustainable development goals.

The release on gross domestic product by industry is an example of how Statistics Canada supports monitoring the progress of global sustainable development goals. This release will be used to help measure the following goal:

Note to readers

Monthly data on gross domestic product (GDP) by industry at basic prices are chained volume estimates with 2012 as the reference year. This means that the data for each industry and each aggregate are obtained from a chained volume index multiplied by the industry's value added in 2012. The monthly data are benchmarked to annually chained Fisher volume indexes of GDP obtained from the constant-price supply and use tables (SUTs) up to the latest SUT year (2019).

For the period starting in January 2020, data are derived by chaining a fixed-weight Laspeyres volume index to the previous period. The fixed weights are 2019 industry prices.

This approach makes the monthly GDP by industry data more comparable with expenditure-based GDP data, which are chained quarterly.

All data in this release are seasonally adjusted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

An advance estimate of industrial production for January 2023 is available upon request.

For more information on GDP, see the video "What is Gross Domestic Product (GDP)?"

Revisions

With this release of monthly GDP by industry, revisions have been made back to January 2022.

Each month, newly available administrative and survey data from various industries in the economy are integrated, resulting in statistical revisions. Updated and revised administrative data (including taxation statistics), new information provided by respondents to industry surveys, data confrontation and reconciliation process and standard changes to seasonal adjustment calculations are incorporated with each release.

The advanced estimate of real GDP by industry for the fourth quarter of 2022 published January 31, 2023 has been revised from +0.4% to +0.2%. Estimates were revised as a result of the incorporation of updated monthly data and new information only available on a quarterly or annual basis used in finance and insurance, construction and support activities for mining and oil and gas extraction as well as data confrontation exercise resulting from the availability of the income and expenditure based GDP estimates.

Real GDP growth in July and August was revised down from +0.3% to +0.2% in both months primarily as a result of revisions in construction and public administration, in part as a result of the incorporation of new Annual Capital and Repair Expenditures Survey data and updated government sector estimates. These monthly revisions combined to lower real GDP by industry growth in the third quarter from +0.7% to +0.6%.

Real-time table

Real-time table 36-10-0491-01 will be updated on March 6, 2023.

Next release

Data on GDP by industry for January 2023 will be released on March 31, 2023.

Products

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is also available.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: