New Housing Price Index, December 2022

Released: 2023-01-23

December 2022

0.0%

(monthly change)

December 2022

0.0%

(monthly change)

December 2022

0.0%

(monthly change)

December 2022

0.0%

(monthly change)

December 2022

0.0%

(monthly change)

December 2022

0.2%

(monthly change)

December 2022

0.0%

(monthly change)

December 2022

-0.3%

(monthly change)

December 2022

-0.3%

(monthly change)

December 2022

-0.1%

(monthly change)

December 2022

-0.1%

(monthly change)

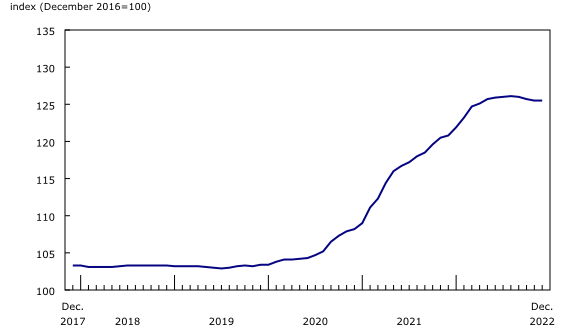

New home buyers continue to see cooling house prices

Nationally, prices were unchanged in December following three months of declines. New house prices were unchanged in 19 of the 27 census metropolitan areas (CMAs) surveyed, down in 6 and up in the remaining 2.

Elevated mortgage rates add downward pressure on house prices

High mortgage rates continued to impact the housing market in December as the Bank of Canada increased the policy interest rate again at the beginning of the month, bringing it to 4.25%.

In December, new home prices decreased the most in Regina (-0.4%) month over month. Similar weakness was found in the resale market, with the Saskatchewan Realtors Association noting that detached home prices were down 1.1% for the month.

The new home market saw prices drop in Winnipeg, Saskatoon, London, Kelowna (all -0.3%) and Edmonton (-0.2%), with builders noting deteriorating market conditions as the reason for the decrease.

Price increases were reported in Montréal (+0.3%) and Calgary (+0.1%) in December, as high interest rates were offset by increased demand and construction costs, as reported by builders.

The year 2022 in review: New house prices see slower growth as borrowing costs increase rapidly

Nationally, new home prices rose at a slower pace in 2022 (+7.7%) compared with 2021 (+10.3%).

New house prices are up because of historically low mortgage rates and rising construction costs in the first half of 2022

Prices for new homes grew quickly at the start of 2022, increasing 2.5% in the first quarter of 2022 compared with the fourth quarter of 2021, as interest rates were at an all-time low. Prices continued to rise in the second quarter of 2022 (+1.9%) compared with the first quarter, as the cost of building a single-detached house (+5.8%) and townhouse (+5.7%) grew.

Nationally, house prices end the year on a decline

Interest rates continued to grow throughout the year, and, by year's end, the policy rate was 4.25%, compared with 0.25% at the beginning of 2022. This increase made borrowing more expensive, curbing demand for homes and leading to a decline of 0.4% in new home prices from July to December.

Calgary posts the largest year-over-year increase in new house prices in 2022

New home prices increased the most in Calgary in 2022 (+16.3%) compared with 2021 (+9.0%). The first six months of 2022 saw prices surge in the CMA by 11.4%. The rapid growth in Calgary was attributable to increased construction costs and high housing demand in the CMA. Also, home prices in Calgary were more affordable compared with other hot real estate markets in Canada, attracting buyers from other provinces, especially Ontario and British Columbia.

Outlook: Change in new home prices projected to be muted in 2023

High mortgage rates have resulted in reduced home sales and increased inventory, with the Canadian Real Estate Association reporting a 25.2% decline in national residential sales in 2022 compared with 2021, thus decreasing home prices. The Bank of Canada has noted that the policy interest rate may need to rise further to bring supply and demand back into balance and return inflation to target.

As well, since their high in March 2022, softwood lumber prices have fallen rapidly, by 57.3% until December 2022.

This decrease in lumber prices, along with elevated mortgage rates (plus the risk of further increases in 2023), should continue to cool new house prices, at least during the first half of 2023. As mortgage rates stabilize and uncertainty in the market calms, housing demand and growth in prices should edge up in the latter half of 2023. This, along with other factors such as increased immigration targets and continued interprovincial migration, especially in the hottest markets with a limited supply of new homes, could lead to price increases in the new home segment.

Note to readers

The New Housing Price Index (NHPI) measures changes over time in the selling prices of new residential houses. The prices are those agreed upon between the contractor and the buyer at the time the contract is signed. The detailed specifications for each new house remain the same between two consecutive periods.

The prices collected from builders and included in the index are market selling prices less value-added taxes, such as the federal goods and services tax and the provincial harmonized sales tax.

The survey covers the following dwelling types: new single homes, semi-detached homes and townhomes (row or garden homes). The index is available at the national and provincial levels and for 27 census metropolitan areas (CMAs).

The index is not subject to revision and is not seasonally adjusted.

Products

The Technical Guide for the New Housing Price Index (NHPI) is available. This document provides details on the methodology used to calculate the NHPI.

The New Housing Price Index: Interactive Dashboard, which allows users to visualize statistics on new housing prices, is available.

The Housing Market Indicators dashboard, which provides access to key housing market indicators for Canada, by province and by CMA, is also available.

For more information on the topic of housing, visit the Housing statistics portal.

The video "Producer price indexes" is available on the Statistics Canada Training Institute web page. It introduces Statistics Canada's producer price indexes—what they are, how they are compiled, and what they are used for.

Statistics Canada launched the Producer Price Indexes Portal as part of a suite of portals for prices and price indexes. It provides users with a single point of access to a wide variety of statistics and measures related to producer prices.

Next release

The New Housing Price Index for January 2023 will be released on February 22, 2023.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: